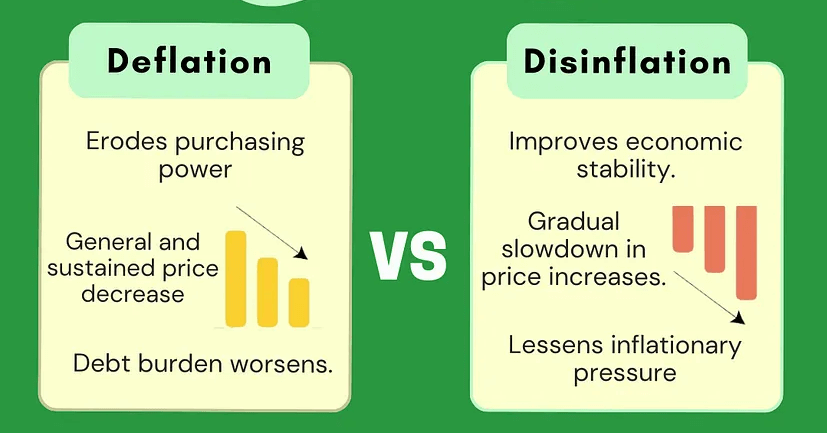

While inflation is widely feared as a significant economic challenge, those with a deeper understanding of economics often view deflation as the more concerning scenario. Unlike inflation, which erodes purchasing power, deflation can lead to stagnant or declining prices, signaling economic slowdown or recession. Yet, many are unfamiliar with the concept of deflation and its potential consequences, as well as effective strategies to navigate such economic adversity. This article aims to provide a detailed exploration of deflation, its economic implications, and proactive measures to address and mitigate its effects.

The Concept of Deflation

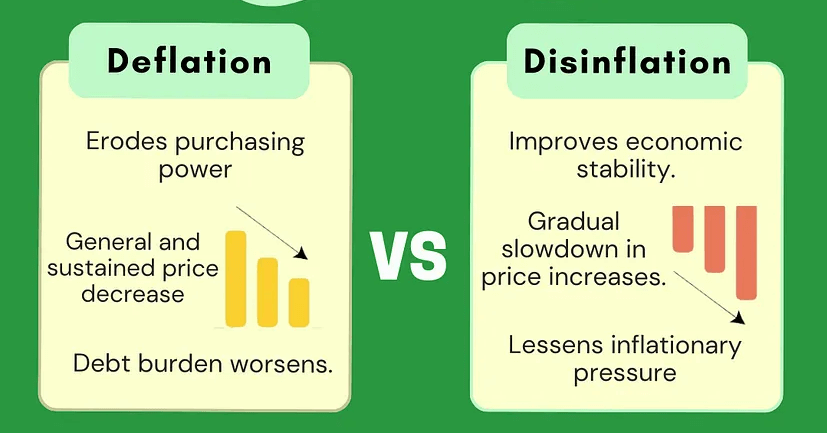

Deflation is an economic phenomenon in which the purchasing power of money rises,leading to a general decline in the general price level. In this case,the same amount of money can buy more goods and services. Because prices continue to fall,the purchasing power of money increases. However,this should not be taken to mean that it is a good thing; in fact,it is a serious crisis.

From a financial point of view,it is relative to inflation. Inflation is a rise in prices caused by the amount of money issued in the market exceeding the amount of money needed in circulation.Deflation is the opposite of this and is characterized by a lack of money supply and a sustained decline in the general price level. Deflation is generally considered to have occurred when the CPI, or index,continues to fall for three or more months.

People often hate inflation because,as prices rise,money can buy fewer and fewer things. But according to this logic,deflation in the hands of people is more and more valuable currency,but it is also not necessarily a good thing.

It can be categorized as good or bad according to its causes.Good deflation is due to technological advances in production efficiency,which lead to a decline in the overall level of prices. Under good deflation,technology creates new jobs,increases people's real income level,and promotes economic growth.

For example,in the 19th century,because of the industrial revolution,some developed countries experienced great economic growth. However,at the same time,their total price level fell sharply in the opposite direction. Compared with 1800. the Consumer Price Index of the United States in 1900 was only half of what it was in 1800. By the same token,prices in the United Kingdom fell by 1/3 in the same period.

Bad deflation is then a fall in the aggregate price level due to a lack of effective demand and a liquidity trap. In this case,the lack of demand leads to massive overproduction. A generalized under-employment of firms and a decline in employment lead to a recession,which in turn leads to a generalized decline in the standard of living of the population.

