The state does not officially support most of the channels available in China for those seeking to invest in foreign products. However, QDII funds, as an important channel for offshore investment, have not only been supported by the state but have also been exceptionally hot in China recently, even leading to certain funds having to announce a suspension of accepting investments. In this article, we will delve into the trading rules and buying techniques of QDII funds and analyze the people who are suitable for investing in such funds.

What kind of people are suitable to buy QDII funds?

What kind of people are suitable to buy QDII funds?

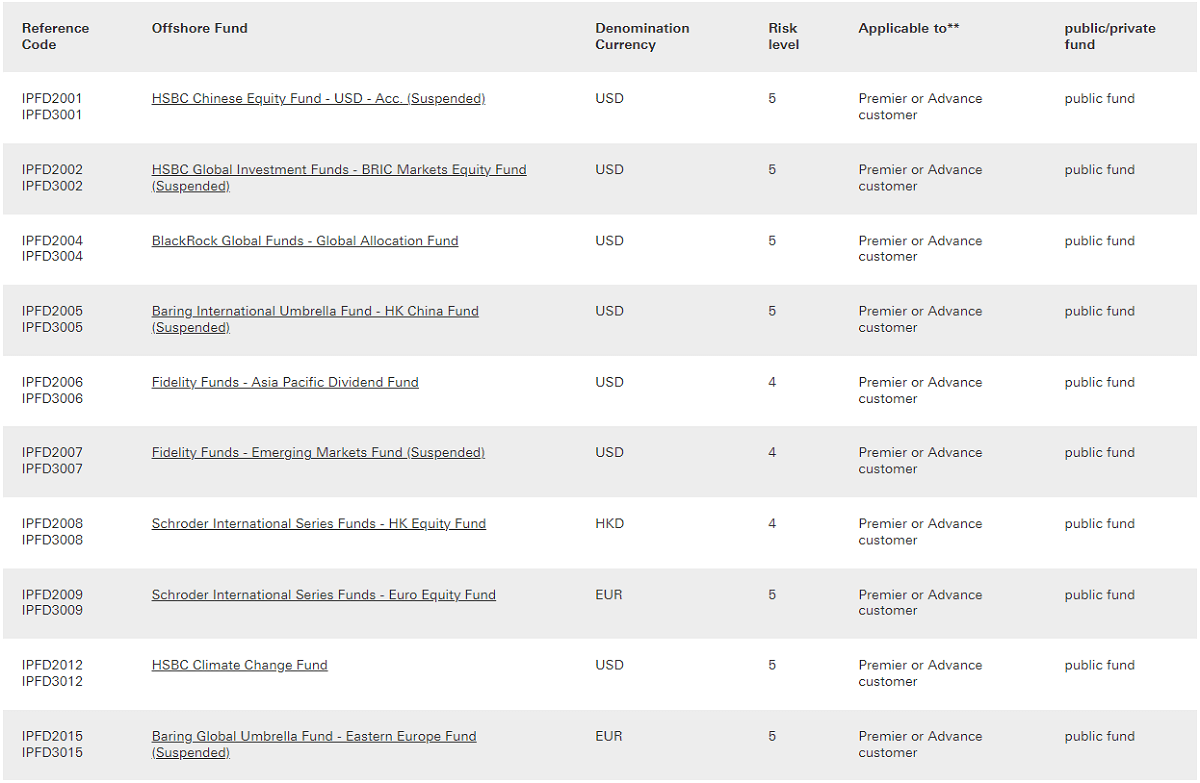

QDII funds (Qualified Domestic Institutional Investors Offshore Investment Funds) can invest in a wide range of financial assets in overseas markets, including stocks, bonds, real estate investment trusts (REITs), money market instruments, etc., according to the fund contract. These investment types and ratios will be determined in accordance with the fund's investment strategy and objectives, aiming to provide investors with diversified global investment opportunities and the flexibility to adjust the investment portfolio according to the market situation in order to achieve long-term investment objectives and risk management.

QDII funds are therefore suitable for investors who seek global diversification. It allows investors to diversify their investments in various global markets through a single investment channel, thereby reducing single market risk. This type of fund is particularly suitable for investors who wish to participate in overseas economic growth and business development through international markets, providing them with the means to explore and capitalize on global market opportunities.

