To ride in the stock market, it is inevitable to have some tools in hand. And in the Chinese stock market, there are two such tools. One is the Shanghai Stock Exchange's SSE index, and the other is the Shenzhen Stock Exchange's SZSE index. Compared to Shanghai, the SZSE is home to small and medium-sized enterprises (SMEs), technology, and innovative companies. With the development of technology, the Stock Prices of these enterprises have soared, attracting the attention of many stockholders. Therefore, in this article, we will take a look, along with many stockholders, at SZSE index investment and market analysis.

What is the meaning of the SZSE index?

What is the meaning of the SZSE index?

It is a stock price index compiled by the Shenzhen Stock Exchange. The calculation method of the index is basically the same as that of the SSE index, but its sample includes all stocks listed on the Shenzhen Stock Exchange, so it is broadly representative. It reflects the overall price changes and market performance of all stocks listed on the Shenzhen Stock Exchange. As one of the key indicators for measuring the overall performance of the Shenzhen stock market, it provides investors with a reference for understanding market trends and investment opportunities.

As the first and most representative stock index compiled by the Shenzhen Stock Exchange, the Shenzhen Composite Index generally refers to the Shenzhen Index. Of course, in recent years, since the SSE Composite Index covers the larger and more liquid stocks in the Shenzhen market, investors often use this index to understand the trend and movement of the Shenzhen market.

Apart from these two representative stock indices, the Shenzhen Stock Exchange also compiles a series of stock indices, including composite indices, constituent indices, and industry indices. These indices reflect different aspects of the Shenzhen stock market and provide investors and analysts with comprehensive information to help them understand market dynamics and assess investment opportunities.

Among them, the composite indices include the Shenzhen Composite Index, the Shenzhen A-Share Index, the Shenzhen B-Share Index, and the Shenzhen Industry Classification Index. These indices reflect the overall performance of the Shenzhen Securities market, the A-share market, the B-share market, and the market performance of various industry classifications, respectively.

The constituent indices include the SSE Constituent Index, the SSE Constituent A-share Index, and the SSE Constituent B-share Index. These indices track the market performance of the better-performing constituent stocks in the Shenzhen stock market, covering the entire market, the A-share market, and the B-share market, respectively.

The SSE sector indices cover different industries and sectors, such as the SSE Fund Index, the SSE Technology Index, and the SSE Medical Index. These indices reflect the market performance of various industries and sectors in the Shenzhen stock market, providing investors with market trends and investment opportunities in the segmented areas.

The criteria and methodology for the selection of constituents of these indices include three main aspects: listing time, market size, and market liquidity. Firstly, companies are required to be listed in the market for at least 3 months to ensure the stability and reliability of the data. Secondly, shortlisted companies are determined according to the order in which the outstanding Market Capitalization of listed companies accounts for the market share, with preference given to companies occupying a larger share of the market. Then, shortlisted companies are identified in the order of the turnover of listed companies as a proportion of the market, with priority given to companies with higher liquidity.

After determining the shortlisted companies, the constituent samples are determined by taking into account a number of factors. The first is market capitalization and turnover, and companies with higher market capitalization and turnover are selected. Secondly, for industry representativeness and growth, select companies that are representative of their industry and have good growth potential.

Next is financial status and operating performance, prioritizing companies with sound financials and good operating performance. Lastly, it is the standardized operation within two years, selecting companies that have operated in a standardized manner in the past two years. By taking these criteria into consideration, the constituent samples are finalized to ensure that the index is highly representative and scientific.

The constituent sample selection process strictly follows the criteria and methodology, aiming to ensure that the selected companies are highly representative, liquid, and in line with industry trends. This selection method helps to reflect the overall performance of the market and provides investors with a reliable reference basis.

The constituent stock selection criteria and methodology of the SSE Index ensure the accuracy and representativeness of the index by taking into account the time of listing, market size, market liquidity, industry representativeness, financial status, business performance, and standardized operation, and provide investors with a scientific and reliable market reference. And it is synchronized with the release of the Shenzhen stock market quotes, so it is an indispensable reference for shareholders and securities practitioners to study and judge the trend of stock price changes in the Shenzhen stock market.