Before the Second World War,such bad deflation was common in all countries. Even after the Second World War,there were about 100 deflationary episodes worldwide. But for a long time after the Great Depression of the 1930s,central bank were always more worried about inflation than deflation.

It wasn't until the late 1990s,as a result of Japan's economic weakness and the Asian economic crisis,that mainstream economists realized that deflation was becoming a more serious threat than inflation. This is not some unfounded concern,and knowing the consequences of deflation,I believe we are all worried about it.

Causes of Deflation

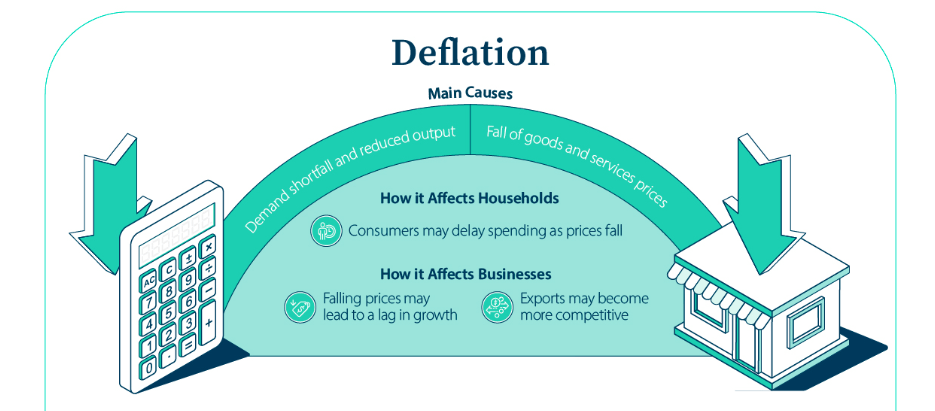

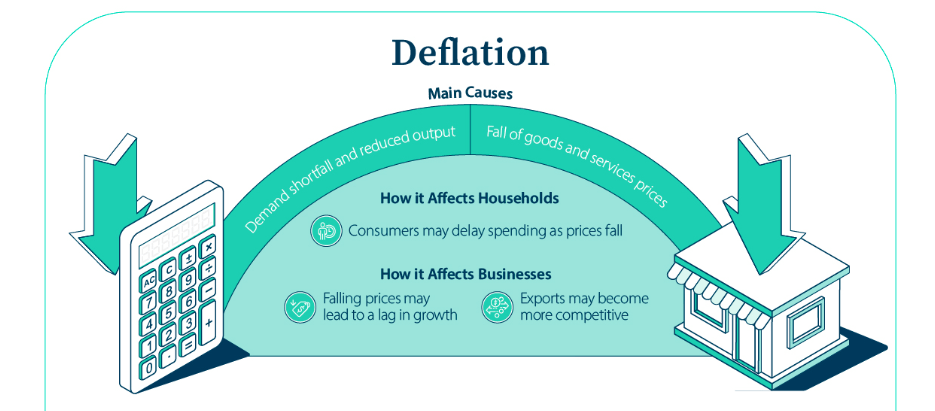

Deflation can be the result of a combination of factors,but in general,it must be due to a lack of aggregate demand in the economy. This is when companies lower their prices to promote their goods,which leads to a fall in prices. Lack of demand can be caused by a number of factors,including a drop in consumer confidence,a reduction in investment,cuts in government spending,and so on.

As far as current international examples are concerned,the most serious is still the deflationary consequences of the bubble economy. The global economy has been booming since the 1980s,and many countries have even experienced the phenomenon of bubble economies due to the overheating of the economy and the inflow of large amounts of capital into the asset market,causing an abnormal surge in property and Stock Prices. Once the bubble economy burst,the original domestic demand for the country's enterprises to reduce profits,the value of the poor manufacturers closed down,and the impact of normal business triggered a series of economic chaos.

The more serious the bubble economy,the more serious the negative effects of Japan and Taiwan are. On the contrary,since the United States was founded in the 1970s,although the lessons of economic development focus on monetary policy,it is relatively conservative. Although the Internet technology bubble also occurred,the financial and general business systems are sound,so they do not have to appear as obvious negative phenomena.

