In financial market trading, investors are often faced with the question of whether they should continue to hold an asset. To help determine the trend and direction of an asset, many indicators are used in technical analysis. Among them, the DMI indicator is recognized as one of the most effective and practical technical indicators, which is why it has managed to survive in the market for so long. Now let's take a look at a practical guide to the DMI indicator.

What is the meaning of the DMI indicator?

What is the meaning of the DMI indicator?

DMI (Directional Movement Index) is a kind of technical analysis indicator, also called movement indicators or tendency indicators. The indicator is determined by analyzing the stock price in the process of rise and fall in the buyer and seller power balance point of change, as well as changes in the power of both sides of the short and long to determine the market trend of the technical indicators. It is affected by price fluctuations and provides a basis for judging trends through a cyclical process from equilibrium to disequilibrium.

It is a technical analysis method created by J. Welles Wilder Jr., an American mechanical engineer and technical analyst, and its basic principle is to analyze the changes in the equilibrium of the long and short forces in the process of the rise and fall of the stock price in order to judge the market trend. The indicator can predict the completion of the market head and bottom to help determine the swing trend.

The DMI indicator is made up of four lines: the main average directional index (ADX), as well as the positive directional indicator (+DI) and the negative directional indicator (-DI). In addition, there is the Average Directional Movement Index Rating (ADXR). Together, these four lines provide traders with a comprehensive view of market trends and can help determine the long and short forces in the market, the strength of the trend, and the sustainability of the trend.

Of these, the Average Directional Index (ADX) does not indicate the direction of the trend but merely measures the strength of the trend, which helps traders determine whether the current market environment is a trending market or a consolidating market. Investors can determine the direction of a trend by analyzing the positive direction indicator (+DI) and the negative direction indicator (-DI) and using the ADX to confirm the strength of the trend.

When the ADX value is high, it usually indicates that there is a clear trend in the market. Whether it is an uptrend or a downtrend, the higher the ADX value, the stronger the trend. Typically, an ADX value above 25 indicates a clear trend in the market, and an ADX value above 50 indicates a very strong trend. When the ADX value is low, the market trend is weak and may be in a state of oscillation or consolidation. In general, an ADX value below 20 may indicate that the market is in a state of no clear trend.

The positive indicator (+DI) measures the strength of a positive market trend. When the positive indicator (+DI) value is high, it indicates that the strength of the market's positive trend is strong and the stock price may be rising. Traders can use changes in the +DI value as a potential signal of an uptrend in the market. The negative indicator (-DI) measures the strength of a negative market trend. When the negative DI (-DI) value is high, it indicates that the strength of the negative market trend is strong and the stock price may be declining. Traders can use a change in the -DI value as a potential signal of a downtrend in the market.

And by comparing the relative positions of the positive indicator (+DI) and the negative indicator (-DI), traders can determine whether the market is in an uptrend or a downtrend. When the value of the positive indicator (+DI) is higher than the value of the negative indicator (-DI), it usually indicates that the market is in an uptrend. This can be a buy signal, and traders may consider entering the market to buy as the market may be rising.

