Since ancient times, gold has not only had the function of money but is also regarded as a sound hedge tool, attracting investors seeking asset preservation and diversification of investment strategy. There are various ways to invest in gold, among which gold futures, as an important financial derivative, provide a very attractive market for buying and selling. If you want to know more about it, let's take a look at this article on gold futures account opening and trading points.

What is Gold Future Trading?

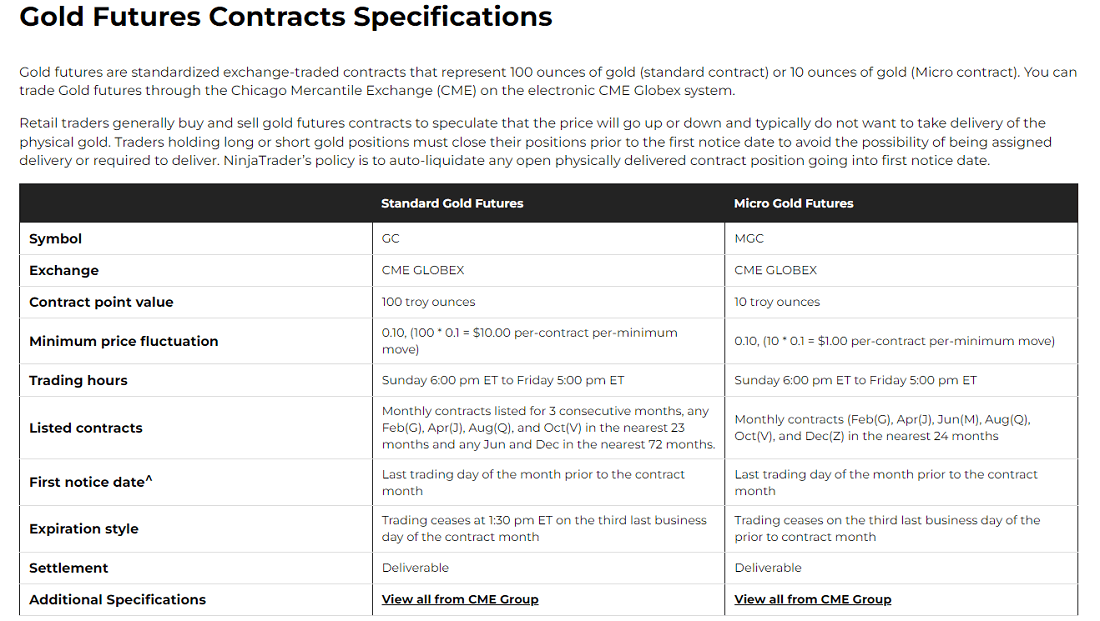

It is a financial derivative whose trading does not involve the delivery of physical gold but rather contracts based on the price of gold at a future point in time. These contracts are traded on major commodity exchanges around the world, such as the New York Mercantile Exchange (NYMEX) and the Tokyo Commodity Exchange (TOCOM), etc. Investorscan participate in fluctuations in the price of gold through the futures market and engage in risk management and speculative trading.

