The ASX 200 index rose by 5.8% so far this year, underperforming most major

stock markets, as China’s malaise is denting raw material demand – a vital

source of Australia’s revenue.

Iron ore price hit the lowest level since 2022 last week and has stayed below

$100 per ton. The steel staple is among the biggest losers in the commodity

market while gold has just set its record high.

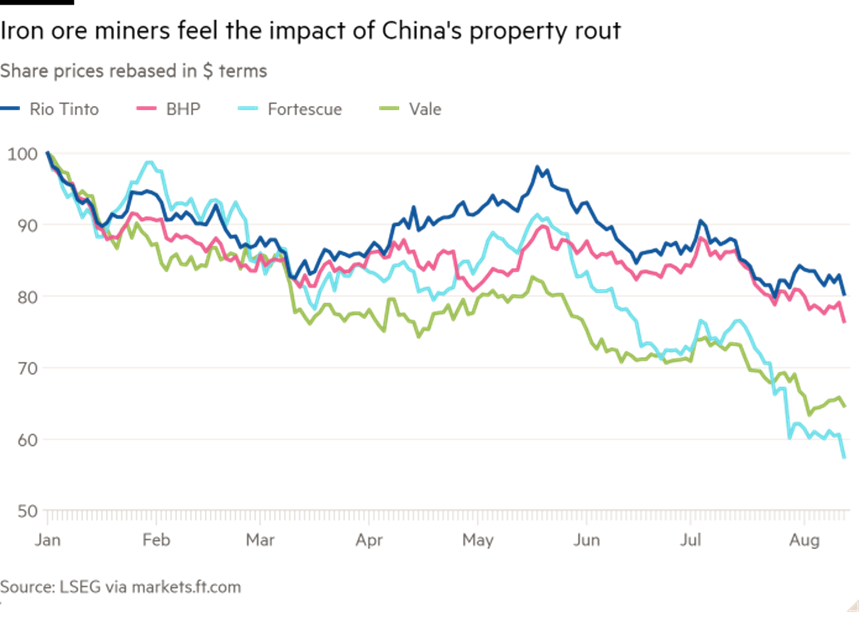

The yearly decline of roughly 28% cumulatively has wiped off about $100

billion in market capitalisation of the “big four” iron ore miners — BHP, Rio

Tinto, Vale and Fortescue.

For big miners such a BHP and Rio Tinto, iron ore gives them the firepower to

make bumper returns for investors and a solid foundation for growth in other

commodities such as copper and fertiliser.

Rio Tinto’s first-half profit edged higher from the year before although it

narrowly missed estimates. Shares in Fortescue, which derives more than 90%of

revenues from the commodity, has been hit harder.

BHP and Vale pumped out iron ore at record volumes in the first half of 2024.

Analysts said the market players would probably be disciplined to prevent iron

ore prices from collapsing too far.

The broader mining sector is also chasing acquisitions after a period where

shareholder returns took centre stage, with BHP’s fruitless attempt to acquire

Anglo America in May.

Industry Downturn

China accounts for more than half the world’s steel output. Hu Wangming,

chairman of Baowu Steel, recently said the industry was in the midst of a

long-term adjustment period.

Steel makers’ margins are getting increasingly squeezed by weak demand which

is expected to continue into 2025 on the back of a “very weak” Chinese property

market, according to BofA.

