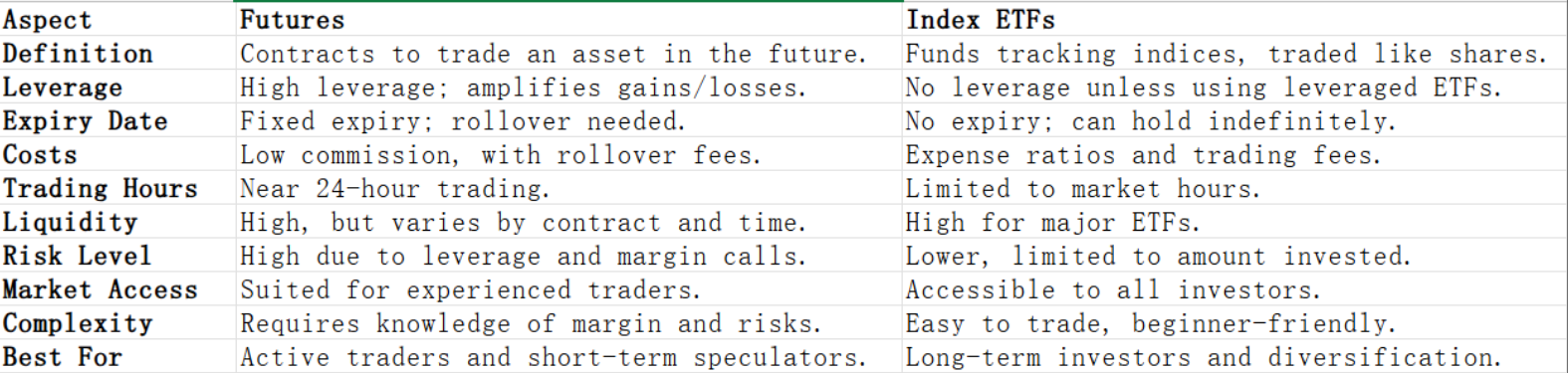

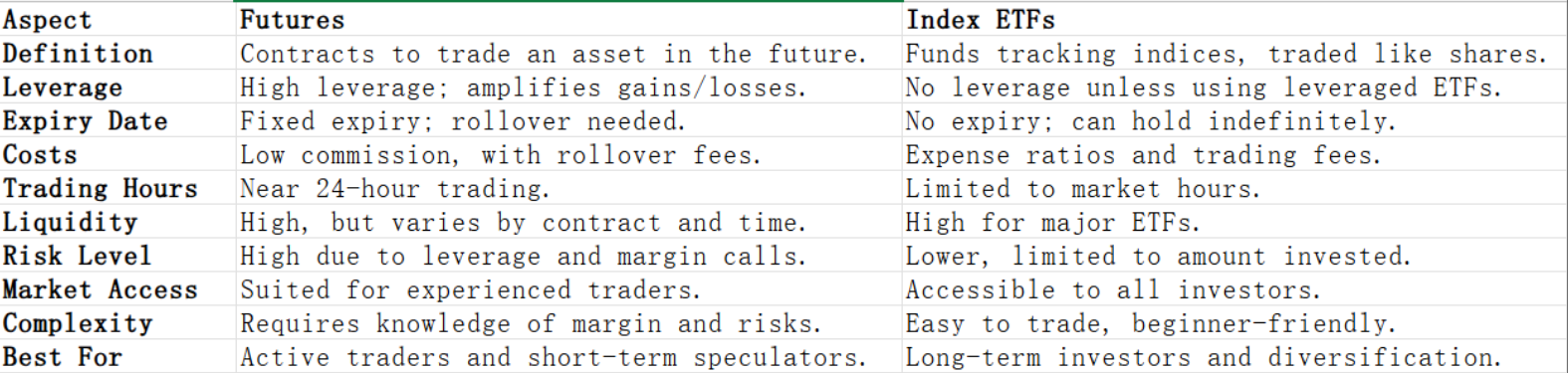

Futures contracts and index exchange-traded funds (ETFs) are two widely used tools for gaining exposure to financial markets, particularly major indices like the S&P 500 or FTSE 100. While both can help you capitalise on market movements, they differ in structure, risk, and purpose. If you’re deciding between these two options, understanding their unique features and how they align with your trading goals is essential.

