People's daily lives are not close to banks. But we only know the ordinary banks; for the central bank, the boss of the national bank, we basically only heard of its name and did not see its people; we do not know what its role is. In fact, although there are fewer and fewer appearances in our lives, But his existence in the official national financial and economic situation, under the people's purse, closely related to its importance, can be imagined. Here we will have a good understanding of the role of the central bank in the end.

What is a Central Bank?

It is also known as the country's bank and is one of the country's highest financial management institutions. It is an official institution set up and managed by the government of a country or monetary region and is the core institution of a country's monetary system, responsible for formulating and implementing monetary policy, managing currency issuance, supervising the banking system, and maintaining financial stability.

Its organizational structure and legal status vary from country to country, but it is usually independent to ensure that it is able to carry out its monetary policy and financial stability responsibilities without undue interference from political pressures. Its independence helps to ensure that it is able to formulate and implement monetary policies that are long-term and in the overall economic interest of the country.

The name and organizational structure of the central bank may vary from country to country, e.g., the Federal Reserve System (FRS) in the US, the European Central Bank (ECB) in the Eurozone, the People's Bank of China (PBOC) in China, and so on. Overall, it is a key component of a country's monetary system and is responsible for maintaining the stability of the monetary and financial system in order to promote sustainable economic development.

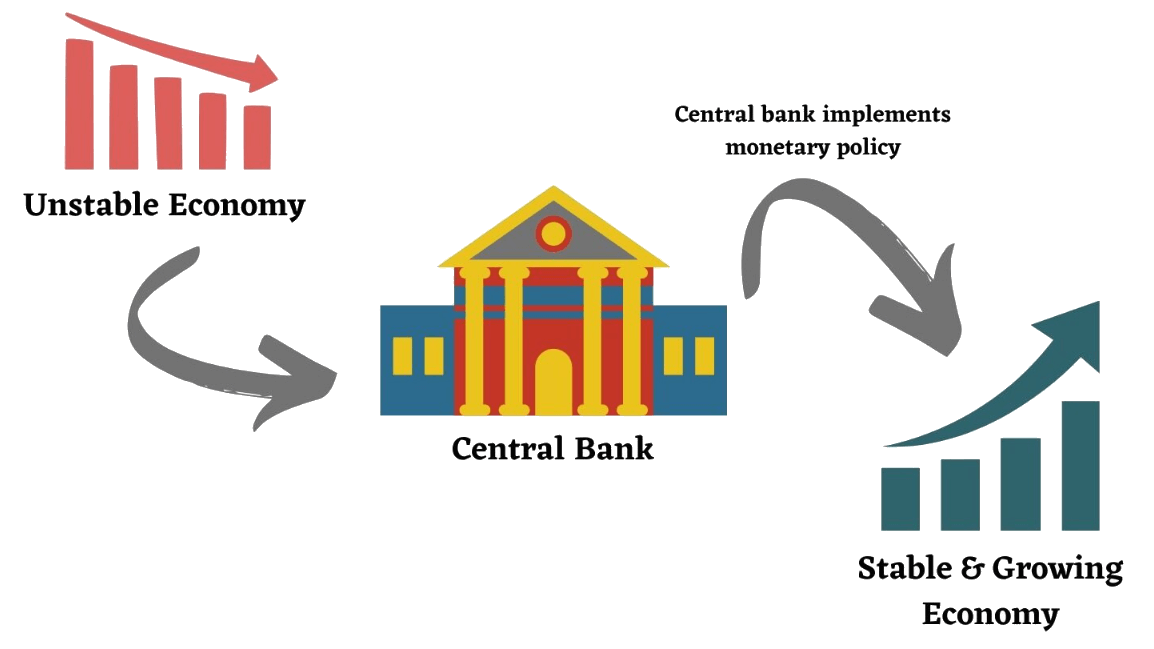

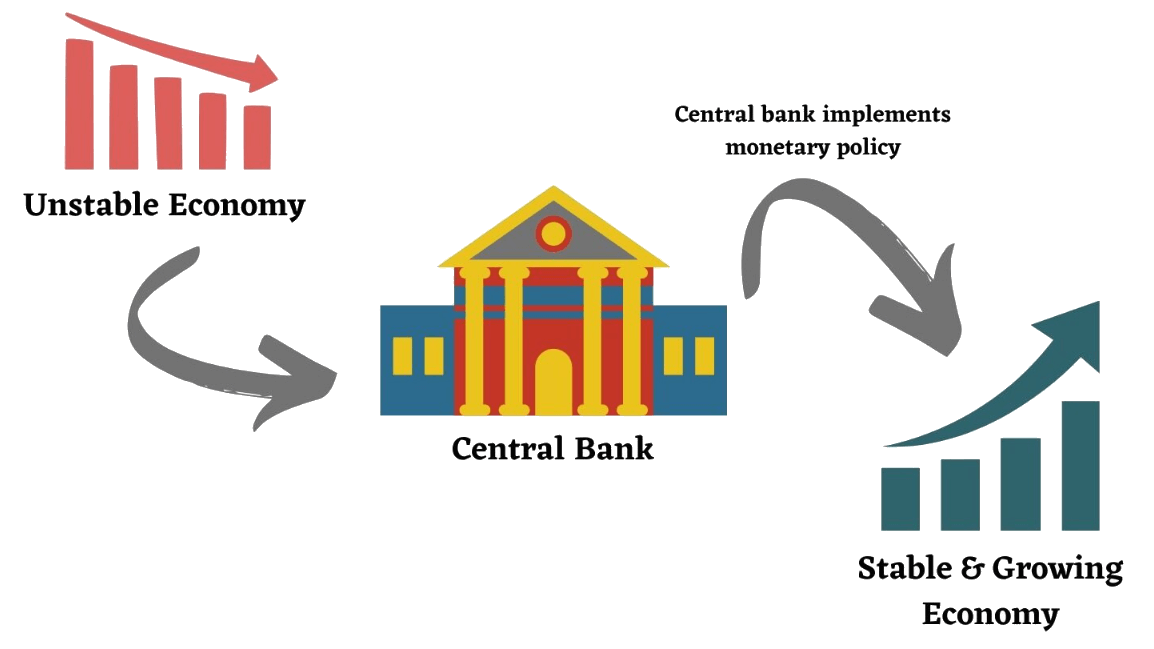

