As of April 2025, investors are closely examining the merits of platinum versus gold as investment options. Gold has surged to record highs, driven by economic uncertainties, while platinum presents a potential opportunity due to supply deficits.

However, is platinum better than gold in the long run? This analysis explores the current market conditions, price trends, and investment considerations for both metals to determine which is better this year.

Gold's Performance and Outlook

Gold has traditionally been a safe-haven asset, especially during economic uncertainty. In 2025, gold has reached unprecedented heights, with prices hitting a record high of $3,391.62 per ounce on April 21, driven by global economic concerns and a weakening U.S. dollar.

Analysts from Goldman Sachs have projected that gold prices could reach between $3,650 and around $3,950 and potentially as high as $4,500 if recession risks materialise.

Several factors contribute to gold's strong performance:

Central Bank Purchases: Emerging market central banks have continued to drive demand, with sustained purchases in the London over-the-counter market.

Geopolitical Tensions: Ongoing trade disputes and geopolitical uncertainties have increased gold's appeal as a hedge against market volatility.

Economic Indicators: Concerns over inflation and potential recession have led investors to seek the stability that gold traditionally offers.

Platinum's Market Dynamics

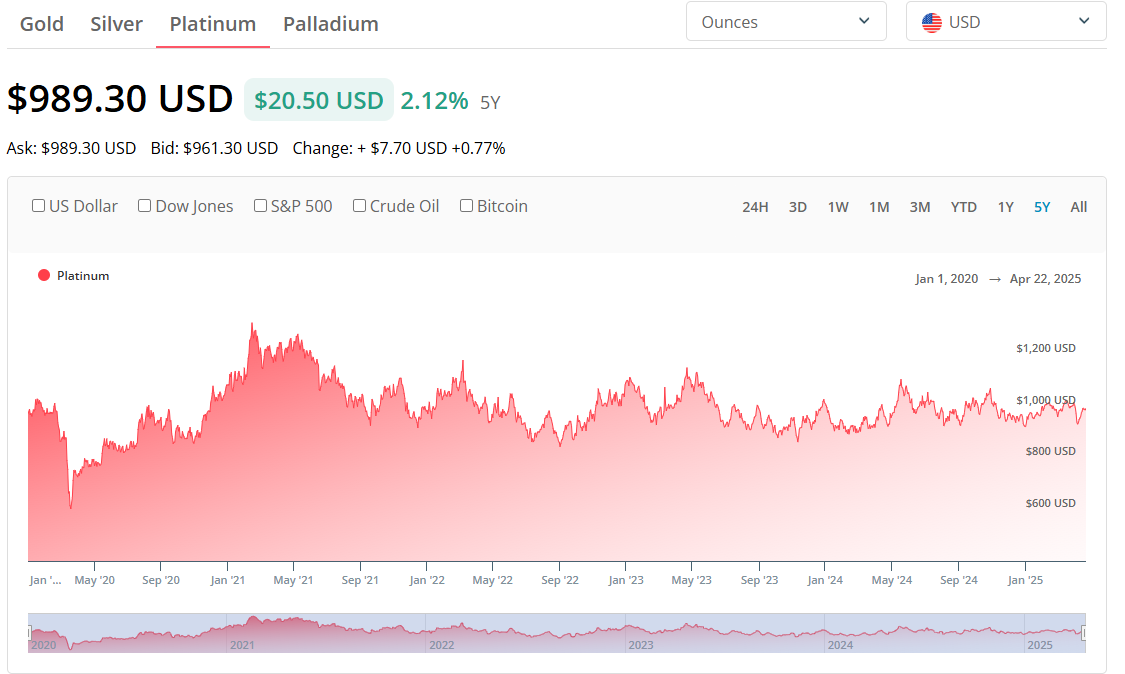

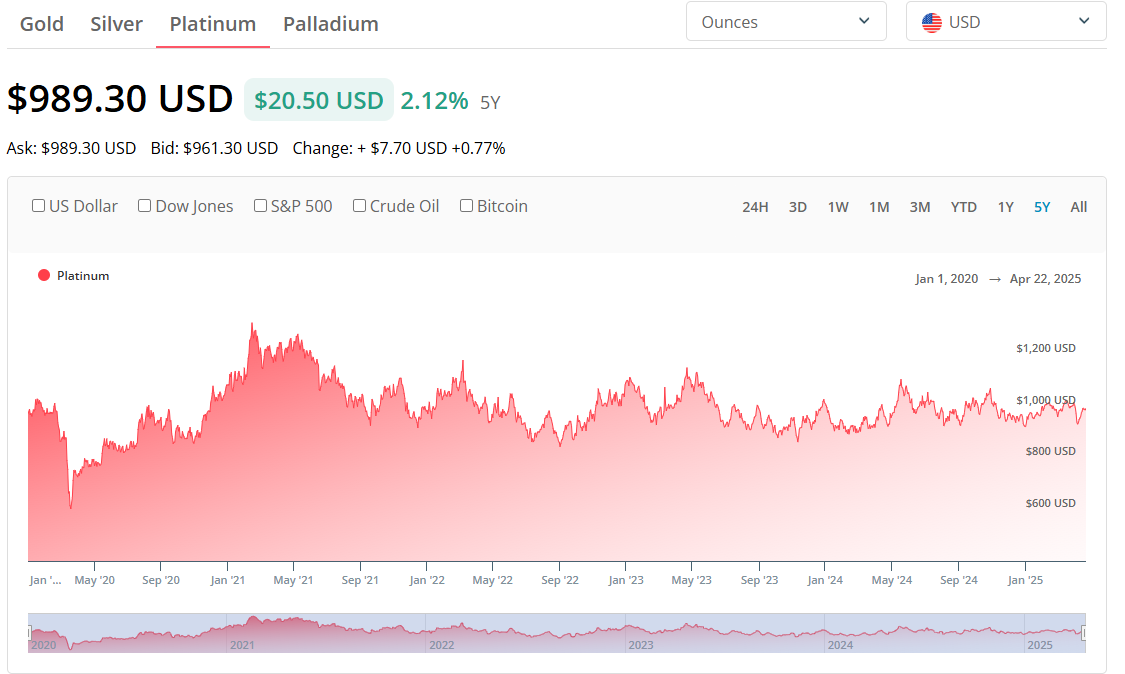

While not experiencing the same price surge as gold, platinum faces a significant supply deficit. The World Platinum Investment Council forecasts a market deficit of 848,000 ounces in 2025, marking the third consecutive year of shortfalls. Despite this, platinum prices have remained relatively flat, trading around $1,000 per ounce.

UBS analysts predict challenges will drive prices higher over the medium to long term despite a 2% year-over-year decline in automotive platinum demand.

Key factors influencing platinum's market include:

Industrial Demand: Platinum is heavily used in the automotive industry, particularly catalytic converters. However, the shift towards electric vehicles, which do not require catalytic converters, may impact demand.

