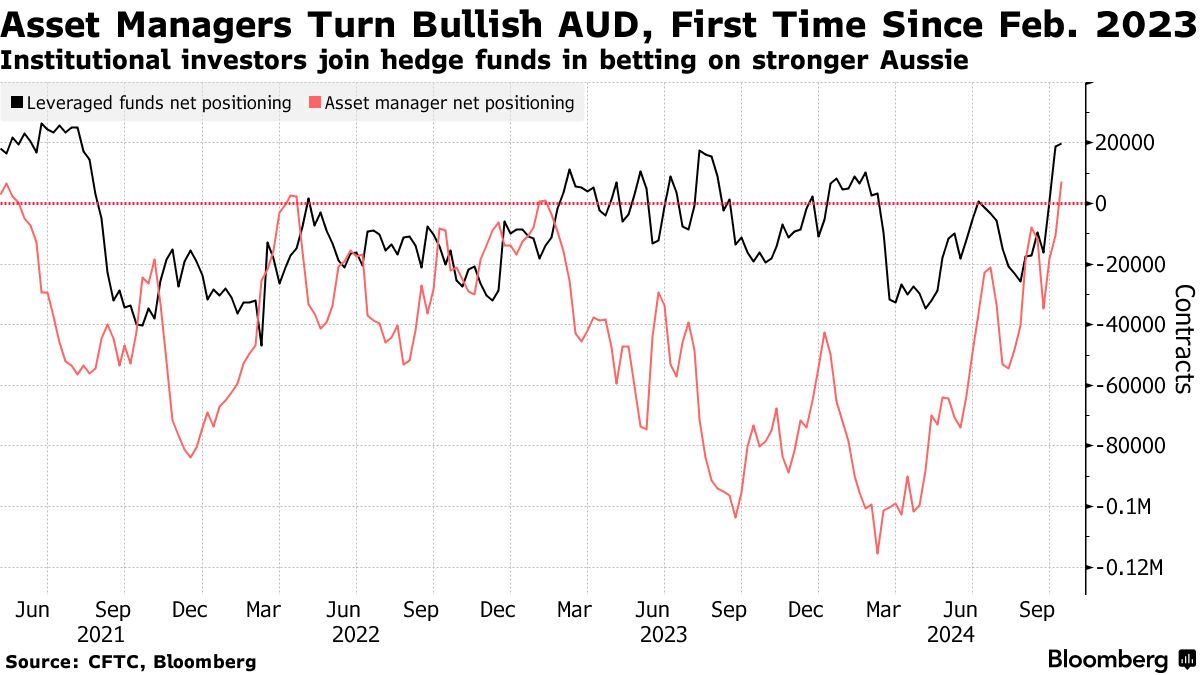

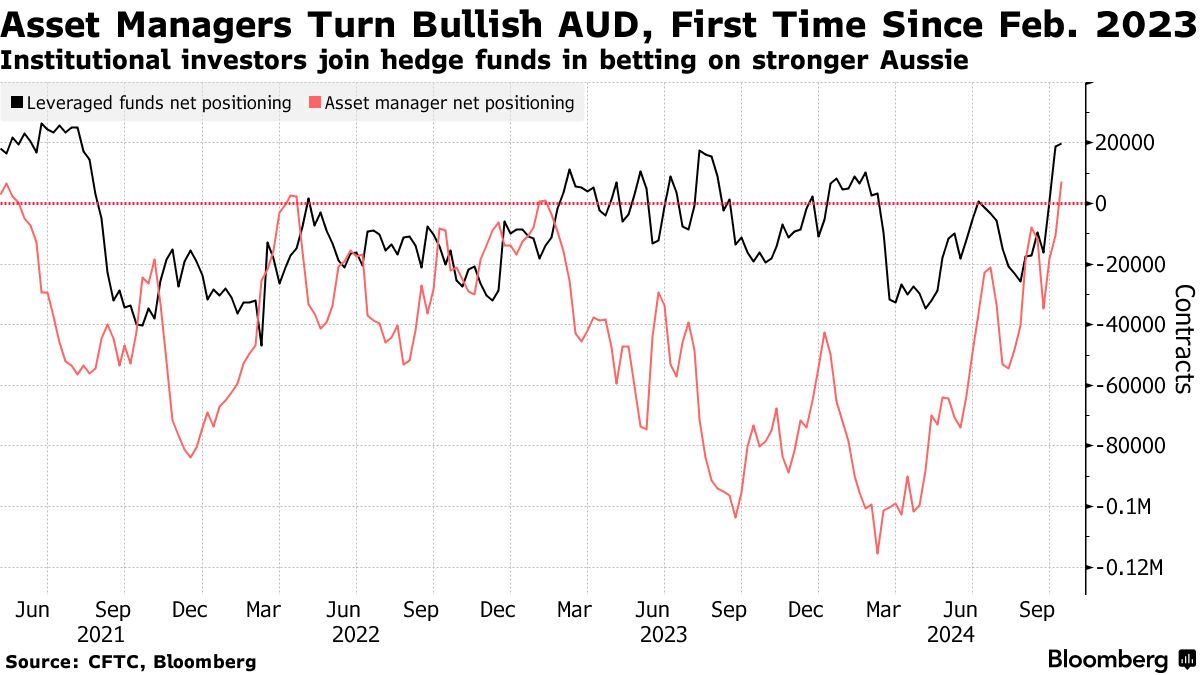

Institutional investors have shifted their stance on the australian dollar, turning the most bullish on the currency since March 2021. This change comes as expectations rise that the Reserve Bank of Australia (RBA) will maintain interest rates at elevated levels for the foreseeable future. According to recent data from the Commodity Futures Trading Commission (CFTC), asset managers flipped to a net long position on the Australian dollar in the week ending October 8. This marked a significant turnaround after months of bearish sentiment that had persisted since February 2023. This shift in investor outlook highlights growing confidence in the Australian economy and its ability to withstand global economic challenges.

The RBA will sit tight on rates until being confident that inflation is

moving sustainably toward target, minutes of the last meeting showed, suggesting

policy easing still remains some way off.

The minutes shine a spotlight on the board's policy conundrum at a time when

Australia's inflation remains elevated and sticky while the rest of the world is

slowly embarking on an easing cycle.

Financial market pricing implies the RBA's next move is down, with a cut seen

early next year. A Bloomberg News survey showed that a majority of economists

expect it to keep rates on hold this year.

