What is your favorite supermarket to visit when buying household goods? With its huge product assortment and competitive prices, Walmart is often a preferred shopping destination. And for investors, it is an even more compelling target. But if you want to invest in its stock, you need to conduct a thorough analysis to avoid making the wrong investment strategy. After all, even the god of stocks, Warren Buffett, has had his share of trouble with Walmart, so investors need to be more careful when considering it. This article will specifically talk about Walmart's overview and its investment evaluation to help investors complete their investment strategy.

What is Walmart?

Walmart Inc. is one of the largest retail companies in the world and is headquartered in Bentonville, Arkansas, USA. The company operates more than 11.000 stores around the world, offering a wide range of goods and services, including food, home furnishings, electronics, and health and fitness products.

Its growth began in the early 1950s, when Sam Walton and his wife founded the first small store in Arkansas. It was not a smooth operation at first, but he was able to make the store a gradual success by keeping a tight rein on costs and implementing a low price strategy. After facing jealousy from his landlord and repossession of the store, he decided to take a different route, purchasing an underperforming franchise in another town and running it successfully.

Walton insisted on low prices and always gave his customers the profits. His "Sunset Principle" and "Seek Attitude" became the company's core values, which meant that employees had to complete their tasks and give the best service to customers by sundown. This focus on customer needs and service helped Wal-Mart expand rapidly in and around the region.

In 1962. Walton opened the first true Wal-Mart supermarket in Rogers, Arkansas, marking the company's full-scale entry into retail mass expansion. This small retail store quickly won the favor of consumers through its low-priced and efficient sales strategy.

Over time, it rapidly expanded to become a leading global retail giant. The company has a strong market presence in several countries and regions around the world, attracting a large number of consumers with its massive purchasing power and favorable prices. By allowing it to demonstrate the strength of its retail business not only in its home country of the United States but also in the international market, it became one of the largest retailers in the world.

Its ipo in 1972 made it one of the few recognizable department stores in the U.S. The introduction of the Sam's Club model in 1983 further strengthened the company's position in wholesale retailing by offering special wholesale price treatment to its members. The success of this model accelerated Wal-Mart's expansion in the U.S. and international markets.

In 1985. Walton became Forbes' richest man in the world due to the company's tremendous success. Wal-Mart became the largest retailer in the United States in 1990 and entered the Chinese market in 1996. The company has expanded rapidly since then, and today it has more than 8.500 stores worldwide, employs more than 2.3 million people, and has long been ranked among the world's top 500 Fortune 500 companies.

Its success can be attributed to a combination of factors. First, it has established an innovative supply chain management system, which allows it to purchase at lower prices and maximize profits through efficient inventory management. This efficient supply chain management system helped it maintain its competitive edge and was able to adapt quickly to changes in market demand.

Secondly, its accurate grasp of the needs of a large number of consumers is one of the keys to its success. The company consistently offers low-priced and high-quality goods to meet the shopping needs of low- and middle-income families. This pricing strategy not only enhances consumer loyalty but also expands its market share.

In addition, Wal-Mart's investment in information technology has also played an important role. The company has built the world's largest civilian database and optimized its supply chain and sales strategy through data analysis. This data-driven decision-making has helped it better understand consumer behavior patterns, which in turn has improved market response and service levels.

Its management philosophy emphasizes teamwork and high efficiency. Sam Walton's own "sun down" and "10-foot attitude" requirements for employees reflect Wal-Mart's commitment to customer service and the development of a sense of responsibility among its employees. Such cultural values have not only helped Wal-Mart become invincible in business competition but have also become the cornerstone of its long-term development.

Today, it has grown to become one of the world's largest retailers, and in addition to brick-and-mortar sales, it is actively engaged in e-commerce, providing online shopping and express delivery services in countries across the United States. Its influence is not limited to commerce but also has a profound impact on the U.S. economy and society, providing millions of jobs and serving as a vital part of the global supply chain.

