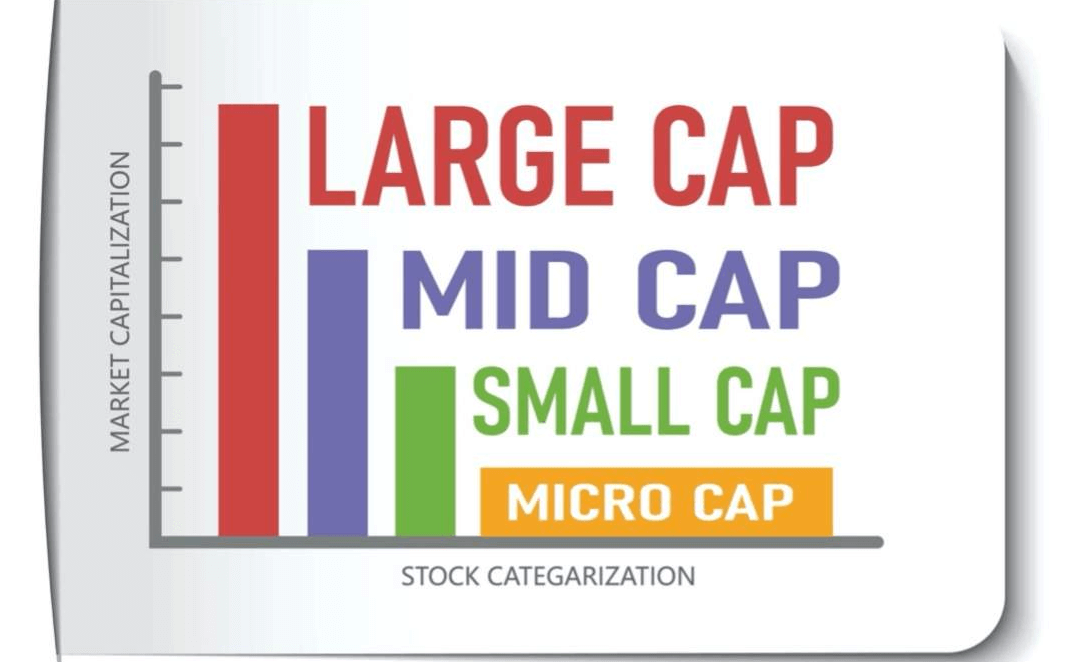

In the global environment,the size of a country determines its influence.The same is true in the stock market,where companies with large market capitalizations have a greater impact on the stock market as a whole.But just like there are big countries and there are small countries,apart from big Market Capitalization companies,there are also small cap stocks with small market capitalization.In the stock market,its status is the same as in small countries;although the influence is small,it also has its own special features.Let's take a look at the following:special small-cap stock investment analysis and risk assessment.

What is the meaning of small cap stocks?

It refers to stocks with a small number of outstanding shares,meaning publicly traded companies with a general outstanding share capital of no more than 500 million dollars.Their market capitalization is generally under billions of dollars,and they are relatively small companies.These companies are usually at the start-up stage or small in size in their industry and have relatively limited market share.

Such listed companies with smaller market capitalization are generally under billions of dollars and are within the range of stocks of companies with smaller market sizes.Due to the relatively small size of the company,there is usually a higher risk.These companies may face more market competition,financial pressures,and operational risks.

Despite the higher risk of small cap stocks,they are usually in the growth stage,have high growth potential,and may grow in the future.Due to their relatively small size,these companies are likely to deliver a higher return on investment as they grow and develop.

Their greatest strengths are that they have great potential,their business is easier to read,and they are often undervalued.Many of the big,successful companies nowadays initially grew from small companies,such as Starbucks,Yahoo,eBay,and Walmart.And investors who invested in these companies in the early days have made huge gains after holding them for a long time.

At the same time,because it is still in the early stages of development,it will be deeply involved in a specific business area.It is much easier to analyze such small companies and properly evaluate their prospects in the near future.

