For many stock market traders, trendlines are one of those things that they love and hate. If you use it well, you will feel that you have captured the pulse of every wave of the k-line and that the market moves are under control. Failure will occur if you do not understand how to operate. This article will give you a good explanation of the mystery.

A Trend Line is the adjacent price highs or lows connected to a straight line. The stock market is one of the most basic technical analysis tools. There are two basic types of rising and falling. In the K chart connecting two neighboring troughs, if the latter trough is higher than the previous one, it shows that the stock price is rising, and the line drawn is an uptrend. Conversely, connect two neighboring peaks; if the latter peak is lower than the previous one, indicating that the stock price is falling, the line is in a downtrend.

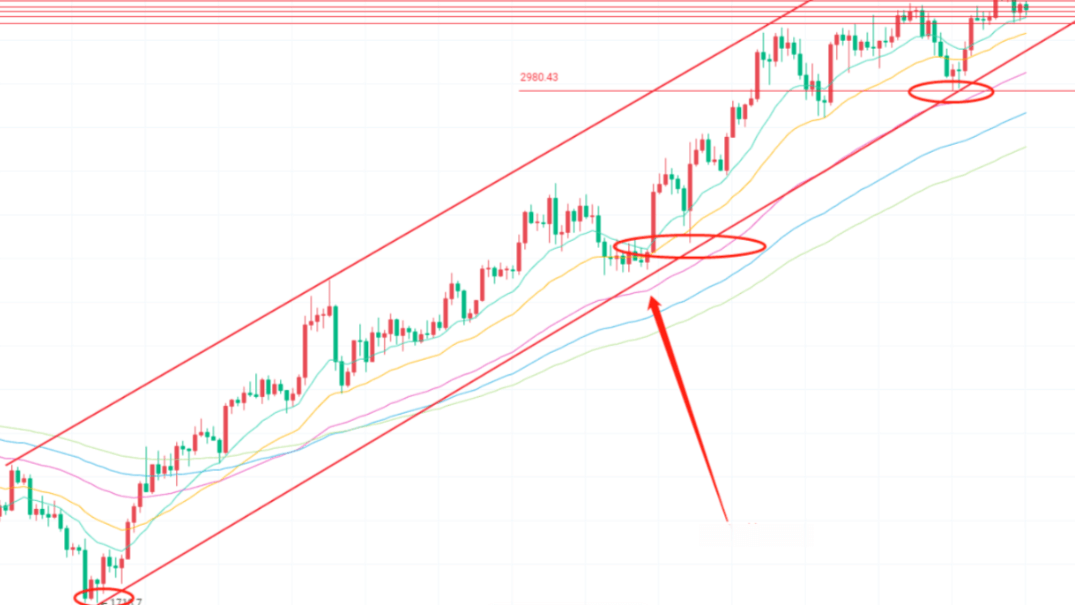

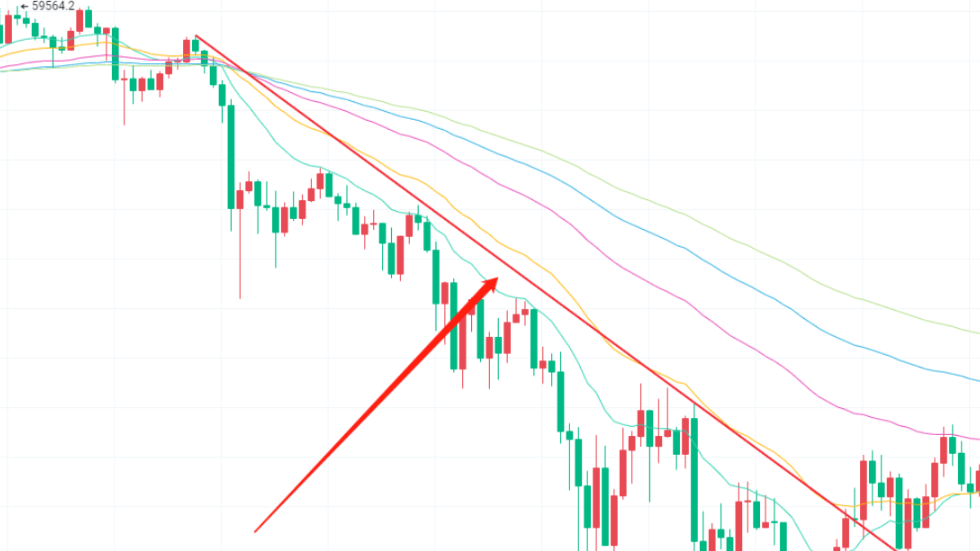

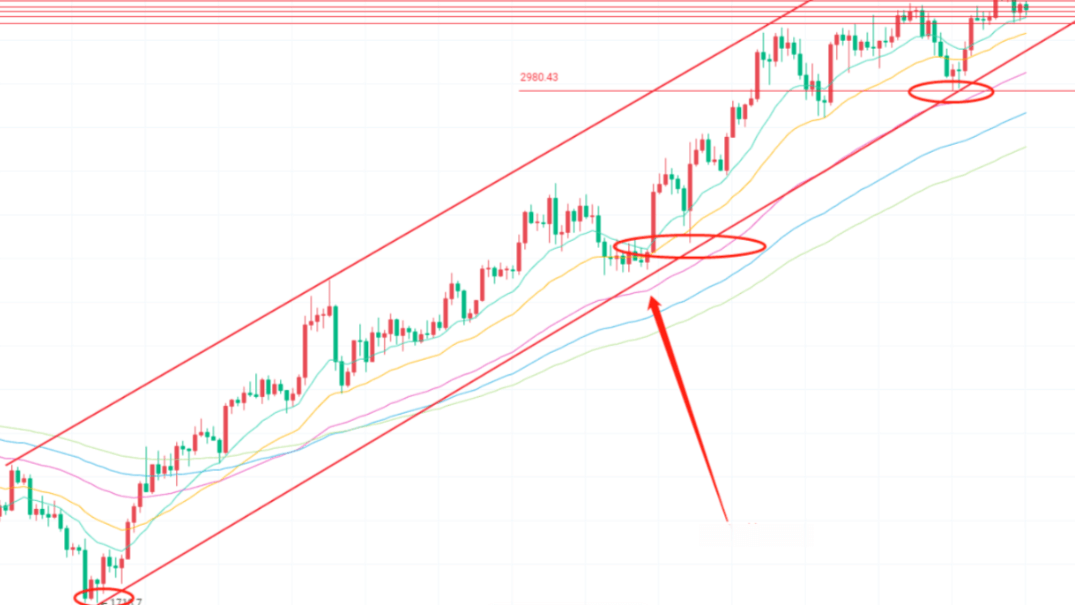

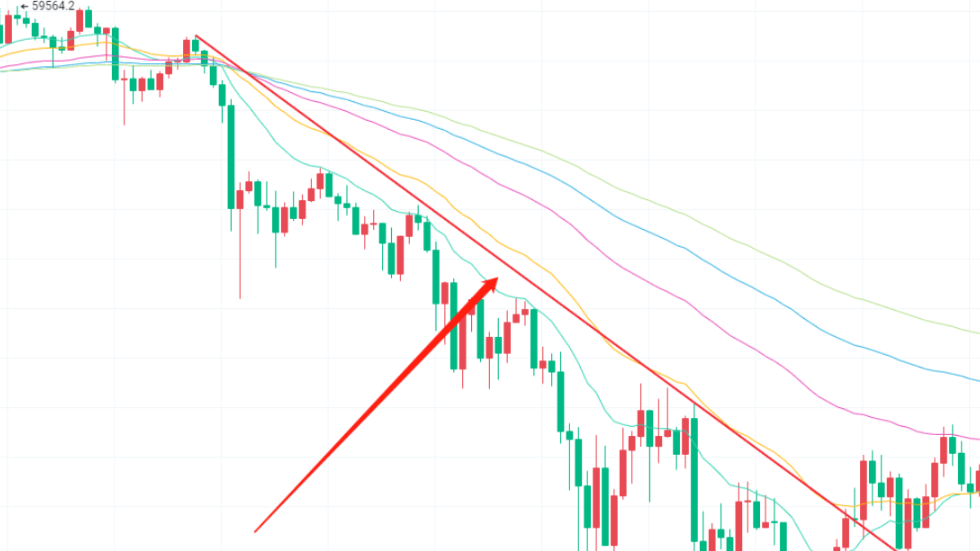

It should be noted that the determination of the uptrend should be based on the low point of the stock price, that is, the wave stock, while the downtrend should be based on the high point of the wave to determine the peak. Every two wave stocks or wave peaks can draw a trend; the more wave stocks or wave peaks a trend passes through, the more accurately the trend is reflected.

It is mainly used to predict the future trend of the stock price. In practical operation, when the stock price in a rising market falls below the uptrend, it means that the market has reversed the possibility of a decline. On the other hand, when the stock price breaks through the downtrend, it is a signal for the stock price to rebound.

Usually, to determine whether the breakthrough to the closing price of the day will prevail, the breakthrough range should be more than 3%. However, there are many factors that affect the price change. Investors in the specific operation should also be combined with volume and other technical indicators to determine a comprehensive stock market. The choppy ups and downs and uncertain sailing period also need to be doubly careful.

How to see

First, draw on the price chart. Connected to a series of low points, you can draw a rising line; connected to a series of high points, you can draw a falling line; connected to the price fluctuations in a period of time, high or low, you can draw a horizontal line. Then observe its direction to determine the direction of the market trend. Rising indicates that the market is rising, falling indicates that the market is falling, and horizontal indicates that the market is relatively flat.

Multi-point connections help to reduce the subjectivity involved in drawing this line. To increase its credibility, make sure it passes through at least three points. Observe its angle and slope. An ascending line should slope upward, and a descending line should slope downward. The steeper the slope, the stronger the trend.

