The stock market is often perceived as highly volatile, where fortunes can be made or lost overnight, leading to extremes in investment outcomes. However, stability can be found through stock dividends, which serve to stabilize profits for investors. Many have developed successful investment strategies around dividend-paying stocks, yielding substantial gains. Here's a detailed look at what you need to know about stock dividends:

Stock Dividends

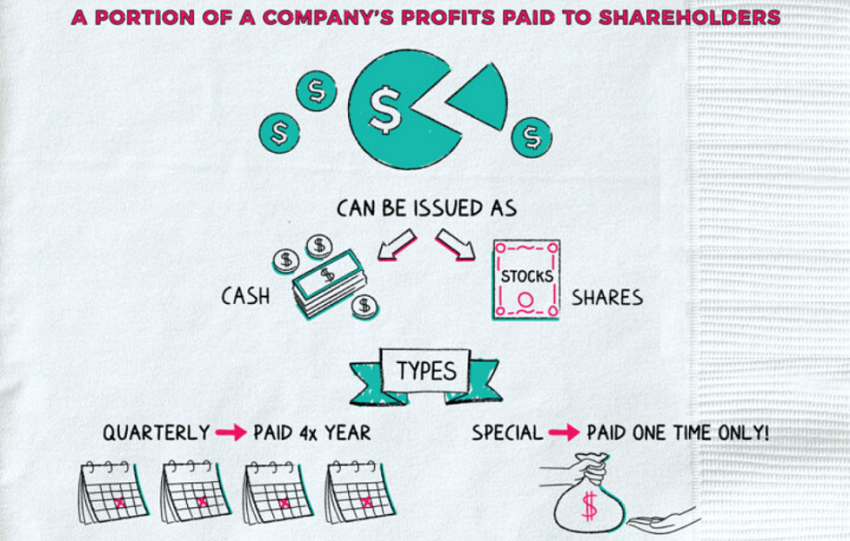

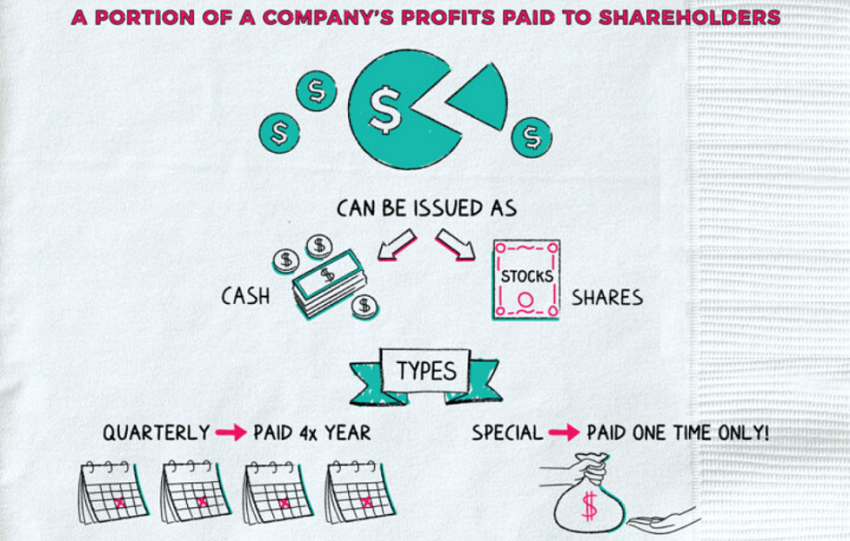

This is a way for a company to pay a portion of its earnings to its shareholders. When a company makes a profit,it has the option of reinvesting its profits,paying off debt,or paying dividends to its shareholders. Typically,a company declares dividends on a regular basis to distribute its earnings to its shareholders.

Dividends can be paid in the form of cash or stock,and they are also known as cash dividends and stock dividends. If paid in cash,the company will pay a certain amount of cash directly to the shareholders. For example, a $4.50 dividend on 10 shares of stock means a dividend of $4.50 for every 10 shares of stock.

If the payment is in the form of stock,the company will distribute additional shares to shareholders. For example,if the stock pays 5 out of 10. this means that for every 10 shares of that company's stock held,a dividend of 5 shares will be distributed. If the number of shares held is not a multiple of 10. a proportionate number of shares will be received as a dividend. For example,if 20 shares of the company's stock are held,you will receive 10 shares as a dividend.