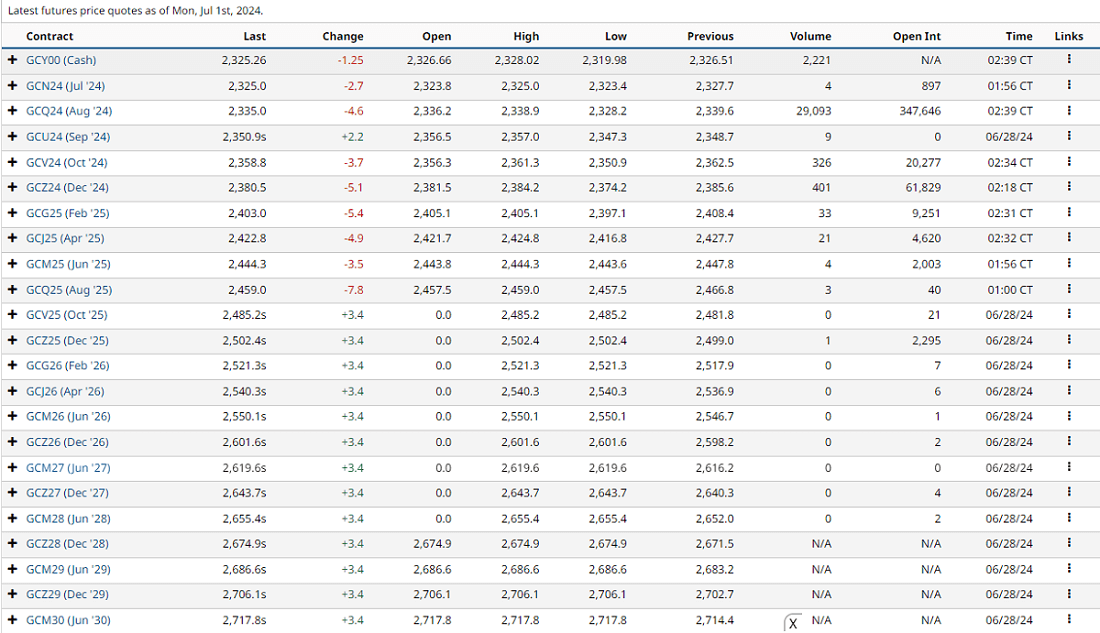

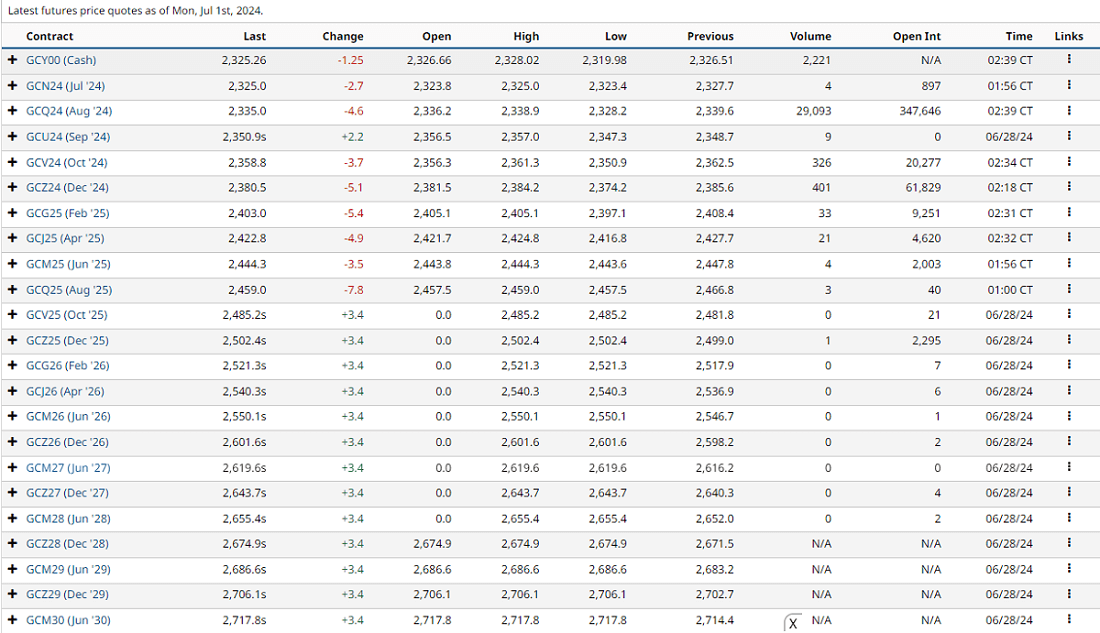

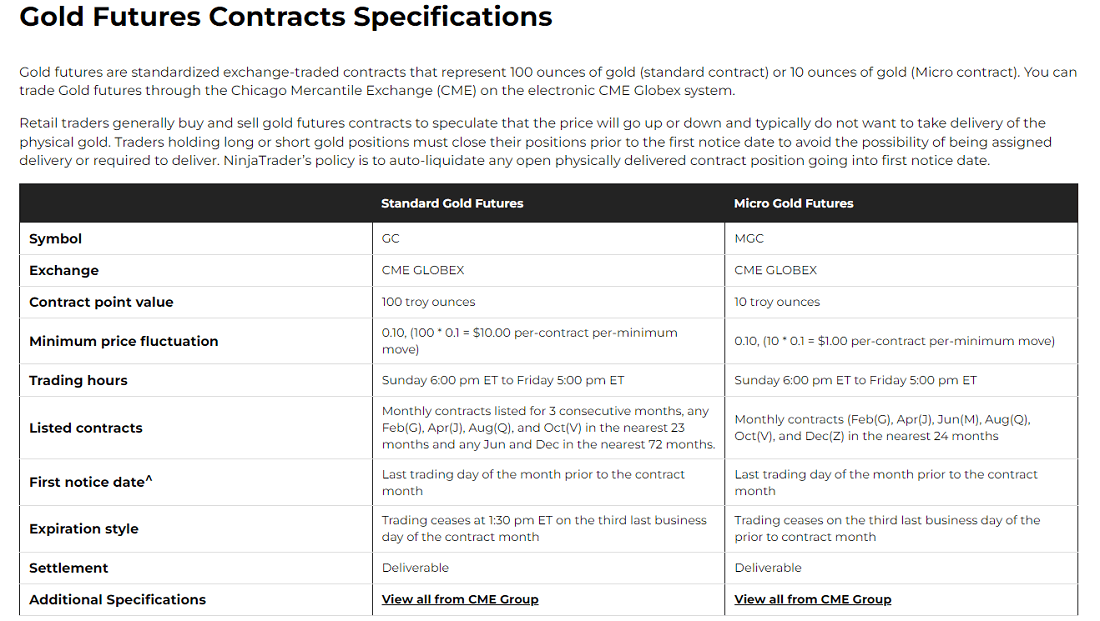

These exchanges offer standardized gold futures contracts, usually measured in ounces (oz). A standard futures contract usually represents 100 ounces of gold and weighs approximately 3110.35 grams. At the same time, the contract price fluctuates by the smallest unit of change of $0.02. This means that investors can trade on the basis of smaller price fluctuations, thus participating in the market flexibly and adjusting their trading strategies and risk management plans according to market fluctuations.

Moreover, these contracts are standardized to specify important details such as delivery dates, delivery locations, and gold quality to ensure effective and actionable trading. By signing these standardized futures contracts, investors buy or sell gold at an agreed price on an agreed date in the future, taking advantage of market price fluctuations.

This mechanism makes the gold futures trading market open and liquid, attracting both long and short sides to participate in trading extensively. Compared to physical gold trading, the threshold for investors to participate in the futures market is lower, as they can participate in the market through futures contracts without the need to actually hold large amounts of physical gold. This flexibility allows investors to buy and sell more easily, thereby seeking trading opportunities and risk management strategies amidst market volatility.

At the same time, this type of trading also allows investors to control larger quantities of gold contracts by paying a margin, a leverage effect that can magnify profit potential. By paying a small percentage of the contract value as a margin, investors can participate in large trades, thereby increasing their return on investment. However, leverage also brings with it potential risk, as any small market fluctuation can significantly affect an investor's account capital.

It is important to note that the gold futures market has a diverse group of participants, including producers, consumers, and speculators. Producers (e.g., mining companies) use futures contracts to lock in future sales prices to hedge against market price fluctuations. Consumers (e.g., jewelers) use futures contracts to lock in future purchase prices and effectively manage the risk of price fluctuations affecting their businesses.

Speculators such as hedge funds and investment banks make their profits in the gold futures market by buying and selling futures contracts, which they trade to take advantage of market price fluctuations. Rather than targeting the price of physical gold or demand for the commodity, these speculators typically use technical analysis, fundamental analysis, or market sentiment to predict price movements and trade accordingly. Their goal is to make a return in the market by earning spreads or profits from short-term price fluctuations.

