When you start investing, one of the first decisions you'll face is whether to go for growth or value stocks. These two types of investments represent very different strategies, each with its own potential rewards and risks. Understanding the key differences can help you decide which fits your financial goals and risk tolerance.

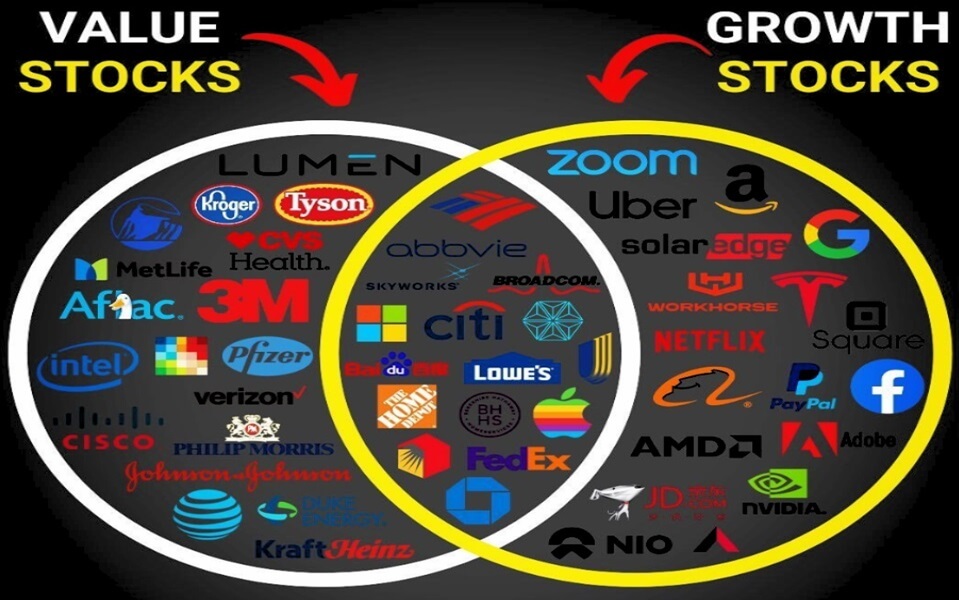

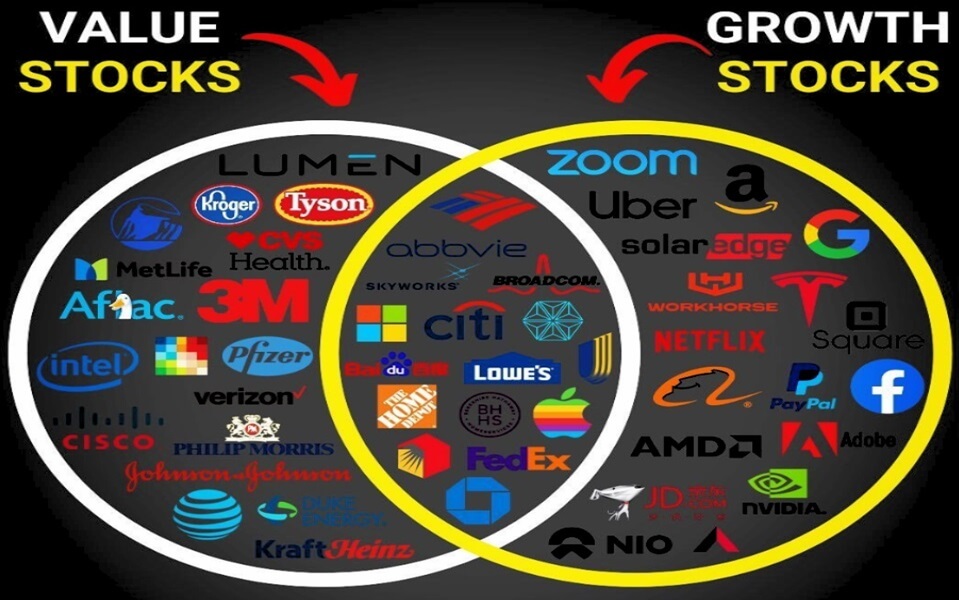

Growth stocks are typically from companies that are expected to grow at an above-average rate compared to others in the market. These companies often reinvest their profits to fuel expansion rather than paying dividends. On the other hand, value stocks are generally from well-established companies that are priced lower than their intrinsic value, making them an appealing option for traders looking for stability and long-term returns.