Since 1992. the economic growth rate of the United States has been maintained at over 3.1% and was as high as 7.2% in 2003. The unemployment rate has also been kept at about 5%, and in 1999 it dropped to 4.2%, the lowest point in the United States in the past ten years. Prices fell in the U.S. people's purchasing power to increase,but to enhance the people's standard of living,coupled with the fact that the U.S. domestic demand market was originally large. With the recovery of the global economy,the economy will soon resume the monetary phenomenon caused by inflation.

At the same time,technological advances may also lead to increased production efficiency and lower costs,which make the price of goods and services lower,which in turn leads to deflation. Also,if there is overcapacity in certain industries or markets,firms may compete to lower prices to attract consumers,leading to a fall in prices.

For example,after the mid-20th century,advances in production technology led to a significant increase in global production capacity and product quality. The rise of the IT industry in the 1980s led to the introduction of new products with high functionality,and the prices of information products continued to fall. The establishment of the global information network made production and marketing information increasingly transparent and accelerated the integration of the global industrial division of labor. This situation led to deflation at the end of the 20th century.

At the same time,if the money supply is reduced,for example,if the central bank tightens monetary policy or reduces money printing,it may also lead to deflation. A reduced money supply may lead to an increase in the purchasing power of money,which in turn leads to a fall in prices. It is worth noting that the sharp decline in real estate and stock market prices after the bubble economy caused a wild ride is actually a monetary phenomenon.

Debt crises may cause consumers and businesses to cut back on spending,leading to a lack of demand and falling prices,which in turn exacerbates deflation. There are also factors such as global recession,international trade tensions,natural disasters, etc. that may lead to a slowdown in economic activities,which may also in turn lead to deflation.

In other words,there is the same deflation,but the consequences of different causes are not the same. For example,the same fall in prices can result in extremely different economic responses in Japan and the United States.

What are the Consequences of Deflation?

What are the Consequences of Deflation?

Once deflation occurs,the price index continues to fall,and the same amount of money can buy more goods. Money getting bigger seems like a good thing,so why are governments and economists so worried? This is because past experience shows that deflation is often accompanied by three lows and one high:low income,low consumption,low economic growth,and high unemployment.

It is important to realize that just because prices are falling does not mean that many people are going to spend. In fact,the opposite is true:deflation may cause consumers to worry. They will delay spending and wait for prices to fall further. And when consumers delay purchases,this can lead to lower corporate profits and less investment. This then leads to a recession or slower growth as aggregate demand is reduced.

At the same time,businesses are consequently faced with falling sales and pressure on profits,which in turn may lead to reduced production,which in turn creates layoffs or a hiring moratorium,leading to higher unemployment. In a recession,people who are unemployed are not only left with no money and no way to spend it. Even for those who are not unemployed,office workers can hardly escape the fate of pay cuts. With their wallets shrinking and the fear of losing their jobs,people are afraid to spend. And in order to attract consumption,manufacturers have no choice but to cut prices again. Prices then fall again,and so on,in a vicious circle.

In addition,deflation will also make debtors face a higher real debt burden. Because of the increased purchasing power of money,debt becomes more difficult to repay. And it makes investors worried about the future prospects of the economy,so investor confidence declines,which in turn causes asset prices to fall,including stocks,real estate,and so on.

