Technology stocks have been the subject of much pursuit, but recently, big tech stocks like Microsoft and Tesla have been on a downward trend for a variety of reasons. Meanwhile, second-tier tech stocks such as Oracle have instead performed well and attracted the attention of investors. As the world's second-largest software company, how exactly can its performance remain so stable? More importantly, can investors find better investment opportunities in it? This article will analyze Oracle and its stock investment value in? depth in order to help investors fully understand its potential and investment value and provide investment advice.

Oracle Corporation

It is a multinational technology company headquartered in California, USA, and co-founded by Larry Ellison, Bob Miner, and Edward Oates. Oracle, one of the world's largest database software companies, primarily provides enterprise-class database management systems (Oracle Database) and related technology services. rvices. These databases are widely used to store, manage, and process critical enterprise data such as transaction information, customer data, and business operations data.

Initially known for its powerful enterprise-class database management systems, Oracle has since expanded into a variety of areas, such as enterprise application software, cloud computing services, hardware systems, and development tools. In addition to database software, it is also involved in cloud computing, artificial intelligence, enterprise software and hardware, and other areas, providing comprehensive technology solutions for enterprise customers.

Its services include cloud-based applications and platform services (e.g. Oracle Cloud), artificial intelligence and machine learning technology applications, enterprise applications (e.g., ERP and CRM systems), and hardware products (e.g., database servers and storage solutions). These diversified businesses enable it to support its customers' digital transformation and technological innovation globally, helping them improve efficiency, reduce costs, and grow their businesses.

It also has an extensive global customer base and operational network serving leading organizations in a variety of industries, including financial services, retail, manufacturing, communications, and energy. Through its strong technology foundation and comprehensive solutions, Oracle provides customers with customized technical support and business applications that help enterprises optimize operations, improve productivity, enhance data security, and support the needs of business innovation and digital transformation.

Oracle is committed to technology innovation and investment in research and development and continues to introduce new products and services to meet market and customer needs. Through continuous technology innovation, it has not only strengthened its leadership position in database management systems but also expanded its market presence in a number of areas, including cloud computing, artificial intelligence, enterprise software, and hardware. These innovative products and services help enterprise customers achieve more efficient data management, more flexible business applications, and stronger competitive advantages in the process of digital transformation.

As a mature technology company, it is financially robust, demonstrating good profitability and a sound capital structure. Through its stable cash flow and effective capital management, the company ensures sustained profitability and is able to make continuous investments in technology innovation and market expansion. Stable performance in the global marketplace and financial health enable it to continue to create long-term value for shareholders and maintain a competitive advantage in the technology industry.

And these characteristics have made Oracle one of the world's leading providers of enterprise IT solutions, due to the steady demand for its products stemming from the fact that the majority of its customers are enterprises. These customers' demand for software services remains stable during economic downturns, which allows it to continue to outperform during economic downturns. The company's stock price has often outperformed market indices during all downturns, thanks in part to its steady cash flow and customer stickiness.

That said, Oracle faces some challenges. Its high debt ratio and continued investment in mergers and acquisitions, buybacks, and dividends increase financial risk. It has been relatively slow to transform itself in the cloud computing space, and competitive pressures are mounting, especially with the complexity of its ecosystem and customer experience issues that need to be addressed.

To address these challenges, the company has adopted an aggressive strategy that includes accelerating the development of its cloud computing services and strengthening its competitiveness in the market through acquisitions. In recent years, the company has introduced a new generation of cloud offerings and continues to optimize its enterprise software and database services to meet the growing needs of its customers.

Overall, Oracle, the world's second-largest software company, has a strong product portfolio and a stable customer base that have brought it steady revenue and market position. However, in the face of a rapidly changing technology industry and a competitive market environment, it needs to continue to innovate and adapt its strategy in order to maintain its leadership position and achieve sustained growth.

