Many people wonder how much money there is in the world. In fact, it is not as vague and uncertain as the number of stars or the number of roots in a hair. The money supply is exactly one indicator that can accurately show this question, and the M1 of it, as an important measure, is especially crucial for many people. Now, let's take a deeper look at the meaning of M1 money and its data applications.

What is M1 Money Supply?

It is an indicator of money supply in the narrow sense, representing money with immediate purchasing power in the economy of a country or region, including cash in circulation and demand deposits of business units. These funds are immediately available for consumption and transactions. Therefore, M1 is considered an important indicator of economic activity and the speed of money circulation.

Cash in circulation refers to legal tender issued by the state, including banknotes and coins, and is the form of money that people use directly in their daily transactions and consumption. These cash currencies are widely circulated payment instruments in the economy with universal acceptance and immediate availability that support the day-to-day operations and trading activities of the economy.

Demand deposits are deposits that can be withdrawn at any time and are categorized into two forms: personal demand deposits and corporate demand deposits. Personal demand deposits refer to accounts opened by individuals in banks where funds can be deposited or withdrawn at any time, which is very flexible and convenient. Corporate demand deposits, on the other hand, are accounts held by corporations in banks that can also be accessed and withdrawn at any time, which helps corporations with their fund management and daily operational needs.

For example, when using cash from your wallet to make purchases or paying bills from your checking account, these funds fall under M1. These funds are immediately available for a variety of transactions and payments, facilitating the day-to-day financial activities of individuals and businesses. It is therefore considered the most liquid form of money in the economy, reflecting changes in the liquidity of residents and businesses.

In addition to reflecting the flow of cash, M1 also reflects the liquidity needs and funding status of residents and enterprises. By observing its changes, it provides insight into the willingness to pay and consumer confidence of economic agents. Its increase shows a rise in liquidity demand, which usually signals an enhancement of economic activity, while its decrease may reflect an increase in uncertainty about the future of the economy, which in turn affects consumption and investment decisions.

In financial markets, it is commonly used to analyze market liquidity, especially in stock market analysis. Investors pay close attention to changes in M1 data to assess the potential impact of market liquidity on stock market movements. As it increases, it usually signals an expansion in the supply of funds in the market, which may support stock market rallies, while its decrease may imply a tightening of funds, which may have a negative impact on the stock market.

At the same time, changes in M1 will also reflect fluctuations in economic activity. When it increases, it means that more money is available for consumption and trading, thus suggesting that economic activity may strengthen. Conversely, if it decreases, it suggests that less money is available for immediate payments, possibly signaling a slowdown in economic activity.

Its changes are therefore widely used to analyze macroeconomic trends and formulate monetary policy, and they are one of the key tools for understanding the state of economic performance. By observing and adjusting the data on M1. central banks can assess the abundance of the money supply, which in turn affects the liquidity of the economy and inflationary pressures.

For example, central banks can directly influence their size by adjusting interest rates and conducting open market operations. Lowering interest rates and buying government bonds usually stimulates economic activity; conversely, raising interest rates and selling government bonds reduces that money supply to curb inflation. This regulatory tool helps the central bank adjust the liquidity and money supply of the economy, which in turn affects the consumption and investment behavior of economic agents.

To summarize, M1 money is an important indicator for understanding and analyzing the money supply and economic activity of a country or region. Its changes not only reflect the liquidity of cash and demand deposits but also show the capital status and liquidity demand of residents and enterprises, providing a key basis for the central bank's monetary policy and market analysis. By releasing and analyzing this monetary data on a regular basis, it can provide valuable information for economic decision-making and investment.

