In the investment market, if you can't choose a strong individual stock, then not only can't make a profit, but there is a possibility of losing money. And to avoid this, funds become a good choice. According to the investment targets, those who want to get long-term stable income can choose bond funds, and those who want to get higher profits can choose stock funds. But index funds are less chosen because most people don't know much about them. Therefore, this article gives you a guide to investing in index funds, hoping to give some help.

What is an index fund?

What is an index fund?

Its English name is index fund, and you can see from the name that it is following an index. This index can be the dow jones industrial average or the S&P 500. It can also be an index of a particular industry, such as railroads, airlines, technology, consumer goods, and so on. The manager of the index fund then buys stocks or Securities in accordance with this index to create a portfolio that is identical or essentially identical to the index.

Its history can be traced back to 1974. John Boger (John Boger) he issued the first index fund. At the same time brought a whole new family of investments, the passive investment series. Because most index funds only passively track an index without adding any human intervention, it is often referred to as a passive fund.

It is a variant of a mutual fund. This means that not all mutual funds are index funds, but all index funds must be mutual funds. But unlike a mutual fund, which pools money to buy just one stock, an index fund pools money to buy all the stocks in the entire U.S. stock market.

Because it holds all or most of the assets included in the index it tracks, it achieves portfolio diversification. This helps reduce the risk of specific stocks or sectors, so an index fund will have broader coverage and somewhat lower risk.

Also because it is passively managed, this means that fund managers will not make frequent buying and selling decisions. Instead, they will try to keep the fund's portfolio in line with the target index. This is also why it has much lower trading fees compared to actively managed funds. This is because they do not require complex research or timing trades, but simply replicate the performance of the index.

A passive fund is one that is benchmarked to an index and then the portfolio is matched to that index. The index has a formula for calculation, and passive investments simply follow that formula to match. How many positions should be built in this stock and how many positions should be built in that stock. Then when there is a change in the weighting of which, the investor then adjust the position appropriately. This simple method of operation makes its management fees much lower.

In the U.S., the management fee for a passive fund, also known as an index fund, is about 0.2% or less per year. That's why there are so many people who choose index funds in the US market. This is because the investment expenses are very low and there is also a dividend reinvestment scheme, which basically meets all the requirements of long-term investors in terms of anti-inflation.

There are many relevant studies in the United States that prove that in the long term, such as over 10 years, active investments will not perform much better than passive investments, and sometimes even worse than passive investments. Coupled with the fact that active investments have high management fees, the stock god Warren Buffett and others believe that smart investors should not go for active funds with high management fees.

With more and more index funds on the market, it's actually getting harder to pick. And there are quite a few of their categories, which differ from each other quite a bit. So before an investor picks one, he should first figure out which type of index fund is more suitable for his investment objectives.

Characteristics of index funds

| Characteristics |

Description |

| Wide range |

Highly representative, reflecting diverse industry and market performance. |

| Low cost |

Lower fees cut investor costs vs. active funds. |

| Passive investment |

Mirrors an index, no need for active management. |

| High transparency |

Transparent portfolio, investors can check asset allocation anytime. |

| Diversification of risk |

Multiple stocks diversify risk, reducing overall portfolio volatility. |

What are index funds

An index is usually a weighted average of a series of stocks, and different indices have different criteria for choosing which stocks can go into its calculations. There are many different types of indices, so there are many different types of index funds. There are three common categories of index funds in the market, broad-based indexes, industry indexes and strategy indexes.

Broad-based indexes are based entirely on indexes that already exist in the market to describe market trends, such as CSI 300. SSE 50. CSI 500. and so on. It is a passive, fully replicated market performance equity fund with no subjective factors.

It has the advantage of being able to comprehensively cover major stocks in the market with relatively small tracking error. It is suitable for investors who hold it for a long time and pursue simple and steady investment. Especially for ordinary investors, long-term fixed investment in broad-based index funds is a low-cost, low-risk way of financial management.

Sector indices select stocks within a certain vertical industry, such as pharmaceutical indices, military indices, consumer goods indices, technology indices, and so on. Compared to broad-based indices, sector indices are slightly more subjective, but relatively less so.

The advantage is that investors can selectively allocate to sectors that they are interested in or bullish on. Suitable for investors who understand the dynamics of a particular industry and have industry research capabilities, sector indices can be used to track the development of a specific sector more accurately.