When considering an investment in Walmart stock, it is important to thoroughly analyze its financials in addition to gaining an in-depth understanding of its complex operating model and global market strategy. By evaluating operations and finances together, investors can develop an effective investment strategy that maximizes their return on investment and minimizes risk.

WalMart Market Capitalization and Financial Results

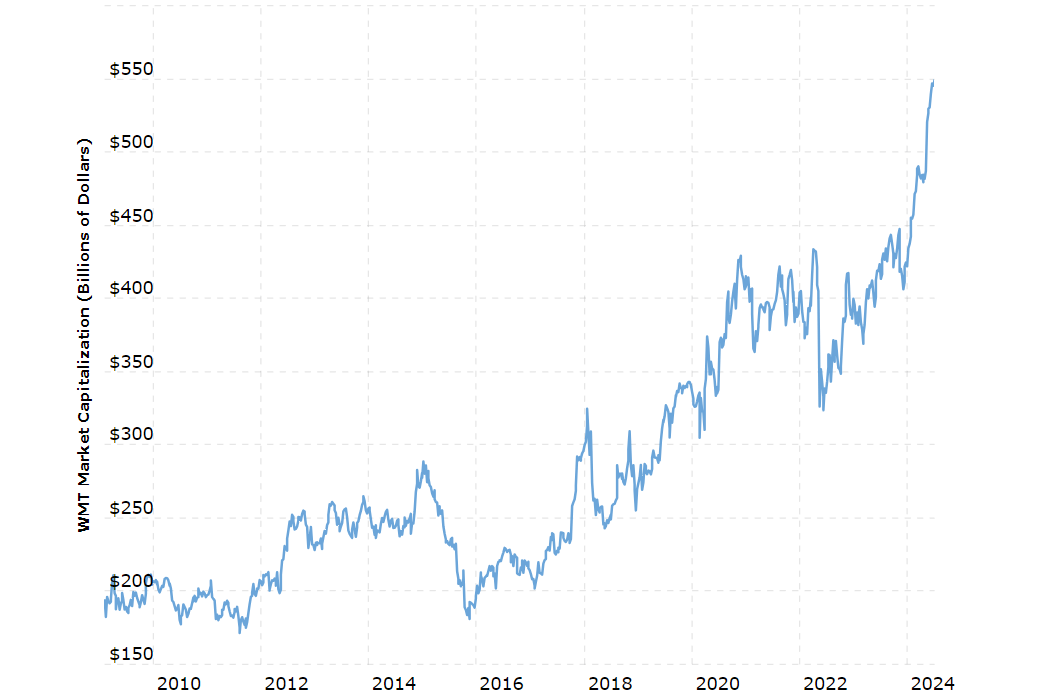

As one of the largest retail companies in the world, Walmart is a major player in the global stock market, and its market capitalization and financial performance have a significant impact on the market. As of July 2024. the company had a market capitalization of $548.89 billion, making it the 16th most valuable company in the world.

Meanwhile, Walmart's financial performance has been seen as an important indicator of market stability and economic indicators. For example, its latest earnings outperformance also drove the consumer staples sector up 1.42%, positively impacting the overall sector and market sentiment. In other words, its strong results not only highlighted its competitiveness in the retail market but also boosted investor confidence, which in turn drove the related sector higher. This positive market reaction suggests that its performance has a significant impact on the overall economic and investment climate.

The company regularly releases quarterly and annual earnings reports, which provide investors with an important reference point for understanding its business operations and financial condition. These reports provide investors with a comprehensive view of the company's key financial indicators, such as sales revenue, net income, and earnings per share. These figures not only reflect the company's market share and profitability in the retail industry but also provide investors with important information to analyze its future growth potential.

From the financial report, it is clear that it generates revenue primarily from its widely distributed supermarkets and large retail stores, while also increasing its sales channels through its expanding online platform. The company ensures its competitive advantage in the market through its diversified business model and strong supply chain management.

