Current Gold Price Trend and Historical Context

Gold has long been revered as a store of value and a hedge against economic instability. In the aftermath of the pandemic and amid a series of macroeconomic uncertainties, gold entered a bullish phase. Between late 2023 and early 2025. the precious metal surged from under $1.800 per ounce to above $3.500—a remarkable climb driven by inflation fears, central bank buying, and geopolitical tensions.

Yet history teaches us that such rapid ascents are often followed by periods of correction. Previous gold bull markets—in the 1980s and again in the early 2010s—eventually peaked and declined once economic conditions stabilised and alternative assets gained appeal. As of mid-2025. many analysts are now wondering: have we reached a turning point?

Impact of U.S. Federal Reserve Policy and Rate Cuts

One of the most important factors influencing the gold rate is the stance of the U.S. Federal Reserve. Gold tends to thrive in low-interest-rate environments, where the opportunity cost of holding non-yielding assets is minimal. However, the narrative has shifted.

In 2022 and 2023. aggressive rate hikes by the Fed in response to inflationary pressures caused a temporary dip in gold. But when inflation eased in late 2024. market expectations turned to rate cuts. The Fed's pivot has indeed provided support to gold in the first half of 2025—but this support may not last indefinitely.

If the Federal Reserve slows the pace of rate cuts or signals a return to a more hawkish stance due to resilient inflation or a stronger labour market, gold could experience downward pressure. Moreover, if real interest rates (nominal rates minus inflation) start to rise again, investors might prefer bonds and other yield-generating instruments over gold.

Influence of U.S. Dollar Strength and Exchange Rates

The inverse relationship between the U.S. Dollar and gold prices is well-documented. When the dollar strengthens, gold becomes more expensive in other currencies, thereby reducing global demand. Conversely, a weakening dollar typically supports gold prices.

In 2025. the dollar has shown surprising resilience, supported by capital inflows into the U.S. equity market, a still-robust economy, and diverging monetary policy paths between the Fed and other major central banks. If this trend continues—especially if the European Central Bank or Bank of Japan delays their own easing cycles—gold may see reduced upward momentum.

Currency markets are also pricing in a relatively stable macroeconomic outlook for major economies, which diminishes the urgency for gold as a currency hedge.

Effect of Easing Geopolitical Tensions and Trade Deals

Geopolitical uncertainty is often a major driver of gold rallies. In recent years, global markets have contended with the war in Ukraine, U.S.-China tensions, energy disruptions, and sporadic regional conflicts. Each flare-up has corresponded with a spike in gold prices, as investors rushed into safe-haven assets.

Yet by mid-2025. there are signs of easing in several fronts. Ceasefire agreements in Eastern Europe, resumed diplomatic channels between major global powers, and renewed trade discussions have all contributed to a slight softening of risk sentiment. Should these developments persist, investor demand for gold as a crisis hedge could wane, pulling prices lower.

That said, geopolitical risks are notoriously unpredictable. Any resurgence in global instability could quickly reverse this trend.