SZSE Index Trends

SZSE Index Trends

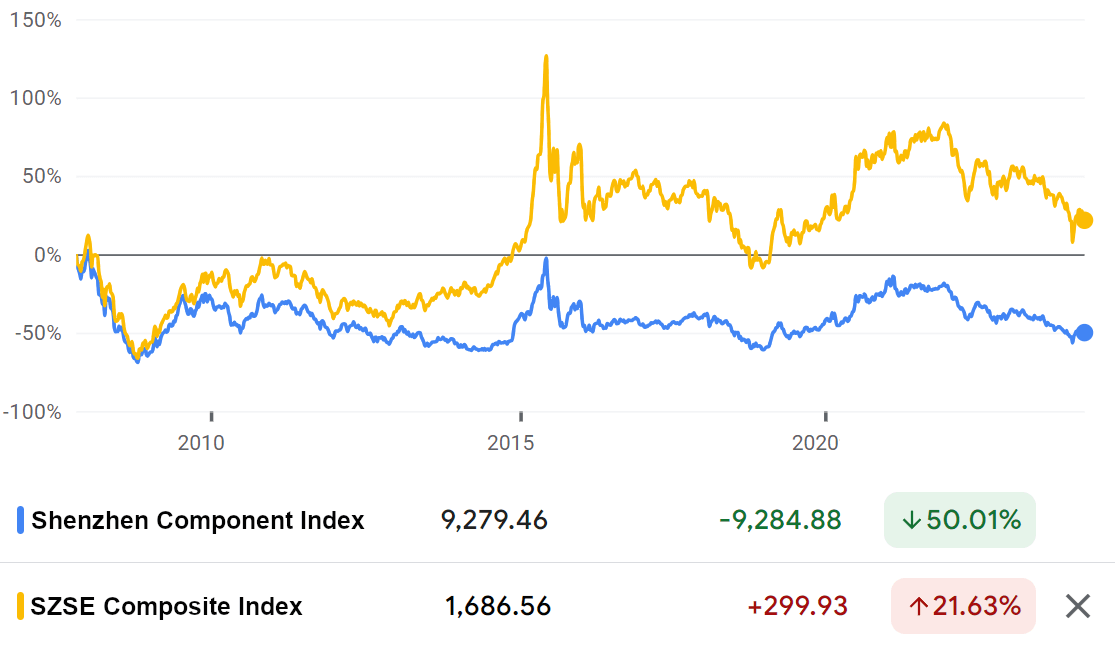

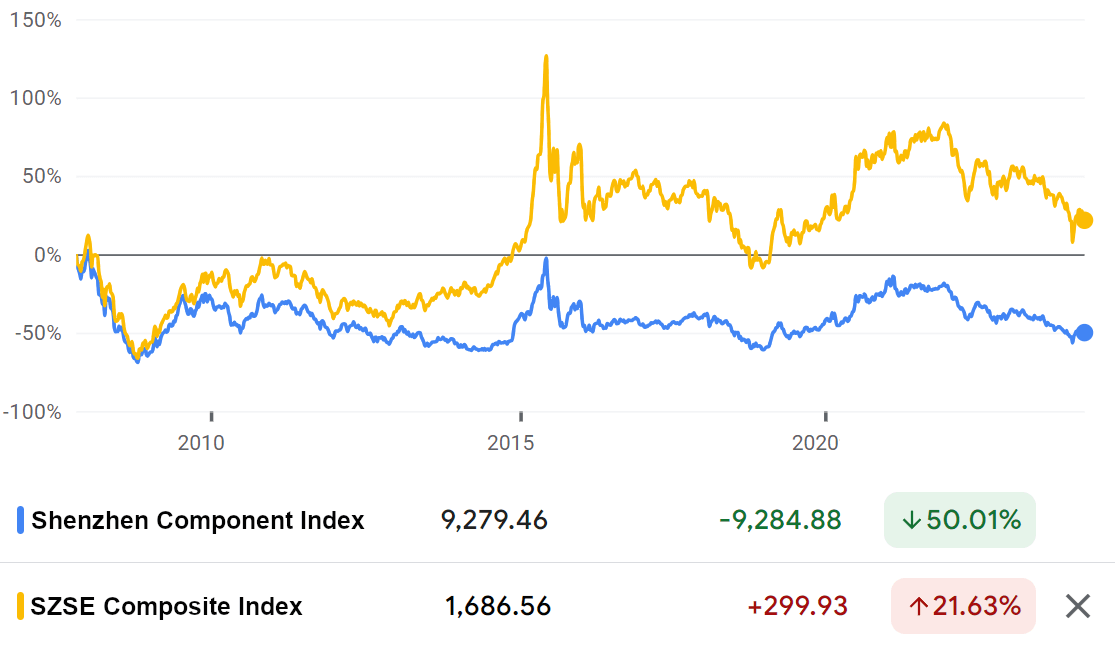

It is also known as the Shenzhen Composite Index, which is a stock price index compiled by the Shenzhen Stock Exchange to measure the overall price performance and trend of the Shenzhen Stock Exchange market. Its trend can reflect the stock price change trend of all listed companies in the Shenzhen market and is an important reference indicator for investors and securities practitioners to analyze the market. Its market trend reflects the overall performance of stocks listed on the Shenzhen Stock Exchange, and it is currently trending downward from a general perspective.