In addition to its traditional retail business, it is actively expanding into emerging areas such as advertising, fulfillment services, financial services, and healthcare, further driving the company's revenue growth and market presence. This diversification of revenue sources not only enhances the company's financial stability but also provides new growth points for its future development.

As of its most recent financial report, Walmart has seen steady revenue growth and remains competitive in the global market. It has continued to demonstrate strong financial performance over the past few quarters. Since the first quarter of 2020. the company has exceeded Wall Street's expectations for 13 consecutive quarters, with profits falling short of expectations only twice. This shows its resilience in the market and the stability of its business.

As for its latest financial statements, first quarter 2024 earnings totaled $161.51 billion, an increase of 6.03% from the same period last year. Net income of $51 increased by 30.8% over the same period last year. Of this, operating income amounted to $680 million, an increase of 9.6% over the previous period. Earnings per share of $0.63 beat the market's estimate of $0.60 and increased 34.35% since last year.

Such growth not only reflects its competitive advantage in the market but may also have a positive impact on investors in its stock, as it shows the company's solid performance in terms of growth and market share. These financials not only demonstrate its improvement in operational efficiency and profitability but also emphasize its dominant position in the retail industry.

Within the segment, Walmart's U.S. store sales increased 4.5% year-over-year, beating market expectations of 3.12%. This growth was mainly attributed to more shoppers frequenting its stores. This indicates that the company has made significant progress in attracting consumers, possibly thanks to its low-priced and efficient sales strategy and its precise understanding of consumer needs.

In addition, e-commerce sales increased by 10.7% year-on-year, demonstrating strong growth momentum in the company's online business. Meanwhile, Sam's Club same-store sales increased by 4.4% year-on-year, demonstrating the effective appeal and growth potential of its membership program. These figures not only reflect Walmart's success in digital transformation but also demonstrate the remarkable results of its diversified business strategy. By continuously optimizing its online and offline business models, it has further consolidated its leadership position in the retail market.

Whereas the average unit price of purchases has decreased, it only indicates that customers are purchasing fewer items, while the overall sales volume has still increased significantly. This may reflect its successful strategy in attracting consumers, i.e., by lowering the price of goods to attract more customers to shop in the store, thus increasing sales. The increase in overall sales volume, despite the decrease in the amount of money spent per purchase, demonstrates the company's strong performance in a competitive market and increased consumer loyalty.

It also confirmed its plan to acquire TV maker Vizio, a move that demonstrates its strategic intent to expand its business and diversify its product line. With the acquisition of Vizio, it is expected to further enhance its competitiveness in the electronics market, particularly in the TV and home entertainment device segments. This will not only help it expand its product portfolio but also help it appeal to a wider consumer base and further consolidate its leading position in the retail industry.

Overall, Walmart's second-quarter results showed strong financial and business performance, with significant progress in e-commerce and membership sales in particular. The company demonstrated a relatively solid stance on adjusted profit and market growth expectations, demonstrating its leadership and resilience in a highly competitive retail market.

WalMart Stock Investment Analysis

WalMart Stock Investment Analysis

Its solid financial performance demonstrates that Wal-Mart has gained market acceptance through its strong sales growth and diversification strategy, and its stock price has performed positively. These factors make its stock an attractive investment option, offering stable returns and considerable growth potential.

This is because the company's revenues are growing steadily each year, albeit modestly, but this growth is considered reasonable and excellent due to its large size. The company's free cash flow has remained positive and has increased year after year, indicating its ability to continue to expand and invest in new areas.