Uses of M1 data

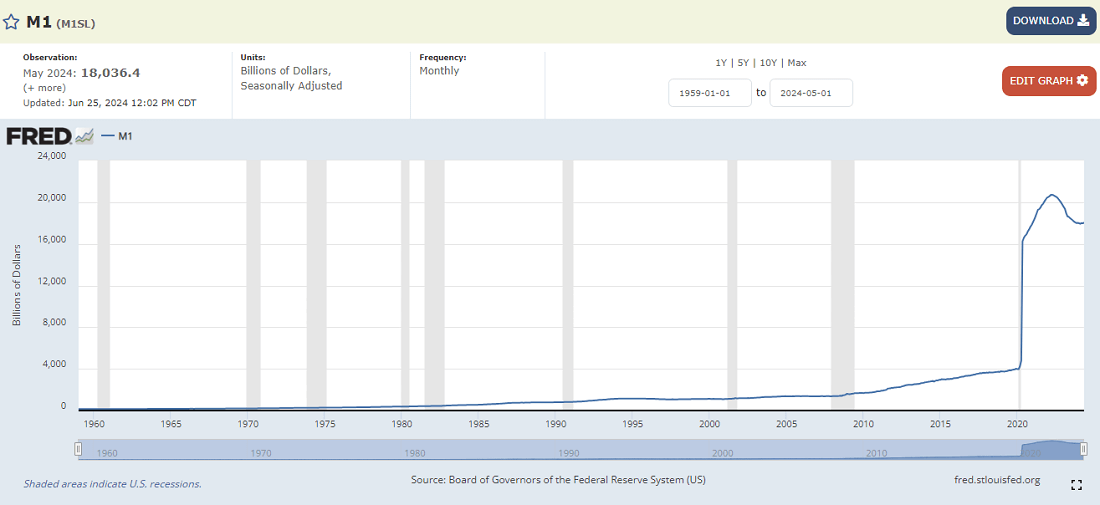

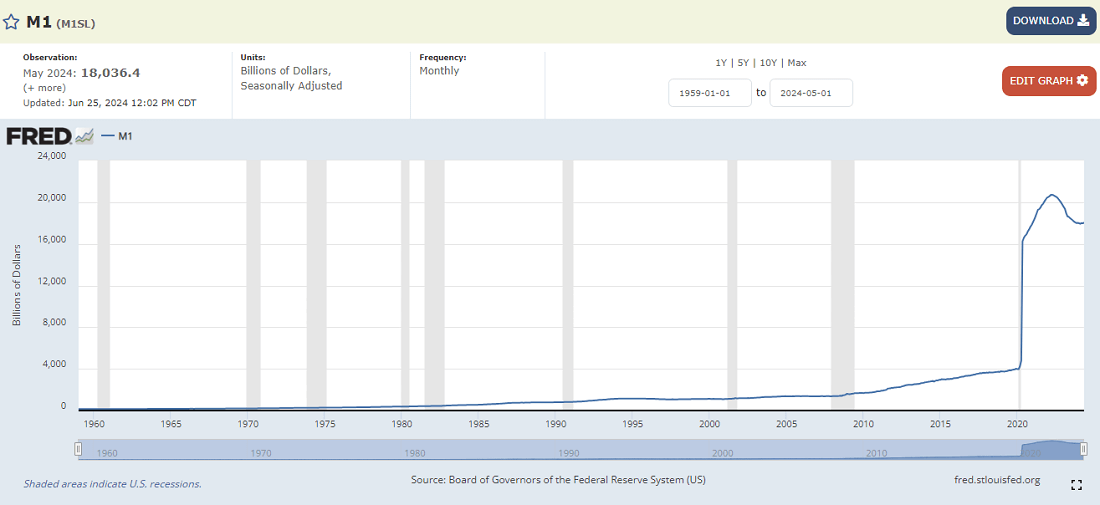

Central banks in various countries, such as the U.S. Federal Reserve System (Fed), the European Central Bank (ECB), and the People's Bank of China, These institutions regularly release data on the M1 money supply, including demand deposits from individuals and businesses and cash in circulation. These data help analysts, economists, and investors understand how money flows in a particular country or region's economy and how these data affect economic activity and monetary policymaking.

In economic analysis, M1 data reflect the total amount of cash and demand deposits in circulation and can help analysts understand the overall money supply. When it increases, it usually means that more money is available for transactions and payments, potentially driving growth in economic activity; conversely, its decrease may suggest a slowdown in economic activity or a decline in market demand for money.

And central banks, such as the Federal Reserve, use M1 data to assess the effectiveness of their monetary policies. By monitoring its changes, central banks can learn whether their money supply regulation measures are having the desired effect. For example, if its growth rate is too fast, it could lead to inflationary risks and further adjustments to monetary policy are needed, or conversely, economic activity may need to be stimulated.

At the same time, economists and analysts can use the data to predict the future trend of economic activity. By analyzing its long-term trends and short-term fluctuations, they are able to determine in advance the likelihood of economic growth or recession. This analysis helps formulate investment strategies and economic policies, and it helps governments and businesses make smarter decisions to adapt to the challenges and opportunities of different economic cycles.

M1 data provide detailed information on the total amount of cash and demand deposits in circulation, enabling central banks to monitor the amount of money available in the market and assess the demand for and supply of money in the market. At the same time, the central bank can control the pace and size of its growth by adjusting open market operations and other monetary policy tools to achieve the dual objectives of economic growth and price stability.

