In financial news, a common refrain is, "The Fed is set to raise interest rates again, and the U.S. stock market may decline." But what does it mean when the Federal Reserve decides to increase interest rates? How does it affect the economy and financial markets? Many people lack a clear understanding of these implications. Therefore, this article aims to provide a detailed explanation of the impact of the Fed's interest rate hikes on financial markets.

What is the Federal Reserve Interest Rate Hike?

It refers to the U.S. Federal Reserve System Management Board decision to raise the federal funds rate after the interest rate meeting in Washington. The so-called Fed, that is, the U.S. Federal Reserve System, and the interest rate hike are the Fed's monetary policy for regulating macroeconomic conditions such as inflation.

Fed interest rate hike means to increase the federal funds rate; its English name is Federal Funds Rate, which is the interest rate of banks borrowing from each other. This is a very short-term loan, often for only one night. That's why it's also called the overnight rate or the interbank lending rate.

This means that the Federal Reserve increases the interest rate on loans to commercial banks, and commercial banks increase the interest rate on deposits in order to reduce the cost of lending but to keep money in reserve. Encourage people to deposit money in the hands of the bank, thus reducing the liquidity of the market and affecting the pricing of goods and services in the market, to achieve the purpose of fighting inflation.

To draw an analogy, if you classify the U.S. monetary policy system into four roles, the Fed corresponds to the school, the bank corresponds to the class, the citizen corresponds to the classmate, and the market corresponds to the school supermarket. For ease of understanding, let's zoom in on the hypothetical numbers. The class needs to pick up a certain amount of class fees from the school each month, and every $100 needs to be returned to the school for $110.

When inflation occurs, prices at the school supermarket rise. So the school introduces a new rule that the class needs to return $150 to the school for every $100 borrowed. The class decides to introduce a new class rule in order to reduce costs but keep the class fee in reserve. Classmate A deposits 100 yuan into the class and then returns 130 yuan every month, while classmate B borrows 100 yuan from the class and then needs to return 130 yuan to the class.

The high return attracts students to deposit more money into the class, and the high interest rate dissuades students from lending their living expenses. The school supermarket then becomes cold and is forced to adjust the price of items to attract students to buy them. By raising the lending rate, the school affects the class and even the classmates and ultimately realizes the control of inflation in the school supermarket. This is my understanding of the interest rate hike.

To put it simply, the central bank in the United States raises interest rates. The central bank is the bank of the bank. We are short on money. Can we find a bank to borrow from? You can find a central bank to borrow from. Currency is like water; the central bank is the faucet, and commercial banks are like water pipes. The central bank uses this faucet to control the release of water, that is, the supply of money.

So, the Fed rate hike is complex policy behavior; it involves a number of aspects of the impact, including but not limited to lending rates, money supply, international trade, and the United States domestic economic development.

What is Fed's Interest Rate Hike?

What is Fed's Interest Rate Hike?

