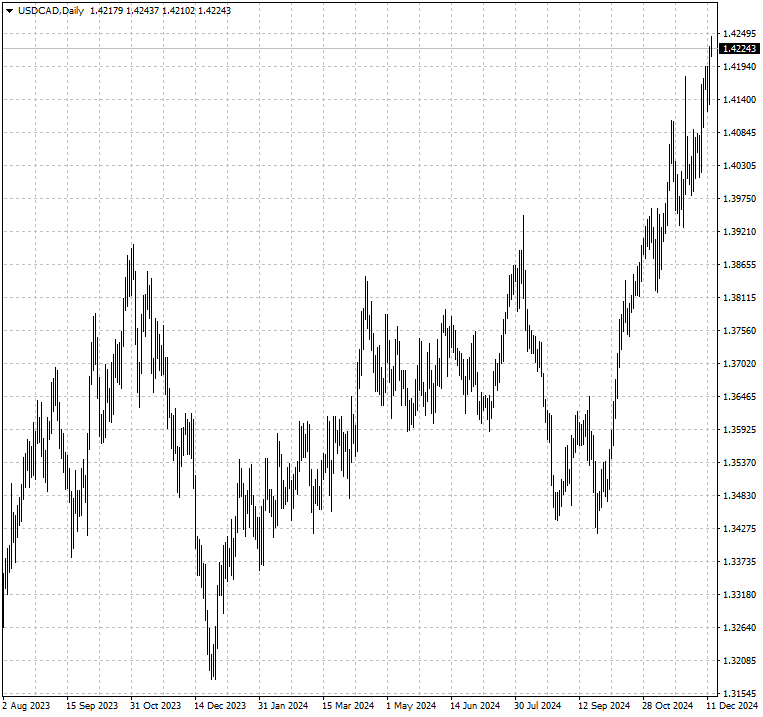

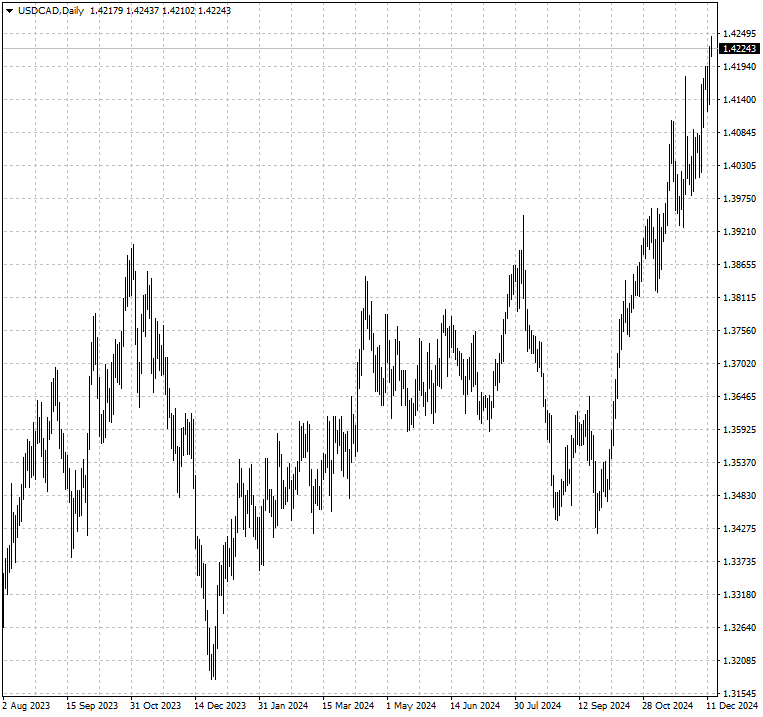

The Canadian dollar weakened to a 4.5-year low this week as the greenback

notched more gains and a recent widening in the gap between US and Canadian bond

yields weighed on the currency.

The BOC slashed its key policy rate by 50 bps to 3.25% on Wednesday to help

address slower growth, though Governor Tiff Macklem indicated that further cuts

would be more gradual.

The unemployment rate spiked to an 8-year high - outside the pandemic period

though twice the number of jobs expected were added to Canadian payrolls last

month.

Inflation rose to the 2% target in October, the first rise in the annual rate

since May, in line expectations. Signs of improvement in parts of the economy

suggest there is a risk it rises further.

GDP grew at an annualised rate of merely 1% in Q3, missing the central bank's

forecast of 1.5%. Unexpected growth in consumer spending and persistent

government expenditure failed to offset declines in business investments.

Low productivity has been a drag for years. The productivity gap with the US

stands at about $20,000 per person a year, putting Canadians' wages roughly 8%

below their US counterparts.

A bigger-than-expected trade deficit was recorded and the surplus with top

trading partner the US fell to its lowest this year, data showed on Thursday,

while exports rose for the first time since June.

Policy pivot

Concerns are growing that Trump may follow through on his tariff threat. PM

Justin Trudeau met with Canada's premiers on Wednesday to discuss plans to

address the border issue.

They are considering to spend hundreds of millions of dollars on it, possibly

even more than $1 billion, sources have told CBC News. Washington will likely

opt for lower proposed trade barriers given the appeasement.

"In this climate of heightened uncertainty", business investment or

international trade could hardly put wind in the sail next year, said Stephen

Tapp, chief economist at the Canadian Chamber of Commerce.

Canada has announced a sharp cut in the number of immigrants it allows into

the country in an effort to "pause population growth", marking a notable shift

in policy for the government.

That is the aftermath of Democratic Party's electoral rout. Americans' angst

over social changes is shared by their northern neighbours who favour mass

deportation, according to a Leger poll.

Trudeau said last month he would lead his Liberal Party into the next

election due Oct 2025. He is supposed to would lose badly to Conservatives of

Pierre Poilievre and hence some policy reforms underway.

