What Is a Stock Exchange and How Does It Work?

2025-08-08

Summary:

Summary:

Learn how stock exchanges work as regulated marketplaces for securities, promoting liquidity, transparency, and fair pricing.

The stock exchange is the beating heart of modern financial markets. It serves as the central hub where buyers and sellers meet to trade shares, bonds, and other financial instruments, enabling companies to raise capital and investors to grow their wealth. While the concept may sound straightforward, the mechanisms that power stock exchanges are complex and fascinating, blending technology, regulation, and market psychology.

Understanding how stock exchanges operate is crucial for anyone looking to participate effectively in the markets—whether as a casual investor or a professional trader.

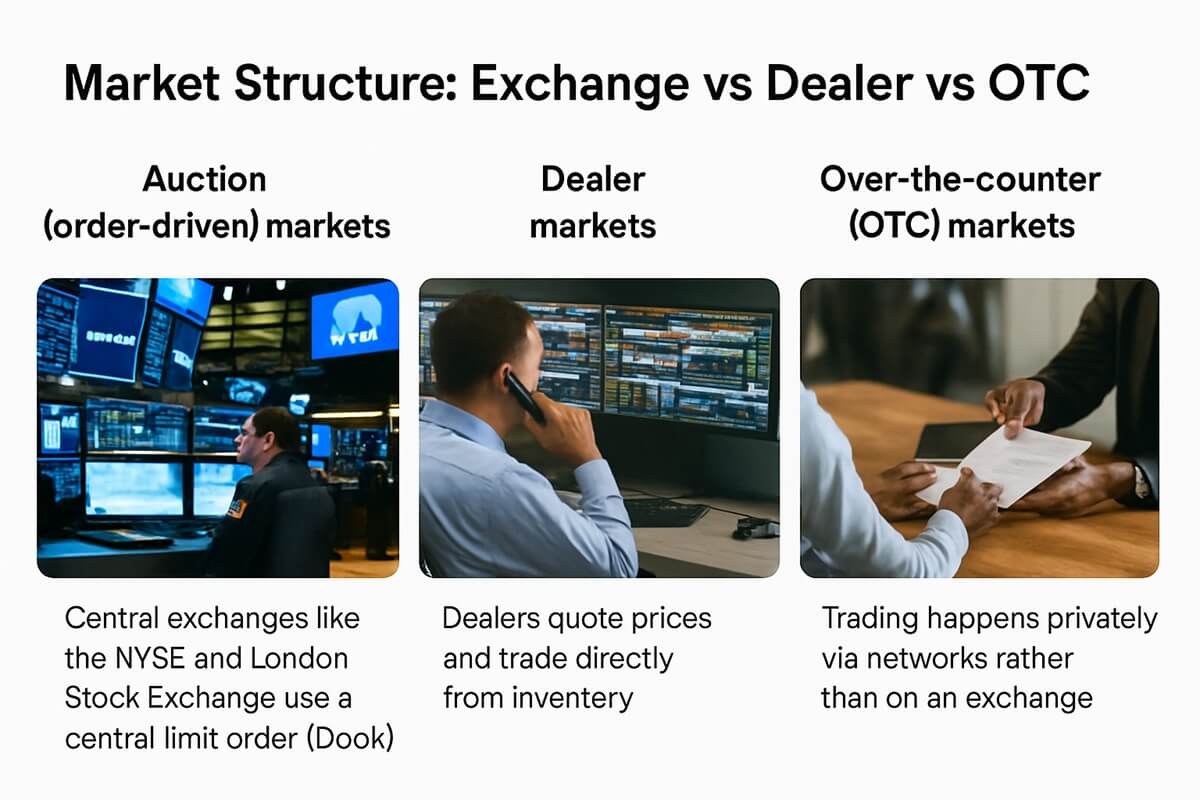

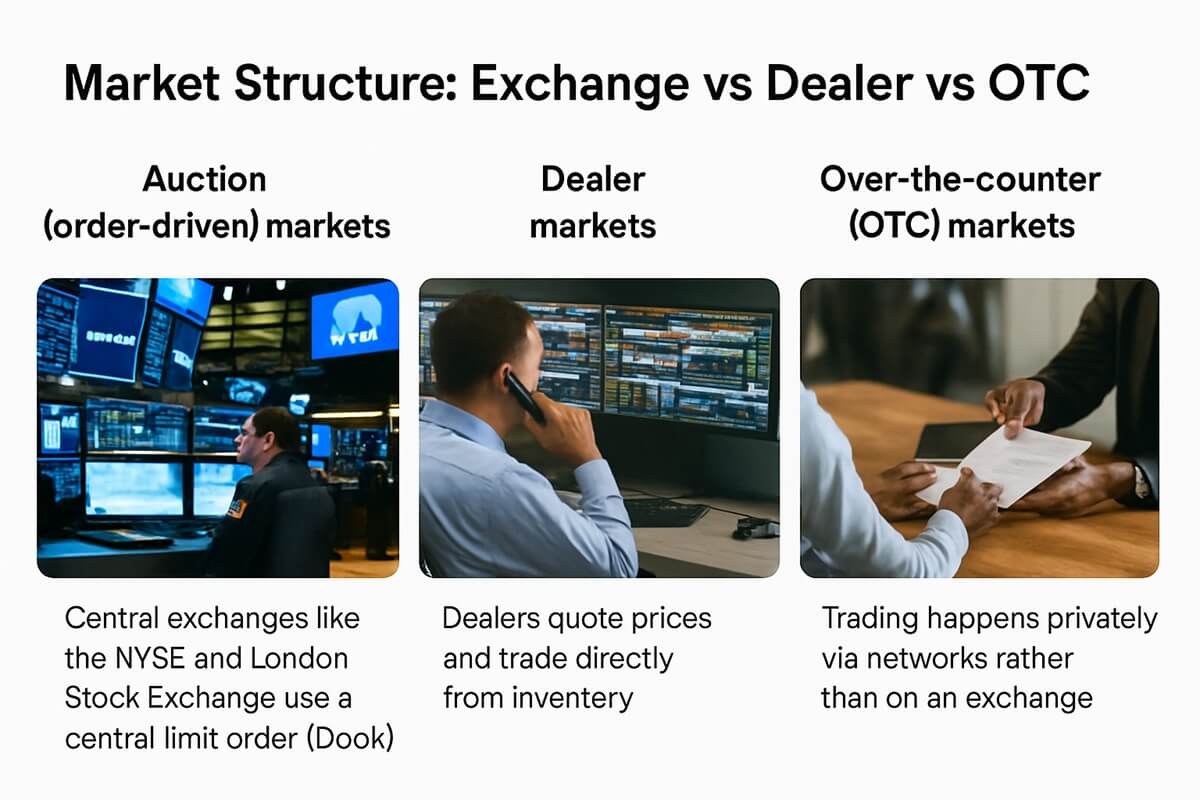

Market Structure: Exchange vs Dealer vs OTC

Auction (order-driven) markets: Central exchanges like the NYSE and London Stock Exchange use a central limit order book (CLOB)—participants submit buy/sell orders that are matched by price-time priority. The highest bid meets the lowest ask, and the matching engine executes trades transparently in real time.

Over-the-counter (OTC) markets: These are less centralized and less regulated, often used for bonds, smaller stocks, or delisted securities. Trading happens privately via networks rather than on an exchange.

Order Flow and Matching: Order Types, Market Makers, and Matching Engines

"If the spread of Apple shares was 10 cents…the market maker had just profited $12 through these two trades".

Listing and Delisting: How Companies Join or Leave an Exchange

Listing (e.g., via IPO): Companies must meet certain thresholds—like minimum market capitalization, shareholder equity, financial reporting, and governance standards—to be listed.

Involuntary delisting: Occurs when listing standards aren't met. A company usually gets a warning and a grace period to comply (e.g., regain share price levels or file reports) before delisting proceedings begin.

Voluntary delisting: Companies may choose to go private or merge, opting out of being public.

