Value Stocks vs Growth Stocks

For anyone starting their investment journey, one of the first decisions you'll face is whether to focus on value stocks or growth stocks. These two types of investments are often seen as opposites, but understanding the difference between them can unlock new opportunities for your portfolio.

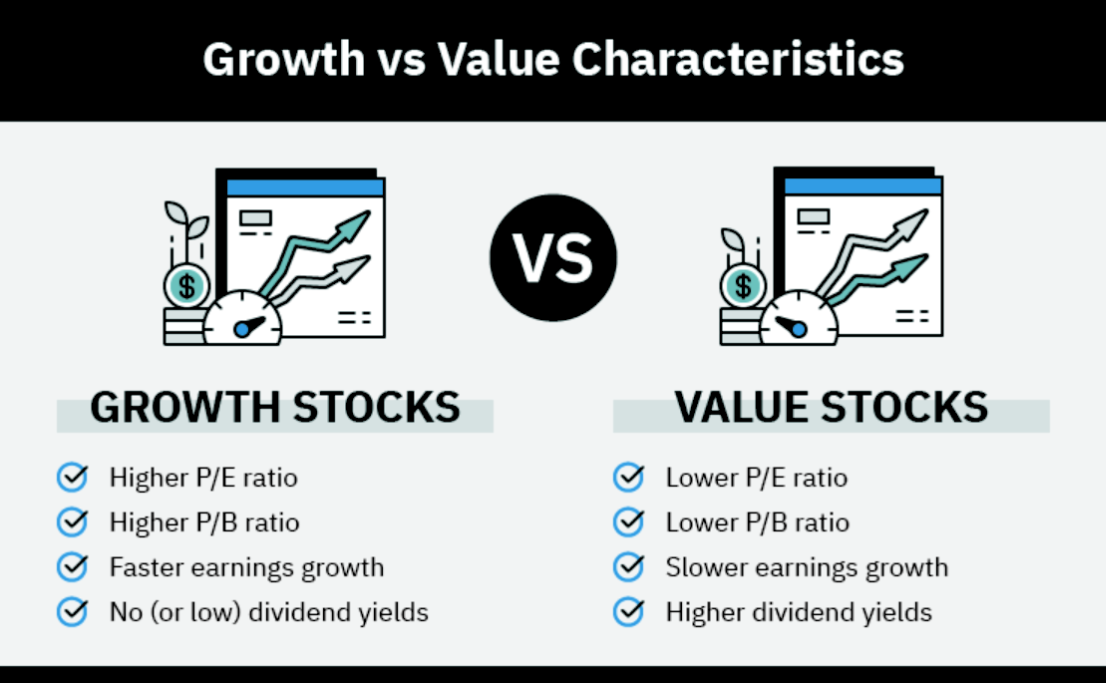

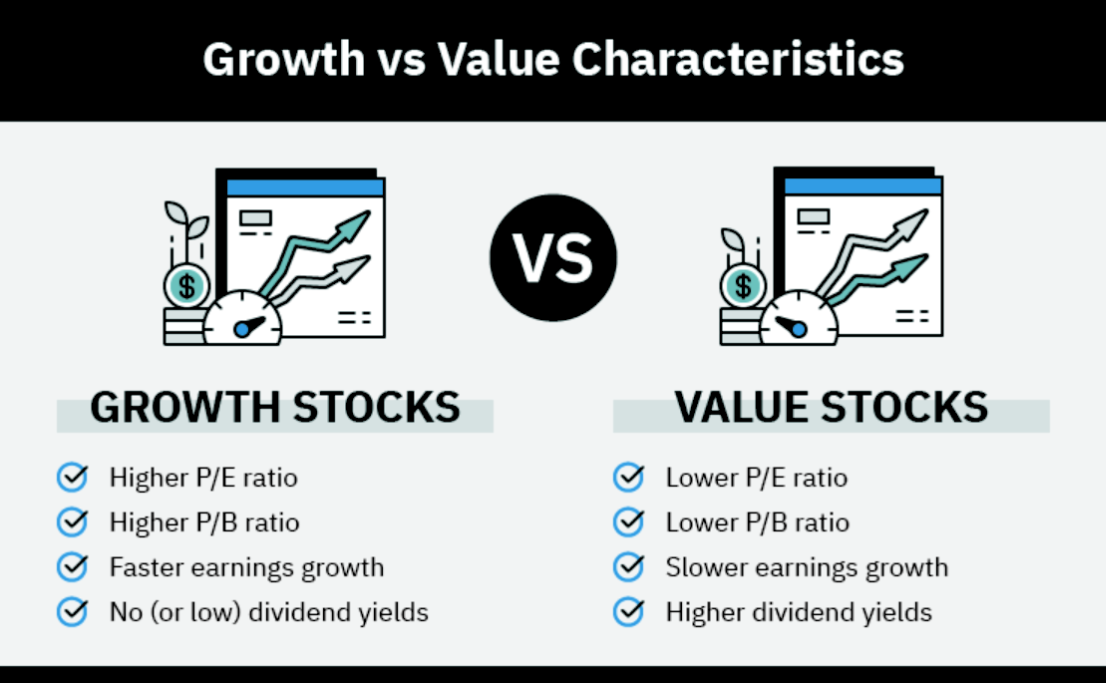

Value stocks are those shares of companies that are currently undervalued by the market. These companies are typically stable and well-established but might be temporarily out of favour due to market conditions, poor trader sentiment, or sector-wide issues. The key here is that the market has yet to recognise the company's full potential. Traders buy value stocks with the expectation that over time, the price will rise as the market catches up.

Growth stocks, on the other hand, represent companies that are expected to grow at an above-average rate compared to the market. These companies often reinvest their profits back into the business rather than paying dividends, with the goal of expanding quickly. Growth stocks can be exciting but often come with higher risks because their future performance is based on expectations of rapid growth, which may or may not materialise.

Take Johnson & Johnson, for example. This healthcare giant has a long history of stable performance and steady growth, yet it sometimes trades below its intrinsic value during periods of market uncertainty. Investors who understand its solid fundamentals might view it as a value stock, anticipating that, over time, the market will correct and recognise its true worth. On the flip side, growth stocks like Tesla or Amazon would likely be more appealing during periods of rapid market growth, but they also carry the risk of not meeting their high expectations.

Take Johnson & Johnson, for example. This healthcare giant has a long history of stable performance and steady growth, yet it sometimes trades below its intrinsic value during periods of market uncertainty. Investors who understand its solid fundamentals might view it as a value stock, anticipating that, over time, the market will correct and recognise its true worth. On the flip side, growth stocks like Tesla or Amazon would likely be more appealing during periods of rapid market growth, but they also carry the risk of not meeting their high expectations.