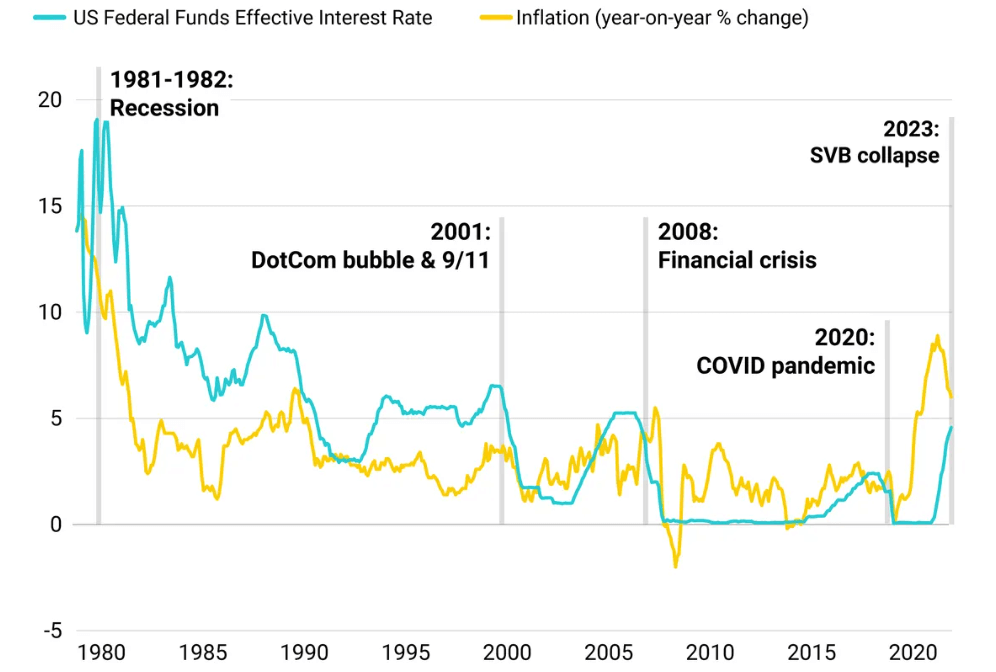

It means that the U.S. Federal Reserve System (Fed) has raised its benchmark interest rate, and this has wide-ranging implications for the economy and financial markets. Firstly, by raising interest rates, the Fed is trying to curb inflation, as high interest rates reduce consumer spending and investment, thus slowing down the rate of price increases.

It is also important to realize that the reason for the soaring prices in the United States is that the country was printing money like crazy in the previous two years. At that time, it was trying to harvest the whole world, intentionally or unintentionally, by virtue of its world currency status. The United States first printed dollars to release water; a large number of U.S. dollars as the world currency will flow like water to the world; the money will enter the countries (many developing countries) stock markets, housing markets, etc.; asset prices rose and even produced bubbles.

And at this time, if the United States raises interest rates, it will let the dollar go back to the United States. The money in each country's market is rapidly reduced, and the price of the bubble assets will plummet. And if it goes well, the U.S. capital, if this time to come back to the horse and take the opportunity to buy these discounted core assets, will be able to harvest global capital.

A US interest rate hike would lead to a rise in interbank interest rates, which would raise the cost of borrowing for businesses and individuals. This could slow down economic activity as it becomes more difficult for businesses and individuals to obtain loans to invest or spend. The decision to raise interest rates may trigger volatility in the financial markets, especially the stock and bond markets. Investors may adjust their portfolios to the new interest rate environment, which could lead to market price volatility.

At the same time, US interest rate hikes usually lead to an appreciation of the US dollar. This benefits importers, as they can buy foreign goods at a lower cost. However, it could be a challenge for exporters as their products become more expensive, which could affect the export market.

Overall, the Fed's interest rate hike is usually seen as a tightening move in economic policy, aimed at controlling inflation and keeping economic growth stable. However, interest rate hikes may also have negative impacts, such as increasing borrowing costs and dampening economic activity.