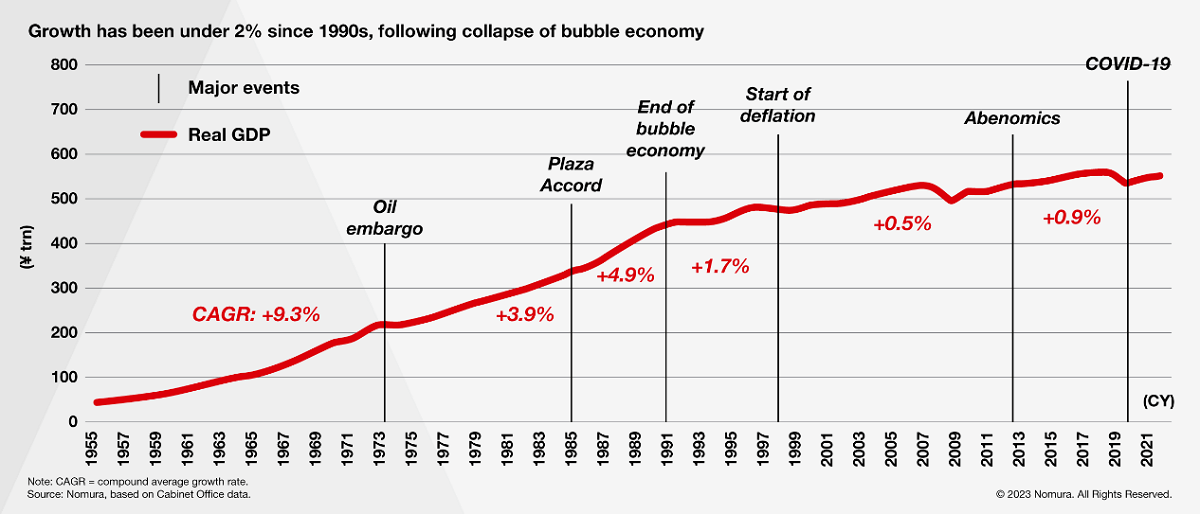

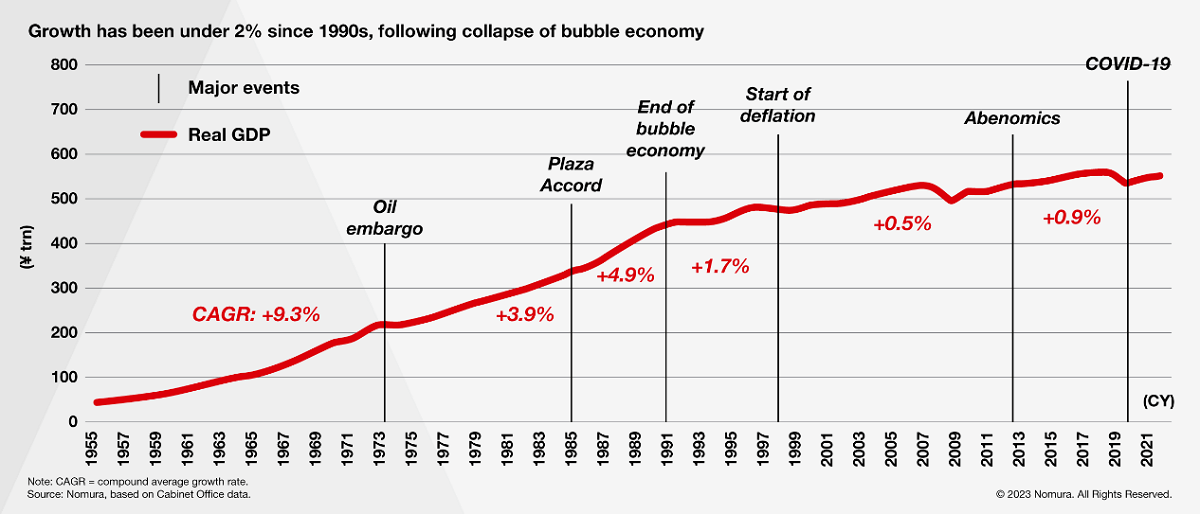

Japan,for example,has seen a steady decline in price levels since the 1990s. By 2001. the Consumer Price Index had been growing negatively for five consecutive years. The unemployment rate has also risen from 2.1% in 1990 to 5.4%, and to date, 40% of Japan's labor force has no formal job and can only work part-time.

In addition,its stock prices have fallen to the lowest point in 20 years,real estate prices have dropped by 80%, national salaries have dropped for five consecutive years,and the number of bankruptcies has been on the rise,resulting in many social tragedies. As shown in the above chart,not only has Japan's economy stagnated—its economic growth rate has been below 2% since 1999—but also the income level of the Japanese people has remained the same for decades.

By coincidence,Taiwan's economy has also been in recession since 2001 and has even experienced negative growth. Not only is the housing market in the doldrums,but the stock market index has also dropped from over 10 000 points in early 2000 to over 4 000 points in 2002. The unemployment rate has gradually risen since 2001. and by July 2002. it had hit a record high of 5.31%. Employment centers in various counties and cities were often crowded with people seeking jobs.

The adverse effects of deflation are very obvious,not only on individuals but also on enterprises and the entire economic system,which will have extensive and far-reaching negative impacts. Therefore,the government and the central bank usually take measures to alleviate its impacts and maintain economic stability and growth. And naturally,the average person's response to such a situation varies.