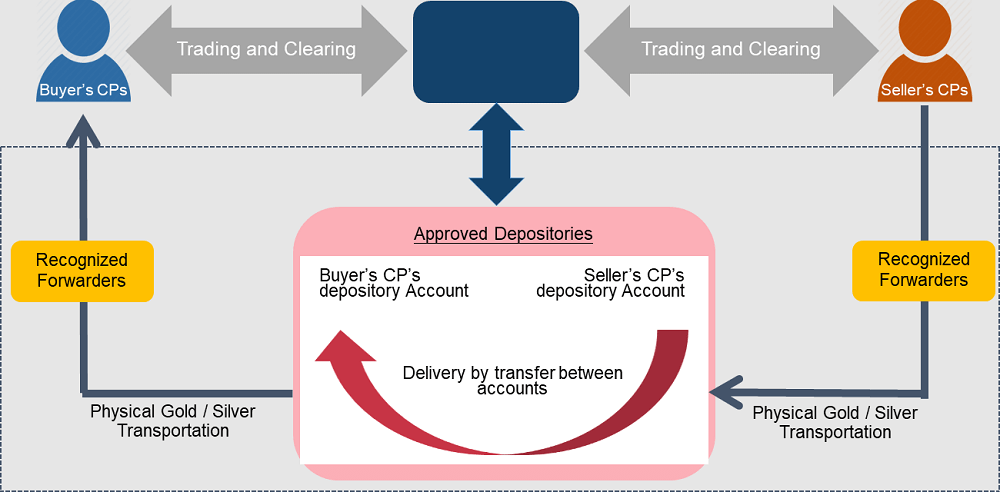

In gold futures contract trading, investors usually have the option of closing their positions before the contract expires without having to take actual delivery of the gold. This means that investors can choose to close out their original position by buying or selling a contract in the opposite direction before the contract expires, thus settling the trade rather than taking physical delivery. This flexibility allows investors to adjust their positions during market volatility without the complexity and cost associated with physical delivery.

At the end of a futures contract, there are two main ways to handle expiration: First, through physical delivery, where investors deliver or receive the specified quantity and quality of gold as per the contract standards and procedures. Second, by closing the position, where investors offset their original contract by engaging in an opposite trade (buy or sell) before expiration. The choice between these methods depends on the investor's needs and market strategy, allowing the gold futures market to flexibly accommodate various trading preferences.

In addition, investors can choose between standard futures contracts and small microfuture contracts when participating in the gold futures market. Standard gold futures contracts usually represent larger quantities of gold and are suitable for large capital investors or investors who need large leverage to operate. Microfuture contracts, on the other hand, have a lower threshold and are suitable for small-capital investors to participate in while reducing trading risks and capital pressure.

Overall, gold futures contract, as an important risk management and speculation tool in the financial market, provide investors with diversified investment portfolios and options for hedging. In this market environment, whether for long-term investment or short-term trading, investors can find suitable trading strategies to cope with different market conditions and risk preferences.

Gold Futures Account Opening Conditions and Requirements

The exact conditions and requirements for this account opening vary from country to country and futures company to futures company. Typically, investors will need to fulfill an age requirement, which is that they must be at least 18 years old or the age of legal majority. In addition, a valid identification document, such as an ID card or passport, may be required, as well as bank account information for fund transfers.

When choosing a gold futures contract company to open an account with, investors should select a reputable and well-serviced organization and be prepared to submit the necessary proof of identity and bank account information. The investor submits the necessary proof of identity and bank account information to the company for review. Only after the audit is passed can the company open a futures contract account for the investor.

The account opening process typically involves signing an account opening agreement and a risk disclosure statement to ensure that the investor fully understands and accepts the high-risk nature of futures trading. Before this step, futures contract companies often conduct knowledge tests for investors to verify their basic understanding of the futures market. These tests may cover fundamental concepts, trading rules, risk management, and other essential aspects.

At the same time, an assessment of the investor's risk tolerance is also conducted. The purpose of this assessment is to ensure that the investor fully understands the high-risk nature of futures trading and has sufficient financial capacity to absorb potential losses. The assessment process may cover the investor's investment experience, financial situation, and level of understanding of market volatility and leveraged trading.

In addition, some futures companies may require investors to conduct a certain number of simulated trades to verify their trading ability and decision-making level in real market operations. These measures help to ensure that investors are equipped with the necessary skills and knowledge to better cope with the high risks and complexity of the futures market before real trading begins.