Strategy indices are based on the concept of factor investment, whereby an index is formed by selecting stocks with specific criteria, such as dividend funds, fundamental funds, value funds, and so on. Strategy indices are relatively subjective, with fund managers selecting and weighting according to different criteria and algorithms.

Its advantage is that it can seek for relatively more promising stocks through specific strategies and pursue returns beyond the market average. It is suitable for investors who have some investment experience and are willing to pursue excess returns, and can choose different strategy indices according to their personal risk preferences.

For ordinary investors, it is recommended to suggest a broad-based index because it is usually larger in size, with low investment costs and relatively small tracking error. When choosing a broad-based index fund, factors such as size, fee rate and tracking error can be considered.

The larger the scale, the better, the lower the rate, the better, while the tracking error does not vary much among public fund companies. Long-term fixed investment in low-cost broad-based index funds is a simple and effective investment method for ordinary investors.

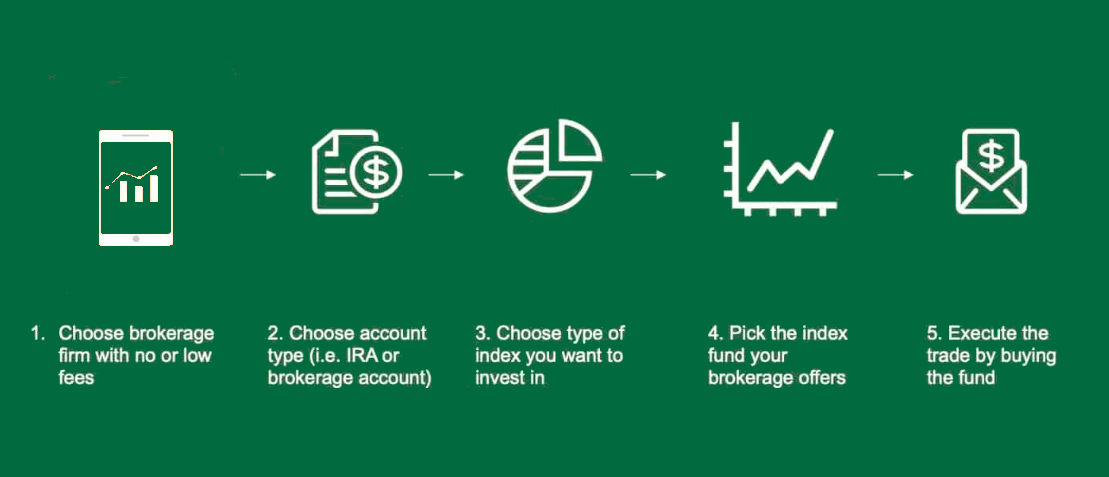

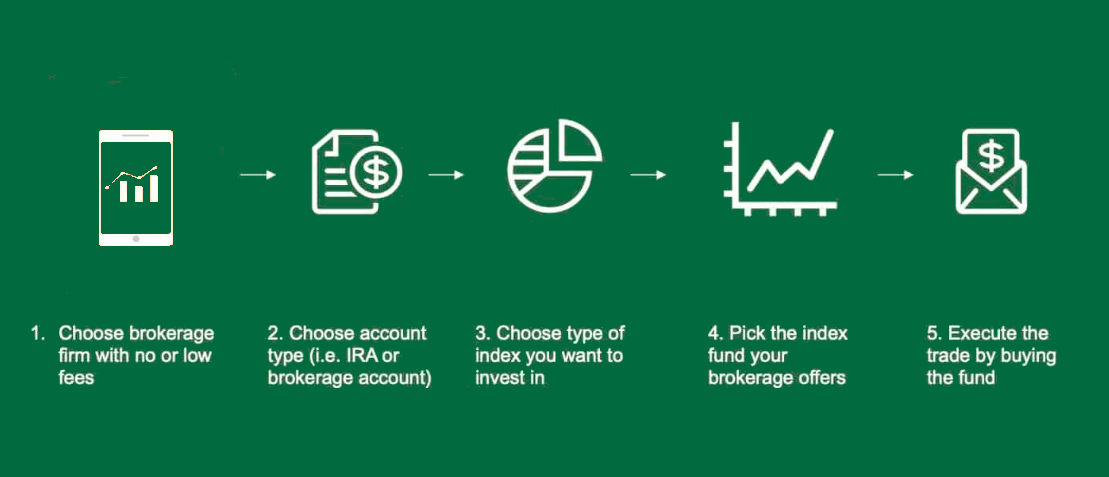

How to buy index funds

How to buy index funds

To buy an index fund, you need to first choose a reputable broker to ensure that it provides the service of buying index funds. Then come in and register for a stock brokerage account as required, and use the tools and information provided within the brokerage account to research different index funds. Consider the fund's investment objectives, fees, historical performance, and asset classes held to select a fund that meets the investment objectives.

Determine how much you plan to invest and how often. You can invest a lump sum or choose to invest a fixed amount at regular intervals to diversify market fluctuations. Locate the index fund of choice within your brokerage account, enter the quantity and price to be purchased, and place a purchase order.

If you choose to invest a fixed amount, determine the amount you plan to invest, the frequency of the investment, and the duration of the investment. For example, you may choose to invest a certain amount of money on a regular monthly basis. Find the index fund of choice within the brokerage account and set up a fixed investment order. You can choose a specific date of the month and the amount to be invested. Confirm the fixed investment order to ensure that the order is set up in accordance with the investment plan. Some brokers also offer a simulated investment feature, which allows you to test your investment plan before investing for real.

