Periods of rapid price swings and bold innovation have put MicroCloud Hologram Inc. (NASDAQ: HOLO), commonly known as Holo stock, in the spotlight for both speculative traders and technology investors.

With a dramatic share price collapse over the past year, a recent reverse stock split, and ambitious investments in next-generation technology, HOLO is a stock that divides opinion. Is it a turnaround opportunity or a high-risk bet?

Here, we examine the key insights and risks to help you decide if Holo stock is a buy in 2025.

What Is Holo Stock?

MicroCloud Hologram Inc. is a technology company based in China, specialising in advanced holographic solutions, quantum computing, blockchain, and artificial intelligence.

The company's focus on cutting-edge R&D has led to a portfolio of over 180 patents and nearly 1,700 holographic copyrights. HOLO aims to be a leader in the rapidly growing holographic display market, which is projected to expand at over 10% annually through 2032.

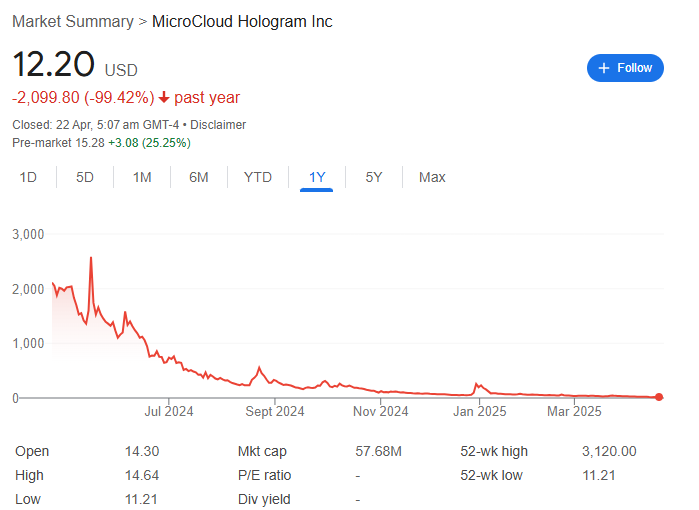

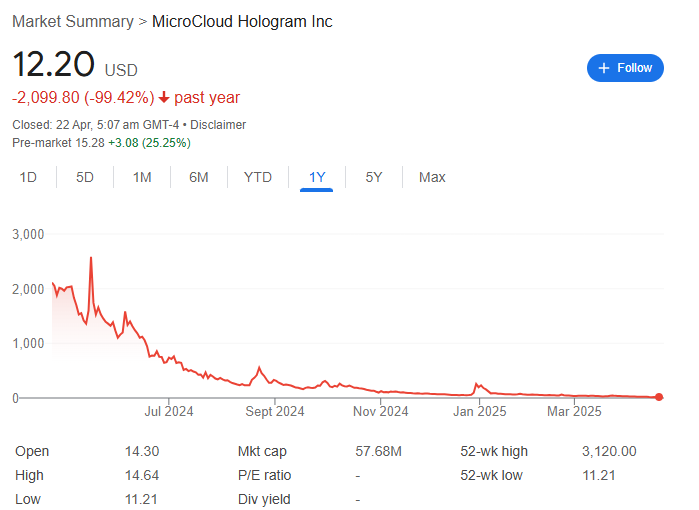

Recent Performance: A Year of Extreme Volatility

Holo stock has endured a brutal twelve months. As of April 2025, the share price has plunged 99% year-on-year, with a further 62% drop in just the last month. The company's market capitalisation now hovers around $67 million, a fraction of its previous highs. These declines have pushed HOLO close to Nasdaq's delisting threshold, prompting urgent action from management.

Despite these setbacks, HOLO has reported strong revenue growth. In 2024, total operating revenue climbed to RMB 290 million (approximately $40.76 million), a 42% increase year-on-year. Service business revenue grew even more rapidly, up 53% to RMB 277 million. These results suggest that HOLO's products and services are gaining traction, and the company is consolidating its market position within the industry.

Corporate Actions: Reverse Stock Split and Capital Moves

To avoid delisting and boost its share price, HOLO implemented a 1-for-40 reverse stock split, effective 21 April 2025. This is the second such move in less than a year, following a 20-to-1 consolidation in 2024. While reverse splits can help maintain exchange listings, they do not address underlying business challenges and often signal distress.

HOLO has also raised $40 million through convertible notes, increasing its cash reserves but creating the risk of future share dilution. The company has announced plans to invest up to $200 million in blockchain, quantum computing, and AI, aiming to position itself at the forefront of technological innovation.

Valuation: High Price-to-Sales Ratio

Despite the share price collapse, HOLO's price-to-sales (P/S) ratio remains high at 7.7x—well above the US software industry median of 4.2x, and much higher than the 1.6x seen in many peers.

This elevated valuation may reflect optimism about HOLO's future growth, but it also raises questions about whether the company can deliver on its ambitious promises. If future revenue growth fails to materialise, the current valuation could prove unsustainable.

Forecasts and Analyst Sentiment

There are no widely available analyst forecasts for HOLO, reflecting the uncertainty and speculative nature of the stock. Some independent projections suggest that the share price could see significant swings in both directions, with 2025 targets ranging from as low as $0.56 to as high as $98.78.

The wide range of estimates highlights the unpredictable outlook and the high-risk, high-reward profile of this stock.

Key Risks to Consider

1. Ongoing Volatility

The extreme price swings and history of sharp declines mean HOLO is not suitable for risk-averse investors. Even after the reverse split, the share price remains highly volatile.

2. Potential for Dilution

Raising capital through convertible notes and increasing authorised share capital could dilute existing shareholders, especially if the company struggles to achieve profitability.

3. Execution Risk

HOLO's strategy relies on turning ambitious R&D and intellectual property into sustainable revenue. The transition from innovation to commercial success is uncertain, particularly in highly competitive and rapidly evolving technology sectors.

4. Industry and Market Risks

While the holographic display market is expected to grow, HOLO faces stiff competition from larger, better-funded rivals. Broader market conditions, regulatory changes, and technological shifts could all impact the company's prospects.

5. Lack of Analyst Coverage

The absence of institutional analyst coverage means investors have less independent guidance and must rely on company disclosures and their own research.

Is Holo Stock a Buy in 2025?

HOLO offers the potential for outsized returns if its technology bets pay off and revenue growth accelerates. The company's strong intellectual property portfolio and recent revenue gains are encouraging signs. However, the risks are substantial: persistent share price declines, high valuation, potential dilution, and the challenge of converting innovation into profit.

For most investors, HOLO is likely to be a speculative play rather than a core portfolio holding. Those considering a position should be prepared for significant volatility, conduct thorough due diligence, and only invest what they can afford to lose. Monitoring the company's progress in commercialising its technology, managing cash burn, and navigating competitive pressures will be crucial in the months ahead.

Conclusion

Holo stock is a classic high-risk, high-reward proposition in 2025. While its technological ambitions and recent revenue growth are impressive, the company’s financial instability, share price volatility, and uncertain outlook mean caution is warranted.

Investors should weigh the potential for a turnaround against the very real risks before deciding if HOLO deserves a place in their portfolio.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.