At the same time, this type of fund invests in overseas markets, which are subject to the influence of international economic and political factors and hence have higher market volatility. Investors need to have sufficient risk awareness and tolerance to be able to cope with potential investment losses. In addition, as exchange rate risk is involved, investors need to be able to accept the possible impact of exchange rate fluctuations. It is therefore suitable for investors with a certain degree of risk tolerance and a long-term investment horizon.

If one wishes to invest in specific countries or regions, such as the United States, Europe, or Japan, it can provide access to these markets. At the same time, if investors are interested in specific industries such as technology, healthcare, or energy, it can also help them participate in these industries. QDII funds are therefore suitable for investors who are interested in specific overseas markets or sectors.

It is also suitable for investors with medium- to long-term as well as regular investment plans. These investors are usually able to tolerate short-term market volatility and seek long-term investment returns. By holding for a long period of time, investors can capitalize on the potential of global markets and achieve capital appreciation. Investors with regular investment plans can achieve their long-term financial goals more effectively by leveling out costs and reducing the impact of market volatility on their investment portfolios through regular fixed-rate investments.

In addition, it is suitable for people with certain investment experience. They are able to understand and cope with the dynamics and risks of overseas markets, familiarize themselves with the linkages and impacts of different markets, and make rational decisions based on market trends and global economic dynamics. Investors with investment experience are also able to effectively access and understand relevant information about QDII funds, assess the fund's investment strategy, asset allocation, and risk management, and thus better manage their investment portfolios.

Investors seeking high-yield opportunities are suitable for investing in QDII funds. These funds are able to invest broadly in global equities, bonds, and other financial instruments, seeking higher return potential through a diversified investment portfolio. Despite the risks associated with international market volatility and exchange rate changes, investors are expected to achieve greater investment returns than in the domestic market.

It is also a good choice for investors who value the preservation and appreciation of their assets. As it invests in overseas markets, it can effectively diversify risks and is not only dependent on the performance of the domestic market. At the same time, it covers a wide range of asset classes globally, including equities, bonds, and other financial instruments, so it can capitalize on investment opportunities in different regions and sectors to counteract the effects of possible inflation.

For short-term speculators, QDII funds are not suitable. Short-term speculators usually seek quick profits and trade frequently in an attempt to profit from short-term market fluctuations. However, it is more suitable for investors who have long-term investment objectives. This is because long-term investors can better capitalize on the potential of global markets and pursue stable long-term returns rather than quick profits in the short term.

It may not be suitable for people with high liquidity needs, such as investors who need to use their funds frequently or have high liquidity requirements. Although it is usually available for subscription and redemption on trading days, there may be a minimum holding period and a closed period for the fund shares, which are not suitable for frequent adjustments to fund requirements.

Also, QDII funds are not suitable for stable investors. This is because these funds invest in overseas markets, which are highly affected by international economic and political factors, with high market volatility and exchange rate risks that may lead to investment losses, making it difficult to meet the needs of stable investors.

In conclusion, QDII funds are suitable for medium- to long-term investors who wish to reduce risk through diversification, pursue investment opportunities in the global market, and have a certain degree of risk tolerance and investment experience. However, before choosing them, investors should have an in-depth understanding of their trading rules and buying techniques in order to make smarter investment decisions, fully utilize the potential of the global market, and achieve their long-term investment goals.

