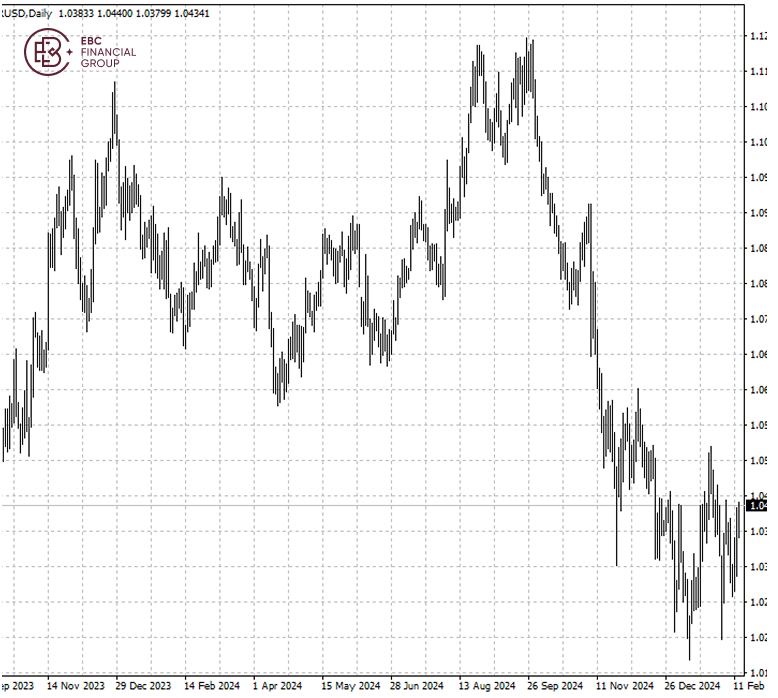

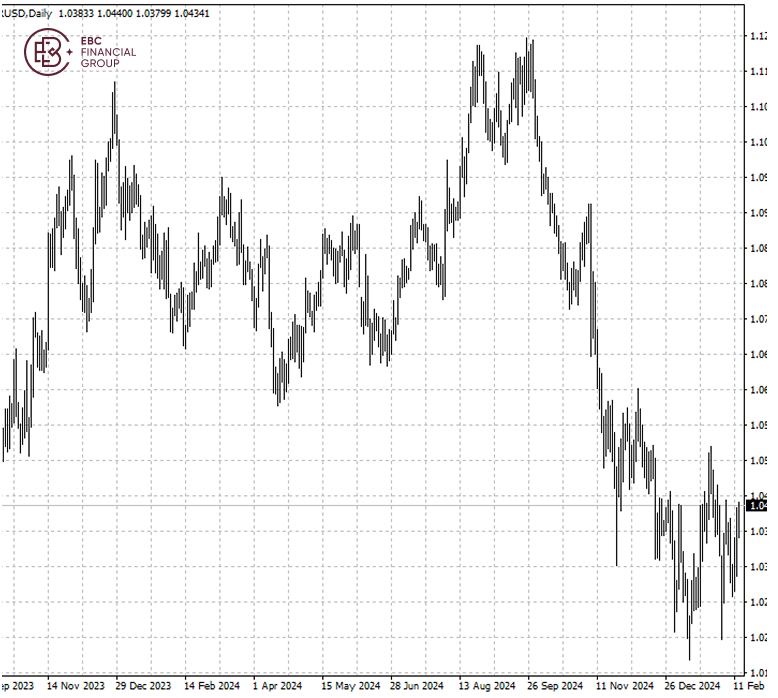

The euro has barely moved so fat in 2025. But near one-third of currency

strategists polled by Reuters are now expecting it to fall to parity with the

dollar or below versus only one-fifth last month.

The median survey view was for the euro to hold steady over the coming three

and six months at $1.03, and strengthen about 2% in the second half of the year

to $1.05 at the end of January.

However, the dollar's strength could out of steam in Q2 and weaken over the

longer run, "but conviction on when this turning point will happen is quite

low," said Meera Chandan, co-head global FX strategy at JP Morgan.

An FT report outlined the reasons the American economy will continue to

outperform. For Europe, the US has been less affected by the war in Ukraine,

owing to its abundant domestic energy supplies.