Oracle Stock Analysis

Oracle Stock Analysis

Oracle, one of the world's largest enterprise software companies, is traded under the ticker symbol ORCL and is currently listed on the NASDAQ exchange. The company enjoys broad market share and high brand recognition globally, and its market capitalization has stabilized at over tens of billions of dollars. Although market capitalization is subject to market volatility, it maintains a strong market position and solid financial performance, reflecting investors' confidence in its long-term growth potential.

The company has achieved steady revenue growth globally through its strong database and enterprise software solutions. Its good profitability demonstrates sustained earnings potential, enabling it to maintain steady growth and expand its market share in a highly competitive market environment.

According to the latest financial report, total revenue of 142.87. increased by 3.26% year-on-year. Operating income was $47.52. up 10.61% year-over-year. Cloud and license revenue accounted for 70.68% of this, and services accounted for 11.2%. These figures show that Oracle's strong performance in its core business areas, particularly in cloud and license revenue, drove a steady improvement in its overall financial performance.

At the same time, Oracle demonstrated strong cash flow management capabilities that helped support its business expansion and technology innovation investments. The data showed its cash-to-debt ratio was 0.72. indicating that the company has a relatively healthy financial structure and is able to flexibly respond to debt payments and financial pressures. These characteristics not only highlight its soundness in financial management but also provide investors and analysts with an important indicator for assessing its financial risk and debt-servicing ability.