A mini budget to be posted next week could present his rivals another

opportunity to win at a time of significant economic and fiscal challenges. More

are needed to "make Canada great again."

Besides tariffs

In addition, Trump's planned tax cuts would wipe out Canada's slim corporate

tax advantage, likely driving more capital from the northern nation and

deepening its productivity crisis.

After accounting for provincial and state levies, corporate income tax rates

are nearly the same in the two North American countries, said John Oakey, vice

president of taxation with CPA Canada.

Moreover the government's decision to raise the capital gains inclusion rate

in June to "make Canada's tax system fairer" drew the ire of many economists and

businesses.

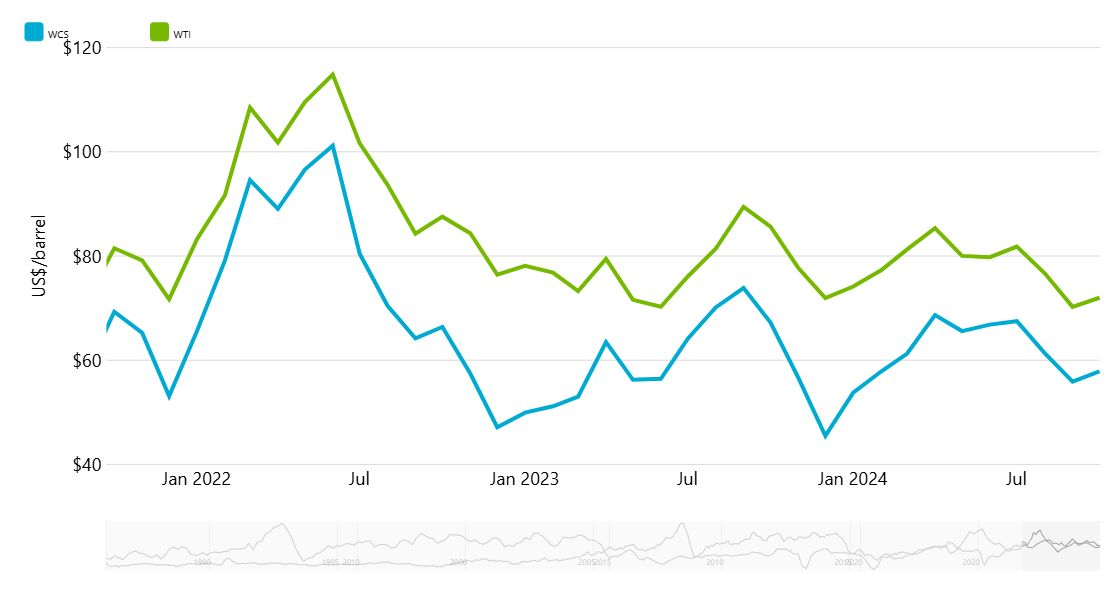

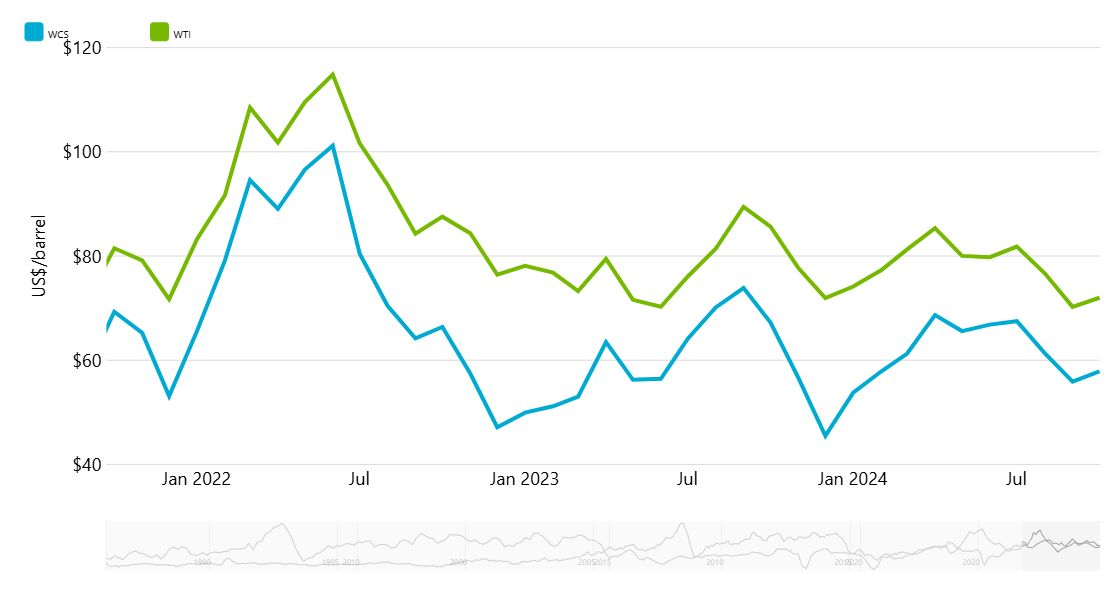

The oil market has also moved against the economy. Last month Citi forecasted

that Trump's second term could exert downward pressure on oil through 2025 due

to trade war and pro-oil policies.

API was calling for him to lift the pause on new LNG export projects, process

pending applications to export LNG and to increase federal leases to develop

offshore and onshore oil and gas patches.

The IEA increased its forecast for 2025 global oil demand growth to 1.1

million bpd from 990,000 bpd last month, thanks to China's recent stimulus

measures, it said in its monthly oil market report.

Despite that, the agency still forecast a surplus for next year, when

non-OPEC+ nations are set to boost supply by about 1.5 million bpd, driven by

Argentina, Brazil, Canada, Guyana and the US.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.