Impact of the Fed's Interest Rate Hike on US Stocks

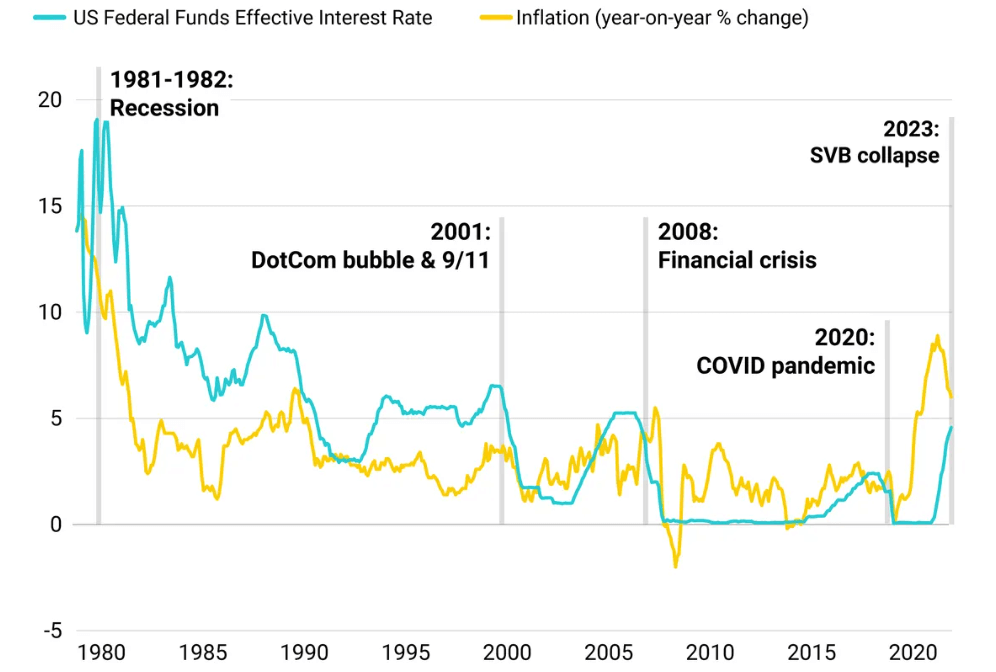

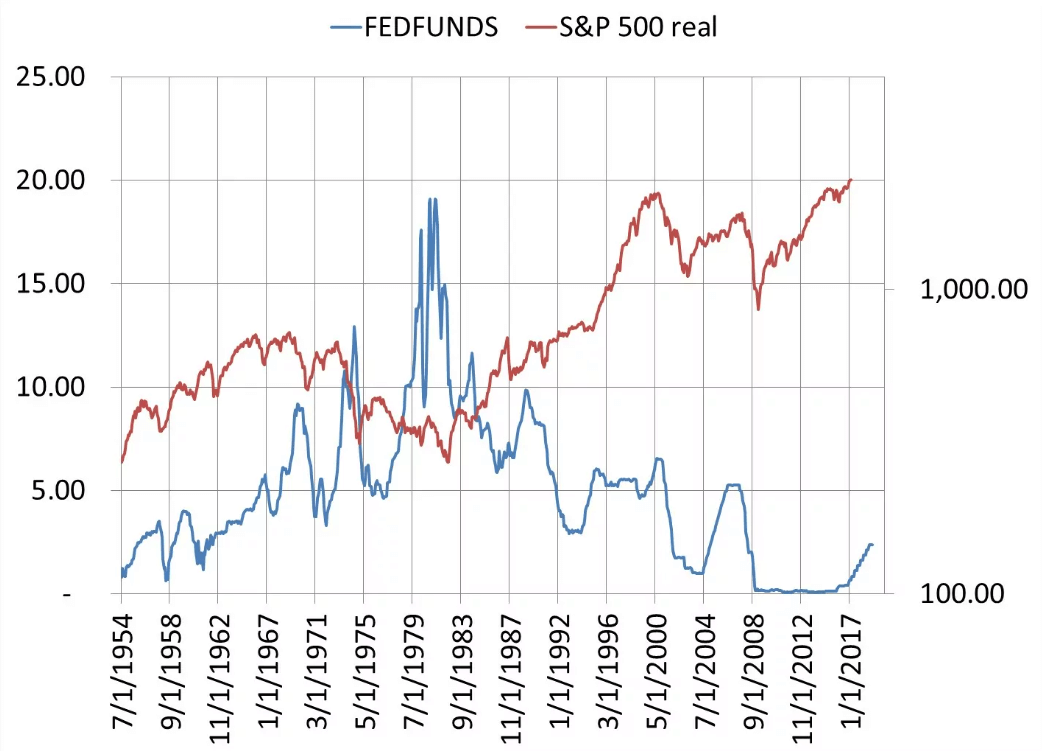

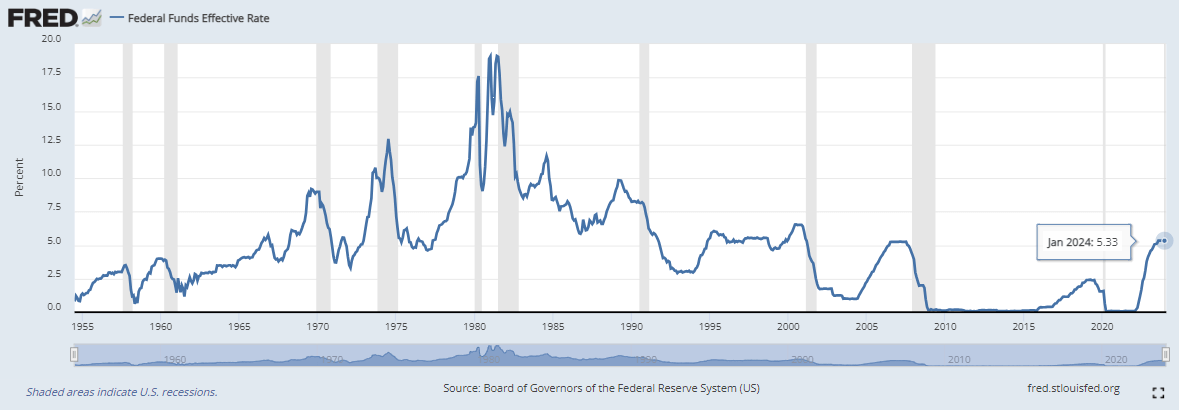

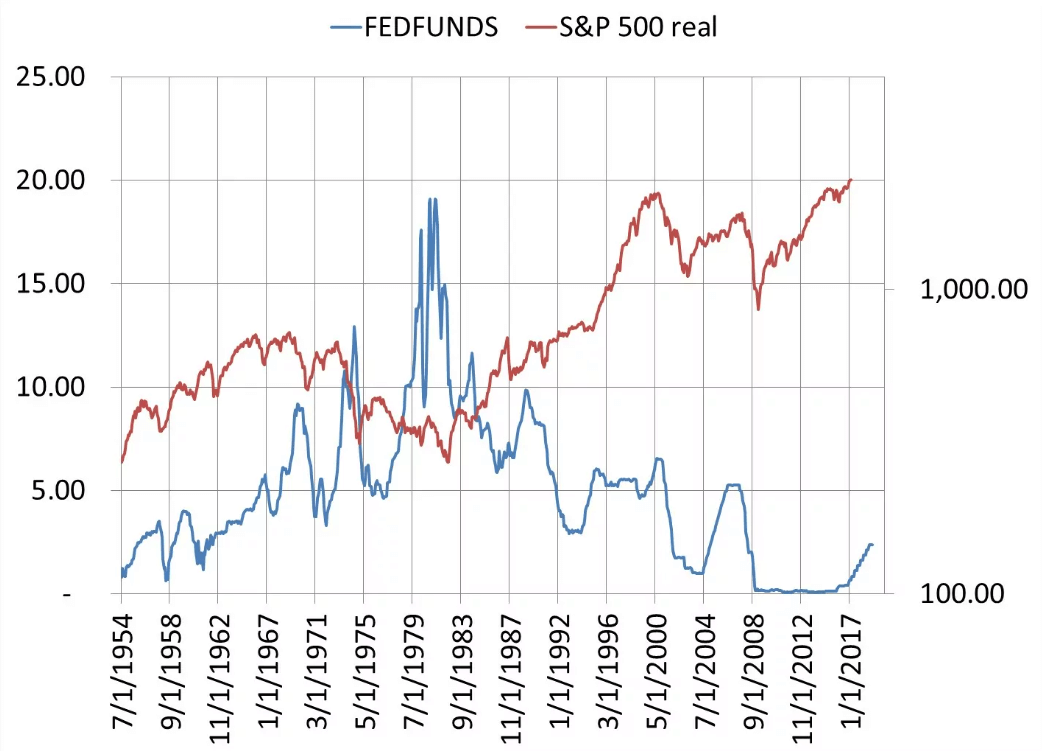

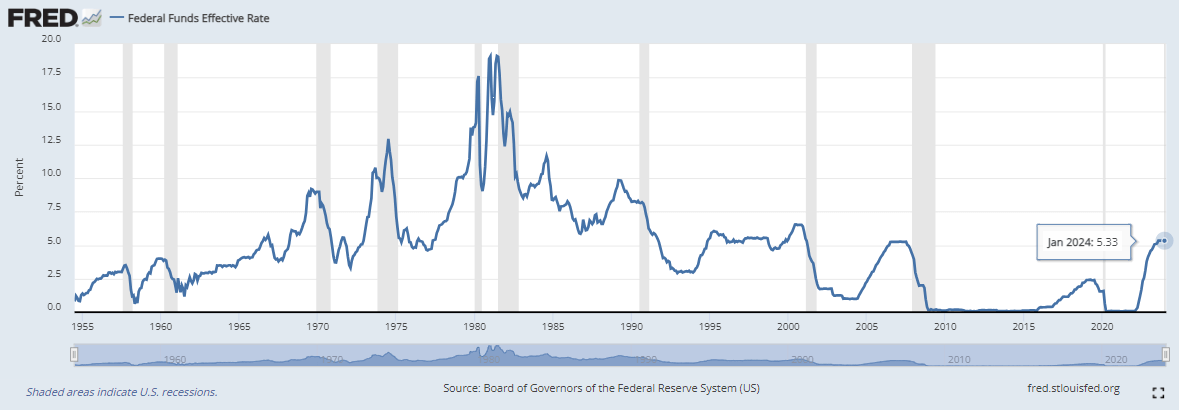

Because the U.S. interest rate hike is meant to guard against the risk of the stock market asset bubble bursting, it does have a significant impact on U.S. stocks. As shown in the chart below, several interest rate hikes in U.S. history have had some impact on the market performance of U.S. stocks. Of course, this impact can't necessarily be described as positive or negative. The impact it causes can vary depending on a variety of factors.

We should know that the United States, as a developed country with a mature financial system, is mainly in the stock market. If accidentally high stock prices suddenly burst at the end of the day, a sky-high amount of wealth may