Based on changes in this data, the central bank can decide whether it needs to adjust its benchmark interest rate. When it grows rapidly, this may suggest strong demand in the economy, at which point the central bank can curb excessive money supply and potential inflationary risks by raising interest rates. On the contrary, when it grows slowly or decreases, the central bank may consider lowering the interest rate to stimulate economic activity.

In addition, M1 data reflects the total amount of cash and demand deposits in circulation, providing investors with an important indicator for understanding trends in economic activity. When it grows rapidly, it usually means that there is more available money in the market, which may boost economic activity and stock market performance; conversely, if its growth slows or decreases, it may signal the risk of an economic slowdown or recession.

Moreover, investors can assess the effectiveness and direction of monetary policy by focusing on M1 data. For example, if the central bank pushes its growth through an expansionary monetary policy, investors may expect more money to flow into the market, which could affect asset prices; conversely, if the central bank tightens its monetary policy, causing it to grow at a slower rate, it could have a tightening effect on the market.

Based on the analysis of its data, investors may adjust their asset allocation. In its rapid growth, investors may tend to increase the proportion of risky assets, such as equities, in pursuit of high returns, while in its slowdown or negative growth, they may prefer to choose safer assets, such as bonds or cash.

In conclusion, M1 data is one of the most important tools for investors to assess the economic situation and the effect of monetary policy. Based on the analysis results of this data, investors can adjust their asset allocation strategies to suit different economic environments with a view to obtaining more rational and effective investment returns.

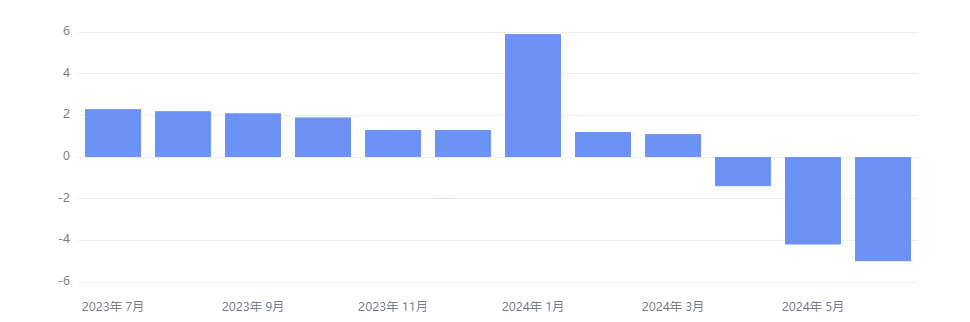

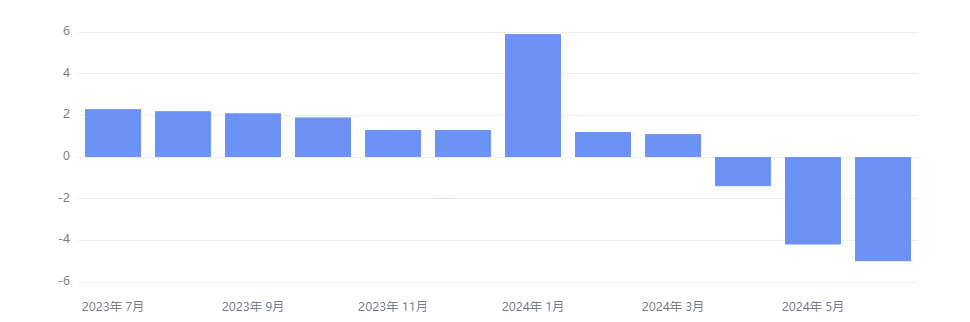

What is negative M1 growth?

It refers to a decrease in the total amount of cash and demand deposits in circulation, i.e., a negative year-on-year growth rate of M1. This situation usually reflects a reduction in spending and investment by consumers and businesses, resulting in a decrease in the amount of money available for immediate payment and circulation. Economics views this as a potential signal of a slowdown or recession in economic activity.

When M1 growth is negative, individuals and businesses may reduce spending and investment because of concerns about the economic outlook or market instability. They may shift funds to safer or longer-term savings options, such as time deposits or other financial instruments, rather than keeping them in immediately available cash or demand deposits.

As that money supply diminishes, the reduced availability of immediately available cash and demand deposits may have a direct impact on the conduct of transactions and spending activities. Businesses may slow down their investment plans and expansion due to insufficient funds, and consumers may cut back on their daily expenditures due to a lack of liquidity. This phenomenon may not only lead to a weakening of economic activity but also have the potential to affect the dynamics of overall economic growth, as a reduction in the supply of funds in circulation usually implies a reduction in purchasing power and economic activity in the market.