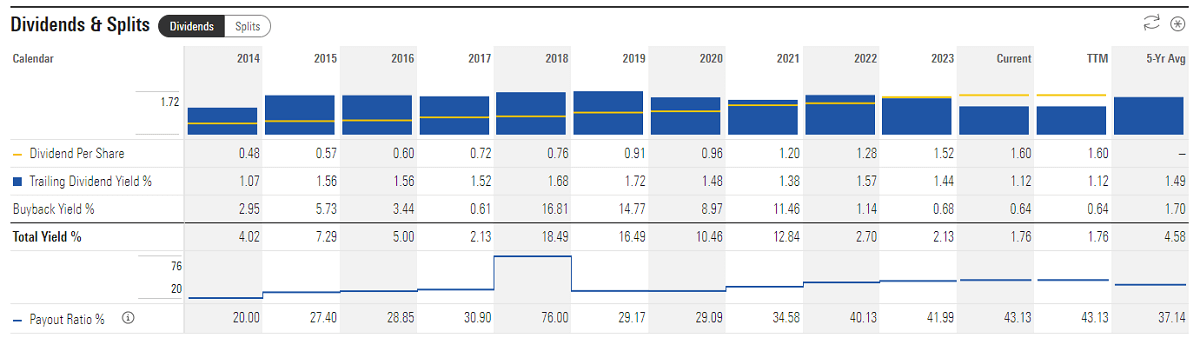

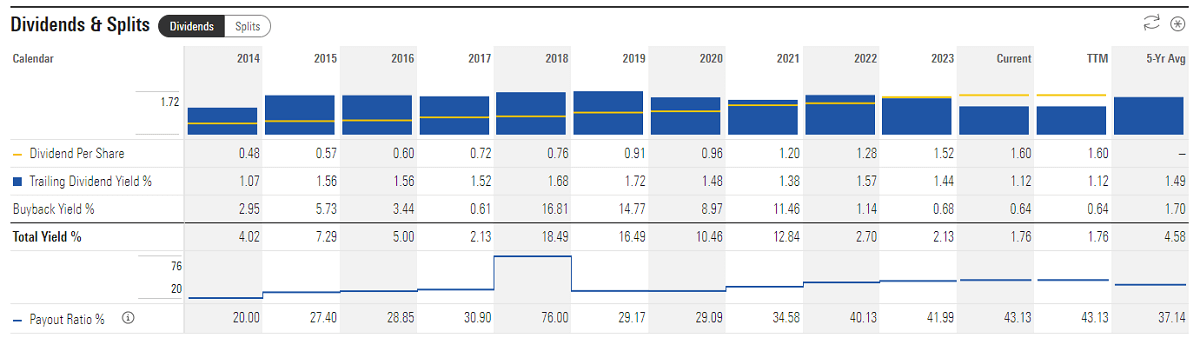

And its stable cash flow and profitability enable it to reward its shareholders through dividends and share buyback programs. Not only does it demonstrate a commitment to shareholder value, but it also shows the ability to sustain growth and financial health. Investors and analysts are thus bullish on its long-term capital appreciation potential and reliable dividend yield, especially in the rapidly expanding cloud computing and enterprise software markets, where Oracle continues to lead and extend its market presence.

Not only that, but its gross margins have consistently outperformed over the years, consistently staying within the competitive range of the industry. And the company's operating profit and margins show a steady growth trend, reflecting its effective cost management and revenue growth. By optimizing its operations and improving its efficiency, the company has continued to achieve enhanced profitability, demonstrating its solid performance and competitive advantage in the market.