This process is supposed to be a way for a company to pay a portion of its earnings to its shareholders,but many shareholders don't buy into it because the stock also goes ex-rights and ex-dividend when dividends are paid. Meaning that when a company pays out dividends to its shareholders,the company's entire Market Capitalization drops and the stock price goes down with it.

The market value of the stock in the hands of the shareholder after the dividend plus the money from the dividend is the same as the market value before the dividend. The money in the account not only did not become more,on the contrary,because of the dividends to pay taxes,but less money. Therefore,many shareholders believe that the stock dividends ex-dividend are equal to zero points.

Though the surface is so,for example, if a company's share price is 10 dollars, its market value is 10 billion. With a dividend distribution of 10 billion, the corresponding company's market value will be reduced to nine billion, and the share price will also be nine dollars. For the shareholders,it is true that they get cash,but the value of the stock has become lower.

But in fact,after the ex-rights and ex-dividends,the stock price will be in the market under the role of the pricing function,rising again. This process is also called filling in the rights to fill in the dividend. After the filling of the right,the dividend out of the cash is equivalent to the net income of investors. Of course,it should be noted that short-term investors find it difficult to profit from the dividend because few companies can pay it immediately after the completion of the fill,which requires a certain amount of time to accumulate.

Therefore,only those long-term investors will be in the dividends and fill in the rights one at a time in the snowball rolled up. For example,if a company with a market capitalization of $10 billion pays out $1 billion in dividends every year,then even if the stock price doesn't rise 10 years later,it will be able to recoup all of the cash from the stock by paying out dividends alone and will have an additional $10 billion in stock market capitalization.

Stock dividends are usually a feature of solid,established companies,and if one chooses to reinvest the dividends in the same company's stock,thereby increasing its return on investment, Over the long term,reinvesting dividends can realize a higher rate of return with the compounding effect. And a company's decision to pay dividends to its shareholders is usually an indication that the company has a solid financial position and good profitability. This stability increases investorsconfidence in their holdings and makes them more willing to hold them for the long term.

Also, diversifying a portfolio to include dividend-paying stocks can help reduce investment risk. Even when Stock Prices fluctuate,investors holding dividend-paying stocks can still benefit from the company's profits,reducing their over-reliance on rising stock prices.

That's why generous and stable stock dividends are seen as a sign of a good company.Warren Buffett,the god of the stock market,has emphasized the importance of holding high-quality stocks,that is,stocks that pay dividends,for the long term. And for retail stockholders,it provides a stable source of income. Retail investors who hold dividend-paying stocks receive regular profit distributions from the company,which is important for personal financial planning and living expenses.

However,it is important to note that the amount of dividends may not be high as retail shareholders hold fewer shares. And it is also subject to certain tax deductions,so the final profit is not substantial. So before you make an investment,you should still find out more information about the dividend rules and other information about the stock company you choose.

Top 10 Stock Dividends Paying the Most

|

Stocks

|

Stock Code

|

dividend yield |

|

Texas Instruments

|

TXN |

3.30% |

|

Airborne Chemical Products, Inc.

|

APD |

3.30% |

|

Lockheed. Lockheed Martin

|

LMT |

2.90% |

|

McDonald's Corporation

|

MCD |

2.30% |

|

Automatic Data Processing, Inc.

|

ADP |

2.20% |

|

Microchip Technology Corporation

|

MCHP |

2.00% |

|

Datsun McLennan

|

MMC |

1.50% |

|

UnitedHealth Group Inc.

|

UNH |

1.50% |

|

Hubbell Corporation

|

HUBB |

1.40% |

|

Elevance Health, Inc.

|

ELV |

1.30% |

How to Calculate Stock Dividends

The calculation depends on the company's dividend policy and profitability. Usually,the amount of dividends is based on the company's earnings per share and the dividend percentage. This is usually done in two ways: one is the amount of dividends per share, and the other is the dividend per share ratio.

Typically,a company will announce its dividend policy after the earnings report is released. The dividend policy may be a fixed amount of dividends per share,or it may be a proportional distribution of the company's earnings. For example,if a company announces a dividend of $1 per share, a holder of 1.000 shares of that company's stock would receive $1.000 in dividends.

Another common scenario is a pro-rata dividend. A company may decide to allocate a certain percentage of its earnings to its shareholders as a dividend. For example,if a company declares a 10% dividend per share, then a person who owns 1.000 shares of that company's stock and the company's earnings per share are $10 will receive a dividend of $1.000*10%*10=$1.000.