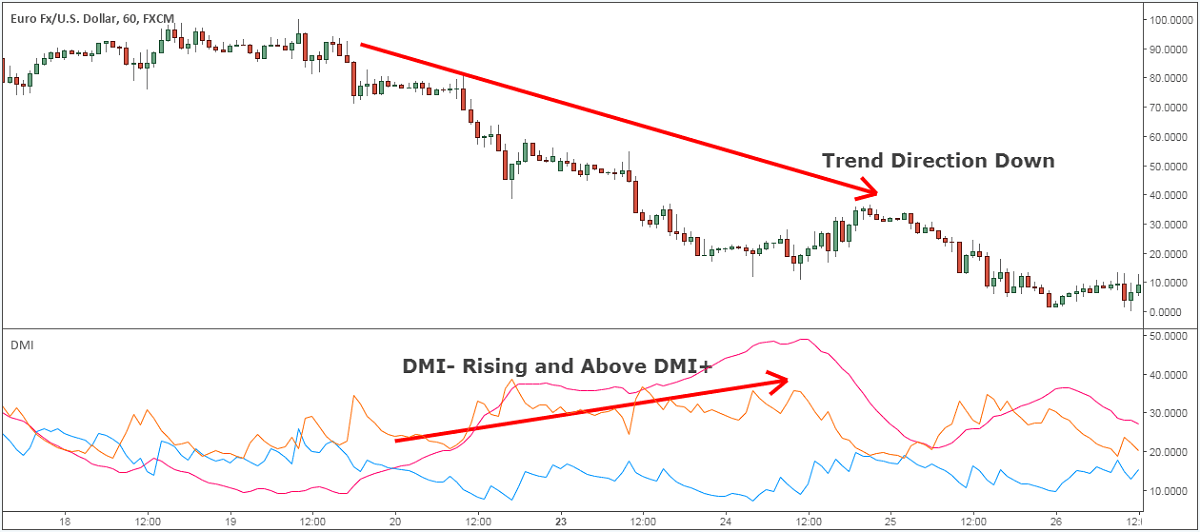

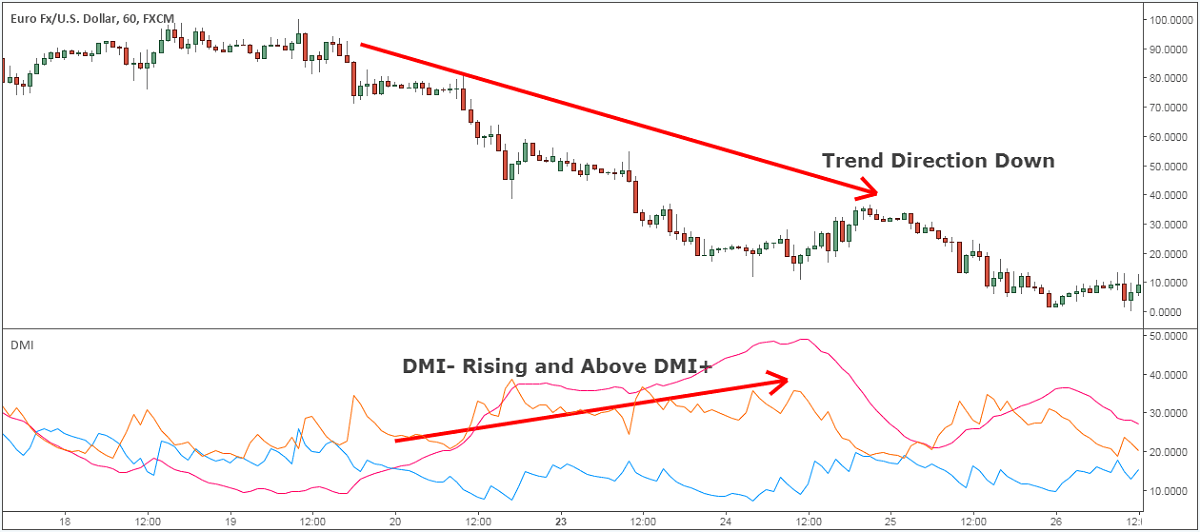

When the value of the positive indicator (+DI) is lower than the value of the negative indicator (-DI), it usually indicates that the market is in a downtrend. This may be a sell signal, and traders may consider selling as the market may be declining. In this case, traders may choose to reduce or close their positions to avoid losses if prices continue to fall. At the same time, traders may also choose to utilize this information to trade short, i.e., to profit by shorting financial products such as stocks or futures when the market is falling.

When the +DI and -DI cross, this usually signals a change in trend. When the +DI crosses up through the -DI from below, it may signal a shift in the market trend from down to up. When the +DI crosses down through the -DI from above, it may signal a shift in the market trend from up to down.

When all three are combined, the direction and strength of the trend can be better determined. For example, when the +DI value is higher than the -DI value and the ADX value is higher, it indicates that the market is in an uptrend and the trend is strong. Traders may consider buying on the low side or holding a long position.

