Copper, often referred to as "Dr. Copper," plays a significant role in the global economy, serving as a reliable indicator of economic health. Investors frequently monitor copper prices to gauge global economic trends. As a vital investment tool in the futures market, the price fluctuations of copper futures not only offer profit opportunities but also provide essential economic signals. These signals enable investors to develop forward-looking strategies. In this article, we will explore the fundamentals of copper futures trading and provide a comprehensive market analysis.

How to Trade Copper with Future Contract?

It is a metal futures contract that allows investors to buy or sell a certain amount of copper at an agreed price at an agreed time in the future. Trading in copper futures contracts takes place on futures exchanges, and investors can use these contracts for price hedging or speculative trading in the broader commodities trading market.

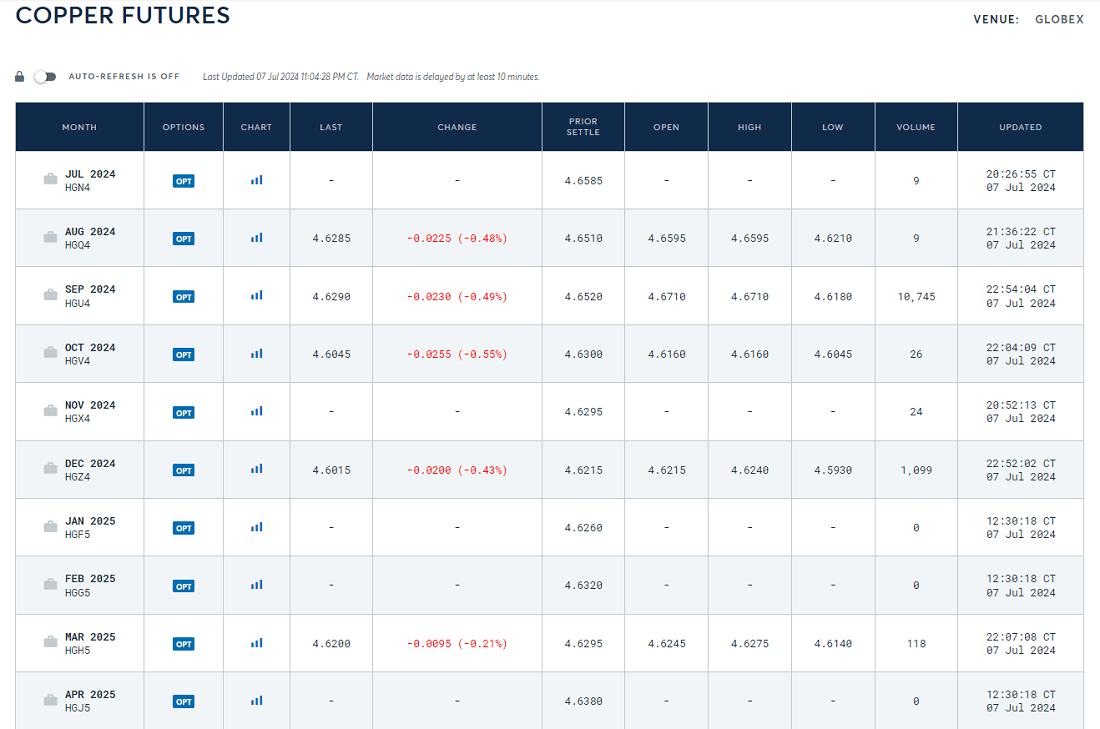

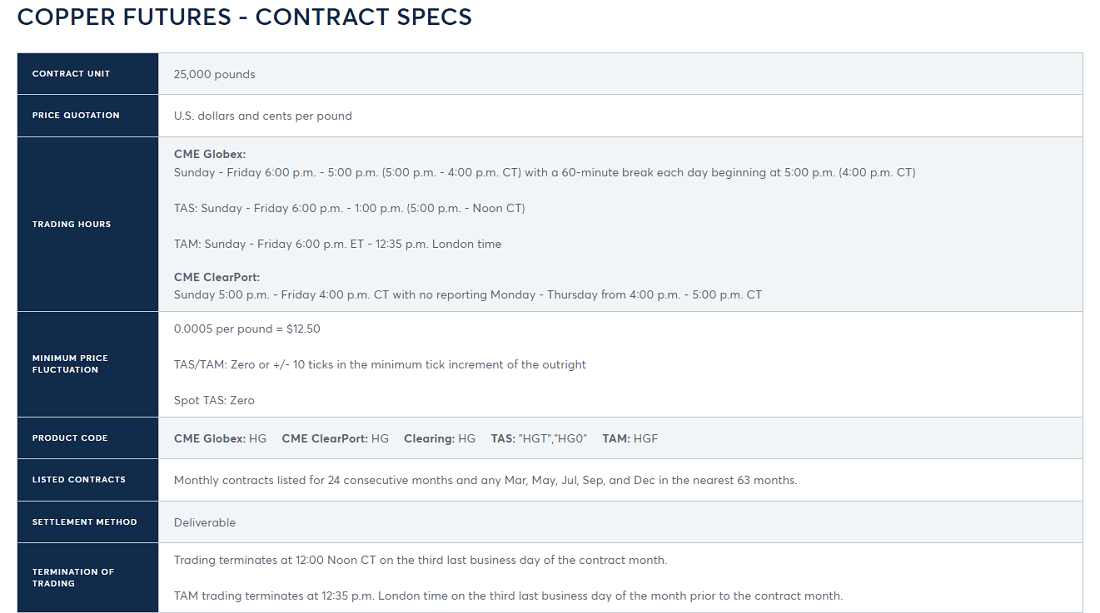

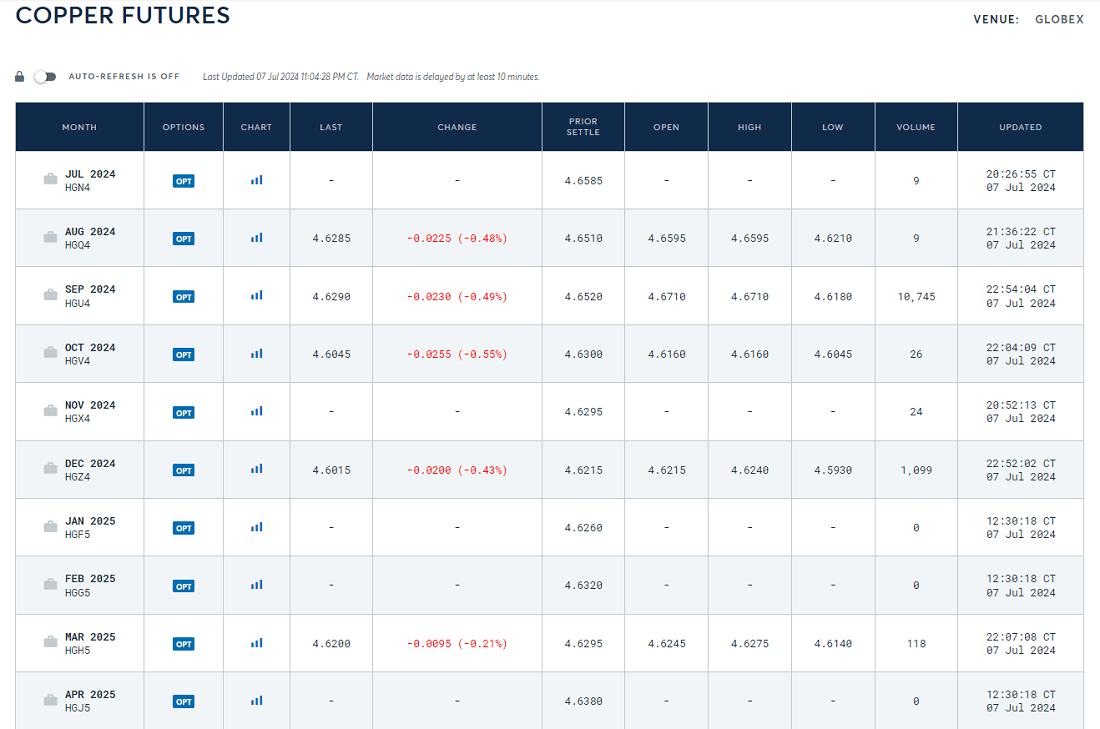

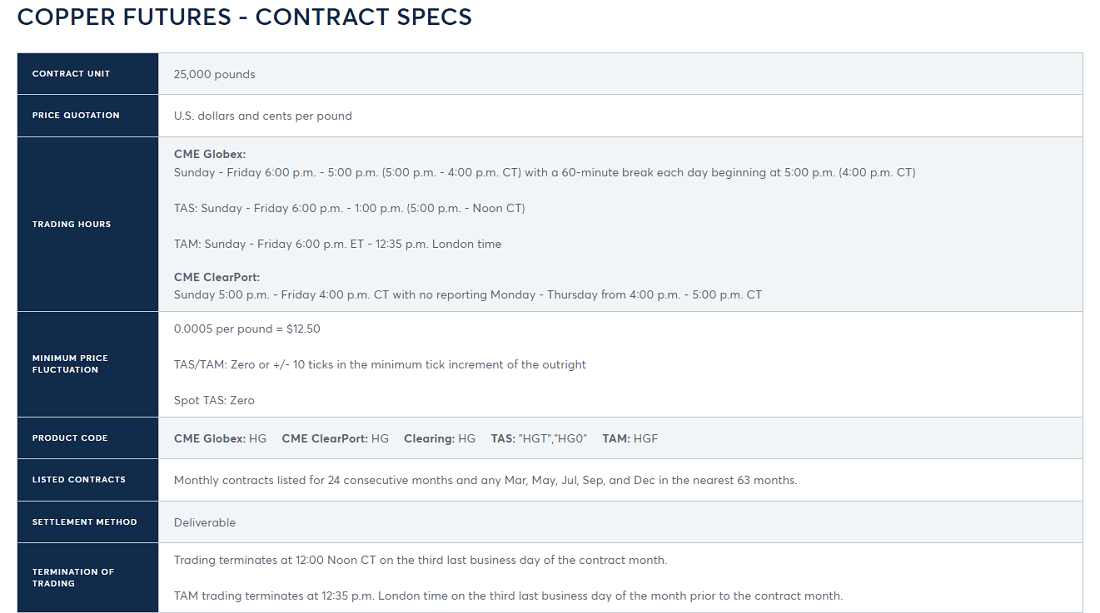

The size and delivery term of each contract are standardized to ensure consistency and predictability in market trading and to provide investors with a stable trading environment and clear trading rules. Generally, each contract represents 25,000 pounds of copper, and delivery usually takes