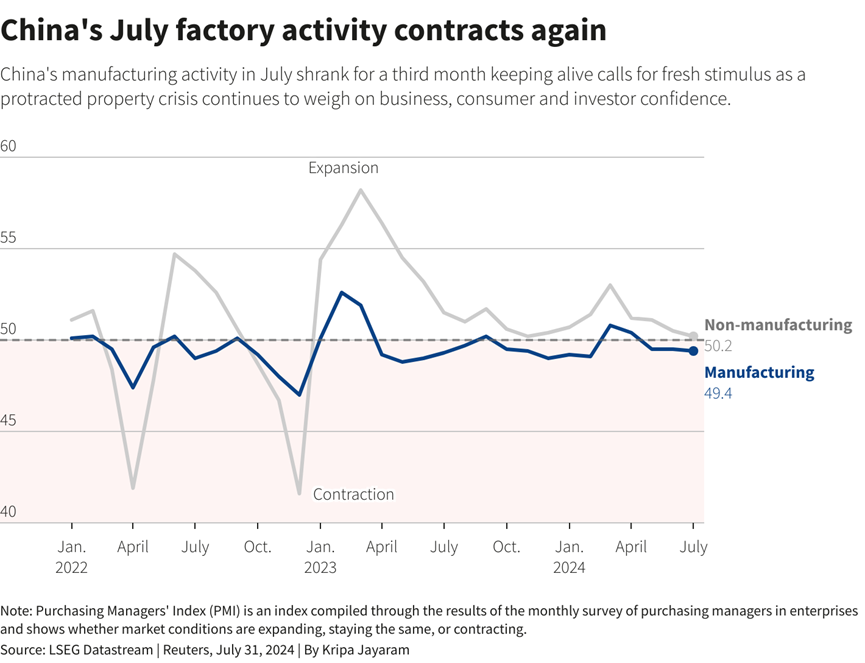

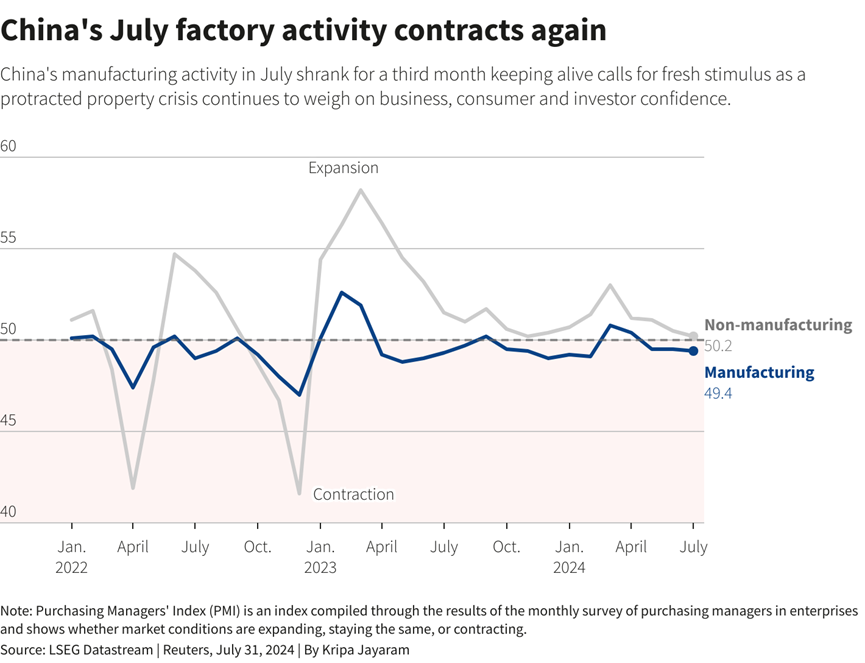

Manufacturing activity slipped to a five-month nadir in July as factories

grappled with falling new orders and low prices, pointing to a grinding second

half for the world's production powerhouse.

“Steel mill margins in China are at risk of falling to the most negative

levels this year, applying potentially even more downward pressure on iron ore

prices,” said Commonwealth Bank of Australia.

Citigroup’s three-month outlook for iron ore was cut to $85 a ton from $95 as

excavator sales, leading indicator of construction activity, in China are

expected to be down 8% year on year for FY24.

Macquarie expect iron ore to remain under pressure, creating a glut. If weak

prices persist, that could be a challenge for the highest-cost producers as

their operations risk becoming unprofitable.

Oversupply is not going to stop at marginal cost, said the investment bank.

“You probably would see prices at high $80s, $85, clearly taking out all the top

portion of the cost curve.”

Big Four

ASX 200’s largest constituent – financial stocks – has seen a substantial

gain of approximately 20% in 2024, more than offsetting a plunge of nearly 16%

in the basic material sector.