When the -DI is higher than the +DI and the ADX is high, the market is in a downtrend, and the trend is strong. Traders may consider selling on the high side or taking a short position. Whereas, when the ADX value is lower, the market trend is weaker and may be in a sideways oscillator phase. In this case, traders may consider staying on the sidelines or using other strategies, such as a range trading strategy.

As a medium- to long-term technical analysis indicator used to assess the direction and strength of market trends, the DMI indicator performs well in markets with clear trends, accurately identifying the direction of the trend and helping traders to operate with the trend. In medium- to long-term trends, DMI can provide high operational accuracy and is suitable for long-term operations.

However, for beginners, the calculation of DMI involves multiple indicators and formulas, which is more complicated. Moreover, when there is no obvious trend in the market, the signal of the DMI indicator may not be clear, and it is difficult to accurately judge the market direction. At the same time, the DMI indicator is more volatile, especially in the consolidation market, which may produce unstable signals.

However, by using the DMI indicator appropriately, traders can better determine the direction and strength of market trends and thus develop more effective trading strategies. In order to improve the accuracy of the analysis, traders can combine other technical indicators (such as KDI, RSI, etc.) to supplement the DMI. Through this combination, traders can obtain a more comprehensive market analysis and be better able to deal with different market conditions.

DMI Indicator Calculation Formula

DMI Indicator Calculation Formula

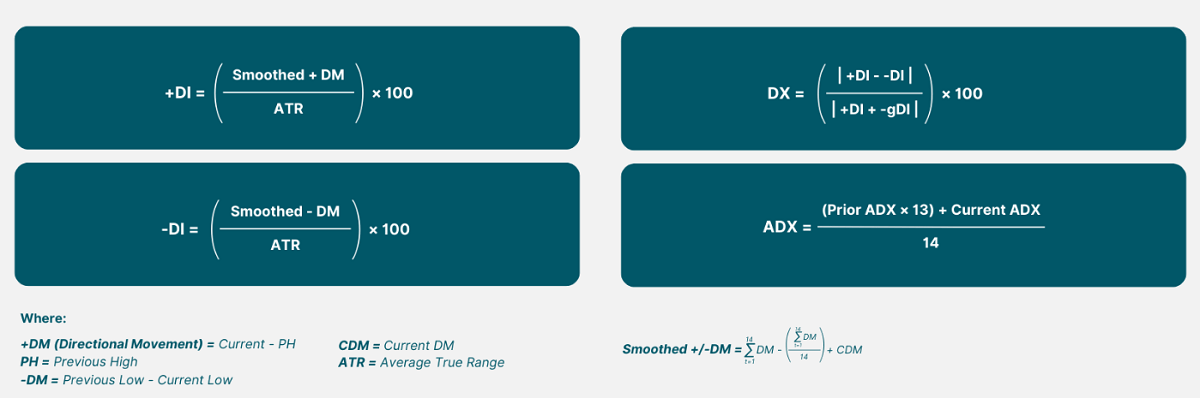

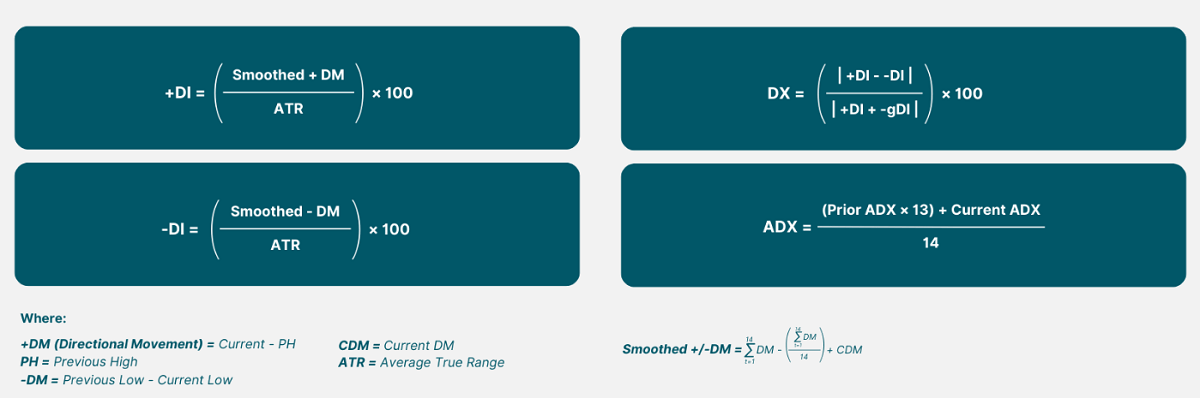

The formula for calculating the directional movement indicator (DMI) is divided into several stEPS, including the calculation of directional movement (DM), true range (TR), directional indicator (DI), convergence indicator (DX), and average convergence indicator (ADX). Although the calculation of the DMI indicator is complicated, if you figure out the exact steps, you will be able to derive the specific parameters step by step.

The first step is to calculate the directional movement (DM), which consists of the positive directional movement (+DM) and the negative directional movement (-DM). By calculating the positive directional movement (+DM) and negative directional movement (-DM), traders can understand the upward and downward momentum in the market and thus further analyze the market trend.

Positive DM (+DM) is calculated by subtracting yesterday's high price from today's high price and, if it is greater than yesterday's low price, minus today's low price. Then it is positive, i.e., positive DM is equal to today's high minus yesterday's high; otherwise, positive DM is equal to 0.