It is much easier to analyze such small companies and properly evaluate their recent business prospects.And since very few people pay attention to them and there is very little information about these stocks in the market,there is often a possibility that they are undervalued,which therefore creates a huge investment opportunity for individual investors.

However,it should also be noted that the risk of investing in these stocks is very high.This is because,on the one hand,because the outstanding share capital occupies a small market share,it is easy to institutionalize large investors to invest money in speculation,commonly known as the banker,to control the market.Therefore,its stock price trend is more active,and fluctuations are also larger.Especially when institutionally large households highlight the funds to sell a large number of times,their share price is likely to fall significantly.If investors do not sell in time or blindly follow the trend to buy,losses are also a matter of minutes.

At the same time,because it is usually a growth-stage company,there are certain business and financial risks.Investors need to conduct adequate research and evaluation.However,compared to large-cap stocks,it is less difficult to analyze but more difficult to obtain basic company information.Since analysts rarely research small cap stocks,investors can only research a company with very limited information,which undoubtedly increases the information asymmetry.

There is also the fact that,due to its small market capitalization,it is usually less liquid,i.e.,its shares are relatively less traded,and it may face certain difficulties when buying and selling.It also faces greater spread and liquidity risks and should not be traded in large amounts.But in general,because it has a larger profit margin,faster earnings,and is accustomed to a fast buying and selling style,investors are more fond of these stocks.

Overall speculation in the stock market is sometimes like looking for a partner and choosing their own investment style in order to choose the right stock to harvest wealth and happiness.Small cap stocks are usually part of the investment portfolio.Investors may consider investing a certain percentage of funds in them to obtain a higher rate of return on investment but also to pay attention to their relatively high level of risk.

Small Cap Risks Have Been Focused

| Low market interest Risk Factors |

Description |

| Market volatility |

Higher volatility is more affected by market fluctuations. |

| Liquidity constraints |

Low-volume trading may impact stock price stability. |

| Financial Risk |

High debt and unstable profits raise investment risk. |

| Industry Risk |

Concentrated in specific industries, more affected by industry challenges |

| Low market interest |

Lack of information and research support, and poor investor understanding |

Small Cap Stocks Investment Analysis

Though there are so many risks associated with this type of stock,it is also equally highly profitable.Therefore,many investors choose to invest in it or at least put it in their portfolio.However,many small cap stocks are unprofitable companies,so a series of analyses are required to make a judgment on how to invest accordingly.

The first step is to assess whether the company is at risk of bankruptcy,and if it is,it should never be invested in.To see if the company is at risk of bankruptcy,the current ratio and quick ratio are two indicators that can be utilized to assess the solvency of the company.

For example,the current ratio is the ratio between the amount of cash or assets that can be turned into cash and the amount of debt that the company needs to repay.If this ratio is lower than one,it means that within a year the company may not be able to repay its debts,thus leading to the risk of bankruptcy.

If a company has current assets of$10 million and current liabilities of$5 million,then its current ratio is 2.This means that the company's current assets are twice as large as its current liabilities,which is a relatively healthy ratio.

This means that the company's current assets are twice as large as its current liabilities,which is a relatively healthy ratio.After determining the safety of the company,technical analysis indicators can be used to make investment decisions.However,if safety is in question,it is best not to invest.

After that,you need to look at the profitability of this company,because this type of stock company basically has no net profit,that is to say,there is no profitability of the company.So how do you see the profitability of these companies?Here is an example.For example,you can use indicators such as adjusted EBIT(interest,taxes,depreciation,and amortization before earnings)to assess their profitability.Then observe the trend of these indicators and compare them with those of other companies.

The idea is that profit is equal to revenue minus a variety of costs,and when all costs are accounted for,the result is called net profit.Now that the small-cap stock company's net profit is a negative number,you can try to subtract a portion of the cost from the current point of view,which cannot be considered first.After subtracting this portion,look at the resulting profit and how it has changed over time.At the same time,use it to compare with other enterprises to see which enterprise's profitability is better.

