Cava Group, Inc. (NYSE: CAVA) has captured significant attention in 2025, emerging as a standout in the fast-casual dining sector with its Mediterranean-themed restaurants. With a remarkable 160% stock price rally over the past 12 months as of early 2025, and a 35.1% revenue increase in fiscal 2024, Cava is often compared to industry giant Chipotle Mexican Grill.

But is this growth sustainable, and how should investors approach this high-valuation stock? This article delves into why Cava stock is generating buzz and offers five essential tips for investors looking to navigate its potential in 2025.

Why Cava Stock Is Turning Heads in 2025

Cava Group has positioned itself as a category leader in the fast-casual Mediterranean dining space, operating 367 restaurants across 25 US states as of late 2024. The company's assembly-line style, offering over 17.4 billion meal combinations, caters to diverse dietary preferences like vegan, vegetarian, and keto, aligning with consumer trends towards healthy and affordable eating. With a 13.4% same-store sales growth in 2024 and plans to expand to over 1,000 locations by 2032, Cava's growth story is compelling.

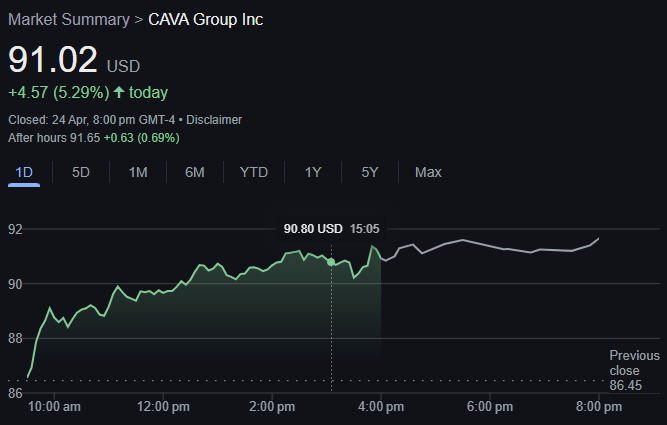

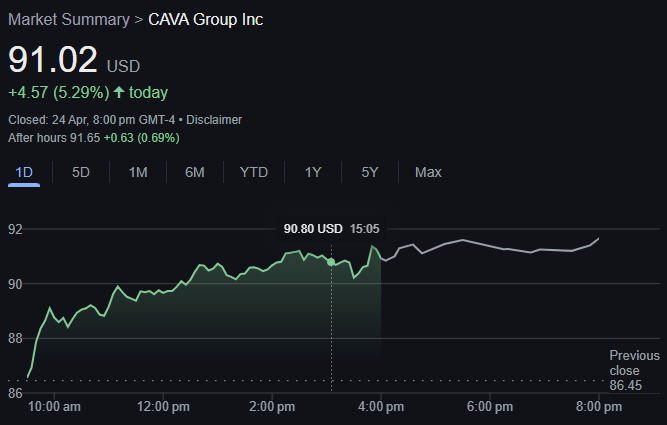

However, its lofty valuation—with a price-to-earnings (P/E) ratio over 300x compared to the S&P 500's average of 23x—raises questions about sustainability. Despite a recent 29% drop in stock price over three months and a 40% loss since its December 2024 peak of $150.88, Cava stock surged to $91.02 as of April 24, 2025, buoyed by analyst upgrades and optimism about its expansion.

5 Key Tips for Investors Considering Cava Stock

Tip 1: Focus on Growth Metrics and Expansion Plans

Cava's primary appeal lies in its aggressive growth trajectory. The company opened 58 new restaurants in 2024 and expects to add 62 to 66 more in 2025. Analysts predict revenue growth of 24.1% for 2025, with same-restaurant sales expected to rise between 6% and 8%.

Investors should closely monitor quarterly results, particularly new unit performance and same-store sales growth, as these metrics will indicate whether Cava can maintain its momentum. With a long-term goal of over 1,000 locations, the potential for scale is significant, but execution risks remain in a competitive market.

Tip 2: Understand the Valuation Risks

Cava's valuation is a double-edged sword. Trading at a forward 12-month price-to-sales (P/S) multiple of 7.73x—well above the industry average of 4.11x—and a P/E ratio exceeding 300x, the stock is priced for perfection. While growth investors may justify this premium due to Cava's 35.1% revenue increase in 2024, any sign of slowing growth or operational hiccups could trigger a sharp sell-off.

As noted by analysts, even strong performance might not prevent a drop if momentum-driven investors shift focus. Be prepared for volatility and consider whether the current price aligns with your risk tolerance.

Tip 3: Track Analyst Sentiment and Price Targets

Analyst forecasts for Cava stock in 2025 are generally optimistic, with an average price target of $129.42, suggesting a 59.19% upside from the recent price of $81.30 before its latest rally to $91.02. Targets range from a low of $88.97 to a high of $169.88, with firms like JPMorgan (target: $110) and Bank of America (target: $112) recommending buying on recent pullbacks.

Piper Sandler also upgraded Cava to “Overweight” in March 2025, citing its fast-casual market positioning. Keep an eye on upcoming Q1 2025 results on May 15, 2025, as they could influence revised targets and sentiment.

Tip 4: Assess Competitive Position and Market Trends

Cava often draws comparisons to Chipotle Mexican Grill, which has delivered 340% returns over the past decade. With only 367 locations compared to Chipotle's 3,700+, Cava has substantial room to grow if it maintains consumer appeal. Its focus on healthy Mediterranean cuisine taps into trends of wellness and dietary diversity, supported by an integrated supply chain ensuring quality.

However, the fast-casual space is fiercely competitive, with peers like BJ's Restaurants, Brinker International, and Dutch Bros also vying for market share. Investors should evaluate whether Cava can sustain its 13.4% same-store sales growth and differentiate itself long-term.

Tip 5: Manage Risk with a Long-Term Perspective

Cava stock's recent 29% drop over three months and trading below its 50-day moving average signal short-term bearish trends and volatility. Despite a 46% surge over the past year as of April 2025, its high valuation means even minor disappointments could lead to significant pullbacks. Growth investors with a long-term horizon may find Cava appealing, especially given forecasts of reaching $375.34 by 2030 (361.68% upside).

However, value and income investors may shy away due to the lack of dividends and premium pricing. Use stop-loss orders, diversify your portfolio, and avoid overexposure to mitigate risks.

Additional Considerations for 2025

Beyond these tips, investors should note Cava's operational strengths, such as a 25% restaurant-level profit margin in 2024 (up 20 basis points year-over-year) and a robust net income of $130.3 million for the year.

Adjusted EBITDA rose 71% to $126.2 million, reflecting efficiency despite rising input costs. Strategic moves, like Midwest expansion with a new Indianapolis location and a focus on digital ordering, further bolster growth prospects.

Yet, macroeconomic uncertainties and consumer spending shifts could impact discretionary dining, so staying updated on economic indicators is crucial.

Conclusion

Cava stock presents a compelling opportunity for growth-focused investors in 2025, driven by its impressive revenue trajectory, expansion plans, and alignment with health-conscious dining trends. However, its high valuation and recent volatility underscore the need for caution.

By focusing on growth metrics, understanding valuation risks, tracking analyst insights, assessing competitive positioning, and managing risk with a long-term view, investors can better navigate the potential of Cava stock. Stay informed with upcoming financial results and market developments to make well-timed decisions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.