Negative DM (-DM) is calculated by subtracting today's minimum price from yesterday's minimum price if the resulting value is greater than today's maximum price minus yesterday's maximum price. If the resulting value is greater than today's maximum price minus yesterday's maximum price, then the negative DM is equal to yesterday's minimum price minus today's minimum price; otherwise, the negative DM is equal to 0.

Then the true range (TR) is calculated, which is the maximum of today's high minus the low, today's high minus yesterday's close, and today's low minus yesterday's close. It is used to measure the volatility of the market over the course of a day and provides the basis for further calculations of directional and tendency indicators.

The direction indicator (DI) is then calculated, including the positive direction indicator (+DI) and the negative direction indicator (-DI). The results of the positive DI and negative DI calculations can be used to determine the direction and strength of a market trend. By comparing the relative positions of these two indicators, it can be determined whether the market is in an uptrend or a downtrend.

The positive DI (+DI) is calculated by dividing the 14-day modified Moving Average of the positive DM by the 14-day modified moving average of the true volatility and multiplying by 100%. The formula is: +DI = (+DM ÷ TR) x 100%.

The negative indicator (-DI) is calculated by dividing the 14-day modified moving average of the negative DM by the 14-day modified moving average of the true volatility and multiplying by 100%. The specific formula is: -DI = (-DM ÷ TR) x 100%.

The convergence indicator (DX) is a measure of the strength of a market trend, which is calculated by first calculating the absolute value of the difference between the positive indicator (+DI) and the negative indicator (-DI). The absolute value of the difference is equal to +DI minus -DI. Then, the sum of the positive and negative indicators is calculated. The sum is equal to +DI plus -DI.

Next, the absolute value of the difference is divided by the sum and multiplied by 100% to arrive at the Direction Indicator (DX). Formula: DX = (+DI minus -DI) ÷ (+DI plus -DI) x 100%. The Average Convergence Indicator (ADX) is calculated based on the 14-day modified formal moving average of the Convergence Indicator (DX) and is used to measure the strength of the market trend.

The Average Convergence Rating Indicator (ADXR) is the average of the current Average Convergence Indicator (ADX) and the average of the ADX from 14 days ago. These two values are added together and then divided by 2. to get the average convergence rating (ADXR). This indicator is designed to assess the stability and strength of the market trend and is a secondary reference to the adx indicator.

These formulas are the basis of the DMI indicator, and by analyzing changes in these values, traders can better determine the direction and strength of the market trend. Of course, to better utilize the DMI, certain skills are needed.