The relisting process is possible once compliance is restored, though it can be rigorous.

Example process: For NASDAQ, a deficiency notice triggers a cure period (e.g., 90 days). If compliance isn't met, a delisting letter is issued, followed by potential hearings and public disclosure.

Trading Hours, Electronic Trading & High-Frequency Trading (HFT)

Clearing, Settlement & Counterparty Risk

Settlement timings: The industry has mostly transitioned to T+1 (trade date plus one business day) in many countries, including the U.S., Canada, and India. Some regions still use T+2. but many plan to move to T+1 soon.

Costs, Fees & Market Regulation

Self-regulation: Exchanges enforce compliance among members.

Government oversight: Agencies like the U.S. SEC mandate transparency, fairness, and investor protections.

Summary Table

Stock Exchange Mechanics: A Snapshot

| Topic |

Core Insights |

| Market Structure |

CLOB vs Dealer vs OTC; importance of transparent matching |

| Order Flow & Market Makers |

Order book mechanics, role of liquidity providers, profit via spread |

| Listing & Delisting |

Criteria, grace periods, voluntary vs involuntary paths, and relisting |

| Trading Mechanisms |

Electronic matching, defined session hours, plus the speed of HFT |

| Clearing & Settlement |

Role of clearinghouses; shift toward T+1 standards |

| Costs & Regulation |

Fee structures, regulatory frameworks, and the opaque world of dark pools |

Conclusion

Stock exchanges are sophisticated, multi-layered ecosystems that enable the efficient trading of securities worldwide. Their intricate market structures, advanced order matching systems, rigorous listing standards, and strict regulatory frameworks work in concert to provide liquidity, price transparency, and investor protection.

For investors and traders, understanding these mechanisms is not just academic—it empowers better decision-making, sharper insight into market behaviour, and greater confidence navigating financial markets. Whether you're placing your first trade or managing a complex portfolio, the stock exchange remains a foundational pillar of modern finance, continually evolving with technology and regulation.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.