place in designated delivery warehouses, the exact location of which is specified by the exchange. This standardization is a common feature in commodity trading.

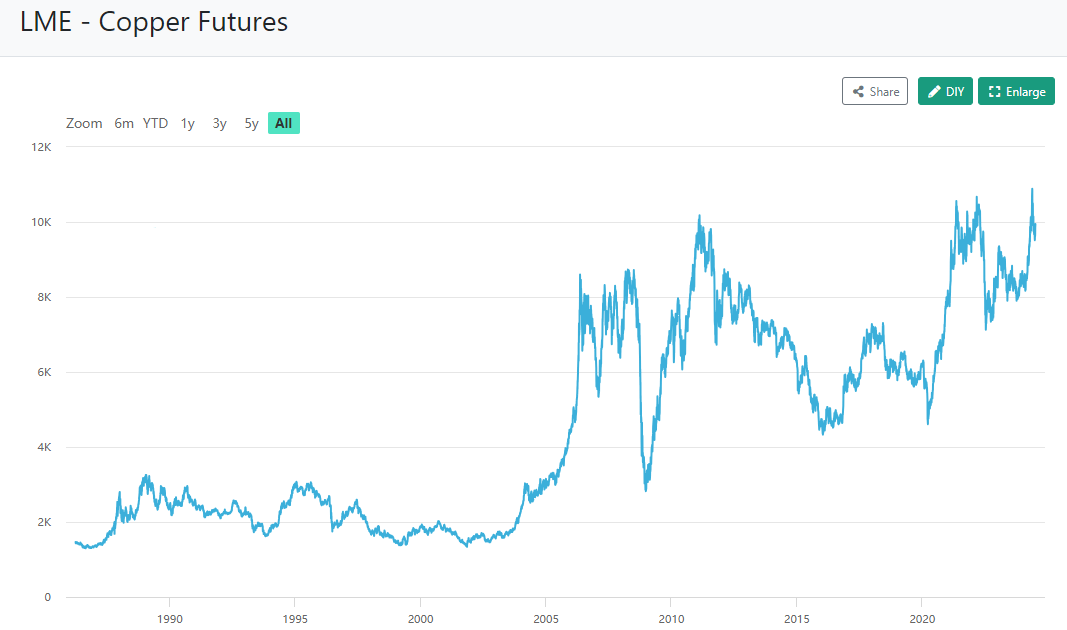

Investing in copper futures has great potential but comes with a high risk of market volatility. Copper prices are highly volatile due to a combination of factors, including global supply and demand conditions, economic cycles, market sentiment, and geopolitical tensions. In the commodities market, shortages or surpluses in supply can lead to sharp price fluctuations; rising demand during periods of economic growth usually pushes prices higher, while recessions or slower growth can lead to lower prices.