Application of the DMI indicator in detail

Application of the DMI indicator in detail

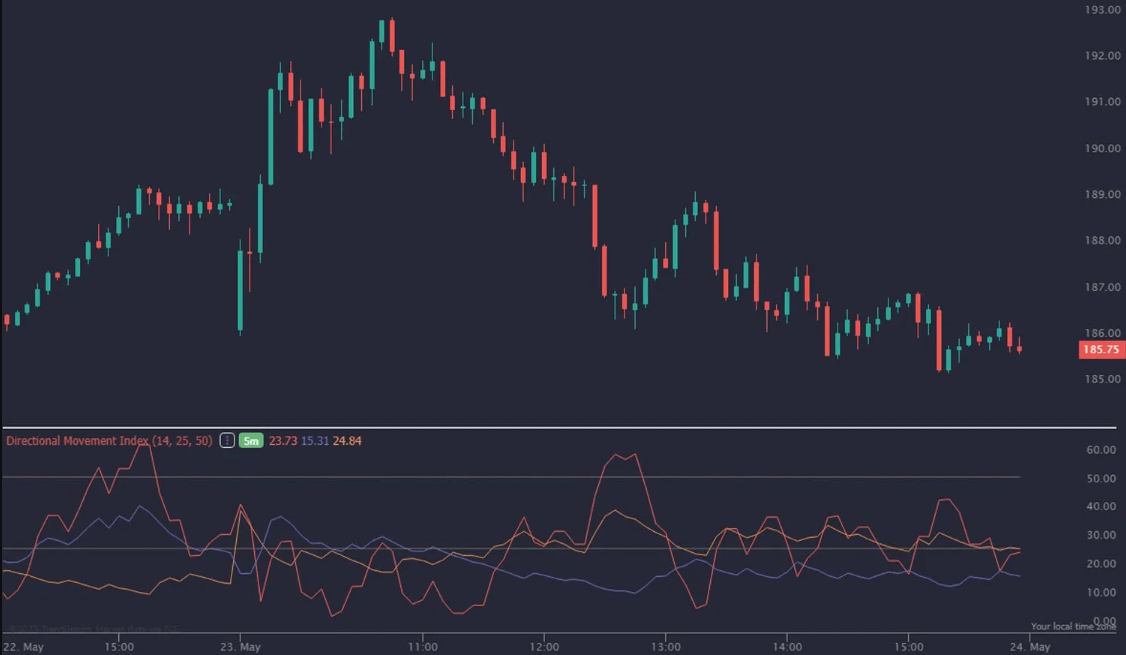

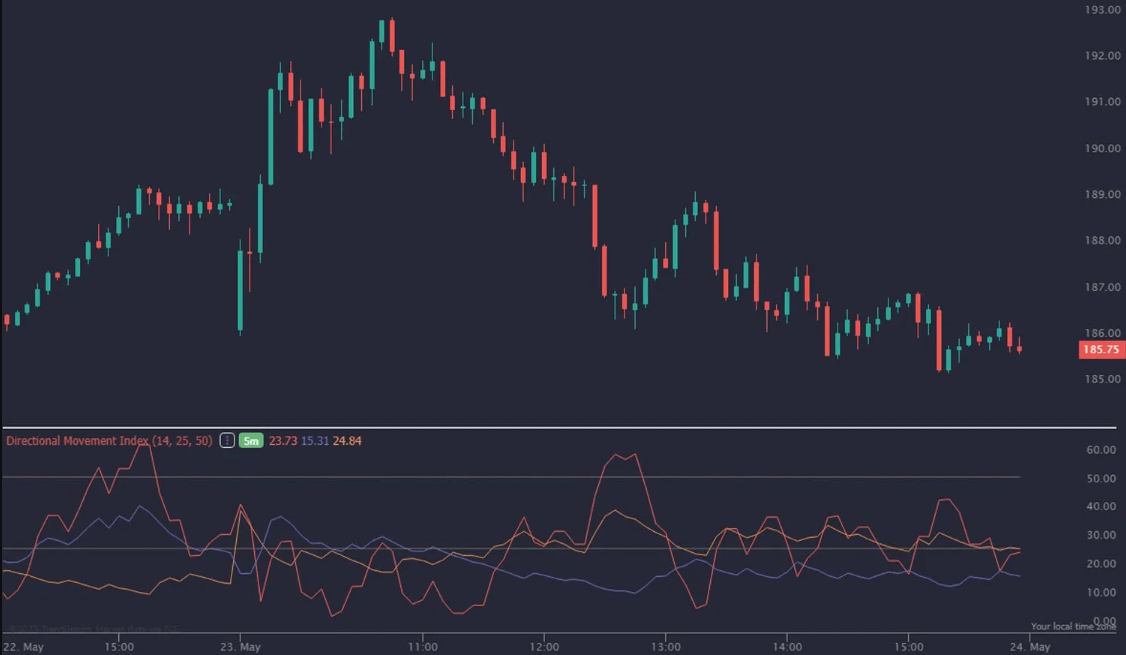

The Directional Movement Indicator (DMI) is a common indicator used in technical analysis to help traders understand the future direction of the market. For example, positive DI (positive indicator) and negative DI (negative indicator) are the key components of the Directional Movement Indicator (DMI), and through the height of their values, the upward or downward trend of the market price can be seen. The chart above shows a downtrend. Through their intersections, traders can determine the timing of market entry and exit and develop buying and selling strategies.