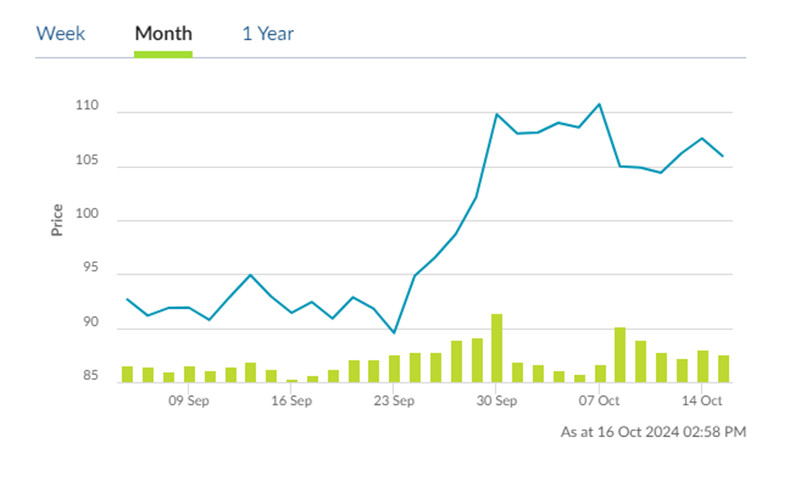

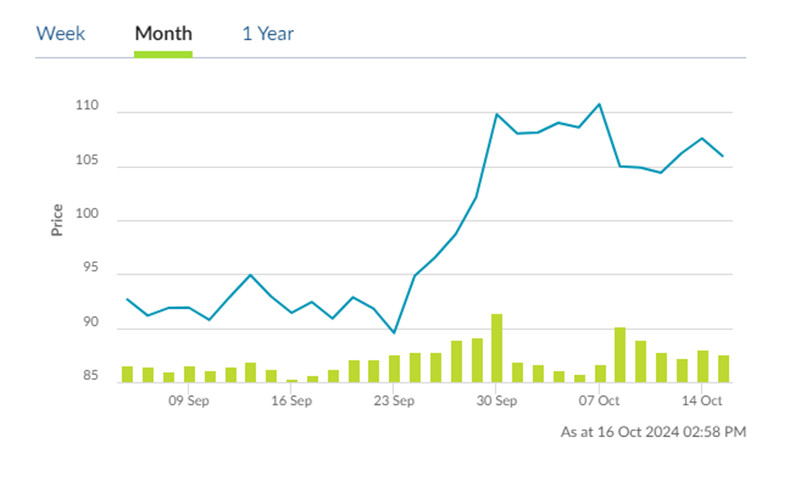

The Aussie dollar rallied to the highest in 19 months in late September

following China's stimulus announcement. However, it has pared some gains this

month due to expectations of smaller Fed rate cuts.

"The position flip to longs … has to navigate a lot of consequential risks in

coming weeks," said Richard Franulovich, head of FX strategy at Westpac. He

recommended going long at better levels towards 0.6630.

A Chinese gift

Consumer price increases slowed to a three-year low in August thanks to

government rebates on electricity, while core inflation hit its lowest since

early 2022. But both are high among developed economies.

Australia added more jobs than expected in August as the unemployment rate

remained steady. Jobless rate needs to rise to ensure inflation's retreat

continued, said the RBA.

The economy expanded by a modest 0.2% in Q2, unchanged for three straight

quarters, slightly below expectations and underscoring persistent economic

challenges

With two strong quarters expected in the second half of the year, evidence so

far is scant that a rebound in consumer spending is materialising as households

saved most tax cuts.

But China's dedicated efforts to pull itself out of a slump could benefit

mining industry. Last week iron ore prices reached three-month highs on hopes

that demand would improve significantly.