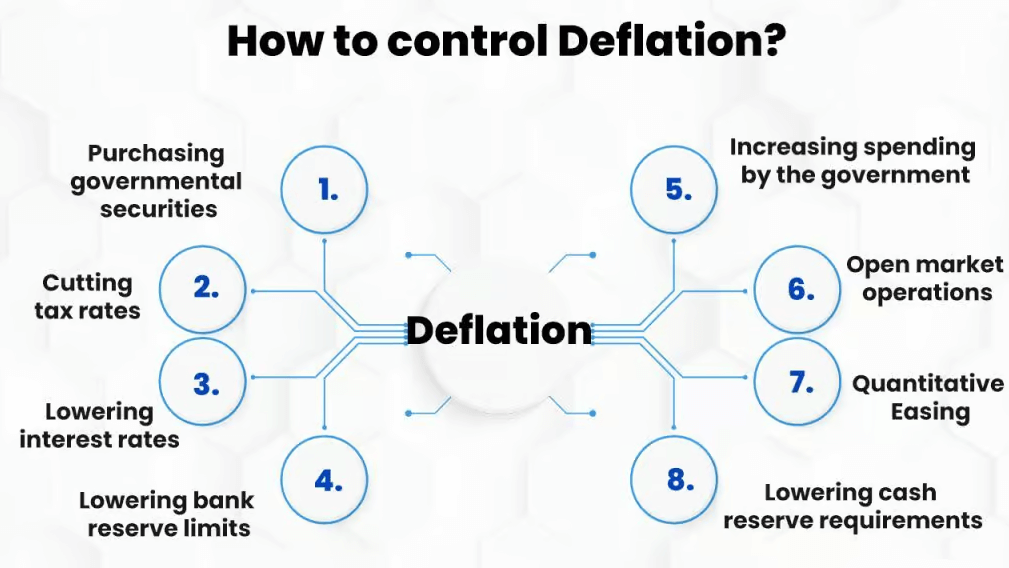

Deflationary Coping Methods

While deflation,or a fall in prices,does not necessarily have a bad effect,a practical example. However,if deflation occurs and has a significant negative impact on the economy,how do you cope with it? Generally speaking,it is difficult for countries to control deflation. Because its cause is not just a monetary phenomenon,its problem is actually more complex.

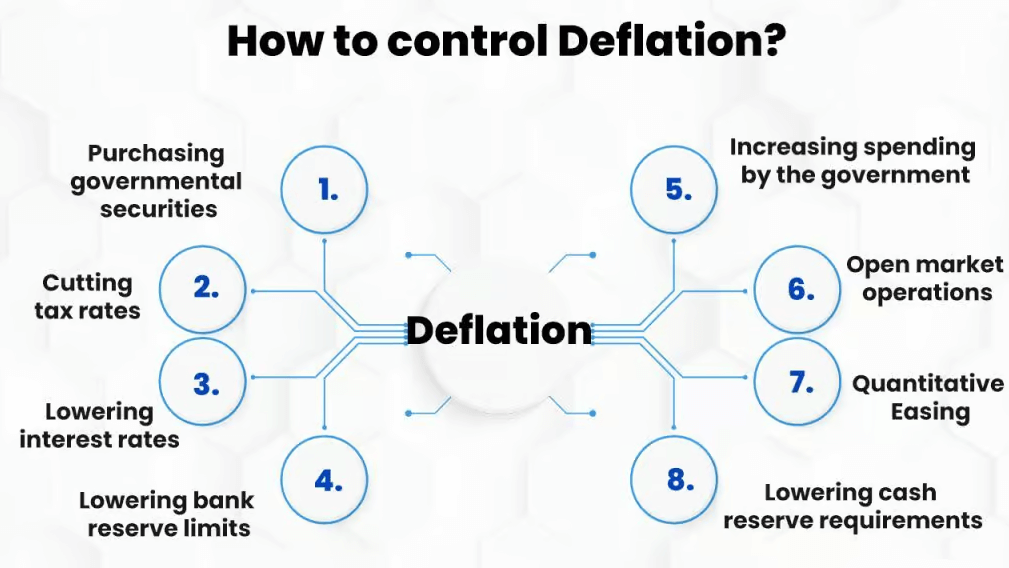

Many studies show that prevention is better than cure. The best policy for the economy is for the government to maintain a long-term,stable money supply. As for deflation,which has already had a negative impact,the central bank,which is in charge of currency issuance,should adopt an accommodative monetary policy to prevent it from worsening.