Institutional investors, on the other hand, are usually required to submit the following qualification documents to open an account: a copy of the business license of the enterprise, a copy of the organization code certificate, a copy of the tax registration certificate, as well as a copy of the legal person's identification and a legal person's power of attorney. These documents are used by futures companies to review the identity and qualifications of institutional investors to ensure that they meet the conditions for opening futures trading accounts.

Moreover, futures companies usually have higher capital requirements for institutional investors, the exact amount of which varies between exchanges and futures companies. Institutional investors are also required to establish a comprehensive internal control system and risk management system with full-time risk management personnel and trading staff to ensure compliance and risk control of trading activities.

After completing the opening of a futures Trading Account, the investor needs to deposit funds into a gold futures account to meet the Margin Requirements of the exchange. The initial margin amount usually ranges from a few thousand to tens of thousands of RMB. This amount of money allows the investor to use leverage during the trading process, thereby controlling a larger contract value. In this way, the investor has the opportunity to obtain a higher return on investment.

The initial margin will vary depending on the futures company and the requirements of the specific contract type and is usually set as a percentage of the contract value, e.g., 8%. This means that an investor can control a much larger quantity of gold contracts by paying only a small percentage of the contract value as a margin. This leveraged trading mechanism can magnify potential profits, but it also increases trading risk.

It should be noted that investors may need to fulfill specific trading experience requirements when applying to open a futures account, such as providing past trading records to prove that they have the relevant experience. In addition, they are required to comply with national anti-money laundering regulations and provide relevant financial and identity information to ensure compliance and the security of trading activities. These special requirements may vary according to the futures company and national regulations; investors need to understand and cooperate with the corresponding requirements.

In conclusion, gold futures account opening needs to meet certain conditions and requirements, and the specific requirements for individual investors and institutional investors may differ. Choosing a reputable futures company and ensuring that you have basic trading knowledge and risk tolerance is the key to successfully opening an account and trading gold futures.

Expert Strategy and Tips for Gold Future Trading

Investors participating in gold futures trading need to choose a suitable broker and complete the account opening process. Usually, opening a futures account requires the provision of identification and other necessary documents to ensure compliance and security. It is especially important for investors to choose the right broker who can provide good trade execution, technical support, and security of funds.

Meanwhile, gold futures trading takes place on major exchanges, such as the New York Mercantile Exchange (NYMEX) and the London Metal Exchange (LME), etc. Each exchange has its own specific trading hours and trading rules. Investors must trade during the specified trading hours and comply with the contract regulations and trading procedures set by the exchange.

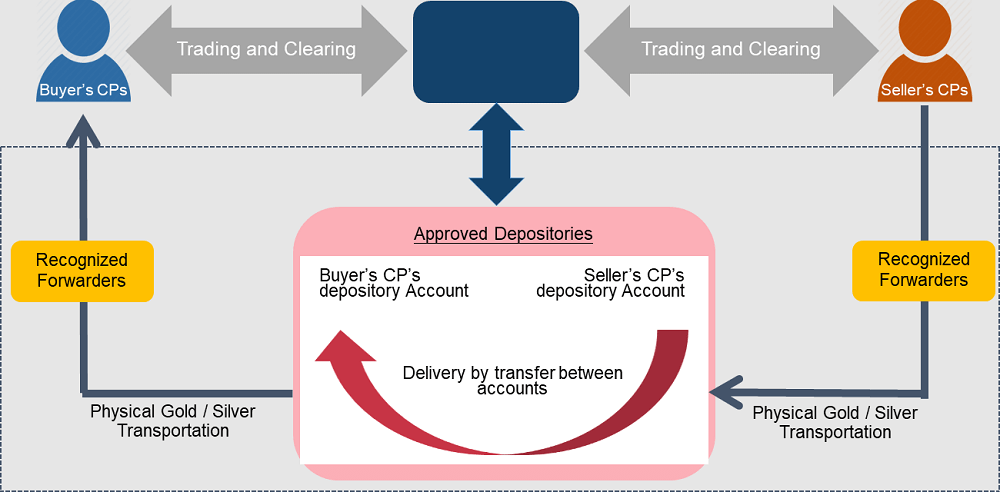

For example, gold futures contracts do have the option of physical delivery on the Hong Kong Stock Exchange. The physical delivery process usually takes a few days to complete the matching and aggregation, which may extend to about a week. Investors considering physical delivery, therefore, need to plan ahead and ensure that they are adequately prepared to deal with possible delivery procedures and related matters.