Regularly monitor the performance of your portfolio. Portfolio adjustments or rebalancing may be required when market conditions change. If the index fund of your choice pays dividends or distributions, you may choose to reinvest the cash portion of it into the fund to increase your position. Be aware that there may be some costs involved in purchasing an index fund, such as trading commissions and fund management fees. Ensure that these fees are understood and taken into account to better manage your investments.

Fixed investment in funds can reduce the impact of market volatility on your portfolio by diversifying market fluctuations over a long period of time and buying fund shares evenly. Make sure you understand the fees and implementation details of the fixed investment program to better manage your investments.

Timing of index fund position adjustment

The timing of its position adjustment is usually determined by the fund management company's investment strategy and the rules of the index that the fund intends to track. Most index funds will make adjustments at the end of each trading day to ensure that their holdings remain in line with the index they are tracking. This can include buying and selling based on changes in index constituents.

Some index funds may choose to review and adjust their portfolios on a quarterly or semi-annual basis, either in response to changes in the index or the fund manager's new assessment of market conditions. Still other index funds may choose to make a major adjustment at the end of each year to ensure that their portfolios are consistent with their long-term investment objectives.

If the index being tracked has periodic constituent adjustments of its own, the index fund may adjust accordingly when those adjustments occur. For example, certain indices may be rebalanced on an annual basis. Please note that the exact timing and frequency of rebalancing may vary by fund company and fund product. In addition, some index funds adopt a "hold-to-maturity" strategy, whereby they hold all the constituents of the index as long as possible and only make adjustments when the index is rebalanced.

Investors should read the relevant fund documents, especially the prospectus (Prospectus) and annual report, carefully when purchasing an index fund to obtain detailed information about the fund's deployment strategy.

best index funds

| Fund Name |

Minimum Investment |

Expense Ratio |

10-Yr Annual Return |

| Vanguard 500 Index Fund Admiral Shares (VFIAX) |

$3,000 |

0.04% |

11.90% |

| Fidelity Nasdaq Composite Index Fund (FNCMX) |

$0 |

0.03% |

14.50% |

| Fidelity 500 Index Fund (FXAIX) |

$0 |

0.02% |

11.90% |

| Vanguard Total Stock Market Index Fund Admiral (VTSAX) |

$3,000 |

0.04% |

11.30% |

| schwab s&p 500 index fund (SWPPX) |

$0 |

0.02% |

11.90% |

| Schwab Total Stock Market Index Fund (SWTSX) |

$0 |

0.03% |

11.20% |

| Schwab Fundamental US Large Company Index Fund (SFLNX) |

$0 |

0.25% |

10.70% |

| USAA Victory Nasdaq-100 Index Fund (USNQX) |

$3,000 |

0.45% |

17.00% |

| Fidelity Total Bond Fund (FTBFX) |

$0 |

0.45% |

2.30% |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

What is an index fund?

What is an index fund? How to buy index funds

How to buy index funds