The reasons for its creation are mainly related to the needs of the monetary and financial system and the development of the economy. As the economy develops, the need for monetary policy gradually increases. The central bank was established to have an institution that could formulate and implement monetary policy to maintain monetary stability, control inflation, and promote sustainable economic growth.

Historically, as the number of commercial banks has grown and the types of businesses have become more diverse, problems such as competition and debt among banks have become increasingly prominent. In order to solve these problems and stabilize the order of the financial market, a specialized institution is needed to regulate and coordinate, and the central bank thus came into being.

The Riksbank, established in Sweden in 1656. is the prototype of the modern central bank. By 1844. the Bank of England was given the monopoly of currency issuance, becoming the first central bank in the true sense of the word. Subsequently, more and more countries have set up central banks through which to manage financial markets and participate in a series of macroeconomic regulations. Formed today, it represents the will of the country's highest financial management institutions.

To date, it has become the leader of the financial sector in each country, the central bank of most countries, to undertake the implementation of national financial policy, currency issuance and management agent treasury supervision, management of the financial industry, the establishment of the national payment and clearing system, participation in foreign international financial activities, and other important functions.

In general, the central bank of each country, through a series of direct or indirect means, realizes the regulation of money supply and demand and social and economic life and profoundly influences the future and destiny of the country.