So, why does this matter for you? Simply put, value stocks are often seen as a more stable, lower-risk investment. They typically don't promise the explosive returns that growth stocks can offer, but they provide the potential for steady returns and protection against market volatility. The idea is that, because they are undervalued, they have nowhere to go but up once the market realises their true worth.

When to Invest in Value Stocks

Investing in value stocks requires a keen sense of timing, but it's not all about luck. Recognising the right market conditions is key. For instance, during periods of economic recovery or when the market is starting to rebound from a downturn, value stocks tend to perform well. This is because many undervalued companies start to catch traders' attention once confidence in the market rises. For example, during past economic recoveries, companies like General Motors (GM) and Bank of America have rebounded significantly, as their core businesses remained strong despite temporary setbacks.

On the other hand, investing in value stocks during a prolonged bull market might be trickier. This is when growth stocks often dominate, as they are perceived as more likely to deliver rapid returns. In contrast, value stocks might be overlooked as traders focus on companies with more aggressive growth potential.

That said, there are always opportunities for value stock traders. When markets are uncertain or going through a bear phase, many traders flock to growth stocks because they are chasing quick gains. However, this is often the time when value stocks are at their most affordable. For instance, energy companies like Chevron and ExxonMobil have historically been undervalued during periods of low oil prices, only to recover strongly as demand stabilised. If you're willing to take a longer-term view and wait for the market to recognise the company's value, you could see some impressive returns as the economic situation improves.