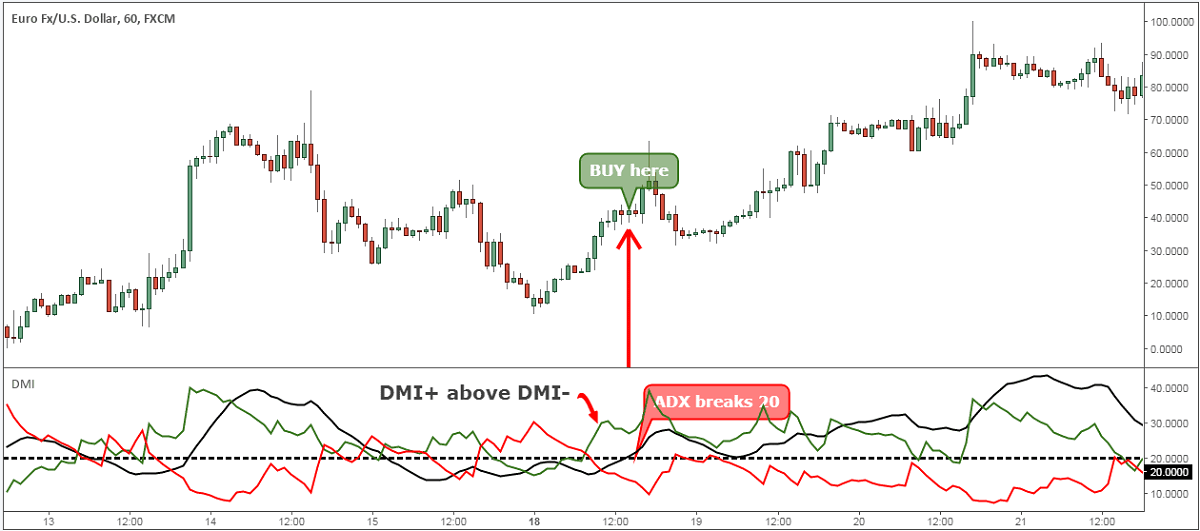

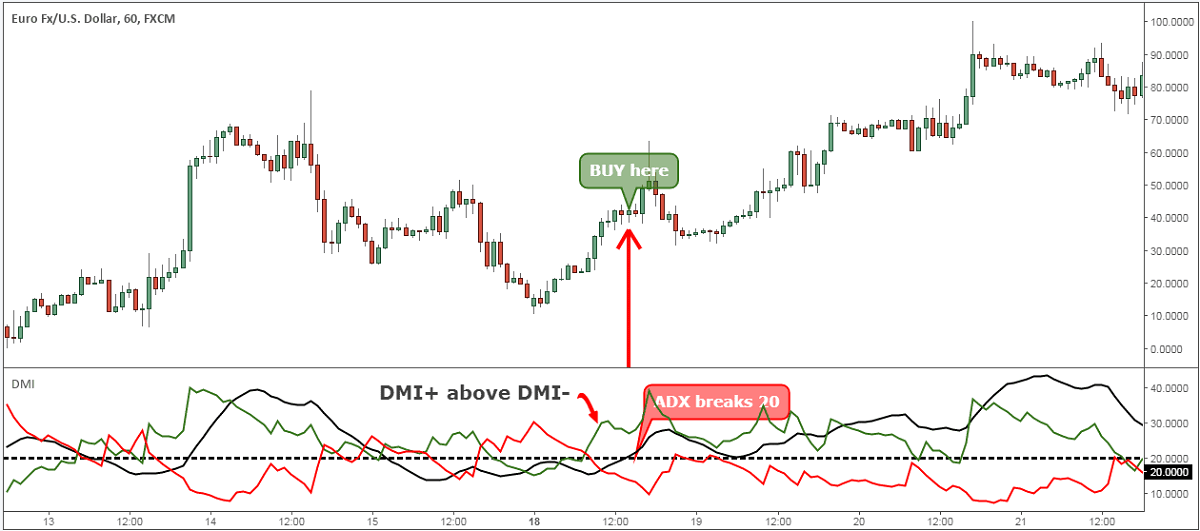

When the positive DI (positive indicator) rises and crosses the negative DI (negative indicator), this is usually considered a buy signal. It means that the market may be starting an uptrend, and traders may consider entering the market to go long. In this case, traders can take advantage of the change in market trend and adjust their trading strategy accordingly in order to profit from the rising market.

In the event that the negative DI (negative indicator) rises and crosses the positive DI (positive indicator), this situation usually signals that the trend has turned bearish. It means that the market is entering a downtrend, and investors may expect prices to fall further and therefore adjust their investment strategy, such as by reducing long positions or considering short-selling operations to avoid potential risks.

To increase accuracy, traders can analyze it in conjunction with the values of the Average Convergence Indicator (ADX). When the positive indicator (positive DI) crosses the negative indicator (negative DI), the ADX value is also rising and above 25. This can be a stronger confirmation that a market trend is forming. In this case, traders can be more confident in determining the direction of the market trend and formulate an entry strategy based on the intersection of the positive and negative DIs.

At the same time, it is still necessary to pay attention to risk management to ensure the robustness of the trade. For example, when executing a breakout strategy of positive DI and negative DI, traders should set reasonable stop-loss levels to ensure that losses are minimized in a timely manner in the event of a trend reversal. This is a crucial part of risk management that protects the trader's capital.