Over a long period of time, the SZSE index as a whole has shown an upward trend. This reflects the overall growth in value of companies listed on the Shenzhen Stock Exchange market, and in particular the strong performance of technology and innovative companies. These companies typically have high growth potential and innovation capabilities, driving the market as a whole upward.

In the first half of 2015. the SZSE Index experienced a period of rapid gains. This was due to a massive influx of funds into the market as investors were optimistic about the market outlook. During this period, the index hit an all-time high. This reflected the market's confidence in the strong performance of listed companies in the Shenzhen stock market, particularly technology and innovative companies.

However, a rapidly rising market also poses a potential bubble risk. The share prices of some companies may be too high, and investors' speculative behavior has increased. During the period of rapid market growth, regulators introduced a series of policies to stabilize the market and combat speculative behavior. These policies may have had some impact on the market.

With the gradual bursting of the market bubble, the index began to experience a significant correction in the second half of 2015. with some degree of decline. Despite the dramatic market volatility experienced in 2015. it still showed an overall upward trend in the long term. This reflects the resilience and growth potential of the Shenzhen securities market.

It experienced a period of decline in early 2020. particularly after the Chinese New Year, due to the Xin Guan epidemic. However, the index then started to rebound in March and quickly recovered to a higher level. This rebound could be attributed to the government's economic stimulus measures and the market's expectation of future economic recovery. With the recovery of investor confidence, the SZSE Index showed a sustained upward trend, reflecting the gradual increase in market confidence in companies listed on the Shenzhen Stock Exchange.

During the period from April to July 2020. the index showed a strong rebound and gradually recovered to a higher level. The rebound during this period may have been influenced by the market's optimistic expectations of economic recovery and government policy support. The rebound in global markets and the gradual recovery of domestic and international economic activities also contributed to the rise of the index. The strong performance of the index was further supported by increased investor confidence in companies listed on the Shenzhen Stock Exchange.

It continued to exhibit a certain degree of volatility during 2021 but generally remained at a relatively high level. Such volatility may be related to a number of factors, including changes in the global market environment, adjustments in domestic economic policies, and fluctuations in market sentiment. Despite the volatility, the SZSE Index has generally maintained a relatively good performance, reflecting the vitality and resilience of the Shenzhen securities market as well as the sustained growth and stability of listed companies. Investors need to remain cautious and practice good risk management in the face of these fluctuations.

Starting in 2022. the index began to show a downward trend. This reflects the fact that the market is affected by a range of factors, including the macroeconomic slowdown, policy changes, and the international situation. Notably, the SZSE Index fell below 10.000 points in October 2023. indicating that the market may be under greater pressure.

