Who is the most influential investment and trading master in modern times? Do

names like Buffett and Soros come to mind? Maybe if you go around Wall Street

and ask, you will hear a very frequent name: Jesse Livermore, who was revered as

the King of Trading. Have you heard of him? Like Buffett, Soros, and others, he

is considered one of the most outstanding investment traders of the last

century. On the American economic and financial stage, his influence has forced

Wall Street financial giants and the government to bow their heads and beg for

mercy.

Jesse Livermore, born in 1877, was already a figure two centuries ago. His

story begins in Massachusetts. His family was poor when he was a child, and he

decided to run away from home when he was 14 years old. With only five dollars

given to him by his mother, he began a wandering and legendary life. In that

era, there were many places in the United States that were called "buckets,"

which were equivalent to stock casinos. You can imagine it as a casino. You go

in and bet on whether stocks will rise or fall. It is similar to buying and

selling stocks, but in fact, you don't actually buy or sell physical

objects.

At this time, the little trading king became very interested in Stock Prices.

By observing price fluctuations and recording them in a small notebook, he found

that stock prices tended to fluctuate within a range. So, he formulated a simple

strategy: buy at the low end of the range and sell at the high end. This

strategy allowed him to earn $200 in a week and easily buy his mother a house

for $1,000 at the age of 17.

So in Boston's stock casino, the name of the trading king gradually spread,

attracting a lot of attention but also causing dissatisfaction in the casino.

Eventually he was blacklisted, and his financial opportunities in Boston were

blocked, so he decided to go to New York. At this time, he discovered that the

real stock market was not as fun as he imagined. The market changed rapidly, and

the prices he saw in the casino were lagging. The actual transaction costs may

be higher, and the liquidity is good and bad. His short-term, high-frequency

trading strategy cannot work in the real stock market. Then he realized he

needed to change his strategy.

After in-depth research, the trading king found that stock prices do not

fluctuate randomly, but there are key points, such as support and pressure

levels. He recognized that stock prices would fluctuate within these areas in

the short term and, once they broke out of these areas, could continue to rise

or fall. This subversive thought upgrade led him to the next stage of trading,

which is to follow the trend. The success of this strategy made him famous in

the stock market, and his net worth reached one hundred thousand US dollars.

Of course, this process was not smooth sailing for him. For example, he was

too timid to sell a waist stock early, which resulted in a regrettable loss.

This laid the foundation for his later trading principle: don't rush to sell on

profitable trades.

After making a large sum of money in the stock market, he was overjoyed and

immediately rushed into the cotton futures market. It was not as simple as

imagined, but the easy situation was shattered before his eyes, so he easily

lost more than half of the $50,000 investment. There is a very important reason

for this: he is reluctant to sell when he suffers a small loss, always hoping to

recover the loss, which ultimately leads to a more serious loss. This leads to

the second trading principle: for losing trades, if you are not confident about

the prospects, you should stop the loss immediately.

This principle echoes the first. When a stock falls, most people's

instinctive reaction is to wait and see, hoping to wait for the stock price to

recover. Some may even consider buying some more to reduce costs and wait for

future increases. Both of these principles tell us to resist our own instincts.

Good trading is often based on rigorous analysis. If the transaction is based on

thoughtful analysis and ultimately makes a profit, then the probability of this

analysis is relatively high. On the contrary, if you start to lose money, it

means that your judgment may be wrong. At this time, you should stop the loss in

time; otherwise, you may lose more.

Of course, this is based on careful analysis rather than blind guesses about

future trends.

The trading king's trading strategies and ideas continued to improve, and his

wealth gradually accumulated to one hundred thousand US dollars. In 1907,

markets lost trust, and people ran to banks. The strategy adopted by the trading

king in the second stage is to follow the trend and fully use this essence to

judge that the market is about to collapse. He decisively shorted the market and

successfully made a fortune. At this time, the U.S. government was nervous and

worried about the economic crisis, so it turned to JPMorgan Chase for help.

Morgan found out that the trading king was short selling and took the initiative

to come to him to intercede, hoping that he would stop the operation. Taking

into account Morgan's face, the trading king decided to close the position and

go long on the backhand. The result was just as he expected. Under the market

operations of the big guys, the stock market rebounded rapidly. The trading king

made one million US dollars in one day, and his net worth reached five million

US dollars.

This success also made the trading king fall into arrogance, and he began to

squander money, buy yachts and luxury houses, and make friends with famous

ladies. He was immersed in the joy of success and thought the whole world

belonged to him. This is exactly the mistake that many people make after

success; that is, they are too careless, spend money like water, and ignore the

risks.

In the second year after successfully making money, the trading king once

again entered the cotton futures market. At this time, a friend who claimed to

be the Cotton King gave him some inside information and suggested that he do

more cotton. Although dubious, the trading king increased the leverage and

started buying cotton futures. Unexpectedly, the cotton king joined forces with

other suppliers to sell off cotton in large quantities, causing prices to

plummet and the trading king to go bankrupt again.