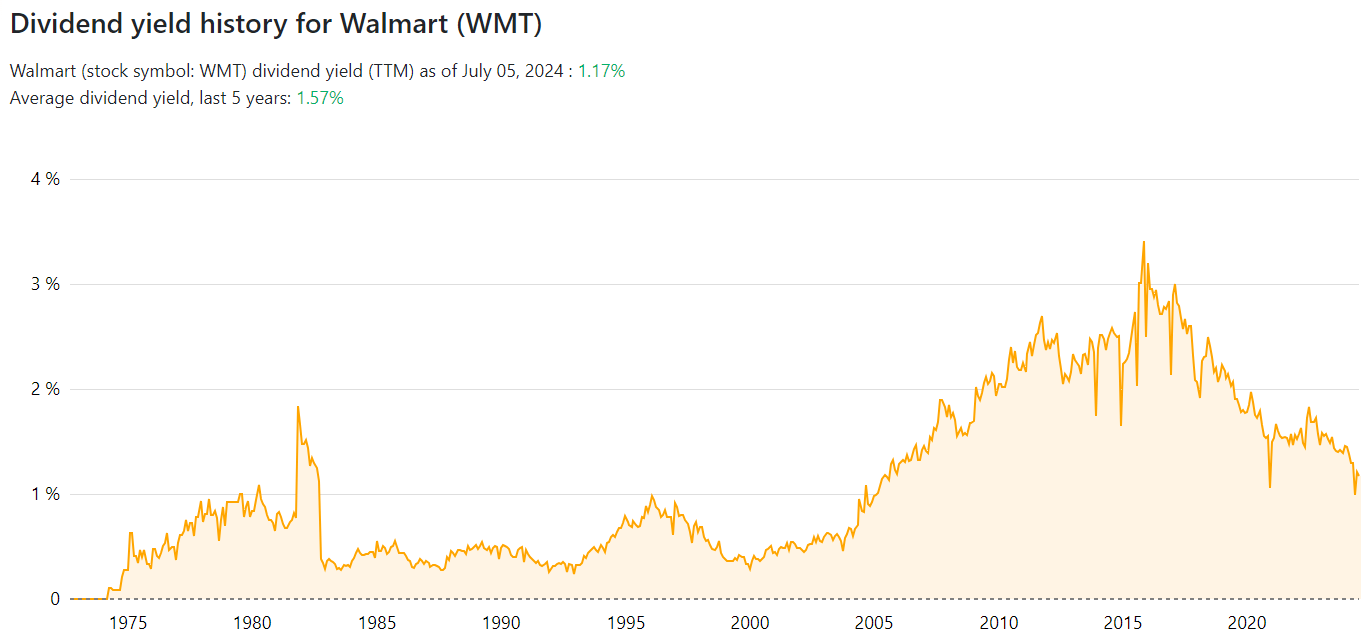

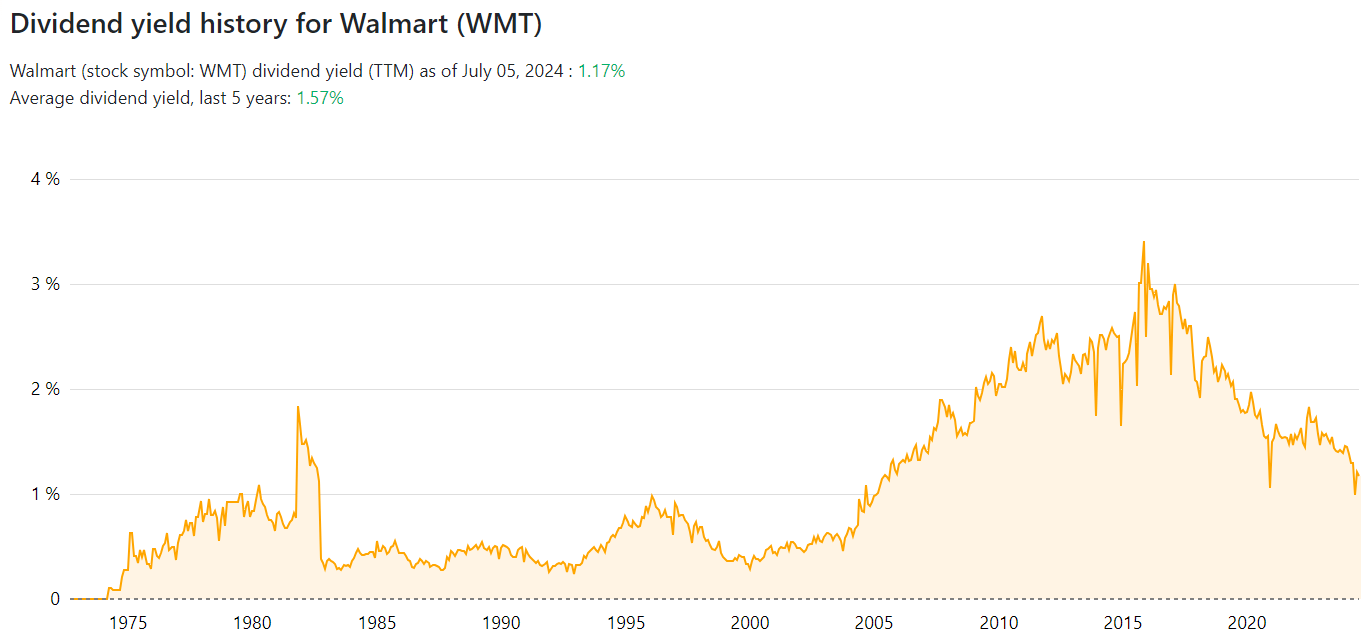

And it has a stable dividend policy, with an average dividend yield of 1.57% over the past 5 years, which makes it a stable investment option for long-term holding. This stable dividend policy helps to diversify investment risk, especially for investors looking for safe returns and growth potential.

From a technical analysis perspective, Walmart stock is showing strength. The stock recently closed with a rising positive line on volume, successfully breaking above the long-term downtrend line that has been in place since last December, as well as the consolidation period during April and May of this year. The stock is now running above key short-term upper levels, especially above the major support at 67.42.

And technical indicators are showing signs of a long signal. Specifically, the macd indicator is showing an upward crossover about to form, signaling a possible increase in buying power; the rsi indicator is in a strong area above 50. indicating that the stock is in a state of relative strength; and the kdj indicator is forming an upward signal in the high 50's area, suggesting that the stock may continue to rise.

Together, these indicators suggest that Walmart stock is expected to continue its upward run. Investors can keep an eye on the stock to see if it can break further above the key $68.9 level, which could trigger more buy signals and further upside momentum. Technical analysis shows the stock is currently in a state of relative strength, and if it can sustain this momentum and break above key technical levels, it will help boost investor confidence and attract more buying into the stock.

That said, based on financial and technical analysis, Walmart stock shows good investment potential and growth prospects. Investors can keep an eye on the stock's gap fill at 68.9 and watch out for a further breakout above the key resistance level, which will help confirm a further uptrend.