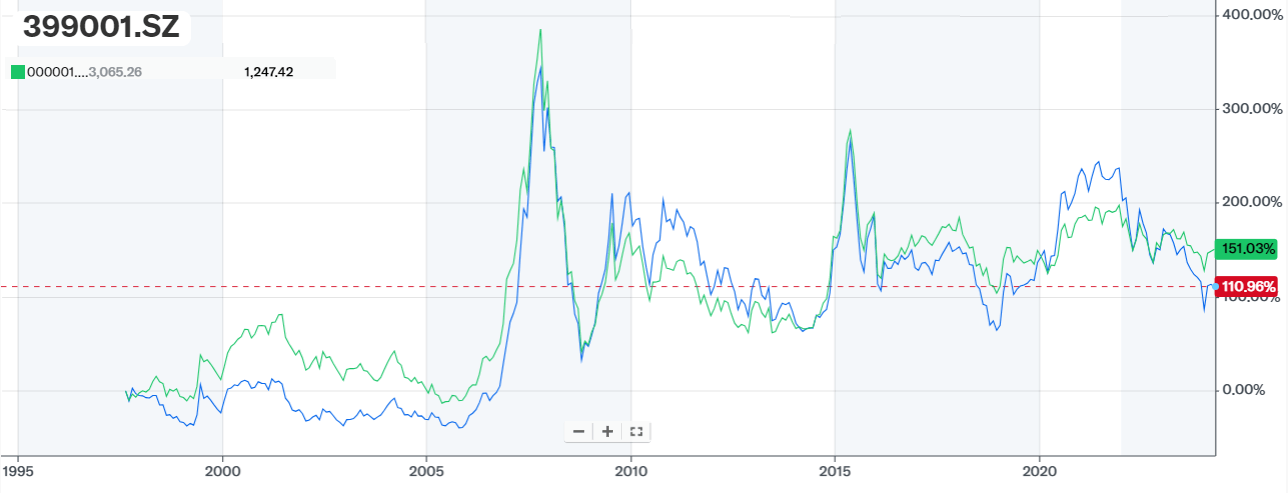

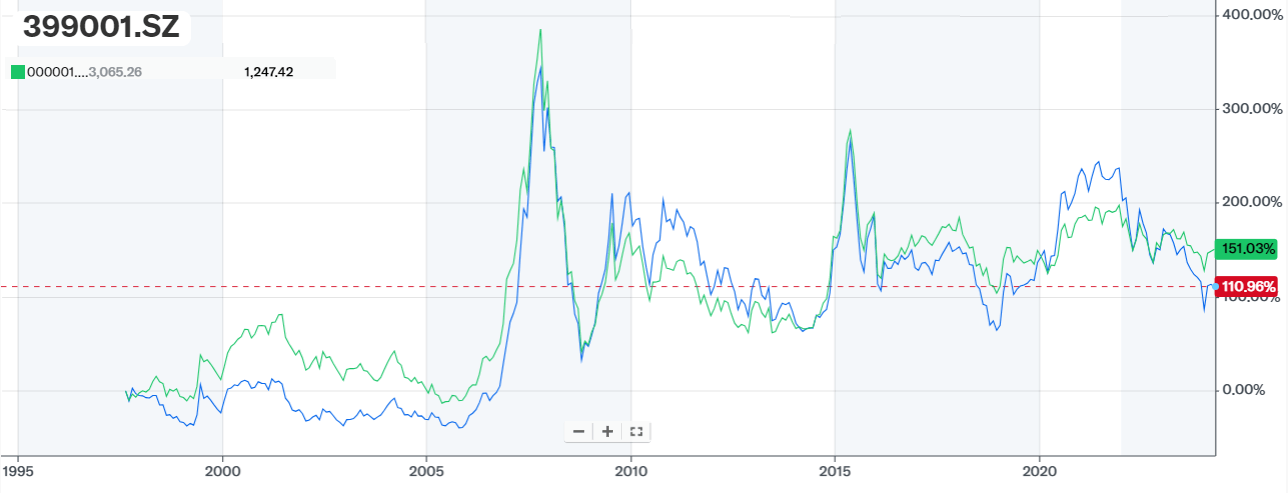

By analyzing the share price distribution chart of the SZSE Index over the past thirty years, it can be seen that the Shenzhen Index is more volatile. This volatility is mainly manifested in the distribution of share prices in different ranges, which implies that the index may experience large ups and downs in a short period of time.

By analyzing the share price distribution chart of the SZSE Index over the past thirty years, it can be seen that the Shenzhen Index is more volatile. This volatility is mainly manifested in the distribution of share prices in different ranges, which implies that the index may experience large ups and downs in a short period of time.

This volatility may stem from a number of factors, such as the industry structure of the Shenzhen stock market, the innovation ability and performance of listed companies, as well as macroeconomics, policy changes, and global market influences. In addition, the performance of technology and innovative companies in the Shenzhen stock market may also have a significant impact on the volatility of the index.

The index has a wide range of share price fluctuations, which means that it may experience significant increases and decreases in a relatively short period of time. This greater volatility may be characterized by the presence of more technology and innovative companies in the Shenzhen stock market, which tend to have more volatile performance. In addition, factors such as the industry structure of the Shenzhen market, market liquidity, and macroeconomic and policy changes may also contribute to a greater range of volatility in the Shenzhen index.

And it remains at a lower share price level for a longer period of time, which may be the result of a combination of factors such as market cyclicality, the macroeconomic environment, policy implications, corporate performance, and market liquidity. The duration of such lower levels makes it necessary for investors to be vigilant and prepared for market volatility.

The fact that the index remains at higher price levels for a significant portion of the time reflects the market's confidence in companies listed on the Shenzhen Stock Exchange and the strong performance of sectors such as technology and innovation. The duration of such high price levels may be affected by a number of factors, including the domestic and international economic situation, policy support, market demand, and corporate performance growth.

Compared with the SSE Index, the SZSE Index had a higher average annual growth rate of 6.47%, indicating that it was stronger in terms of long-term investment returns. However, it is also significantly more volatile than the SSE Index, implying a greater range of ups and downs. Meanwhile, the index typically falls more than the SSE in market declines. For example, between 2007 and 2019. it fell significantly more than the SSE.