Exactly what costs are subtracted needs to be analyzed on a case-by-case basis.For example,consider only the cost of revenue and then get the gross profit.It is then possible to adjust the EBIT indicator,which refers to earnings before interest and taxes and is the total income of the enterprise before deducting interest and taxes when calculating profits.It is one of the most important indicators for assessing the profitability of an enterprise,reflecting its operating conditions.

Add to that negative net profit the costs incurred by including,for example,stock issued to employees and the costs incurred through depreciation and amortization,as well as interest payments,taxes,and legal fees.This is to have seen the cost of that company's revenue,or gross profit.

Look at the trajectory of that profit and see if it continues to rise as a percentage of revenue in recent quarters.Continuing to rise would indicate better cost control and then greater profitability.As long as the revenue is growing,there is no problem with that.

After all this analysis,you have a good idea of what kind of stock to choose.However,it should be noted that for short-term investors,they need to strictly control their positions and set stop-loss levels to avoid risk.Long-term investors should also control their positions and be careful not to over-concentrate on a particular stock.

What does the high turnover rate of small cap stocks indicate?

What does the high turnover rate of small cap stocks indicate?

The stock turnover ratio refers to the ratio of the number of shares traded to the total number of shares outstanding in a given period of time(usually one day).The higher the turnover ratio,the more actively the stock is traded,and vice versa for relatively lukewarm trading.And from the turnover ratio of a small-cap stock,investors can tell how the market views the stock.

A low turnover ratio may indicate that the stock is less liquid,i.e.,it is more difficult to buy or sell.Investors trying to buy or sell the stock may encounter greater resistance because there is a lack of sufficient trading volume in the market to support it.It may also indicate that there is little investor interest in the stock,possibly because of poor company fundamentals,an uncertain industry outlook,or because investors are wary of the overall risk in the market.

A low turnover rate may also mean that investors in the stock are primarily long-term holders who are less inclined to trade frequently or adjust their portfolios,preferring to hold the stock for the long term.It also reflects a decline in overall market activity,i.e.,market participants are trading less frequently.This may be due to uncertainty in the overall market environment or cautious investor sentiment.

However,because these stocks are usually less liquid in the market and investors prefer to buy and sell them frequently to make profits or adjust their portfolios,their turnover rate is usually relatively high.This reflects the level of market interest in the stock or bullishness about the company's future prospects and may imply a high level of investor interest in the stock,which may be driven by media reports,analyst opinions,or the attention of other investors.

It may also be the result of speculative activity driven by investors who may utilize such stocks with high price volatility for short-term trading in search of quick profits.At the same time,investors buy and sell the stock frequently,resulting in a high volume of trading in the stock.It means that the stock is more actively traded,i.e.,the stock is more liquid.

It also indicates that there is a lot of information circulating in the market,and investors may quickly adjust their positions after evaluating new information.And it reflects the fact that the market is more sensitive to changes in sentiment about the stock,and investors are more inclined to adjust their positions quickly to market changes.

Overall,because of one characteristic of the small-cap stock market,its turnover rate is generally high.However,a high turnover rate does not always imply an investment opportunity but may also reflect market uncertainty and risk.Investors should consider other factors,such as fundamental analysis,technical analysis,and the market environment,to make investment decisions.

Buy small cap or large cap stocks in a bull market

| Features |

Small Cap Stocks |

Large cap stocks |

| Advantages |

High growth, high volatility, and market-driven. |

Stable, institutional backing, low risk for conservatives. |

| Risks |

High volatility, market sensitivity, and high risk. |

Limited growth, stable volatility, less sentiment impact. |

| Scenarios |

Investors seeking high risk and high return |

Investors who prefer stability and long-term growth |

Disclaimer:This material is for general information purposes only and is not intended as(and should not be considered to be)financial,investment,or other advice on which reliance should be placed.No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security,transaction,or investment strategy is suitable for any specific person.

What does the high turnover rate of small cap stocks indicate?

What does the high turnover rate of small cap stocks indicate?