How often are stock dividends paid?

This frequency depends on the company's dividend policy and earnings. Generally,companies determine the frequency of dividends based on their profitability and financial needs. Some of the common frequencies are annual dividends,semi-annual dividends,quarterly dividends,and irregular dividends,among others.

For companies that pay dividends annually,they usually announce their annual financial results after the end of the fiscal year and declare the annual dividend at the subsequent shareholders' meeting. Companies that pay dividends on a semi-annual basis may publish their interim financial results after the end of the financial half-year and declare a semi-annual dividend at the semi-annual general meeting.

There are also some companies that choose to pay quarterly dividends,such as listed companies in the U.S. stock market that generally pay quarterly dividends. These companies may release quarterly earnings reports after the end of each quarter and declare quarterly dividends at quarterly shareholders' meetings. There is also an irregular dividend,where there is no set frequency of dividends but rather a decision on when to pay dividends based on earnings and financial needs. In this case, investors may be more flexible,but they may not follow a fixed schedule.

Both the exact frequency of dividends and the amount of dividends may vary depending on the stock dividend rules of different companies. Therefore,when investing,it is important to understand the company's dividend policy and earnings.

Stock Dividend Rules

Stock Dividend Rules

This rule and timing will vary depending on the country, region, and company. It is usually decided by the company's board of directors and implemented in accordance with the company's bylaws and local laws and regulations. It is important to note that the dividend policy of each company may vary. Investors should carefully understand the company's dividend policy and relevant laws and regulations and consider these factors when making investment decisions.

The decision to pay dividends usually belongs to the board of directors of the company. The board of directors will decide whether to pay dividends and the amount of dividends based on the company's profitability,future business plans,financial needs, and other factors. The decision to pay dividends is usually announced at the annual general meeting of shareholders,and a schedule of dividend payments is set.