The SZSE Index is usually more volatile, and this greater volatility means that it may face greater risk during periods of market volatility, so investors may seek to achieve more stable investment returns by focusing on companies with strong fundamentals and good growth prospects during this period, but they also need to be wary of the risks posed by market volatility and be prepared to adjust their investment portfolios at the right time.

SZSE Index Investment

SZSE Index Investment

Given that the movement of the index is affected by multiple factors, such as macroeconomics, policies, and changes in the global market, the market may experience greater volatility during certain periods. Therefore, investment in it can be made by diversifying into different sectors and stocks to reduce risk. By allocating stocks to different sectors or choosing Index Funds, the risks associated with concentrating on a single sector or company can be avoided.

index funds and ETFs track an entire index, covering multiple sectors and stocks with different market capitalizations. This type of investment diversifies risk and reduces the impact of fluctuations in a single stock or sector on a portfolio. By purchasing an index fund, or ETF, instead of selecting individual stocks, investors invest in the entire index at once. This simplifies the investment decision-making process and avoids the complexity of selecting individual stocks.

Index funds and ETFs typically have low management fees and transaction costs, which makes this type of investment more cost-effective for long-term investing. Moreover, ETFs are listed and traded on the stock exchange, so investors can buy or sell them at any time, just like buying and selling stocks. This provides investors with greater flexibility and convenience.

The SZSE Index has been on an overall upward trend for a long time, especially with the strong performance of the technology and innovation sectors. Through a fund or ETF that tracks the index, investors can share in the long-term growth potential of the market. When purchasing index funds, or ETFs, investors can make appropriate allocations according to their risk tolerance and investment objectives. This helps to achieve better risk management and asset allocation.

The index covers companies from a wide range of industries and sectors, and investors should maintain portfolio diversification when investing. This helps to reduce the negative impact of a single industry or company on the portfolio, diversify risk, and improve portfolio stability. By maintaining a diversified portfolio, investors are better able to protect themselves against potential risks during times of market volatility.

A diversified investment strategy involves diversifying into different industries, sectors, and stocks. This strategy can help investors diversify the risks associated with market volatility and avoid potential losses resulting from concentrated holdings in a single industry or company. By allocating stocks to different sectors or choosing an index fund that tracks the SZSE index, investors can better balance returns and risks and improve the stability of their investment portfolio. In addition, investors can utilize diversified investment strategies to maintain higher investment returns in different market environments.

Although the index has high volatility, it shows an overall upward trend in the long run. Investors should therefore adopt a long-term investment strategy, remain patient, and not be swayed by short-term market fluctuations. By holding the index for a long period of time, the risks associated with short-term market fluctuations can be offset, resulting in more stable returns and better risk control during market volatility.

It is important to note that the movement of the index is heavily influenced by domestic and international policy changes, especially policy adjustments involving technology, innovation, and other areas. Investors should pay close attention to these policy developments and make timely adjustments to their investment strategies in response to policy changes in order to better protect their investments and capitalize on opportunities during market volatility.

In conclusion, investors should remain cautious when investing in the SZSE Index and develop a scientific investment strategy to ensure long-term, stable returns in a complex market environment. Investors should pay close attention to market movements and policy changes and reasonably allocate their investment portfolio to diversify risks. Maintaining a long-term perspective in the face of short-term volatility can help balance risks and achieve more stable investment returns.

SZSE Index Investment and Market Analysis

| Topics |

Explanation |

Recommendations |

| Market Overview |

Covers multiple industries and sectors. |

Know index stocks and sectors. |

| Market Volatility |

Highly volatile and rising over time. |

Patience with long-term volatility. |

| Investment Strategies |

Investing through index funds, or ETFs. |

Diversify your portfolio to spread risk. |

| Diversification |

Invest across various industries and sectors. |

Reduce single-sector risk. |

| Long-term returns |

Long-term index holdings yield stable returns. |

Invest long-term to buffer short-term swings. |

| Policy Focus |

Highly affected by policy changes. |

Monitor policies and adapt strategies promptly. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is the meaning of the SZSE index?

What is the meaning of the SZSE index? SZSE Index Trends

SZSE Index Trends By analyzing the share price distribution chart of the SZSE Index over the past thirty years, it can be seen that the Shenzhen Index is more volatile. This volatility is mainly manifested in the distribution of share prices in different ranges, which implies that the index may experience large ups and downs in a short period of time.

By analyzing the share price distribution chart of the SZSE Index over the past thirty years, it can be seen that the Shenzhen Index is more volatile. This volatility is mainly manifested in the distribution of share prices in different ranges, which implies that the index may experience large ups and downs in a short period of time. SZSE Index Investment

SZSE Index Investment