If the central bank can maintain an investment environment with abundant funds and low interest rates,when the economic fundamentals return to normal,such as promoting financial reforms,resolving financial bad debts,and eliminating inefficient enterprises, once the boom improves,private investment willingness rises,consumer confidence is restored,the housing market picks up,and the economy naturally warms,the negative impact of deflation can also be gradually dissolved.

Of course,since deflation has formed and caused a long-term price decline,the central bank's decision to adopt a loose monetary policy may not be very useful. Because although the central bank may have increased the amount of money issued,the circulation of this money will not necessarily be fast.

Let's use a simple analogy: if a salary increases,more money in the pocket does not mean that the money will necessarily be used. In the past, 100 dollars in the pocket took maybe two days to use up; now 120 dollars are in the pocket within a week,which is to say that the circulation of money is slow. This will cancel out the central bank's loose monetary policy.

Therefore,short-term,loose monetary policy will not have a substantial effect on consumption or the investment environment. If consumer confidence cannot be restored and the investment environment is slow to improve,monetary policy will not have the desired effect. It may even have an adverse effect on long-term economic stability.

Of course,during this period,the government's insistence on tight monetary policy will only worsen the economy. For example,the Great Economic Panic of the 1930s in the United States was caused by the Federal Reserve Board's failure to have a stable money supply policy. Excessive tightening of money instead ended up making the boom worse and the recession longer.

It takes about six to twelve months for an increase in the money supply to affect the economy. If the central bank is to look at the economic boom or bust to decide whether to adopt loose or tight monetary policy, because of the time lag,the effect will occur at the wrong time,making the economy more volatile.

Therefore,in order for the economy to grow steadily,the supply of money should be controlled,and a stable monetary growth rate should be customized to meet the needs of the economic environment. From past examples of inflation and deflation,it can be seen that the government's attempts to manipulate money to improve the economy have often resulted in a runaway currency that triggers more complex economic crises.

That is why prevention is better than cure,and it is the best policy for the economy for the government to maintain a long-term stable money supply. This is,of course,the country's way of dealing with deflation. And how ordinary people should deal with it is actually quite simple. First of all,cash is king. Interest rates on savings are low in times of deflation,but falling prices equate to cash appreciation. And holding cash gives you maximum flexibility.

The second is to reduce debt. Because money becomes more valuable in times of deflation,it will be harder and harder to make money in the future. So clearing out debt with money that is cheaper now rounds up to taking advantage of it in the future.Thus,in deflation,if you have to take on some debt,shorten the period of borrowing as much as possible,preferably by paying off the loan early.

Then it is to avoid unnecessary spending,do not be a moonlighter,and save some money as much as possible for a rainy day. Individuals and families should make reasonable budget plans,control spending,reduce waste,prioritize necessities and emergency expenses,and increase savings reserves. Individuals should also consider adding additional sources of income,such as part-time jobs,starting a business,or investing money,to increase their financial income and counteract the effects of deflation.

If it is an ordinary person doing this,it will be fine,while if it is an investor, this is when one should adopt a diversified investment strategy,including investing in sound financial assets,holding real assets,investing in sectors with growth potential,etc., to diversify risks.

Or one can choose quality assets because this is the time when the price of commodities will become cheaper and cheaper and even fall below their value,and many companies and individuals will go bankrupt. If you have some cash,you can take the opportunity to plunge into some cheap assets,such as houses.

All in all,to deal with deflation,we need to comprehensively consider a number of factors,such as monetary policy,Fiscal Policy,structural reforms,and individual behavior,and take active and effective measures to mitigate its impact and promote economic stability and growth. As for ordinary people,find ways to mettle and tighten their belts. Like the southerners who survived the winter without heating,they survived until the cycle passed and everything recovered.

How should ordinary people cope with deflation?

|

Ways to cope

|

Description

|

|

Cautious Spending

|

Control expenses and avoid unnecessary spending. |

|

Saving and investing

|

Save or invest money to counteract the effects of deflation. |

|

Finding extra income

|

Try part-time work or start a business for extra income. |

|

Change spending habits.

|

Adjust your buying habits and prioritize necessities. |

|

Finding deals and discounts

|

Actively look for promotions to save money. |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial,investment,or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security,transaction,or investment strategy is suitable for any specific person.

What are the Consequences of Deflation?

What are the Consequences of Deflation?