This blow was very heavy for the trading king, prompting him to add a

principle to his trading principles: believe that you can listen to what others

say, but you cannot take full credit. The trading king can only lick his face

again and borrow money from friends, hoping to make a comeback. At this time, he

was 39 years old and more cautious than before. He spent six weeks without

making a single transaction, but instead waited and studied the market's

quotation trends. I hope to find a good time. He happened to seize the time of

World War I and knew that the demand for metals would increase during the war,

so he invested a large amount of money to buy shares of a steel company at a

purchase price of $98. The stock rose to $115, but he insisted on not selling,

applied his first trading principle, and even continued to increase positions

and increase leverage. Finally, when the stock reached $145, he felt it was

enough, quit, and made his initial capital back.

Such trading plots are often psychological games. The trading king's

strategies become more and more mature, and he makes more and more money,

gradually understanding the core of the game in the market. He upgraded his

strategy, ushered in his heyday, and once again made money. The trading king was

no longer satisfied with this and began to enter the cotton futures market. This

time, he thoroughly figured out the correct way to open the cotton market and

squeezed the market by buying futures. He used gray means and public opinion

manipulation, which once made it almost impossible to buy cotton in the market.

The U.S. government felt nervous, and the White House sent someone to find the

deal king urgently and asked him to stop. To save face for the government, the

trading king stopped the operation.

It is undeniable that the trading king became more and more successful in the

futures market and then ran on the wheat and corn markets, achieving another

upgrade. His decisions and strategies have made him a dark horse in the market,

constantly refreshing his legend of success.

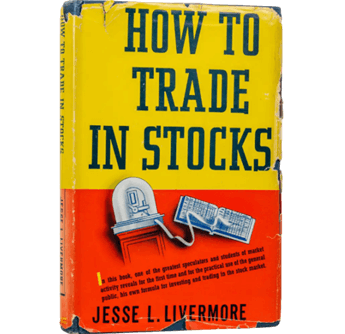

As time goes by, the trading ideas of the trading king become more mature,

and he gradually develops his own set of unique trading rules. He proposed the

famous "Moore's Law", which states that "price changes always move in the

opposite direction." This law is considered to be the pioneering work of stock

market technical analysis theory and has had a profound impact on subsequent

technical analysis schools.

In 1925, the 48-year-old trading king was worth tens of millions of dollars.

At this time, he summed up an extremely important principle in trading: don't

rush into the market when the opportunity is not obvious enough. Patience is the

most difficult thing to maintain during the trading process. Although it seems

simple, I personally think this is the most wonderful point. In short, when you

don't have a good idea, don't act rashly. Many people feel the same way about

stock trading, because when analyzing strategies and transactions, the most

difficult thing is not to come up with a powerful analysis method but to sit

back and wait for good opportunities.

In 1929, the trading king noticed that many leading stocks in the market were

showing signs of slight malaise and vaguely smelled the breath of crisis. This

is a once-in-a-lifetime opportunity for him. He had successfully shorted wheat,

cotton, and certain stocks before, but this time he wanted to short the entire

U.S. stock market. In order to cover up his losses, he hired more than a hundred

brokers to secretly start short selling. On October 29, 1929, which we often

call Black Tuesday, the U.S. stock market suffered an indescribable plunge. The

U.S. government had repeatedly begged for mercy before, but to no avail this

time, leading to the worst economic depression in U.S. history.

Faced with this once-in-a-century opportunity, the trading king used his

lifelong experience and skills to defeat his own instincts. When the market was

depressed, the trading king cleverly took advantage of the opportunity. This act

of jeopardizing the country's wealth was not viewed favorably in the moral

context of the time because capitalists like J.P. Morgan and Trading King often

lacked moral restraint in the absence of supervision.

However, wealth did not bring happiness. The trading king's second wife was

addicted to alcohol and even had a quarrel with her son; she shot and wounded

him and almost took his life. Later, he divorced his wife and suffered from

amnesia, and his career was in chaos. As a result, the United States established

a regulatory agency, the SEC, which made the trading king's sexy operations more

difficult.

In 1934, the once-billionaire trading king went bankrupt for the third time.

To this day, why he went bankrupt remains a mystery. This time, the trading king

could no longer make a comeback and even suffered from depression. At the age of

63, he chose to end his life. This was the life of trading king Livermore. He

ran away from home with five dollars in his pocket at the age of 14. He

experienced three ups and downs, three bankruptcies, and finally became a

billionaire. However, he ended his life by committing suicide.

Although the trading king failed to stick to his trading principles, his

trading concepts had a profound impact on later generations and were adopted by

many modern masters. Finally, he gave everyone the classic principle of the

trading king: "The market is never wrong; only human nature will make

mistakes.”

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.