Trading rules for QDII funds

Trading rules for QDII funds

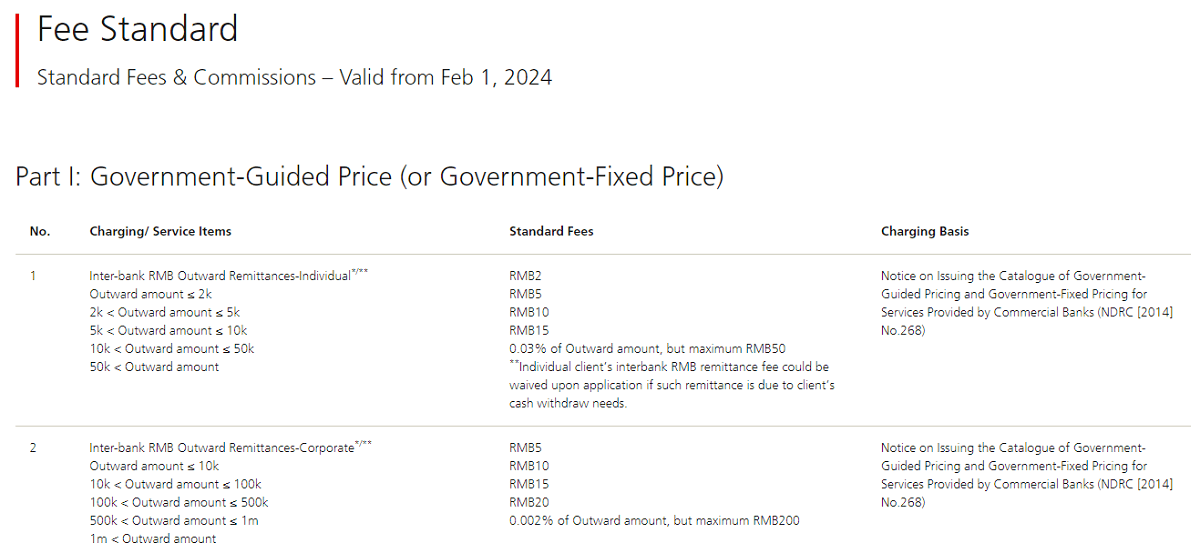

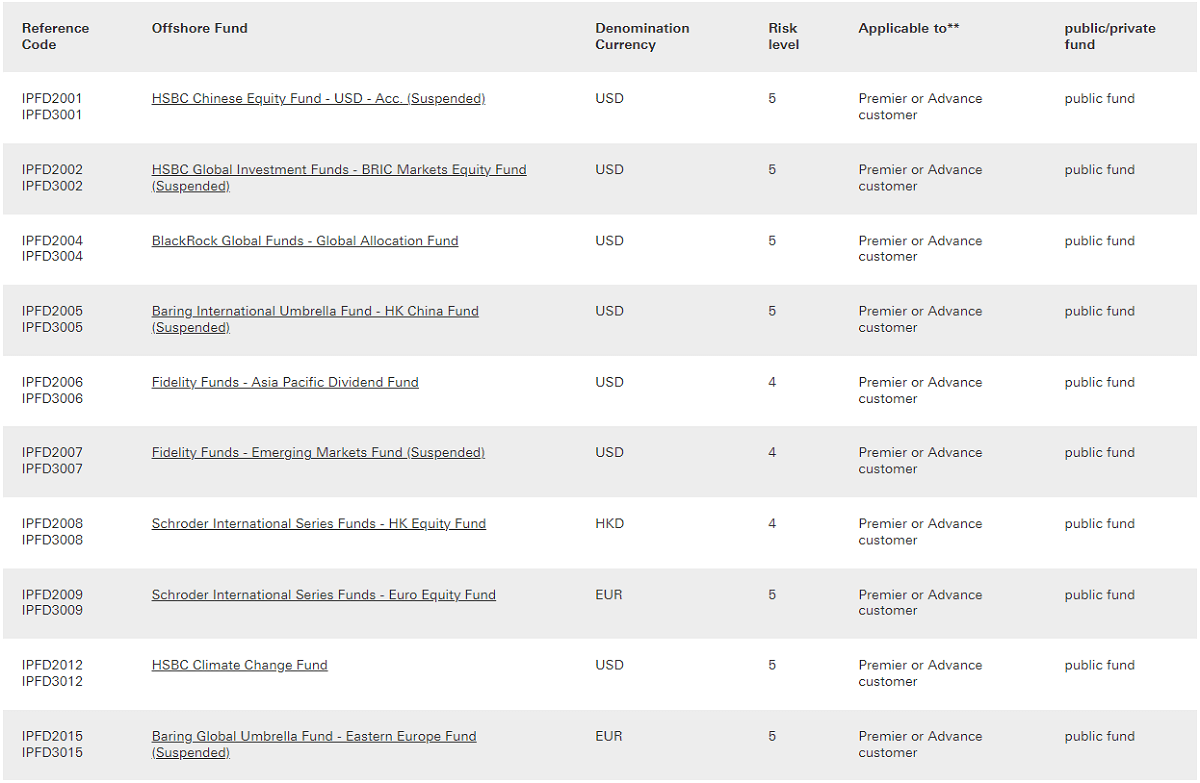

As a financial product that invests in overseas markets within China, its trading rules are significantly different from those of general domestic fund products. Specifically, QDII funds differ in terms of subscription and redemption rules, trading hours, fee regulations, information disclosure, and regulatory requirements.