Understanding Futures Contracts and Index ETFs

Futures contracts are agreements to buy or sell an asset—like an index, commodity, or currency—at a set price on a future date. They are typically used by traders looking to speculate on market movements or hedge their positions. One of the standouts features of futures is that they are highly leveraged, meaning you only need to put up a fraction of the total contract value to trade.

On the other hand, index ETFs are investment funds that track the performance of a particular index. Unlike futures, ETFs don’t come with expiry dates or obligations to settle at a specific time. They are traded on stock exchanges like shares, allowing investors to buy and sell them throughout the trading day. For many, ETFs offer a straightforward way to gain exposure to indices without the complexity of derivatives like futures.

To put it simply, futures contracts are better suited for active traders or institutions seeking leverage or short-term speculation, while index ETFs are geared towards longer-term investors looking for diversification and ease of use.

Comparing Costs and Fees: Futures vs Index ETFs

When it comes to costs, futures and index ETFs differ significantly. Futures are typically traded through brokerage accounts, and the primary cost involved is the commission charged per contract. While commission rates vary by broker, they are often relatively low. However, trading futures also involves a "margin," which is the amount you need to maintain in your account as collateral. Additionally, futures prices may be subject to what’s known as “rollover costs” if you want to extend your position beyond the contract's expiry.

Index ETFs, on the other hand, come with their own set of costs. The most obvious is the expense ratio, which is the annual management fee charged by the fund provider. While these fees are usually low—often below 0.1% for large, widely traded ETFs—they do add up over time, particularly for long-term investors. There may also be trading fees when you buy or sell ETF shares, though these are often minimal with modern brokers.

Ultimately, futures can be cost-effective for high-volume, short-term trading due to their low commissions, but their leverage increases the risk of significant losses. Index ETFs, while slightly more expensive for active trading, are cost-efficient for long-term investors, particularly those focused on simplicity and lower risk.

Liquidity and Trading Hours: Futures vs Index ETFs

Liquidity refers to how easily you can buy or sell a financial instrument without significantly affecting its price. Both futures and index ETFs offer high liquidity, but they differ in terms of trading hours and the mechanics of liquidity.

Futures markets are known for their near 24-hour trading, which makes them ideal for traders who want to react to global events in real-time. Whether it’s economic news from Asia or political developments in the US, futures allow you to trade almost any time of day. However, keep in mind that liquidity may drop during off-peak hours, leading to wider bid-ask spreads.

In contrast, index ETFs are traded during regular stock market hours. While this limits your ability to trade outside those times, ETFs are highly liquid during market hours due to their popularity. Large ETFs, in particular, have robust trading volumes, ensuring tight bid-ask spreads and minimal price impact for most trades.

If you’re someone who values flexibility and the ability to act quickly, futures might be the better option. But for most investors, the trading hours of ETFs are more than sufficient, especially if you’re focusing on long-term market exposure rather than short-term market moves.

Leverage and Margin Requirements: Futures vs Index ETFs

Leverage is one of the most important factors to consider when comparing futures and index ETFs. Futures contracts are inherently leveraged products, allowing you to control a large position with a relatively small amount of money. This can amplify your gains significantly—but it also magnifies your losses. To trade futures, you’ll need to maintain a margin in your account, which is essentially a deposit to cover potential losses. If your position moves against you, your broker may require you to add more funds, known as a margin call.

Index ETFs, on the other hand, are not inherently leveraged. When you buy an ETF, you’re paying the full price upfront, and your exposure is limited to the amount you’ve invested. That said, there are leveraged ETFs available for traders who want to amplify their exposure. These funds use derivatives to multiply the daily returns of an index, but they come with higher costs and risks, making them unsuitable for long-term holding.

For traders who understand the risks and have a strong grasp of market movements, leverage in futures can be a powerful tool. But for most people, the simplicity and lower risk of ETFs make them the more attractive choice, particularly if you’re new to the world of investing.

In conclusion, deciding between futures and index ETFs ultimately comes down to your goals, risk tolerance, and trading style. Futures offer flexibility, leverage, and nearly round-the-clock trading, making them a popular choice for experienced traders. Meanwhile, index ETFs provide a simple, cost-effective way to invest in the market, with lower risk and fewer complexities. Whether you’re looking for fast-paced trading opportunities or a steady, long-term investment, understanding the key differences between these two instruments will help you make an informed decision.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.