Central bank means which bank

|

Central Bank

|

Country/area

|

| Federal Reserve System |

United States |

| European Central Bank |

Eurozone |

| People's Bank of China |

China |

| Bank of Japan |

Japan |

| Bank of England |

United Kingdom |

| Deutsche Bundesbank |

Germany |

| Reserve Bank of India |

India |

| Bank of Canada |

Canada |

| Reserve Bank of Australia |

Australia |

| Central Bank of Brazil |

Brazil |

Functions of a Central Bank

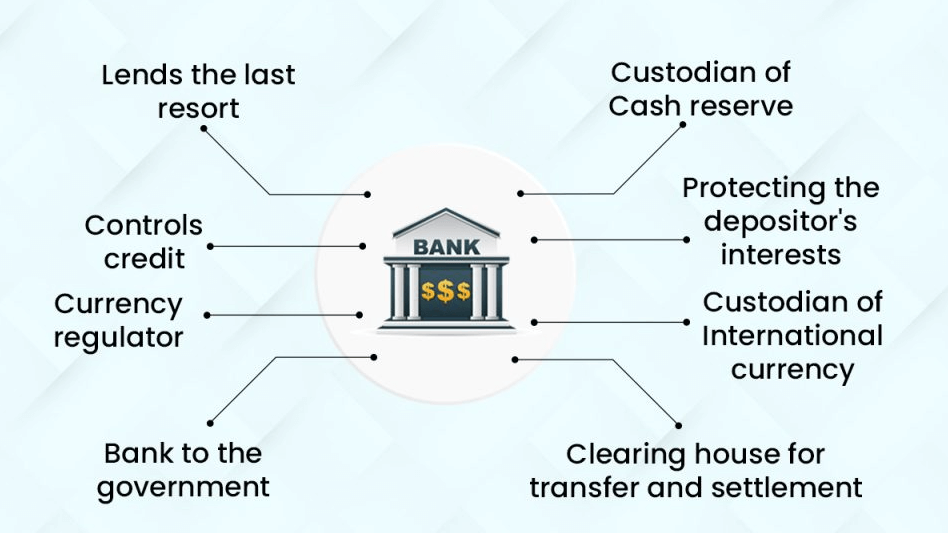

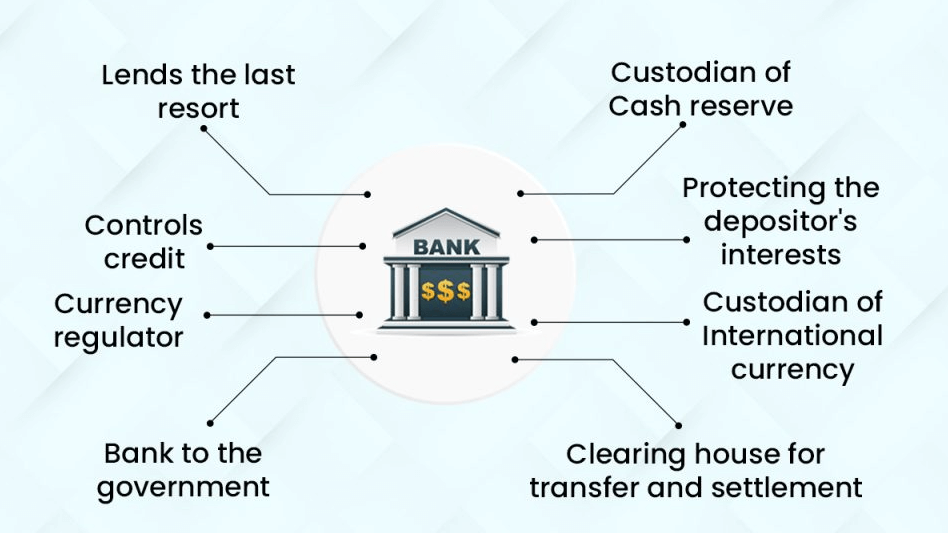

It usually has a number of important functions within a country or monetary area, with its main role being to maintain monetary stability, promote economic growth, and maintain the stability of the financial system.

As the economy grows, the need for monetary policy gradually increases. It was initially established to formulate and implement monetary policy to maintain monetary stability, control inflation, and promote sustainable economic growth. Basically, it does this by adjusting interest rates, the money supply, and other means. And as the only institution empowered to issue the country's legal tender, it manages and controls the money supply to ensure its stability, as well as adjusting it to meet the needs of the economy as and when required.

It is also responsible for managing the country's foreign exchange reserves in order to maintain the balance of payments and stabilize the exchange rate. This includes conducting transactions in the foreign exchange market and managing the investment of the country's foreign exchange reserves, which is essential for maintaining the stability and sustainable growth of the country's economy. It is also responsible for formulating and implementing financial regulatory policies to maintain the stability of the financial system. This is done by regulating financial markets, banks, and other financial institutions to ensure the stability of the financial system and to prevent and deal with financial crises.

It is also responsible for managing the country's payment system to ensure that payments and settlements are made efficiently, safely, and smoothly. This is important to facilitate the smooth conduct of transactions and exchanges in the economy. And conducts economic research and statistics to support the formulation and implementation of monetary policy, as well as providing information on the state of the economy to other government agencies, market participants, and the public. There is also cooperation with other countries and international organizations, particularly on cross-border financial issues, monetary policy coordination, etc.

In addition to these, central banks have governmental functions in their respective countries. For example, China's central bank, the People's Bank of China, is entrusted by the Ministry of Finance to act as the custodian and financial agent of the central government's public funds and to manage the treasury's recovery and the central government's bond business.

Firstly, as the custodian of the central government's public funds, the general public is free to choose to open a deposit account with a financial institution. However, the deposit accounts of the central government are opened by the Ministry of Finance in accordance with the law and are called Treasury Deposit Accounts at the Central Bank. The revenues and expenditures of the organs of the central government, including annual budgets, special budgets, and other revenues and expenditures such as government borrowing or debt service, are channeled through the Treasury Deposit Account. Unless there are special provisions, all of them are managed and recovered through the Treasury Deposit Account.

The central bank manages the Treasury Deposit Accounts, keEPS track of the Treasury's fund dynamics, and handles Treasury receipts and disbursements through the Treasury's system of banks. In recent years, central banks have continued to promote electronic treasury operations, establishing online treasury disbursement mechanisms as well as remittance networks, mobile payments, and other diversified payment channels to enhance the efficiency of treasury operations and increase the convenience of payment.