Participants in this market include multiple stakeholders, including producers, consumers, and investors. In addition, there are participants with an interest in the copper market who have actual demand or anticipate price fluctuations, such as financial institutions and trading companies, who use the futures market for risk management or arbitrage operations.

Together, these participants contribute to the liquidity and price formation process in the copper futures market, where copper producers and consumers can utilize futures contracts to effectively hedge their price risk, thereby ensuring stable prices for future copper purchases or sales. Producers, such as copper miners, facing fluctuations in the price of copper that may affect their profitability, can lock in future sales prices and protect their revenues by opening suitable positions in the futures market. Consumers, such as electronic equipment manufacturers or the construction industry, can lock in the cost of copper purchases through futures contracts, avoiding the cost risks associated with market price fluctuations and ensuring controllable production costs.

Investors can participate in the market and capture investment gains from price fluctuations by buying or selling copper futures contracts, a transaction often referred to as speculation. Speculators may expect the price of copper to rise or fall and make buying or selling decisions based on market analysis and forecasts, thereby earning a profit on the spread.

In addition, investors may use the performance of the copper futures market to predict global economic trends and the direction of industrial activity. As a representative of industrial metals, copper's demand and price fluctuations usually reflect changes in global economic activity. As a result, investors often look at supply and demand, inventory data, and price trends in this market in order to extrapolate global manufacturing activity and expectations for economic growth.

For example, rising copper prices may suggest strong global economic growth because copper is widely used in industries such as construction, power equipment, and electronics, and its demand is sensitive to the expansion of global manufacturing and increased infrastructure development. Therefore, by analyzing the performance of this market, investors can provide important market signals and references for predicting the direction of the economy for their investment decisions.

Copper futures contracts usually have the option of cash settlement or physical delivery, depending on the futures exchange and contract provisions. Cash settlement means that at the expiration of the contract, both parties to the transaction pay cash to settle the contract, which does not involve the actual delivery of copper metal. Physical delivery, on the other hand, requires the buyer or seller of the contract to provide actual delivery of copper metal at the expiration of the contract, meeting the quality and quantity standards set by the futures exchange.

This selective settlement allows the contract to meet the needs of a variety of investors and traders, some of whom may prefer cash settlement to avoid the complexity and cost of physical delivery, while others may opt for physical delivery in order to participate directly in the physical movement of the market and risk management.

As an important industrial metal, the futures market for copper has important price discovery and risk management functions globally. For investors and enterprises concerned about the metal market, it is crucial to understand the basic characteristics and market operation of copper futures. By grasping its supply and demand dynamics, economic data, technical analysis, market sentiment, and policy changes, investors can better formulate trading strategies and manage risks, making full use of the investment potential of this market.

Rules of Copper Futures Trading

Investors buy and sell copper futures contracts through the futures market to hedge price risk or for speculation. This type of futures contract trading with copper as the underlying has high liquidity and transparency and has received widespread attention from investors worldwide. Exchanges offer standardized contracts, including contract size, delivery dates, and quality requirements.

A lot of copper futures refers to the standard trading unit of a one-lot contract, which in most cases actually refers to 25 tons (or 25.000 pounds) of copper metal, a unit that is standardized to determine the amount of copper metal included in each contract. This standardization helps ensure that market participants have a clear understanding of the size and value of each transaction, facilitating risk management and investment decisions.

It is usually delivered at a warehouse or specific delivery point designated by the futures exchange. These locations must meet the standards and requirements set out in the futures contract to ensure that the copper metal delivered meets predetermined quality and quantity standards. The choice of delivery point can have a direct impact on how the futures contract is ultimately executed, and these specific details are usually spelled out in the contract specifications so that market participants are aware of and comply with the appropriate trading procedures.

On China's Shanghai Futures Exchange (SHFE), copper futures are usually delivered at specific warehouses or delivery points designated by the exchange to ensure that the copper metal delivered meets the quality and quantity standards specified in the contract. Bonded copper futures, on the other hand, have the special feature of allowing cross-border delivery, a flexibility that better meets specific market needs and participants' modes of operation.

Different months of the contract have different delivery months, which allows investors to choose the appropriate contract for trading according to their own needs and market expectations. By choosing contracts with different delivery months, investors have the flexibility to participate in the market and manage their risk and return objectives. This flexibility allows the market to meet the strategic needs of different investors, whether for short-term speculative trading or for long-term risk management and hedging.