Knowing when to invest in value stocks involves reading the market carefully and being patient. In periods of economic stress or when trader sentiment is low, value stocks often become a safer, more rewarding option for those willing to ride out the turbulence.

Performance of Value Stocks in Bull and Bear Markets

To understand how value stocks perform in different market conditions, it helps to consider both bull and bear markets. In a bull market, where the economy is growing and trader sentiment is generally positive, growth stocks tend to take the lead. traders are often willing to take more risks in exchange for high returns, so the focus is on companies that are expanding quickly.

However, value stocks can still hold their own, particularly in the later stages of a bull market. When the economy has grown for a while, some traders begin to look for bargains, which can turn attention back to undervalued companies. For example, Berkshire Hathaway—a classic value stock—often attracts interest when markets become overheated, as traders look for solid, undervalued businesses backed by strong fundamentals. At this point, the market may be ready for a correction, and value stocks often benefit as traders seek more stable, lower-risk options.

In contrast, during a bear market, where the economy is contracting and stock prices are falling, value stocks can often provide more stability. Traders tend to flock to these companies because they represent safer, more predictable investments in uncertain times. Take Walmart as an example—during market downturns, consumer demand for essential goods remains steady, allowing Walmart's stock to hold its value better than more volatile growth stocks. Similarly, Procter & Gamble, a consumer goods giant, tends to perform well in bear markets as demand for its household products remains consistent.

The key takeaway is that value stocks can offer a hedge during market volatility. They may not always shine in a bull market, but in uncertain times or bear markets, they often outperform their more volatile counterparts.

Combining Value Stocks with Other Investment Strategies

While value stocks can be a solid choice on their own, they can also complement other investment strategies, such as growth investing or dividend investing. By combining value stocks with other types of investments, you can create a well-rounded portfolio that balances risk and return.

For example, you might pair value stocks with growth stocks to ensure that you're not putting all your eggs in one basket. While growth stocks provide the potential for high returns, value stocks act as a safety net in case the market turns sour. If you focus solely on growth stocks, you might miss out on the stability and long-term growth that value stocks can provide.

Another option is to include dividend-paying value stocks in your portfolio. Dividend stocks can generate passive income while also benefiting from potential price appreciation. The added benefit here is that companies paying dividends are often more stable, making them a good fit with value stocks, which tend to favour stability over volatility.

Additionally, value stocks can be used alongside index funds or ETFs, which provide diversification by tracking a broad range of companies. This can help to smooth out any rough patches in the performance of individual stocks and give you exposure to a wider variety of industries, some of which might have undervalued companies in their midst.

The real power of combining value stocks with other strategies is that it allows you to tailor your investment approach to your specific risk tolerance and financial goals. Whether you're looking for growth, income, or stability, incorporating value stocks into your broader strategy can help you achieve a more balanced portfolio.

In conclusion, value stocks are an important part of any trader's toolkit. While they may not have the same immediate excitement as growth stocks, they offer a steady, reliable path to long-term gains. By understanding the key differences between value and growth stocks, recognising when to invest in value stocks, and knowing how they perform in different market conditions, you can make more informed decisions and manage your investment risks better.

As with any investment strategy, the key is to remain patient, keep an eye on market conditions, and be ready to take advantage of opportunities when they arise. Whether you're a seasoned trader or just starting out, value stocks can provide the stability and growth potential you need to build a well-rounded portfolio.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Take Johnson & Johnson, for example. This healthcare giant has a long history of stable performance and steady growth, yet it sometimes trades below its intrinsic value during periods of market uncertainty. Investors who understand its solid fundamentals might view it as a value stock, anticipating that, over time, the market will correct and recognise its true worth. On the flip side, growth stocks like Tesla or Amazon would likely be more appealing during periods of rapid market growth, but they also carry the risk of not meeting their high expectations.

Take Johnson & Johnson, for example. This healthcare giant has a long history of stable performance and steady growth, yet it sometimes trades below its intrinsic value during periods of market uncertainty. Investors who understand its solid fundamentals might view it as a value stock, anticipating that, over time, the market will correct and recognise its true worth. On the flip side, growth stocks like Tesla or Amazon would likely be more appealing during periods of rapid market growth, but they also carry the risk of not meeting their high expectations.