As the core process for investors to buy and sell fund shares, the subscription and redemption operations of QDII funds usually require the submission of applications on the trading day and are subject to minimum limit requirements. Subscription is the process of purchasing fund shares, while redemption is the process of converting fund shares into cash.

The redemption amount will be paid to the investor's designated bank account within a certain number of business days to complete the whole redemption process. The prices of these operations are usually calculated based on the net value of the fund on the application date or the next trading day, ensuring that investors enjoy fairness and transparency in the transaction process.

It is also important to understand that there are two main differences between QDII funds, A and C. The first one is that QDII funds have a front-end charging system. Its A class generally adopts the front-end charging mode, i.e., investors are required to pay a certain percentage of the subscription fee when subscribing to the fund, while no additional fee is usually charged for subsequent redemption. Under this model, investors need to consider the impact of front-end fees on the principal amount invested at the time of purchase.

Class C, on the other hand, adopts a back-end fee model, whereby investors pay a redemption fee when redeeming the fund and are not charged for subscriptions. This model is usually suitable for short-term investors, as the redemption fee will gradually decrease as the holding period increases and may even be waived after a certain holding period. Investors need to consider the impact of changes in holding periods and fees on investment returns when making a choice.

The trading hours and calendar arrangements of QDII funds are relatively complex, usually following the trading days in China but also affected by the trading hours and holidays of the overseas markets in which they invest. This means that its trading days may not correspond exactly to those of the domestic A-share market, requiring investors to pay attention to the specific conditions of the overseas market.

In terms of trading hours, it generally trades during the opening hours of the overseas stock exchanges in which it invests. Different fund companies may have subtle differences in regulations, and investors should make reasonable arrangements for subscription and redemption operations according to the fund company's specific arrangements and the trading hours of the markets in which they invest.

The calculation of the net value of QDII funds is usually conducted every trading day and announced later. As these funds invest in overseas markets, the net value calculation will take into account the time difference factor, and therefore the published net value data may have a certain lag. Investors should be aware of this lag when referring to and using their net asset values and make investment decisions accordingly in light of the actual situation and market movements.

As it invests in overseas markets, the value of its fund assets and investment returns will be directly affected by exchange rate fluctuations. In selecting and holding it, investors need to be cognizant of the possible risks associated with exchange rate fluctuations, which may have a significant impact on the actual returns of the fund. Effective exchange rate risk management strategies, such as selecting the appropriate timing of investments or using foreign exchange market instruments to hedge against the risk, are essential to reduce investment risk and optimize investment returns.

In addition to exposure to exchange rate risk, it is also important to note that some QDII funds have a closed period, during which investors are not able to conduct subscription or redemption operations, in order to maintain stable fund operations. In addition, fund companies must regularly disclose information on the fund's asset mix, performance, and significant events to enhance market transparency and investors' access to information.

In summary, QDII funds, as a bridge connecting Chinese investors with the global capital market, have unique trading rules and features that require investors to have in-depth knowledge and understanding before investing. Investors should fully consider the subscription and redemption rules, the impact of time differences in NAV calculation, and the potential impact of exchange rate fluctuations on investment returns before making reasonable investment decisions and adopting corresponding risk management strategies.

QDII Fund Buying Time Tips

QDII Fund Buying Time Tips

To buy QDII funds, first choose a reputable fund management company. Then, open a securities account with the chosen securities company and complete the identity verification and bank account information submission. After choosing a suitable product, fill in the purchase amount and submit the subscription order.

Throughout the purchase process, investors can make use of buying timing techniques to optimize investment returns, including investing regularly in a fixed amount, buying during market correction, choosing to buy when the fund's net asset value is low, and choosing the right time to invest according to the economic cycle. These techniques help investors effectively manage risk and pursue long-term investment returns.