Both growth and value stocks have their merits, and the right choice for your portfolio depends on your financial goals, risk tolerance, and the current state of the market.

The Core Difference: Growth vs. Value

At the heart of the debate is the fundamental difference between growth stocks and value stocks. Growth stocks are shares in companies that are expected to grow faster than the market average, often because of innovation, new products, or expanding into new markets. These stocks typically don't pay dividends because companies reinvest their earnings back into the business to fund future growth. As a result, growth stocks tend to be more volatile, but they offer the potential for high capital gains over time.

In contrast, value stocks are shares in well-established companies that are undervalued by the market. These stocks tend to have lower price-to-earnings (P/E) ratios, and traders buy them because they believe the market has not recognised their true value. While growth stocks focus on future expansion, value stocks focus on buying established companies at a discount, with the expectation that their stock price will rise as the market realises the company's true worth.

Both types of stocks play a crucial role in building a diversified portfolio, and the key is knowing when and how to use each one.

Identifying Which Strategy Suits Your Portfolio

The next question that often arises is: how do you decide which strategy to follow? The answer depends on your investment goals, risk tolerance, and the current state of the market.

If you're an trader with a long-term horizon and you're comfortable with some level of risk, growth stocks could be a great fit for you. These stocks offer the possibility of high returns, but they come with volatility, and their value can fluctuate significantly. Think of technology companies like Apple or Amazon—while their stock prices can be unpredictable in the short term, the long-term growth potential is enormous.

On the other hand, if you're more risk-averse and prefer stability, value stocks could be a better option. These stocks are typically less volatile and are often from industries that are more stable, such as consumer goods, utilities, or healthcare. Because they're undervalued, they often come with the potential for consistent returns, and they may even provide dividends. For example, established companies like British Gas or HSBC offer steady growth and income, making them ideal for conservative traders or those looking for more security in uncertain markets.