It should also be noted that in an oscillator market, positive and negative DIs may cross frequently, when the validity of the crossover point may be lower. Therefore, traders should pay close attention to the ADX values and the market environment in combination with other technical indicators such as SMAs and Bollinger Bands to filter and confirm the validity of the signals.

Pairing the positive DI (DI) with the average convergence indicator (ADX) allows for more accurate trend capture. When the positive DI breaks the negative DI, if the ADX value is above 25 and continues to rise, it means that the market trend is strong and rising, and traders can consider entering the market to go long; on the contrary, when the positive DI breaks the negative DI, if the ADX value is also above 25 and continues to rise, it means that the market trend is strong and declining, and traders can consider entering the market to go short.

ADX can also be used to determine the strength of the unilateral trend. For example, its value ranges from 0 to 100. This can help determine the strength of a market trend. When the ADX value is high, it means that the market trend is strong, and traders may consider following the trend. If the ADX value is low, it means that the market may be oscillating, and traders should beware of possible trend reversals.

When it has a value between 0 and 25. it means that the market does not have a clear unilateral trend and may be in an oscillator. In this case, the market lacks clear direction, and traders should be cautious as the market trend may be more unstable and volatile.

If its value is between 25 and 50. it means that the market has formed a unilateral trend and the trend force is stronger. This means that the market is moving in a certain direction, and that trend is more pronounced. Traders may consider trading with the trend, such as buying operations in an uptrend or selling operations in a downtrend.