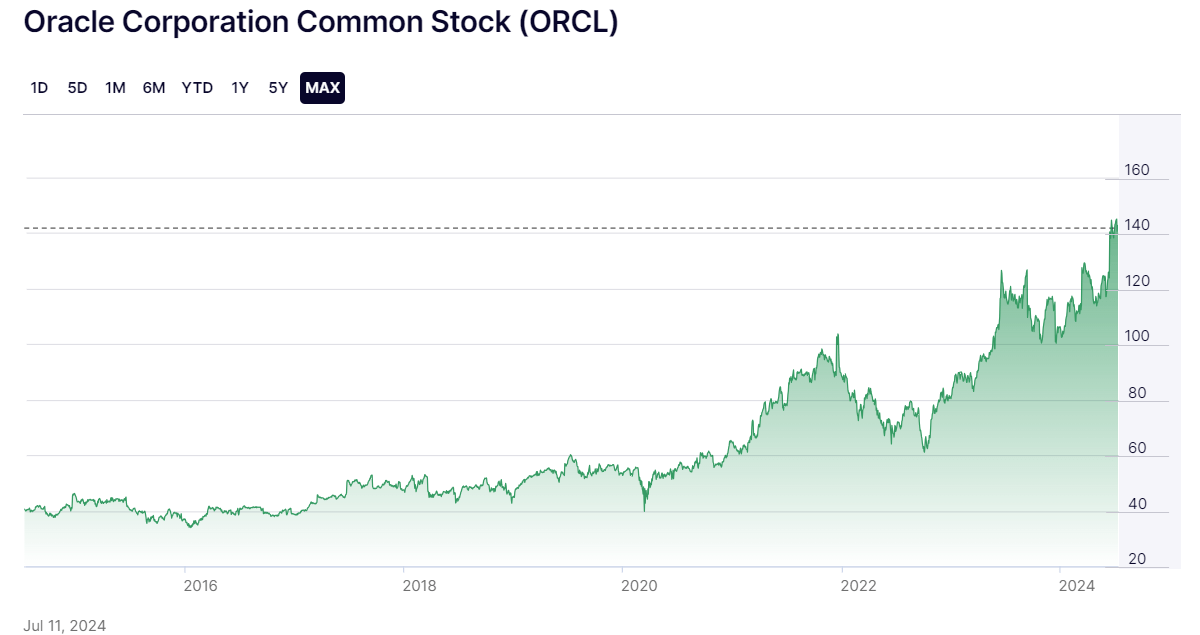

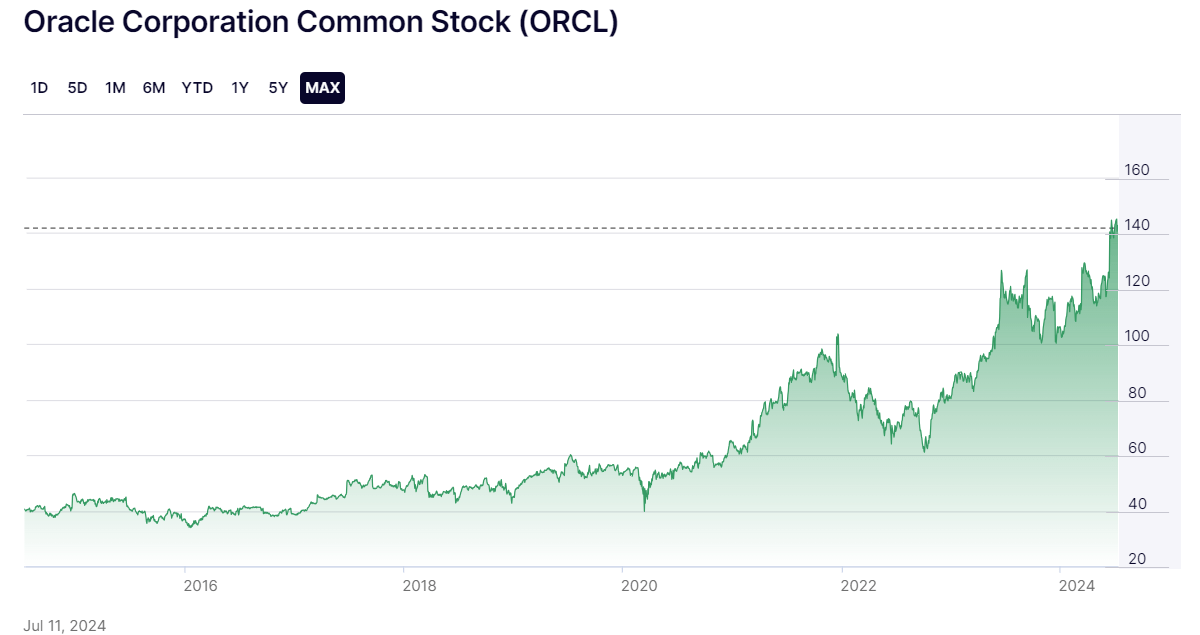

Meanwhile, the stock price chart shows that the company's stock has exhibited some volatility in the past, but the overall trend has remained stable and is generally trending upward. This stability reflects investors' confidence in Oracle's long-term growth potential, and the company has been able to maintain relatively stable stock price performance even during periods of market volatility. This is due in part to its strong financial health, steady revenue growth, continued technological innovation, and business expansion.

In addition, Oracle's solid cash flow and high customer stickiness provided the company with solid support during periods of market uncertainty. These factors not only enhanced investors' trust in the company but also helped the company's stock price maintain a steady upward trend over the long term.

And with its stable financial performance and reliable market positioning, it demonstrated leadership in the highly competitive enterprise software industry. The company's sustained profitability and steady growth in the global market have continued to make it attractive to investors and recognized by the capital markets.

And most recently, the company has entered into a partnership with NVIDIA, with plans to bring in tens of thousands of GPUs one after another to boost cloud processing power. This cooperation not only enhances its competitiveness in the cloud computing field but also provides enterprise customers with more efficient processing power and faster AI services. This will help enterprises reduce operating costs, improve productivity, and enable smarter business decisions and operational optimization. Also, by working closely with NVIDIA, the company has demonstrated its continued investment and strategic vision in technology innovation and market expansion.

In addition, these efforts are aimed at increasing market share and enhancing competitiveness to ensure a leading position in the rapidly evolving cloud computing market. Through continued technological innovation and strategic collaboration, Oracle is expected to further narrow the gap with its major competitors and achieve greater market breakthroughs.

As a result, as a solid technology company, Oracle stock is often viewed by investors as an ideal choice for long-term investment. Its strong financial performance, ongoing technology innovation and market expansion strategies, and strategic partnerships with leading technology companies have given it a favorable reputation among investors.