Supply Constraints: Rising production costs and limited investment in mining operations pose risks to supply, potentially supporting higher prices.

Substitution Trends: Platinum sometimes substitutes for palladium, depending on price dynamics, which can influence demand.

Comparative Analysis and Future Forecasts

Gold's role as a hedge against inflation and economic instability has solidified its position as a preferred investment in 2025. Its strong performance is underpinned by central bank purchases and investor demand amid market volatility.

Notably, Chinese insurers have been permitted to allocate up to 1% of their assets to gold, potentially adding significant demand to the market. Major financial institutions have adjusted their gold price forecasts accordingly:

Goldman Sachs anticipates prices reaching between $3,650 to $3,950, with potential peaks at $4,500 if a recession occurs.

Citi Research has raised its three-month target to $3,500 per ounce, citing strong demand from Chinese insurers and ongoing market uncertainties.

Platinum, on the other hand, offers potential for long-term gains due to supply constraints and industrial demand, but its price remains subdued in the short term.

For context, platinum's performance has been more subdued, with prices hovering around $1,094 per ounce in April 2025. Forecasts suggest a gradual decline in the latter half of the year, with year-end prices projected near $1,013.93.

Investment Considerations

Investors seeking stability and a proven store of value may find gold the more attractive option in the current economic climate. Its historical performance during times of uncertainty supports its status as a safe-haven asset.

Platinum may appeal to those looking for undervalued assets with growth potential, particularly if industrial demand increases and supply deficits persist.

Conclusion

In conclusion, gold stands out as the better investment choice in 2025, driven by its record-breaking performance and role as a hedge against economic instability. Platinum presents a speculative opportunity, with the potential for future gains contingent on market developments.

Ultimately, the choice between gold and platinum investments should align with individual risk tolerance, market outlook, and investment objectives.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.