Understand its role as both support and resistance. Upward trending lines usually act as support, and downward trending lines usually act as resistance. These levels are often important when the price bounces or falls near a trendline. Trying to recognize specific patterns such as head and shoulders tops, double tops, double bottoms, etc. can be observed for clues to future price action.

It needs to be constantly revised and updated to accommodate new price data and market conditions. It is also used in conjunction with other technical indicators, such as moving averages and the Relative Strength Indicator (RSI), to further analyze market conditions. The analysis of it requires practice and observation. Observe the charts for different time frames to improve its analysis.

Trendline Analysis

| Type of Analysis |

DESCRIPTION |

| Trend Direction Analysis |

Determines the current primary market trend direction, up or down. |

| Support and Resistance Analysis |

Price bounces in its neighborhood. |

| Multi Time Frame Analysis |

Its comparison on different time frames, e.g. daily and 4 hourly. |

| Breakout Analysis |

Breaking above an ascending line may signal a downturn. |

| Dynamic Analysis |

Use moving averages for tracking trend changes. |

| Chart Pattern Analysis |

Analyze with patterns like head and shoulders or double bottoms. |

Drawing and Application Skills

Being an important technical analysis skill, it helps in identifying the direction of trends and key support and resistance levels in the market. The stEPS are as follows:

Drawing of an uptrend line:

First, look for obvious lows in the market, which should be in an uptrend. Use a straight line (or tool) to connect these lows, and make sure the line passes through as many lows as possible. It is not necessary to match every low exactly; it is normal to allow for some small deviations as there is always some noise in the market.

How to draw a downtrend line:

First, look for obvious highs in the market that should be in a downtrend. Use a straight line to connect these highs, and make sure the line passes through as many highs as possible. As with the uptrend, the downtrend doesn't have to match every high exactly; small deviations are normal.

Horizontal trend lines are drawn:

It's used to mark a market crossover area or levels of support and resistance. It is usually a horizontal line that connects the highs or lows of price movements over a period of time.

Application skill

Its main use is to identify market trends. In an uptrend, an upward sloping line can be plotted by connecting the price highs, while in a downtrend, a downward sloping line can be plotted by connecting the price lows. In an uptrend, it is the level of support, while in a downtrend, it becomes the level of resistance. So it can also be used to identify support and resistance levels. When the price approaches these lines, a rally or reversal is often signaled.

To ensure the continuity of a trend, it can be analyzed using different time frames. For example, short-term, intermediate-term, and long-term can be plotted to see if they remain consistent over different time frames. This enhances the reliability of Trading signals when the price trend matches the signals of other technical indicators. Therefore, it is also used to confirm signals from other technical indicators.

It helps to avoid Overtrading. When the price is close, you can wait for the price to bounce or reverse before trading instead of blindly chasing the price. It can also be utilized to develop a stop-loss strategy. Once the price breaks through the line and stays there for a while, this may indicate that the trend is reversing, at which point it can be used to set stop-loss levels.

Some traders use dynamic converging lines, such as moving averages, to better track changes in the trend. Moving averages with different periods can help determine the strength and direction of a trend. It also has a number of fixed Chart Patterns, such as head and shoulders, double bottom, triple top, and cup and handle patterns, which help predict future price movements.

How many daily averages does it mean?

They are two different concepts and are not equivalent. A daily average is used to smooth out price data to provide a reference to a trend, while the other is used to mark the direction of a trend.

Trendline is a technical analysis tool used to identify and confirm market trends. They are usually formed by connecting a series of price highs or lows to show the direction of a market trend. There is no specific number of days, and the way it is drawn depends on the actual market conditions and the analyst's choice. It can be short-, medium-, or long-term, depending on the time frame being analyzed.

The daily average is a Moving Average used to smooth out price data to better identify market trends. It is an average calculated from the closing prices of a certain number of trading days. Common daily averages include the 5-day, 10-day, 20-day, 50-day, and 200-day averages. The number of days for these daily averages indicates the number of trading days used to calculate the average. For example, the 20-day SMA is the average of the closing prices of the last 20 trading days.

Trendline Formula

There is no set mathematical formula per se, as it is plotted by connecting highs and lows on a price chart, the shape and angle of which depend on the price action of the market. However, it can be plotted and analyzed using linear regression analysis to help determine the slope and direction of the trend. The equation is as follows:

Trendline Formula

| formulas |

Y = a + bX |

| Y |

The value of the convergence line. |

| a |

Represents the intercept (intersection with the Y-axis) and is usually a constant. |

| b |

Slope, from linear regression, shows the direction and angle of the convergence line. |

| X |

Time or independent variables typically refer to points on a price chart or instances of high volatility. |

The slope b of the trend line can be calculated using linear regression analysis, which indicates the rate and direction of price change over time. If b is positive, then the trend line is upward; if b is negative, the trend line is downward; if b is close to zero, the trend line is horizontal.

In practical technical analysis, it is a visual tool to help analyze market trends but does not require strict mathematical formulas to draw.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.