When trading gold futures, investors can use technical analysis to determine when to enter the market. When the price of gold breaks above the upper Bollinger Band, this may suggest that the price may rise further and indicate that the long trend may be strengthening. In this case, investors may consider opening a position to capitalize on the anticipated upturn.

In addition, if the Bollinger bands show signs of convergence, i.e., the upper and lower rails are gradually coming closer together, this may signal that the market is becoming less volatile and may break above the upper rail again after convergence, which is when Trading signals may have a higher probability of success.

And in a falling market, investors may consider utilizing a short-term trading strategy to hedge and protect their existing financial assets. When the price of gold breaks down through the lower Bollinger Band, this may indicate a downward market trend and suggest the possibility of further declines.

In this case, investors may consider opening a short position, i.e., selling gold futures contracts, to earn profits as the price falls. A breakout of the lower rail of the Bollinger Band is often seen as a potential sell signal, especially when the Bollinger Band shows convergence followed by expansion, which may have higher reliability.

Also, investors can use market sentiment to make trading decisions. It is important to realize that when there is panic in the global markets, investors usually tend to seek safe assets, such as gold, as a hedge, which may lead to an increase in the price of gold. At this time, you can focus on the market volatility index (e.g., VIX), combined with technical indicators such as Bollinger bands, to choose the right time to trade.

Utilizing seasonal factors for inter-period spread trading, this trading strategy involves simultaneously buying low-priced contracts (e.g., near-term contracts) and selling high-priced contracts (e.g., forward contracts). When seasonal demand peaks, the price of the forward contract may be higher than the near-term contract due to an imbalance between supply and demand. In this way, investors can close their positions for profit when the price difference narrows or disappears.

It is important to realize that seasonal factors affect the demand and supply of gold. Traditional festivals in India such as Bengali New Year and Choti usually lead to an uptick in demand for gold, as buying gold is seen as a symbol of prosperity and good luck in Indian culture. And globally, when trade tensions rise between countries such as the U.S. and others, investors may turn to gold as a safe-haven asset, driving up demand.

In short, the gold futures market offers significant short-term trading advantages, as both long and short positions are available and transaction costs are relatively low. Its price is difficult to manipulate because the connectivity of the global gold market makes it difficult to have a long-term impact on its price, even with large amounts of capital. Factors that truly affect the price of gold must occur to cause market fluctuations, which ensures a relatively fair and transparent market.

At the same time, it is not only suitable for long-term investors seeking hedging but also ideal for short-term traders looking for profit opportunities during market volatility. As a safe-haven asset, gold is particularly favored when unexpected events occur, as a sudden increase in global demand can drive up its price.

And investors can choose to buy or sell gold futures contracts at the right time, based on market analysis and personal investment strategies, in the expectation of making the expected profits. This, of course, requires a combination of technical analysis, fundamental analysis, and risk management strategies to ensure that trades can be effectively executed and risks associated with market volatility can be managed.

Gold Futures Account Opening and Trading Essentials

|

Account opening instructions

|

Trading Essential Content

|

| Compare fees and services for futures brokers. |

Choose a reputable futures broker with good service. |

| Fill out the form and verify your identity. |

Provide an ID to open an account and confirm funding. |

| The company reviews and opens the account. |

Know trading hours, terms, and delivery. |

| Learn market rules and strategies. |

Use Bollinger bands to time trades. |

| Execute orders using the trading platform. |

Use stop-loss or take-profit strategies. |

| Set stop-loss and take-profit strategies. |

Monitor market sentiment and seasonal demand. |

| Comply with futures market and tax regulations. |

Choose low-cost, highly liquid investment strategies. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.