In addition, the central bank acts as the financial agent of the central government. In response to the central government's need to issue bonds to raise funds, it handles the bidding of central government bonds. Bidding units participate in the bidding through computer links, and the bidding results are immediately released, facilitating bond market transactions.

Currently, central government bonds are issued in registered form and are no longer printed in physical form. The registration, transfer, and repayment of all rights related to the issuance of bonds and various transactions are all handled through the systematic connection between the Central Bank and the commissioned clearing bank, which is both safe and efficient.

In short, the Central Bank serves as the custodian of the central government's public funds and provides the government with comprehensive and convenient Treasury services. It facilitates the scheduling of government treasury funds, maintains the security of treasury funds, and enhances the effectiveness of government financial management. On the other hand, it acts as the financial agent of the central government, which needs to ensure that the central government issues bonds smoothly, raises funds, pays the principal and interest of the bonds as scheduled to consolidate the government's indebtedness, and maintains the smooth operation of the central government's bond clearing and settlement to promote the active development of the bond market.

Three Tools of Central Banks to Control Money Supply

The central bank controls the money supply by using different monetary policy tools to achieve its monetary policy objectives.

The first is the policy rate, which influences the level of market interest rates by adjusting the policy rate. Generally, the central bank guides the interest rate level of the entire money market by changing the overnight rate or other benchmark rates. When it raises the policy rate, the cost of borrowing for commercial banks rises, which may lead to a fall in demand for borrowing and thus slow down the growth of the money supply. Conversely, lowering the policy rate may stimulate borrowing activity and the expansion of the money supply.

The second is open market operations, which involves adjusting the level of reserves in the banking system by buying and selling financial assets such as government bonds in the open market. When the central bank buys bonds, it injects funds into banks, increasing reserves and prompting them to increase lending. Conversely, when the central bank sells bonds, it recovers funds and reduces reserves, which may cause banks to reduce lending. This adjustment of the level of reserves through open market operations can have a direct impact on the ability and willingness of banks to provide loans.

The third tool is reserve requirements, which allow banks to influence the ability of commercial banks to lend by adjusting their reserve requirements. Reserves are a portion of the funds that commercial banks must deposit with the central bank to ensure that payments are cleared and to maintain the stability of the financial system. By raising or lowering reserve requirements, the central bank can directly affect the amount of money available for commercial banks to lend. Raising reserve requirements may limit the ability of commercial banks to lend, while lowering reserve requirements may help expand lending.

All three tools are used by the central bank to achieve its monetary policy objectives, which are basically to maintain the inflation target, promote economic growth, maintain financial stability, etc.

Liability Operations of Central Banks

Liability Operations of Central Banks

The liability operations of the central bank include the debts and burdens it assumes, which include the currency it issues, the deposits of commercial banks, and the indebted instruments provided by the central bank to financial institutions.

The central bank is responsible for the issuance of the country's legal tender, including notes and coins. These currencies are liabilities of the central bank, as its issuance of currency is tantamount to promising a means of payment to the public. And commercial banks are mandated to keep a certain percentage of reserves with the central bank to ensure the stability of the financial system. These reserves are the commercial banks' deposits with the central bank, which also form the central bank's liabilities. Therefore, one of its main liabilities is the banknotes issued and the bank deposit reserves.

Central banks usually hold international reserves, including foreign exchange and gold. These international reserves are an asset of the central bank as well as its liability. These reserves are in the form of foreign currencies and other foreign exchange assets, which are used to maintain the international balance of payments and exchange rate stability and for which the central bank needs to manage and has certain responsibilities.

The central bank may enter into deposit relationships with central banks in other countries or regions, and these deposits also constitute liabilities of the central bank, usually in connection with the adjustment of liquidity and monetary policy.

At the same time, the central bank may issue short-term liability instruments, such as central bank bills, to adjust liquidity in the market. These notes are usually issued to implement monetary policy and to manage liquidity through other short-term borrowing instruments, such as reverse repo operations into the financial markets.

The role of central banks' liability operations, which are closely linked to the issuance of currency and the functioning of the financial system, is that through the management of these liabilities, central banks can influence the money supply, market interest rates, and the stability of the financial system.

Central bank balance sheets

|

Assets

|

Liabilities

|

| International reserves |

Cash in circulation |

| Loans and deposits |

Funds in accounts with the central bank |

|

Investments in Securities

|

Issued securities |

| Other assets |

Commitments to the IMF |

|

Other liabilities |

|

Capital |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security, transaction, or investment strategy is suitable for any specific person.

Liability Operations of Central Banks

Liability Operations of Central Banks