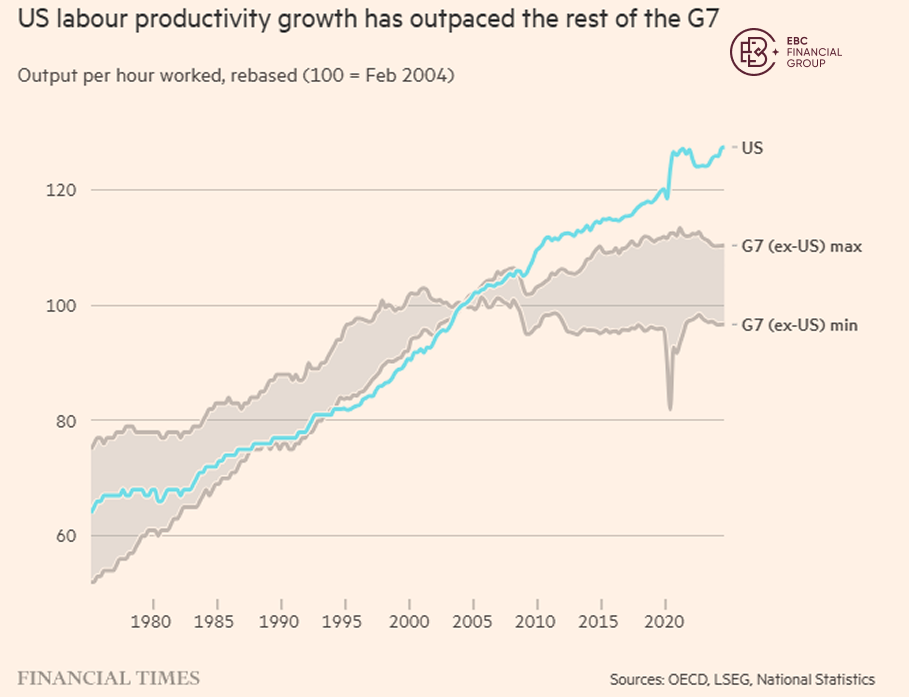

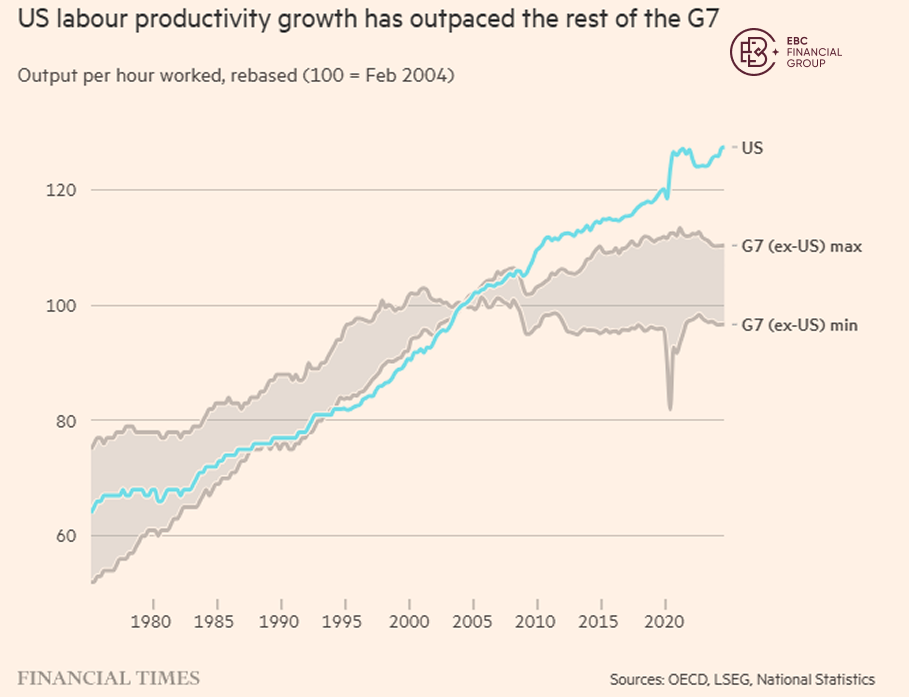

Apart from aftermath of the war, US labour productivity has grown by 30%

since the 2008-09 financial crisis, more than three times the pace in Europe – a

wide gap contributing to the "American exceptionalism."

Globally, the top R&D spenders are increasingly concentrated in the

technology sector which is dominated by US companies. Europe has showed little

sign of this dynamism.

According to Oxford Economics, the level of private investment in the

eurozone would be reduced by almost 2% by the end of 2027 as a result of pending

tariffs on the bloc.

MAGA 2.0

Donald Trump's threatened trade war is driving a wider wedge between the Fed

and the ECB. Powell indicating interest rates will remain on hold given the

strong US economy and political uncertainties.

Traders have taken note of the trend, pricing in more cuts outside of the US

since the election. They still expect another three to four 25-bp rate cuts from

the ECB this year.

"A few years ago, central banks were quite reluctant to move away from the

Fed …" said Dario Perkins, economist at TS Lombard. "It's a much clearer policy

decoupling now."

With inflation much higher than that in 2018, Trump's tariffs are expected to

hit prices more than during his first term. He has targeted nearly every major

trading partner of the US within less than a month.

Empirically MAGA causes a one-off inflationary shock on the countries which

"take advantage of" the US, but can lead price rises to settle at rates higher

than central bankers might like.

European leaders vowed on Tuesday to retaliate after Trump announced that he

would raise tariffs on aluminium and steel to 25%. That could be the first of a

series of "reciprocal" tariffs.

According to Citi, even if the EU imposed a 10% retaliatory tariff on US

non-energy imports, it would have a very small 0.05% upward impact on core

consumer prices inflation.

A hard peace deal

Trump said on Sunday he believed he was making progress in its talks to end

the war between Russia and Ukraine, but declined to provide details about any

communications he had had with Putin.

The US president also wants to meet up to discuss the issue. Saudi Arabia and

the UAE are seen by Russia as possible venues for a summit, Reuters reported

earlier this month.

Last year Putin set out his opening terms for an immediate end to the war:

Ukraine must drop its NATO ambitions and withdraw its troops from the four

regions claimed and mostly controlled by Russia.

Zelenskiy has agreed to supply the US with rare earths and other minerals in

return for financially supporting its war effort. That assuages concerns that

Washington will abandon Ukraine.

About 40% of Ukraine's metal resources are now under Russian occupation,

according to a think tank. That means the US is providing itself with advance

payment guarantee by commitment to a ceasefire.

Business confidence in Europe will get a boost if Trump can deliver his

promise. Still that is unlikely to happen until the dust settles on the

battleground, so European assets shrugged off the news.

Surprisingly Trump suggested Ukraine possibly losing its sovereignty to

Russia in the latest interview. The appalling speech underscores uncertainties

around the outcome of the war.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.