Managing Risks and Maximising Returns in Changing Markets

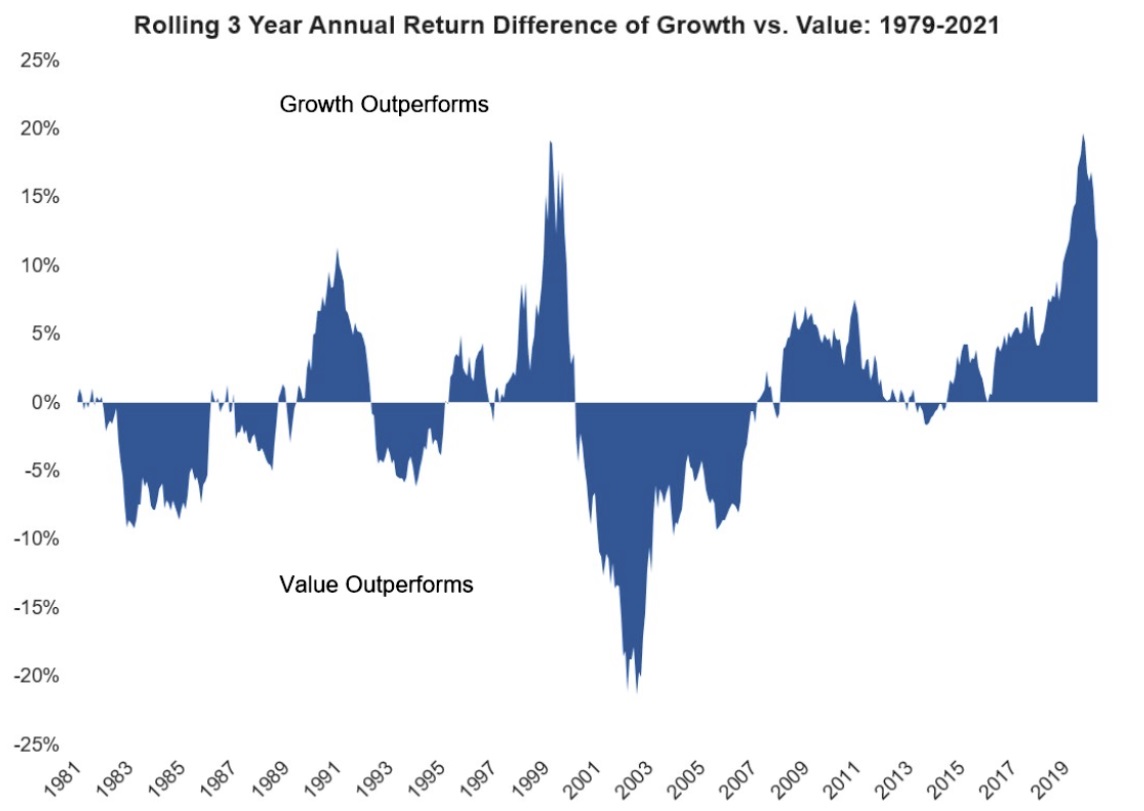

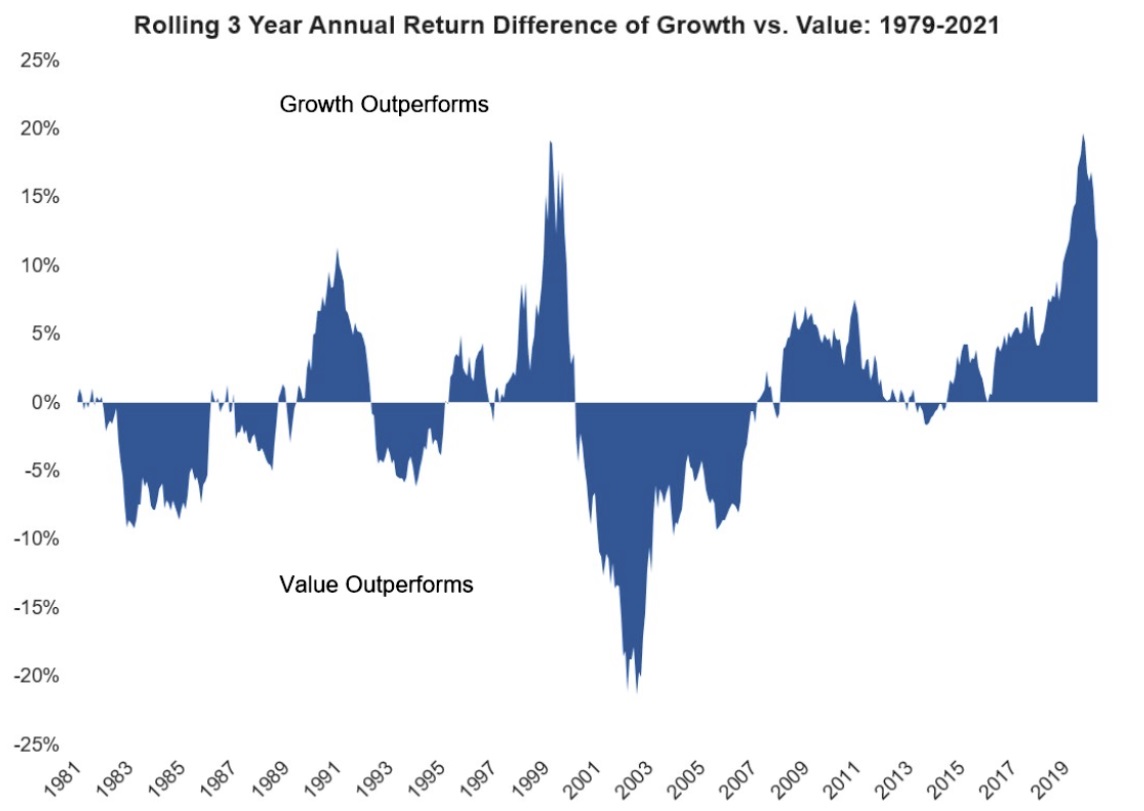

The performance of growth and value stocks can be heavily influenced by the market cycle. Growth stocks tend to perform well during periods of economic expansion when consumer demand is high, and businesses are expanding rapidly. In contrast, value stocks are often better suited for slower market conditions or economic downturns, when traders flock to safer, undervalued companies that have proven track records.

One of the challenges of investing in growth stocks is that they are more susceptible to market sentiment. If a growth stock fails to meet analysts' expectations or if broader market conditions change, these stocks can experience significant price drops. For example, during the global economic downturn of 2020. many tech stocks saw sharp declines despite their long-term growth potential.

Value stocks, however, tend to be more resilient during tough times because they're already priced lower relative to their earnings. Even when the broader market is struggling, traders may continue to see value in these stocks, which can lead to slower but more stable growth.

For a well-rounded portfolio, it's often beneficial to balance both growth and value stocks. In times of economic growth, growth stocks may outperform, while value stocks can offer more protection during market corrections. By incorporating both into your investment strategy, you can manage risk while maximising the potential for returns in both bullish and bearish market cycles.

How to Build a Balanced Portfolio with Growth and Value Stocks

The ideal portfolio will likely include a combination of growth and value stocks, allowing you to benefit from both higher returns and more stability. A good rule of thumb is to allocate a portion of your portfolio to growth stocks if you're looking for capital appreciation and are willing to ride out the volatility. At the same time, you should consider adding value stocks for more stability, especially if you're looking for consistent dividends and long-term growth.