be instantly ashes. So instead of letting the bubbles themselves suddenly burst, rather than taking the initiative to raise interest rates, less money on the market, less money into the stock market, the stock market is money-driven, less money on the market, the natural fall.

A rate hike may suggest a strong U.S. economy, but it may also trigger investor concerns about future growth. If the market's expectations of interest rate hikes are inconsistent or the pace of hikes exceeds expectations, it may trigger market volatility and affect investor sentiment.

Meanwhile, interest rate hikes may lead to higher borrowing costs for companies, especially those with high debt. This may have a negative impact on the profitability of companies, especially those that rely on debt financing for expansion. It may also affect the cost and financial position of companies, which may affect their profitability. The high cost of debt may reduce a company's profits and have an impact on its valuation.

Different industries may have different sensitivities to interest rate hikes. In general, interest-sensitive industries such as financial services and real estate may be more affected, while growth and high-tech industries may be relatively less affected. Interest rate hikes may cause investors to reallocate their portfolios from equities to safer asset classes, such as bonds. This could lead to selling pressure in the stock market, especially for those stocks with high valuations.

Overall, Fed rate hikes may have complex and diverse impacts on the U.S. equity market, and investors will need to tailor their investment strategies to specific circumstances and market expectations. In addition, the interest rate hike policy is usually not a single influencing factor but is also affected by other factors such as inflation, employment data, geopolitical risks, etc.

