On Sunday, Kylian Mbappé, representing France at the Euro 2024 tournament,

said he was "against extremes and divisive ideas" and urged young people to vote

at a "crucial moment" in French history.

The comments from sparked a stream of controversy, with figures on the right

warning him against interfering in politics. France's men's football team has

long been seen as a beacon for diversity in the country.

Several dozen French sports personalities have voiced their support for

liberalism as initial polls suggest the far-right National Rally may win the

largest number of votes in the upcoming election.

Early polls put the RN out in front on more than 30%, with the presidential

group in third place. And the short time frame for campaigning is putting

pressure on all the parties.

Candidates had until Sunday evening to register for the 577 seats in the

National Assembly that will be contested in the first round of parliamentary

elections on 30 June, with the decisive second round on 7 July.

Macron has ruled out stepping down regardless of the final outcome, though he

will likely lose his grip on the nation. The snap election also puts France’s

stock market and the euro at stake.

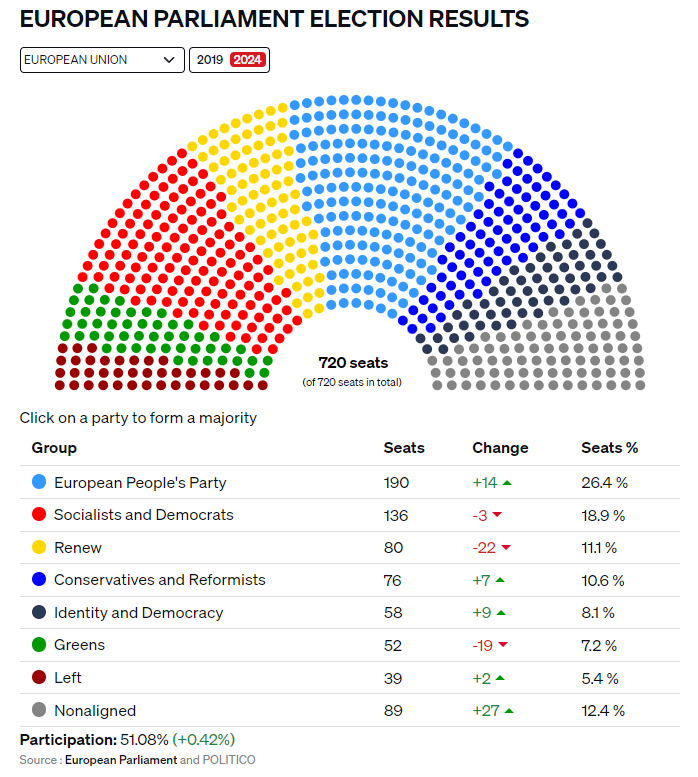

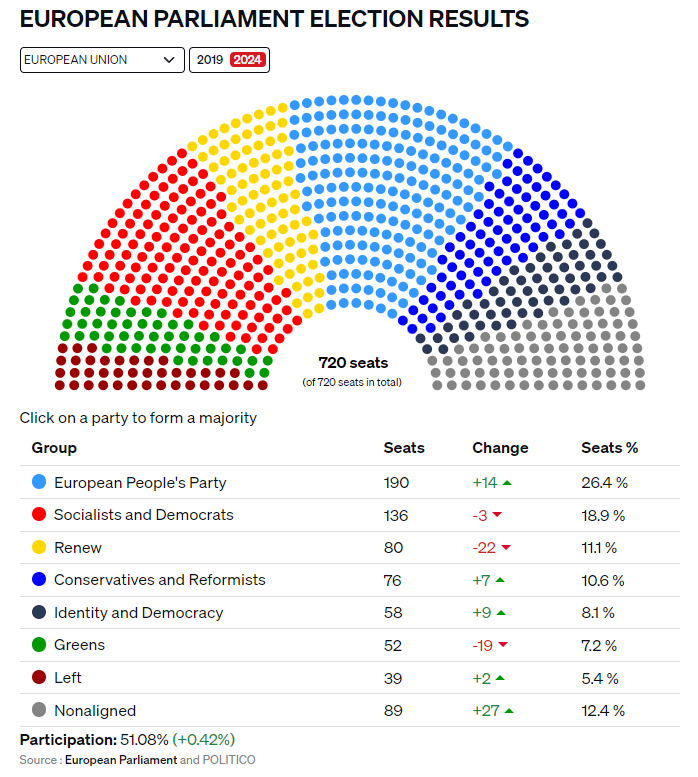

European assets mostly plunged after the far-right gains unexpectedly made

significant gains in the recent European parliamentary elections partly due to

soaring prices and border crisis.

French assets selloff

Investors were more likely to expect French stocks to fall over the next 12

months compared to any other equities across the continent, according to a poll

of fund managers by BofA.

It is a sharp swing from May when investors considered stocks in French

markets to be their top choice and the CAC 40 was hitting record highs. Last

week the index logged its worst performance since Mar 2022.

Along with an equity sell-off, borrowing costs climbed and the spread between

French and German 10-year bond yields widened by 25 bps. That trend is expected

to continue in the coming weeks.

French stocks are likely to take a further beating from political risk in the

weeks and months ahead, but the impact will be focused in certain areas,

according to strategists at Goldman Sachs.

They warned that domestic stocks are particularly vulnerable and recommended

defensive sectors such as health care for hedging political uncertainty in the

short term.

However, the bank argued that Le Pen’s party could prove more

business-friendly than expected in the longer run if it remains focused on

securing a candidate victory in the 2027 presidential election.

On a broader view, a higher perception of political risk in Europe will

maintain the region’s valuation gap with the US although the CAC 40 as a whole

has only around 20% French exposure.