In order to avoid unusual price fluctuations in trading, it usually establishes price fluctuation limits. The price movement of the contract is limited for a certain period of time, and exceeding the set limit will trigger market intervention or suspension of trading to ensure market stability and protection of investors' interests. These limits help to reduce volatility in the market and make the trading process more controlled and secure.

Specifically, exchanges set daily price fluctuation limits. For example, if the exchange sets a daily limit of 5% for copper futures, then its price will not move more than this limit during a trading day. This means that if the price rises or falls by more than 5% during the trading day, the exchange will suspend trading until the market stabilizes or the price limit is reset.

Copper futures trading is divided into daytime and nighttime sessions, with nighttime trading hours from 9:00 p.m. to 1:00 a.m. the following day. Investors can buy and sell during these designated trading hours. At the end of each trading day, there is a daily settlement where positions are settled based on the last traded price in the market. This process determines the profit and loss for the day and adjusts the investor's capital account accordingly. The daily settlement serves as a real-time profit and loss calculation system in futures trading and helps investors manage their risk and capital.

The transaction also involves trading commissions and exchange fees, etc., which vary according to the rules of the futures company and the exchange. In addition, trading requires the posting of margin as collateral, usually a portion of the contract value, to cover potential trading risks. The amount of margin depends on exchange regulations and market conditions and is usually a percentage of the contract value. The investor is required to pay the appropriate amount of margin when opening a position to cover the risk of a possible loss.

In addition, the transaction is usually settled in cash. This means that at the expiration of the contract, a cash settlement is made based on the final settlement price in the market rather than the actual delivery of copper metal. This approach allows investors to capture investment gains from price fluctuations by participating in the futures market without having to deal directly with physical delivery.

Investing in copper futures requires strict adherence to the rules set by the exchanges and regulators, which cover the control of price fluctuations and compliance with trading behavior to ensure the fairness and transparency of market operations. At the same time, in order to effectively deal with the risks associated with market volatility, investors need to develop and implement effective risk management strategies, such as setting stop-loss orders, position management, and regular assessment of the market situation, to ensure that the trading process can effectively control and manage risk.

What to Expect for Copper Futures Price Trends

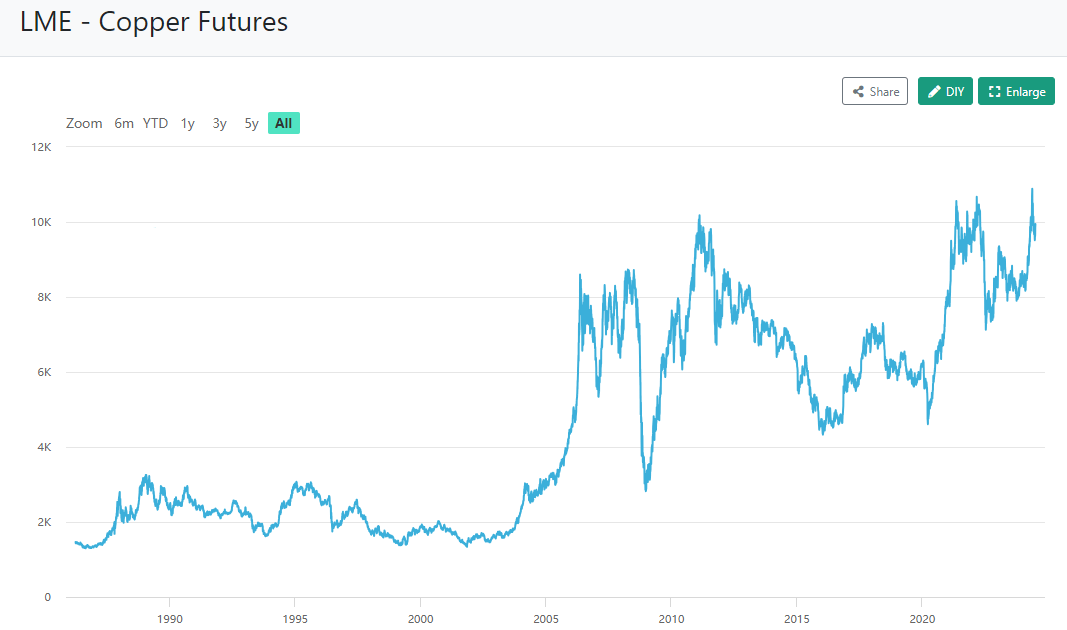

Key factors in understanding copper futures price movements include supply and demand fundamentals, economic data, technical analysis, market sentiment and capital flows, geopolitical risks, industry dynamics, and policy changes. Combining these factors helps to form a comprehensive understanding and an effective forecast of its price movement.