The Impact of the Fed's Interest Rate Hike on Gold

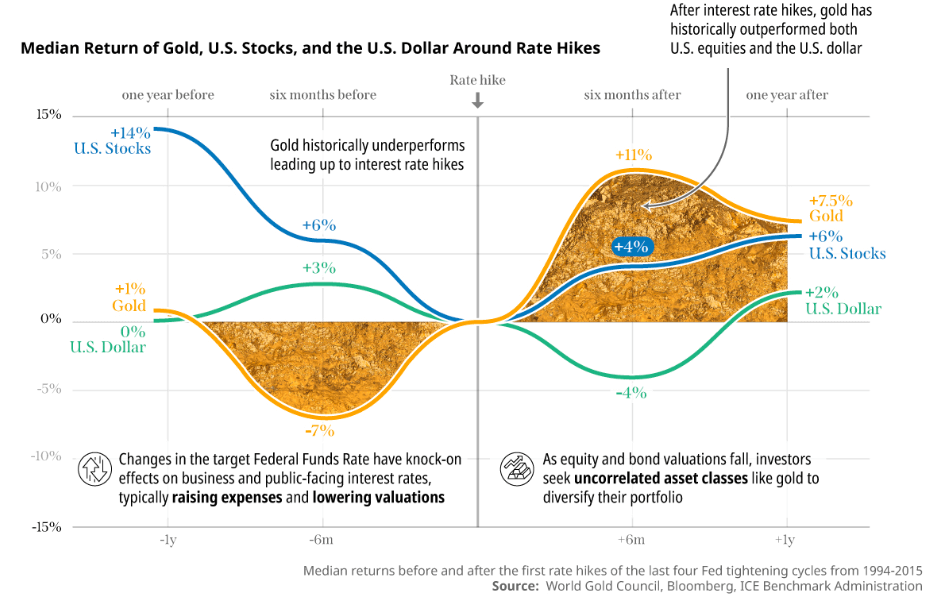

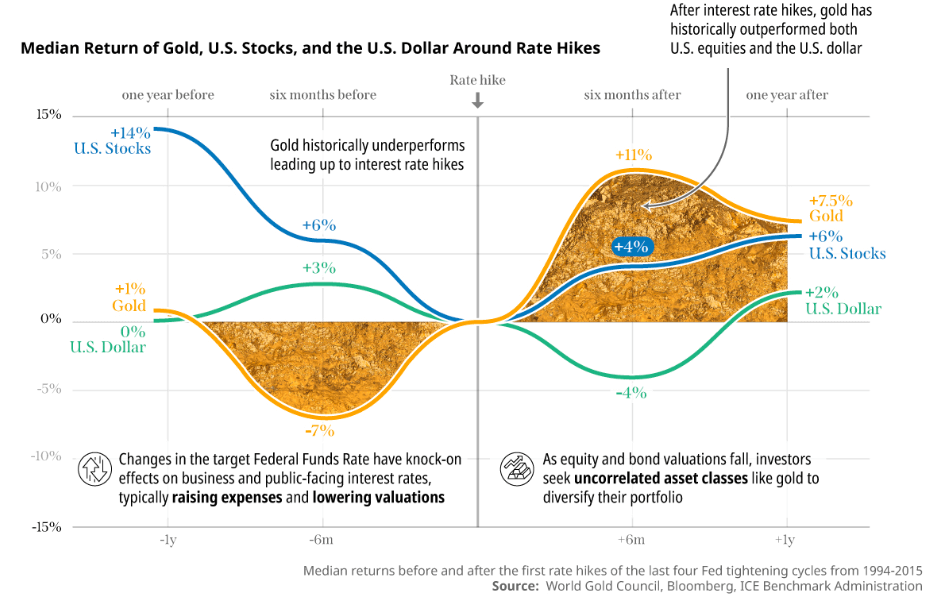

And it will have an impact not just within the U.S. but will cause some turbulence globally. For example, U.S. interest rate hikes usually lead to a stronger U.S. dollar, as they may increase the attractiveness of U.S. assets. Since the price of gold has an inverse relationship with the dollar, a stronger dollar may cause the price of gold to fall.