Home sales ticked up in some cities during the week-long holiday. However,

the average daily transaction area of new homes fell 27% YoY during the period,

according to the report which surveyed 25 major cities across China.

Private reports showed consumer sentiment down under climbed to a more than

two-year high in October, while remaining deep in pessimistic territory, and

business conditions rose to a four-month high.

Tariff man

The dollar climbed to the strongest level in two months as former President

Donald Trump defended proposals to dramatically raise tariffs on foreign

imports.

Just three weeks away from the election, markets need to price in prospects

of a Trump win and currency markets will be directly affected by a fresh trade

war, according to Amundi.

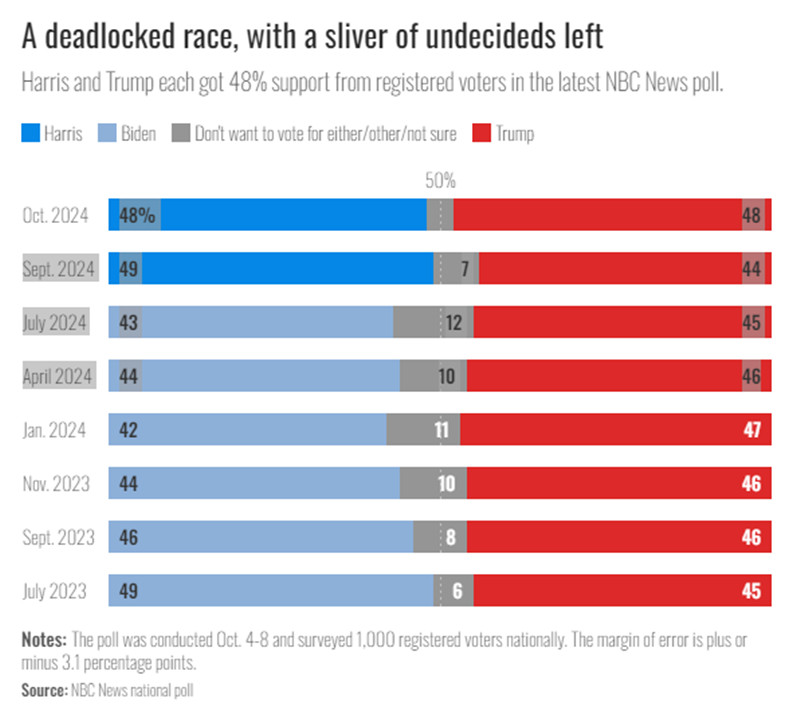

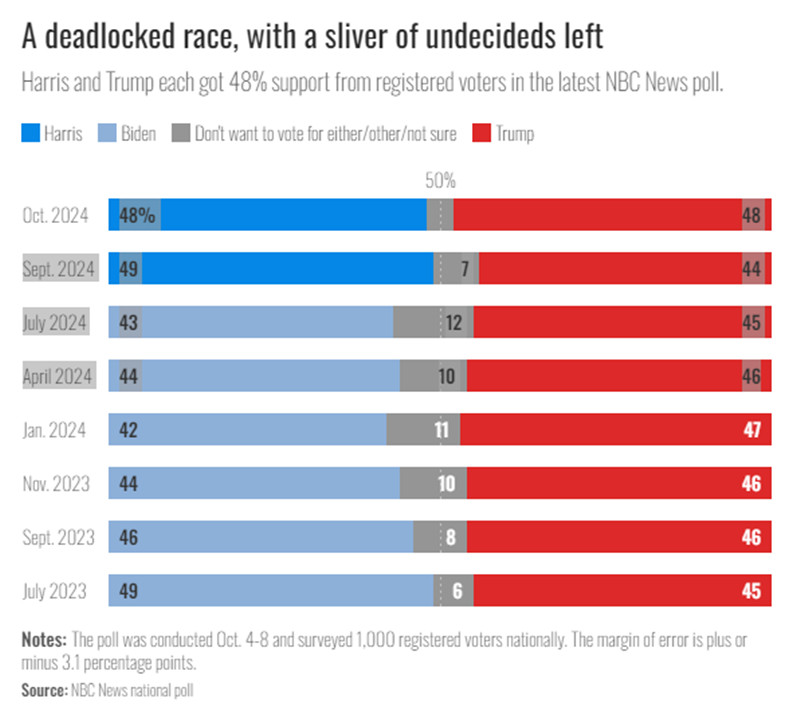

Trump and Harris are deadlocked in the latest national NBC News poll as

Republicans came back home to support him after last month's rough debate and a

subsequent polling deficit.

Still, underlining the poll is uncertainty about the election with 10% of

voters saying they might change their minds and a sliver of unclaimed voters

still on the fence.

Tariffs would stem capital flow overseas, potentially driving up inflation

and interest rates. A prolonged trade war also stands to weigh on global risk

sentiment –another tailwind for the dollar.

Barclay expects to see the biggest impacts against economies with which the

US has a large trade deficit, like China. That could have been behind the urge

to pump in tremendous liquidity in September.

Even countries like India and Vietnam could continue to benefit from

accelerating supply chain diversification from China, their making up of the

Australian export loss from China's pressures seems unlikely.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.