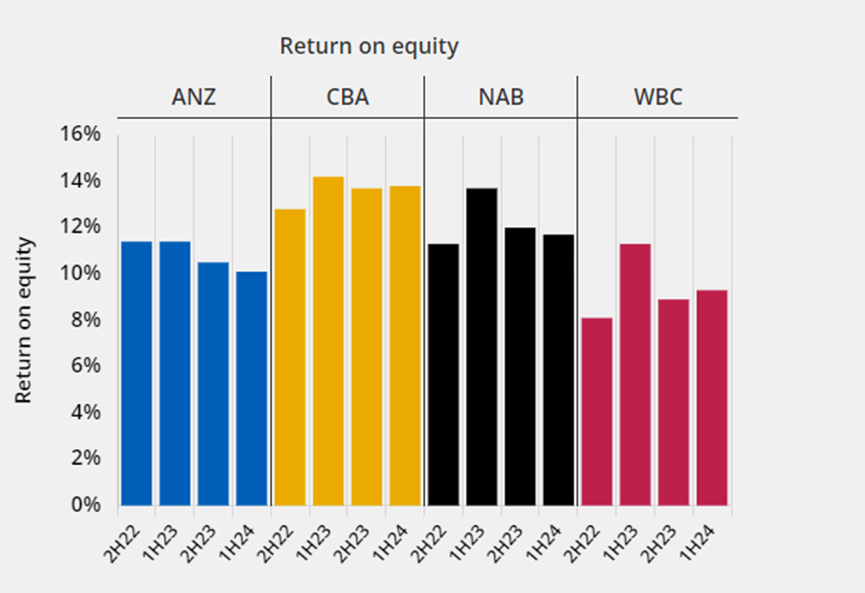

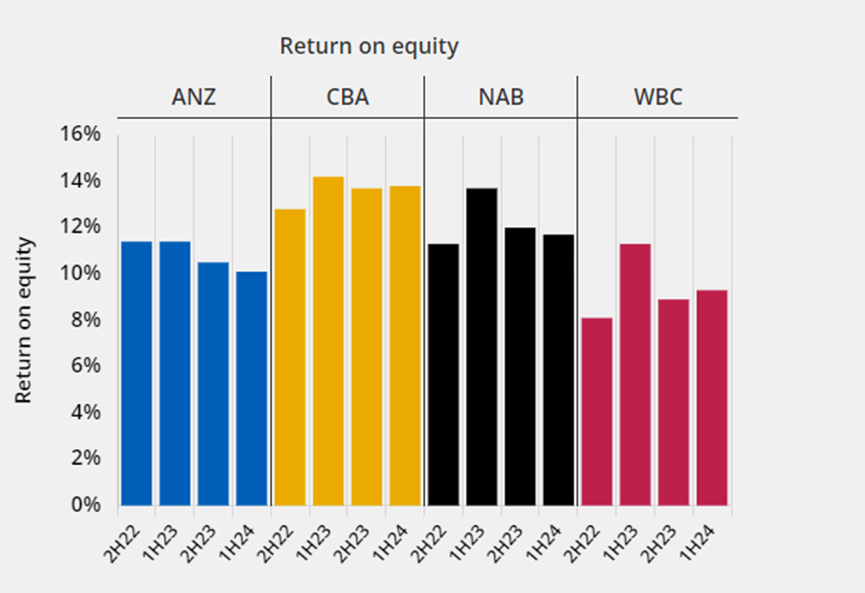

The big four banks down under have reported stable results in the first half

of FY24, according to KPMG’s analysis. They reported a combined profit after tax

of $15 billion, down 10.5% from a year earlier.

ROE over the period decreased compared with 2H23 by 12 bps, to an average of

10.9%. But the companies carried out $2 billion in shares buy backs, which

helped push the share prices higher.

In the year to May, insolvencies reached a record high, according to

CreditorWatch. Crippling interest rates and sky-high prices of everyday items

are behind the business predicament.

Consumer prices in the past 12 months increased by 3.8% annually in Q2,

faster than the 3.6% growth in previous quarter. Sticky inflation has eased

hopes of looser financial conditions.

The RBA judged a near-term rate cut was unlikely and policy might need to

stay restrictive for an "extended period", after debating whether or not to hike

in August.

Analysts have trimmed forward earnings expectations for Australia by almost

4% over the past year - a sign that the ASX 200 could be shaping up for

correction before long, according to data compiled by Bloomberg.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.