Oracle Investment Recommendations

Oracle Investment Recommendations

An analysis of the fundamentals of the company's strong financial performance, ongoing technology innovation and market expansion strategies, and strategic partnerships with leading technology companies shows that Oracle stock is a worthy investment choice. However, investors need to carefully evaluate their investment objectives, risk tolerance, and investment time horizon before deciding to invest.

It is important to keep an eye on its financial health over the long term; solid financial performance is the basis for long-term investment. A company's financial stability is the foundation of an investment, so investors should regularly review its revenue streams and profitability. It is also vital to understand Oracle's ability to innovate technologically to see if it can consistently introduce competitive products and services.

In addition, assessing the company's competitive position and market share in the global marketplace is a key factor in long-term investing, especially its performance in the fast-growing areas of cloud computing and enterprise application software. Investors should focus on the company's market strategies and competitive advantages in these areas in order to make informed investment decisions.

At the same time, it is vital to focus on Oracle's growth potential and market strategy in cloud computing services. Cloud computing, as a major growth driver in the current IT industry, has a direct impact on the company's long-term growth capacity and market competitiveness. The company is committed to enhancing the technical capabilities and service quality of its cloud computing platform and expanding its customer base through continuous technological innovation and strategic cooperation, aiming to increase its market share and enhance its overall competitiveness.

Investors should pay close attention to the company's development in the field of cloud computing. This not only helps to understand Oracle's future growth potential but also helps to assess its long-term investment value. A comprehensive consideration of technological innovation, market strategy, and the competitive landscape of the global cloud computing market will help investors make a more rational and informed investment decision.

And analyzing its competitive relationship and market share with its major competitors, such as Amazon AWS, Microsoft Azure, and Google Cloud, is equally crucial for investment decisions. These companies are highly competitive in the global cloud computing services market and are each known for their strong technological capabilities and market presence. Investors need to focus on their strategic initiatives, market performance, and technological innovations to assess the companies' competitive position and long-term growth potential in the cloud computing space.

For investors, valuation analysis can also be based on metrics such as Oracle's P/E and P/B ratios. Taking into account the company's growth potential and leadership position in the enterprise software industry, the reasonable valuation level of its stock can be more accurately assessed. At the same time, the metrics not only reflect the company's current market pricing but also help investors determine the right time to buy as well as a long-term holding strategy.

According to the latest data, its price-to-earnings ratio is 38.48. Its price-to-book ratio is 45.19. Its enterprise value-to-sales ratio is 8.77. These metrics reflect the market's optimistic expectations for Oracle's profitability and market position in the future, while also indicating the possibility of an overvaluation of the stock.

In addition to focusing on its various financial metrics, it is important to emphasize the multiple risk factors facing the company, such as technological change, fluctuating market demand, intensifying competition, and uncertainty in the global economic environment. It is important to reasonably assess the potential impact that these risks may have on the portfolio.

In addition, the use of technical analysis can help investors determine more precisely when to buy and sell. It is important to realize that large swings in Stock Prices during pre-market and Intraday Trading may reflect rapid market adjustments to specific indicators or future expectations. Even if a company's fundamentals are favorable, market sentiment and expectations may significantly influence stock price movements.

In summary, investors are advised to consider holding Oracle stock for the long term due to its stable cash flow and continued technological innovation. At the same time, pay regular attention to its financial reports, market dynamics, and industry trends in order to adjust investment strategies at any time and respond flexibly to changes in the market. This will better capitalize on the company's growth potential while managing investment risks and adding stability and long-term return potential to the portfolio.

Oracle and its stock investment value

| Advantages |

The Challenge |

Opportunities |

| Strong technology base |

Competitive cloud computing market |

Rising cloud and data demand |

| Extensive market penetration |

Rapid changes in enterprise software |

Global market expansion |

| Leadership in cloud computing |

Tech changes and security challenges |

Growing data security demand |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Oracle Stock Analysis

Oracle Stock Analysis Oracle Investment Recommendations

Oracle Investment Recommendations