Role of Central Bank Gold Purchasing Trends

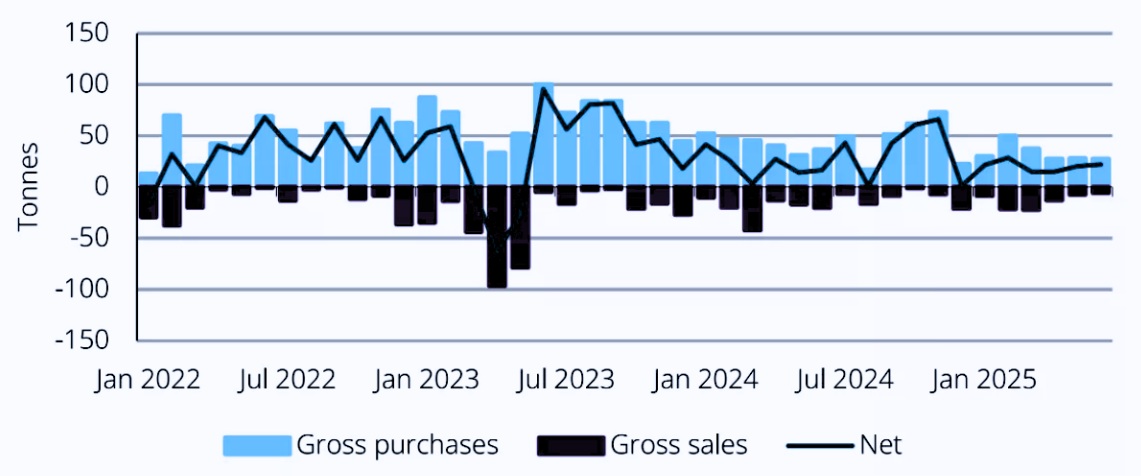

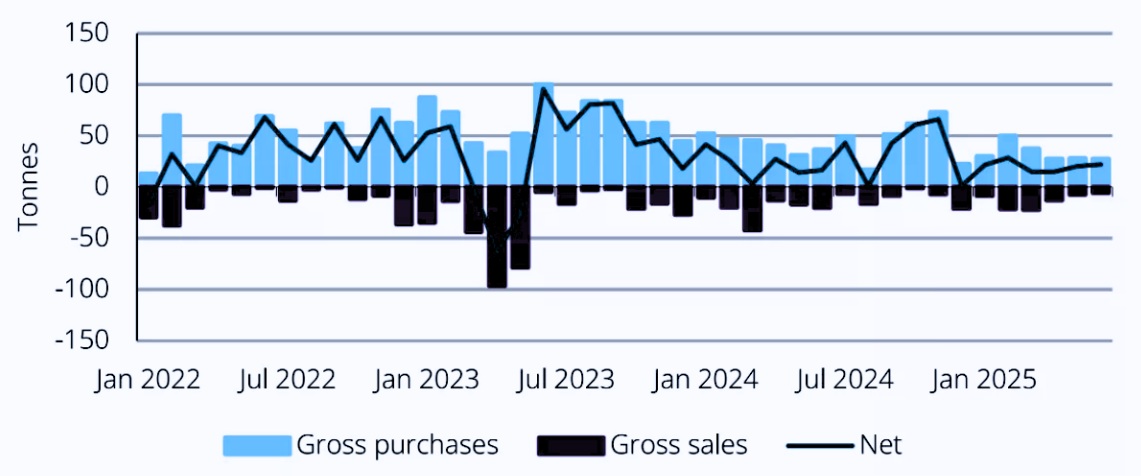

Over the past few years, central banks—particularly those in emerging markets—have been major buyers of gold. Their motivations include diversification away from the U.S. dollar, inflation protection, and enhancing reserve security.

According to the World Gold Council, central bank purchases hit record highs in 2023 and remained robust into 2024. However, in 2025. there are initial indications that this buying spree may be tapering off. Countries like Turkey, India, and several African central banks have signalled a slowdown in accumulation, either due to domestic liquidity constraints or reallocation to other reserve assets.

If global central bank demand weakens materially, it could remove a major pillar of support for gold prices in the latter half of 2025 and beyond.

Expert Forecasts: Short-Term Correction vs Long-Term Uptrend

Financial analysts and commodities strategists are currently divided on the outlook for gold. While many maintain a long-term bullish view—citing structural inflation, debt overhang, and de-dollarisation trends—there is growing consensus around a possible short-term correction.

Goldman Sachs, UBS, and JPMorgan have all recently revised their gold price forecasts downward for Q4 2025. citing reduced central bank demand, relative dollar strength, and easing geopolitical anxieties. Some foresee gold potentially retracing to the $2.800–$3.000 range before stabilising.

However, few believe the broader bull market is over. Instead, the dominant narrative suggests a "healthy correction" as part of a longer-term structural uptrend—driven by macro shifts like climate policy spending, long-term fiscal deficits, and global reserve diversification.

Conclusion

While gold has enjoyed an extraordinary run, multiple macroeconomic factors suggest the rate may decrease in the second half of 2025. A slowdown in central bank purchases, strengthening dollar, moderated Fed easing, and reduced geopolitical risk could all contribute to a correction. However, rather than a sharp plunge, what appears most likely is a gradual cooling in prices—a reset before potentially resuming a long-term climb.

For investors and analysts alike, the key will be to monitor interest rate developments, inflation dynamics, and global capital flows. Gold may be glittering slightly less brightly than in recent quarters—but it remains a vital asset in the evolving global financial landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.