The exact allocation will depend on your personal risk tolerance and investment goals. A younger trader with a longer time horizon might lean more heavily into growth stocks, while someone approaching retirement might prefer a larger portion of their portfolio to be in value stocks to ensure more stable returns.

Another important consideration is market timing. During periods of economic expansion, growth stocks may offer the most opportunity. However, during economic slowdowns or when the market appears overvalued, value stocks could become more attractive as traders seek bargains and more predictable returns.

Growth Stocks vs Value Stocks

| Aspect |

Growth Stocks |

Value Stocks |

| Definition |

Stocks from companies with high growth potential. |

Stocks from established companies priced below their value. |

| Characteristics |

High growth potential.

No or low dividends.

Reinvest profits. |

Undervalued.

Stable earnings.

May offer dividends. |

|

|

| Risk |

Higher risk due to market volatility. |

Lower risk, more stable. |

| Investor Goal |

Long-term capital gains. |

Steady returns and income. |

| Examples |

Tesla, Amazon, Netflix. |

Coca-Cola, HSBC, Procter & Gamble. |

| Performance in Bull Markets |

Outperforms as the economy grows. |

May underperform in strong markets. |

| Performance in Bear Markets |

More volatile and can decline sharply. |

More resilient, tends to hold steady. |

| Investor Preference |

For high-risk, long-term growth investors. |

For conservative investors seeking stability. |

| Valuation |

High P/E ratio, reflecting growth expectations. |

Low P/E ratio, seen as undervalued. |

Conclusion

Whether you're new to investing or a seasoned trader, understanding the dynamics between growth and value stocks is key to creating a balanced and successful portfolio. Growth stocks offer the allure of high returns but come with higher risk, while value stocks provide stability and consistent returns, particularly during uncertain times.

By carefully considering your investment goals, risk tolerance, and the broader market environment, you can tailor your portfolio to make the most of both growth and value investing. With a bit of strategy and diversification, you can ensure that your portfolio is well-positioned to thrive, no matter what the market throws your way.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.