Back to top spot

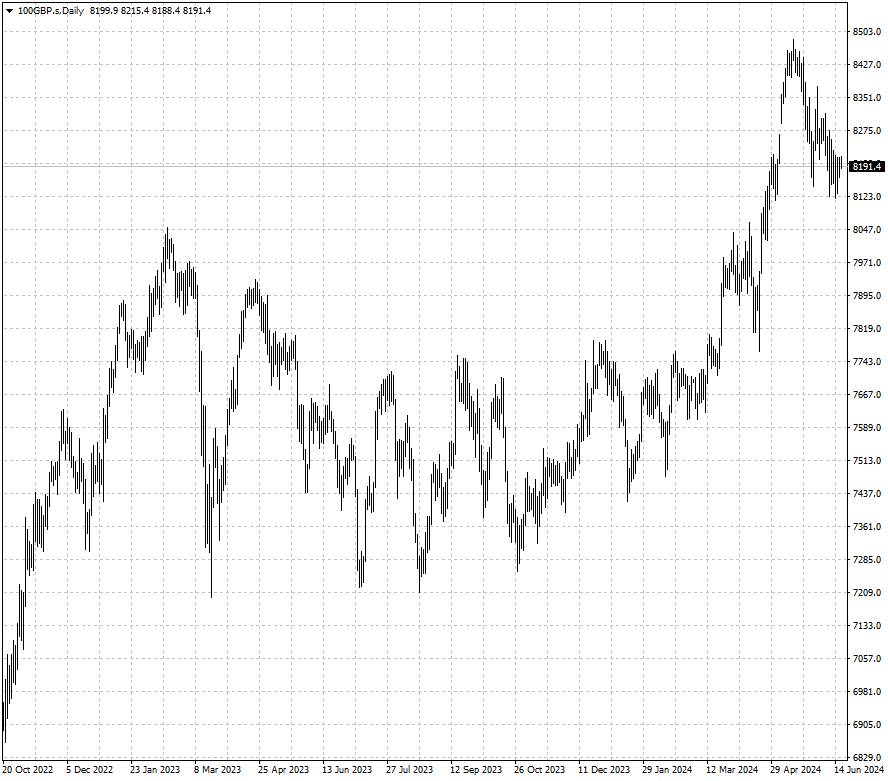

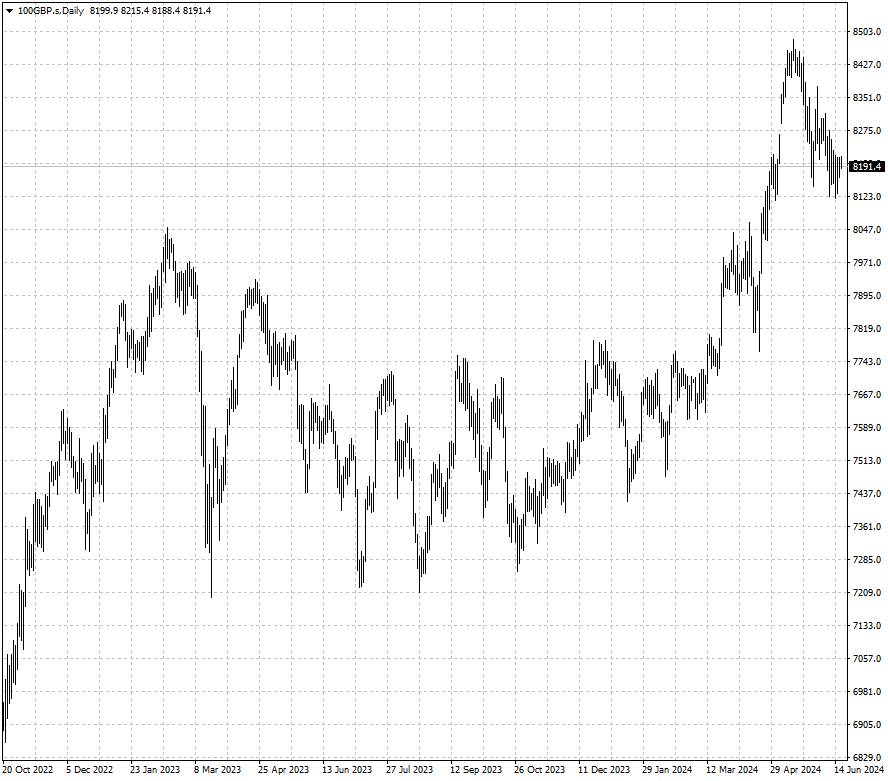

The UK’s main stock market retook its crown as Europe’s most valuable for the

first time in nearly two years, data shows. The total value of companies listed

on the LSE has exceed that listed in Paris.

The valuations remain close, but analysts describe it as a milestone. They

say the UK market is recovering after several years of underperformance while

unease stirs in France.

Analysts blamed the LSE’s poor performance over the past few years on the

fallout from former Prime Minister Liz Truss’s mini-Budget, a weak pound,

recession fears and Brexit.

Both the Labour Party and the Conservative Party have been trying to convince

investors of its approach to businesses. Chancellor Jeremy Hunt said last month

the UK market was underestimated.

Rolls-Royce led the FTSE 100 gains, rising around 56% this year, due to

travel and transport boom after the pandemic. Banking stocks in the index also

surged on higher for longer interest rates.

St James's Place said, the discount between UK stocks and their US peers has

historically hovered between 15-25% on average, whereas it now stands at

approximately 45-50%.

Still investors opted to cash in on the rally. In May, UK equity funds

enjoyed their 36th month in a row of outflows. That’s three consecutive years of

relentless cash drain from the UK stock market.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.