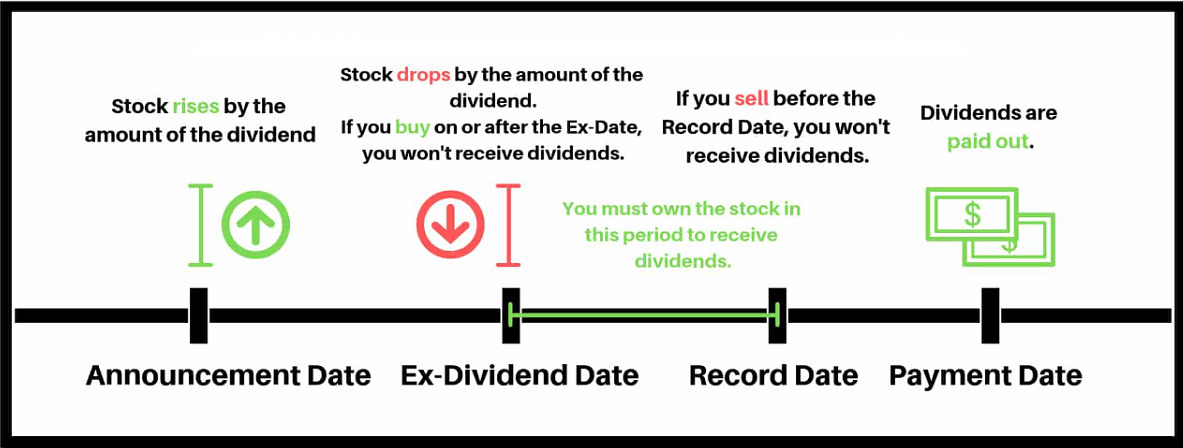

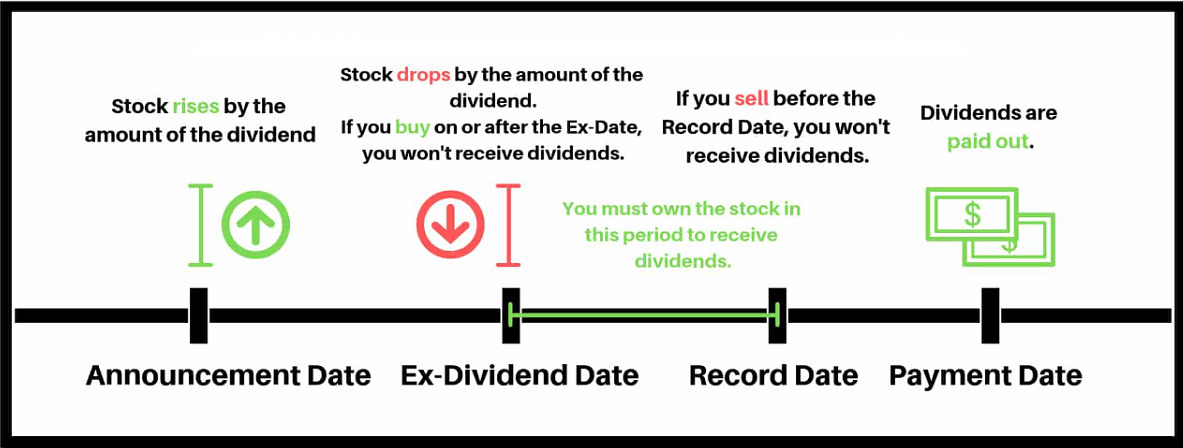

Dividends can be paid to shareholders in cash or in the form of shares (i.e., stock dividends). Sometimes companies also have the option of conducting a reinvestment program,which allows shareholders to reinvest the amount of dividends in the company's stock. In general,however,there are four dates that investors must be aware of.

The first is the announcement date,which is the date on which the company declares the dividend. On this date,the company's board of directors usually passes a resolution to declare the dividend. The second is the ex-dividend date,which is the date on which the stock dividend becomes effective. Shareholders who hold their stock until the ex-dividend date are eligible for the upcoming dividend. This means that even if the stock is sold after the ex-dividend date,it is still eligible for the dividend.

The third is the record date,which is the date on which the list of shareholders is determined. The company will determine the list of shareholders eligible for dividends based on the record date. The fourth is the dividend payment date,which is the date on which the dividends are actually paid to the shareholders. On this date,the company pays dividends to the eligible shareholders.

If someone wants to buy stock before the ex-dividend date and sell it after the ex-dividend date in order to receive the dividends, then one needs to be aware that dividend income is usually included in the shareholder's personal income tax or the company's corporate income tax. In some countries,companies withhold tax when distributing dividends,and shareholders are required to declare the dividend income and pay the corresponding tax when filing their tax returns.

Of course, such tax rules will vary from country to country and region to region. Generally speaking,most countries impose taxes on stock dividends. The tax rate may vary depending on the tax status of the individual or organization. In some countries,they are subject to withholding tax,while in others,the individual or organization may be required to file its own tax return.

In many countries,companies withhold a percentage of tax on dividend payments to shareholders. This is known as withholding tax at source. The percentage of tax withheld depends on the tax laws of the country and region in which the shareholder is located and may vary depending on tax status. Withholding tax is deducted from the dividend income when the shareholder receives the dividend.

In addition to withholding tax at source,there may be a personal income tax charge,the exact rate of which also depends on the tax law provisions of the country and region in which you are located and the personal income tax bracket of the shareholder. Dividend income should be reported to the tax authorities when filing your tax return and subject to personal income tax at the appropriate rate.

Holding time is usually defined as the period from the date of purchase of shares to the date of sale of shares or receipt of dividends. The length of holding time may affect the amount of capital gains tax payable. In some countries,it may be possible to enjoy a capital gains tax concession or exemption if the shares are held for more than a certain period of time. Such concessions or exemptions are usually designed to encourage long-term investment rather than short-term trading.

For example,in the U.S., long-term holdings of stocks (usually held for more than one year) may qualify for lower capital gains tax rates under the Capital Gains Tax Act. Long-term capital gains tax rates are lower than short-term capital gains tax rates,which means that an investor who holds stock for a long period of time may pay less tax.

It is important to note that the exact rules for stock dividends will vary depending on the company's policies and earnings. Ultimately,the specific dividend rules should also be based on the company's announcement. Investors should carefully understand the company's dividend policy and relevant laws and regulations and consider these factors when making investment decisions.

Tax Deduction Rules for Stock Dividends

|

Dividend Tax Rules

|

Description

|

|

Withholding tax at the source

|

The company may withhold a percentage of the tax. |

|

Individual income tax

|

Shareholders must report and pay tax on their returns. |

|

Holding period

|

Shareholding duration can impact capital gains tax. |

|

Tax Differences

|

Tax rates vary by country and region. |

|

Withholding tax credit

|

Withholding tax can offset tax on individual returns. |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security, transaction, or investment strategy is suitable for any specific person.

Stock Dividend Rules

Stock Dividend Rules