Buying in tranches is an effective investment strategy that can help investors reduce the risk associated with market volatility, especially by avoiding buying at once at market highs. By buying in tranches, investors can find a more suitable time to buy during market volatility and gradually build up their positions to balance the uncertainty of the market.

Fixed investment is another effective strategy. By investing in QDII funds at regular intervals, investors can achieve cost averaging and reduce investment risk. Fixed investment can effectively avoid the impact of short-term market fluctuations in the process of long-term holding while gradually accumulating assets to achieve the goal of long-term investment.

Another common investment strategy is to avoid market trading around vacations and holidays. Markets are usually more volatile and risky during these times, so investors should try to avoid buying operations during these periods. This reduces the uncertainty caused by market volatility and protects the invested funds from greater risk.

Since QDII funds invest in overseas markets, it is crucial to pay attention to the trend of overseas markets and major events. First, investors may consider buying when overseas markets are at a low point in anticipation of higher returns when markets rebound. Secondly, the market is usually more volatile before or after the release of major economic data, so investors can choose the right time to buy based on market expectations and their own strategies.

Considering the impact of exchange rate factors on this fund, investors need to pay special attention to the exchange rate changes of the RMB against the currency of the target investment market when making investment decisions. Firstly, they may consider buying when the exchange rate of RMB against the target currency is low, so that they can obtain additional exchange rate gains when the exchange rate recovers and increase their investment returns. Secondly, investors should pay attention to the long-term trend of the RMB exchange rate and avoid buying on a large scale during the stage of continuous appreciation of the RMB, so as not to affect the overall return of the investment.

Choosing the right market timing can be based on the economic cycle. For example, during global economic recovery, overseas markets usually perform better, and buying QDII funds at this time is expected to yield better investment returns. Whereas, buying after the market has gone through some adjustment may result in a lower cost of purchase and the opportunity to earn higher returns when the market rebounds.

What's more, investment decisions can be determined by observing and understanding the historical NAV fluctuations of QDII funds. For example, one can choose to buy near historical lows where the fund's NAV is relatively low, which may have greater upside. And if the fund's NAV is in a stable, volatile range, you can buy at the low point of the range in anticipation of better investment returns when the volatility picks up.

It is important to pay attention to fund announcements and regular reports. This information can help investors understand the fund's investment direction, asset allocation, and risk profile. Regularly checking fund announcements and reports can provide timely access to key market information and fund managers' decisions, which can help investors adjust their buying strategies according to the actual situation in order to more effectively manage investment risks and optimize investment returns.

Utilizing professional investment tools and analysis reports is the key to developing a QDII fund-buying strategy. Investors can combine technical and fundamental analyses to find suitable buying points. Market movements and price trends are analyzed through technical indicators and Chart Patterns, such as moving averages, RSI, and MACD, to determine the timing of buying.

At the same time, we pay attention to the asset classes and geographical distribution of the Fund's investments, analyze the macroeconomic environment, industry outlook, and company financials to assess long-term investment value and profit potential; in addition, we pay attention to market sentiments and professional analysts' reports to obtain market expectations and in-depth analyses to guide our investment decisions. By utilizing these methods in a comprehensive manner, investors are able to improve the accuracy and efficiency of their investment decisions.

Through the above techniques, investors can better grasp the timing of buying QDII funds and optimize their investment returns. However, it should be noted that the market is uncertain and no investment strategy can guarantee complete risk avoidance. Investors should make prudent decisions based on their own risk tolerance and investment objectives.

Trading Rules and Buying Tips for QDII Funds

| Trading Rules |

Buying Tips |

| Minimum limits for subscription and redemption. |

Choose a reputable fund-management company. |

| Trading hours are subject to foreign markets. |

Buy during a market correction to avoid highs. |

| Fees are categorized into front-end and back-end. |

Buy in stages to mitigate market volatility risk. |

| The net value calculation is usually per trading day. |

Regular fixed investments for cost averaging. |

| Exchange rate fluctuations impact returns. |

Watch holiday volatility to time purchases. |

| Monitor fund reports and announcements regularly. |

Time investments are based on economic cycles. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What kind of people are suitable to buy QDII funds?

What kind of people are suitable to buy QDII funds? Trading rules for QDII funds

Trading rules for QDII funds QDII Fund Buying Time Tips

QDII Fund Buying Time Tips