Real interest rates are an important factor affecting the price of gold, taking inflation into account. If the rate hike is greater than the inflation rate, then the real interest rate may rise, which is unfavorable to the gold price. At the same time, its rate hike alone implies that the US economy is strong, but it could also lead to rising inflation expectations. In the event of rising inflation expectations, investors may buy gold as a hedge, thus supporting the price of gold.

Of course, gold is often viewed as a safe-haven asset, and in times of economic instability or geopolitical tensions, investors may seek to hold gold to preserve its value. Therefore, while interest rate hikes may exert some pressure on gold prices, geopolitical risks and market uncertainty may support gold demand.

The impact of a US interest rate hike will also depend on the extent and speed at which the market expects it. If the market expects a rate hike and has fully reflected it in the gold price, the actual rate hike may not have much of an impact. However, if the market's expectation of a rate hike is more aggressive than the actual rate hike, this could trigger market turmoil and boost the gold price.

In summary, the Fed rate hike may have a variety of impacts on gold prices, including exchange rate movements, real interest rates, inflation expectations, market sentiment, and geopolitical risks. Therefore, gold investors need to pay close attention to the Fed's policy movements and consider a variety of factors to assess the trend of gold prices.

The Impact of the Fed's Interest Rate Hike on China

On the other side of the spectrum, when the U.S. raises interest rates, it will cause global capital to flow to the U.S., which may likewise affect China's capital markets. First of all, the rate hike may lead to a stronger US dollar and pressure on the RMB against the US dollar. This means that Chinese people will need to pay more yuan when exchanging dollars or buying imported goods. The cost will rise for Chinese people who go abroad to study, travel, and buy imported products.

Meanwhile, the rate hike may prompt China's central bank to make certain monetary policy adjustments to cope with external pressures. If the interest rate hike leads to increased capital outflows and exchange rate volatility, the Chinese central bank may take corresponding monetary policy measures to maintain RMB exchange rate stability and financial stability. And this may affect the returns and costs of financial products, such as deposit rates and lending rates, for the Chinese people.

And it may raise the global cost of capital, including the cost of China's debt. For Chinese companies and governments with larger debts, they may have to bear higher debt servicing costs, which may affect debt financing activities and economic development. It could also attract global capital flows to the United States, leading to pressure on China's capital markets. Capital outflows may have a negative impact on China's stock and bond markets, and investors need to be mindful of the risk of market volatility.

The Fed's interest rate hike may have an impact on the global economy, and China, as the world's second-largest economy, may also be affected to some extent. If the interest rate hike leads to a slowdown in global economic growth, it may affect China's export demand and domestic investment activities, which in turn may affect China's economic growth rate. The Chinese people need to be concerned about the stability of their domestic economic growth in light of changes in the global economic environment.

It may also lead to a reallocation of global funds, which may increase the prices of some commodities and thus increase inflationary pressure in China. In particular, if the RMB depreciates, it may further push up the prices of imported commodities. In the face of the changes in the financial market brought about by the interest rate hike, the Chinese people need to prudently adjust their investment strategies, pay attention to market dynamics, and reduce investment risks.

In dealing with these impacts, the Chinese people need to raise their risk awareness and adjust their consumption plans and investment strategies to cope with possible exchange rate changes, market volatility, and macroeconomic pressures. At the same time, enterprises and the government need to respond proactively to ensure sustained and stable economic development by adjusting their strategies and policies.

Pros and cons of a Fed rate hike for China

| Interests |

Disadvantages |

| Curb inflation |

Increased pressure for RMB depreciation |

| Reduces capital outflows |

Loss of exports |

| Reduces the risk of global capital inflows. |

The rising cost of debt |

| Promote financial market stability. |

Increased market volatility |

| Currency stability |

Unfavorable foreign trade |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What is Fed's Interest Rate Hike?

What is Fed's Interest Rate Hike?