If its value is between 25 and 50. it means that the market has formed a unilateral trend and the trend force is stronger. This means that the market is moving in a certain direction, and that trend is more pronounced. Traders may consider trading with the trend, such as buying operations in an uptrend or selling operations in a downtrend.

At the same time, traders can use the intersection of the positive indicator (DI+) and the negative indicator (DI-) to determine the exact timing of the market entry. When DI+ crosses DI-, it indicates that the market is trending up and one can consider going long; when DI- crosses DI+, it indicates that the market is trending down and one can consider going short. At this stage, traders should manage risk carefully and set appropriate stop-loss strategies to prevent market reversals that could lead to trading losses.

When its value is between 50 and 75. it indicates a very strong unilateral trend in the market. This means that the market is moving rapidly in a clear direction, and traders can trade within this range to follow the trend. At this point, traders can either maintain their existing positions or consider new trading opportunities to capitalize on the strong market trend. However, it is still important to be aware of market volatility and risk management to prevent potential losses from a sudden reversal of the trend.

When the ADX value is between 75 and 100. it indicates that the market is in an extremely strong unilateral trend. This means that the market is moving quickly in an extremely clear direction, and the trend is very strong. Traders can take advantage of this strong trend to trade with potentially higher returns. However, market volatility may increase during this phase, and traders need to be cautious, pay close attention to market changes, and adjust their trading strategies in a timely manner. At the same time, attention should be paid to proper risk management to prevent losses due to possible trend reversals.

ADX (average convergence indicator) can not only determine the strength of the market trend but also determine whether the price is against the trend based on its changes. When the ADX value continues to rise, it indicates that the market trend is becoming stronger. Conversely, when the ADX value begins to fall, it indicates that the previous trend is beginning to weaken and the market may be reversing.

If the ADX value starts to fall from a higher position and falls below 25. it indicates that the market trend is weakening significantly, the market may enter a shock market, and traders need to be cautious. When the ADX value bounces back from a low (below 25) and rises above 25. it may signal that a new unilateral trend is about to form. This is a potential trading opportunity, and traders can adopt a trading strategy based on the market trend.

This type of analysis helps traders identify possible trend reversals in the market so that they can adopt a strategy accordingly. Moreover, the combination of positive (DI+) and negative (DI-) indicator movements while determining the ADX change can better help traders identify whether a market reversal is occurring or not and further determine trading decisions.

DMI is a useful technical indicator that can assist investors in making buying and selling decisions. By mastering the application skills of DMI indicators, traders can better determine the direction and strength of the market trend so as to develop a more effective buying strategy to improve the success rate of trading. When applying DMI, it is important to pay attention to market trends and fluctuations to ensure the accuracy of decisions.

DMI indicator tips and tricks

| Tips and tricks |

Description |

Role |

| Positive DI high, bearish |

Positive DI above negative DI signals an uptrend. |

Consider going long. |

| Negative DI: strong, bearish |

Negative DI above positive DI signals downtrend. |

Consider going short. |

| ADX is in a high, strong trend. |

ADX over 25 shows a strong trend. |

Price may stay with the trend. |

| Crossover, turnaround |

DI crossover may signal a trend shift. |

Identify the trend. the trend.. |

| ADX low, oscillator |

ADX below 20 suggests a sideways market. |

Avoid Overtrading. |

| Combined view, more stable |

with other indicators, improves signal accuracy. |

Enhance trading strategy accuracy. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is the meaning of the DMI indicator?

What is the meaning of the DMI indicator? DMI Indicator Calculation Formula

DMI Indicator Calculation Formula Application of the DMI indicator in detail

Application of the DMI indicator in detail If its value is between 25 and 50. it means that the market has formed a unilateral trend and the trend force is stronger. This means that the market is moving in a certain direction, and that trend is more pronounced. Traders may consider trading with the trend, such as buying operations in an uptrend or selling operations in a downtrend.

If its value is between 25 and 50. it means that the market has formed a unilateral trend and the trend force is stronger. This means that the market is moving in a certain direction, and that trend is more pronounced. Traders may consider trading with the trend, such as buying operations in an uptrend or selling operations in a downtrend.