Persistent negative M1 growth is usually regarded as a sign of recession, as it suggests a potential downturn in economic activity and weakening market demand. A sustained decline in cash in circulation and immediate deposits reflects consumers' and businesses' concerns about future economic prospects and may lead to a contraction in consumer spending and investment activity.

This situation usually triggers recessionary fears, prompting policymakers to take measures to stimulate the economy in order to ease recessionary pressures and restore market confidence. Possible measures include lowering interest rates to stimulate borrowing and investment, increasing the money supply to boost market liquidity, and boosting consumption and investment activities through fiscal stimulus measures.

Investors may show greater caution due to that data turning negative in the economy. They may tend to prefer safer investment instruments, such as bonds or other low-risk assets, to minimize the risks associated with market volatility and uncertainty. This trend may lead to a reduction in investment activity as investors tend to favor conservative strategies that prioritize capital preservation over the pursuit of high returns.

In conclusion, the negative growth of M1 shows the uncertainty and cautious attitude of economic agents towards future economic conditions, reflecting their conservative stance in the face of market risks. This phenomenon also reflects changes in capital flows and investment behavior, which have a more significant impact on the macroeconomy.

And according to the latest data, China's current M1 growth rate shows negative growth, which last occurred in January 2022. when the global epidemic was at its most severe stage. Despite the easing of the epidemic, the economy has yet to shake off the gloom. This suggests that residents and businesses are more inclined to shift funds from demand deposits to time deposits or other forms of savings, reflecting uncertainty about the economic outlook and a cautious attitude towards market risks.

There are many reasons for this, one of which is the uncertainty of the international situation. It refers to tensions in China's relations with Europe and the United States, as well as instability in the trade and investment environment. This situation may lead to a lack of confidence among residents and businesses in the future economic outlook, which in turn affects their consumption and investment decisions. Such uncertainty typically increases market volatility and reduces the expected and actual level of economic activity, which may lead to a decline in the money supply (e.g., M1).

At the same time, the domestic political and economic environment, such as the frequency of natural disasters and the economic regulations and tax policies imposed by the government on businesses and individuals, may make residents and businesses more inclined to save than to consume and invest. Frequent natural disasters affect economic activity and market confidence, while government regulation and tax policies increase the cost and risk of doing business and reduce willingness to spend. Together, these factors may lead to a reduction or destabilization of the money supply.

And as the international community becomes more assertive toward China, the possibility of future economic sanctions increases, further heightening public and business concerns about the future economic outlook. This uncertainty could lead to a greater flow of funds into savings rather than consumption or investment, with consequent effects on economic activity and the money supply.

The occurrence of these scenarios for the average person would require concern that deposit rates may fall in the future. This means that depositors may receive less interest income. Therefore, managing one's savings needs to be carefully considered in anticipation of a possible low interest rate environment.

On the other hand, maintaining job stability is especially critical as the cost of living may rise in the future. A stable source of income will help people better cope with possible economic challenges and increases in the cost of living. In addition, the government's future subsidy policy may be adjusted to focus on either the consumption side or the capacity side, which may affect individuals' economic dependence and cost of living burden and require close attention and timely adjustments.

As a result, in such an economic environment, the general population is less inclined to consume and more focused on saving. Businesses have also reduced their willingness to invest and expand production, leading to an overall slowdown in economic activity. In the past, many people were willing to take risks in investing and spending, but now most people have become conservative and are reluctant to spend money easily, choosing instead to keep cash to cope with possible uncertainties and risks.

Conclusion: Negative M1 growth is an important economic signal reflecting the current economic woes and challenges. The country needs an active fiscal policy to boost the economy and improve the consumption and investment environment. For ordinary people, focusing on deposit rates, ensuring job stability, and adapting to the rising cost of living are key.

The meaning of M1 currency and its data application

| Meaning |

Data Applications |

| Cash and demand deposits in circulation |

Measure the total money in circulation. |

| Cash and demand deposits |

Analyze market liquidity and the availability of funds. |

| Reflect purchasing power and money velocity. |

Assessing consumption and investment activity |

| Measures economic activity and policy effects. |

Help formulate monetary policy. |

| Monetary data released by central banks |

Provide references for economists and investors. |

| Increases mean growth; decreases, downturn. |

Determine economic trends and adjust strategies. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.