As a global retail giant, it has demonstrated strong investment potential in terms of financial soundness and technical performance. Therefore, despite market competition and economic uncertainty, it is also showing strong resilience to risk with its large market size, diversified business model, and strong e-commerce growth prospects. For long-term investors, Walmart stock offers stable returns and potential growth.

However, it is important to note that despite its demonstrated strong financial performance, investors need to be aware of some potential risk factors. High inflation could affect consumer spending, and the highly competitive market could also put pressure on its market share. In addition, its expansion in international markets faces a number of challenges, particularly operational risks in emerging markets. Investors should take these factors into consideration and formulate their investment strategies accordingly.

Overall, based on current financial reports and market performance, Walmart stock is expected to continue to deliver solid returns to investors. As such, it could be a noteworthy option for investors looking for a long-term investment opportunity, especially when considering its long-term growth potential and market reach.

Overview of Wal-Mart and its investment appraisal

| OVERVIEW |

Investment Appraisal |

| One of the world's largest retailers |

Strong financial stability and long-term profitability |

| Strong supply chain management and global market coverage |

Strong brand presence and market leadership |

| Offers a wide range of merchandise assortments and services. |

Potential for growth in e-commerce and online retail |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

WalMart Stock Investment Analysis

WalMart Stock Investment Analysis