The global copper market is influenced by a number of factors, including supply and demand, the global economic situation, and international trade policies. Major copper-producing countries such as Chile, peru, and China, as well as major copper-consuming countries such as China, the United States, and the European Union, have a direct impact on the balance between supply and demand for copper in terms of changes in production, inventory levels, and export and import data. Imbalances between supply and demand often lead to sharp fluctuations in copper prices, so these factors are of great significance to the price movements of copper futures.

Among them, the inventory situation of the copper market is crucial to the market supply and demand and price trend, which is divided into two categories: explicit and implicit. Explicit inventories include publicly available and transparent data from exchanges such as the Shanghai Futures Exchange (SFE), Energy Exchange Center (EEC), LME, and NYMEX, which provide market participants with an intuitive understanding of the current level of copper inventories. Hidden inventories, on the other hand, refer to stocks that are opaque and difficult to accurately count, such as copper adrift at sea, backlogs in mills, and ore stored in mines, as well as high-quality copper scrap.

Although difficult to accurately count, the existence and impact of these inventories are particularly important in the event of unconventional changes in the market. Therefore, investors and market analysts need to consider both explicit and implicit inventory data and analyze them comprehensively in conjunction with the market environment and economic data in order to develop effective investment strategies and risk management measures.

Meanwhile, as an industrial metal, copper's price is significantly affected by global economic growth and the economic data of major economies. Economic growth leads to increased demand for infrastructure development and manufacturing, which directly pushes up the demand and price of copper. Therefore, investors and market analysts pay close attention to the economic data of major economies such as the United States and China, including GDP growth rate, manufacturing activity index, etc., as well as their economic growth expectations.

Copper futures price movements can be analyzed with the help of technical indicators and Chart Patterns. Commonly used technical indicators include moving averages, the Relative Strength Index (RSI), and moving average convergence divergence (MACD), which help to identify support and resistance levels for prices as well as turning points in market trends.

For example, the Shanghai copper futures market has gone through a relatively quiet and sideways phase over the past year, but recent moves have shown a breakout of a key ascending triangle level and created a gap-break scenario. Once the market breaks above a key resistance point, it usually triggers a sustained medium- to long-term trending market.

Keeping an eye on market participant sentiment and commodity fund flows can have a significant impact on the short-term volatility of copper futures prices. In particular, changes in fund managers' positions and the movement of speculative funds in and out of the market can significantly influence market sentiment and price movements.

For example, when fund managers increase their positions, it may indicate that they are bullish on the future price of copper, which will lead other investors in the market to follow suit, thus driving the price up. On the contrary, if speculative funds pull out of the market on a large scale, this could trigger a fall in prices.

In addition, a high unilateral position in copper futures would indicate that a large amount of money is coming into the market to support higher copper prices. Such large-scale fund entries usually reflect strong incentives to chase higher prices, and the market is looking forward to increasing positions in the coming month, which together support the likelihood of further copper price rises.

Geopolitical tensions, natural disasters, or major events (e.g., supply chain disruptions) could have an impact on the copper market, triggering sharp price swings. It is also crucial to keep an eye on copper-related industry dynamics. For example, the development of electric vehicles, investment in construction and infrastructure, and policy changes all have a direct impact on copper demand.

In particular, China's market, as the world's largest copper consumer and importer, has a significant influence on global copper prices and demand. China's demand for copper in areas such as construction, infrastructure development, and electronics manufacturing is huge, so developments and changes in the Chinese market have a profound impact on the supply and demand pattern of the global copper market.

In summary, to accurately understand copper futures price movements, investors and related industries must pay attention to technical indicators, chart patterns, and market fundamentals. It is crucial to closely monitor market movements and develop flexible strategies to deal with possible changes and challenges.

Fundamentals of copper futures trading and market analysis

| Trading Basics Content |

Market analysis content |

| It is a derivative contract with copper as the underlying. |

Global growth and manufacturing impact copper demand. |

| Includes volume per lot, delivery location, and rules. |

How do changes in copper supply and demand affect prices? |

| Official trading hours and the time of 24-hour market trading. |

Using charts and indicators to forecast copper prices. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.