Exchange‑traded funds (ETFs) have revolutionised investing by offering low‑cost, liquid exposure to a wide range of asset classes. But with over 2,000 ETFs available in markets like the U.S., picking the right one can feel overwhelming.

In this guide, we simplify the landscape by explaining ten popular ETF types, such as broad market index funds and niche thematic plays, and show you how to determine which suits your investment goals.

Top 10 Types of ETFs to Add to Your Portfolio

1. Broad Market Index ETFs

These ETFs follow major, recognisable indices such as the S&P 500, MSCI World, or FTSE All-World. They're ideal for investors seeking instant diversification across sectors and geographies with minimal cost and low tracking error.

Broad index ETFs form the core of many passive portfolios, offering steady exposure to economic growth globally while minimising complexity.

Why traders use them: They offer low cost, minimal tracking error, and solid long-term performance.

Examples: SPDR S&P 500 ETF (SPY), iShares Core MSCI World ETF (IWDA), Vanguard S&P 500 ETF.

2. Sector and Industry ETFs

Sector ETFs focus on specific industry verticals, such as technology, healthcare, energy, or financials and mirror a related index. These funds enable investors to focus on sectors where they anticipate long-term potential without owning specific stocks.

While sector funds increase concentration risk, they offer clear exposure to themes such as green energy, biotech, or infrastructure trends.

Why traders use them: They enable targeted exposure and sector rotation strategies without individual stock risk.

Examples: Technology Select Sector SPDR (XLK), Health Care Select Sector SPDR (XLV), Energy Select Sector SPDR (XLE).

3. International and Regional ETFs

For investors seeking exposure beyond domestic markets, international ETFs track equity markets by region or country. These help diversify currency, geopolitical, and growth factors, complementing core domestic holdings and hedging home bias.

Emerging-market ETFs notably represent rapidly expanding economies but with increased volatility and reliance on commodity cycles.

Why traders use them: They diversify currency and country risk and let you capitalise on regional economic growth.

Examples: iShares MSCI Emerging Markets ETF (EEM), Vanguard FTSE Europe ETF (VGK), iShares Asia 50 ETF.

4. Bond and Fixed Income ETFs

These ETFs expose you to government, corporate, or municipal bonds. They vary in duration, credit quality, and yield structure. ETFs focused on short, intermediate, and long maturities help tailor interest‑rate sensitivity and income preferences.

As a passive investor, bond ETFs offer predictable yield and liquidity to stabilise a portfolio with risk mitigation, especially during equity market downturns.

Why traders use them: They provide liquidity, predictable income, and hedging during equity drawdowns.

Examples: iShares Core U.S. Aggregate Bond ETF (AGG), Vanguard Interm-Term Treasury ETF (VGIT), iShares iBoxx $ High Yield Corporate Bond ETF (HYG).

5. Commodity ETFs

Commodity ETFs track precious metals such as gold and silver, as well as industrial commodities like oil, agriculture, and copper.

They can hold physical bullion, futures contracts, or derivatives. Precious metals serve as traditional hedges against inflation, while energy and industrial ETFs align with economic cycles.

Investors can use them to diversify away from equities, hedge against macro uncertainty, or access demand trends in real assets.

Why traders use them: Commodities often rise during inflation or dollar weakness. ETFs make real-asset exposure convenient.

Examples: SPDR Gold Shares (GLD), iShares Silver Trust (SLV), Invesco DB Commodity Index Fund (DBC).

6. Thematic and Sector Broad ETFs

These ETFs capture long‑term trends in electric vehicles, artificial intelligence, clean energy, cloud computing, robotics, and biotechnology. They often combine companies from multiple sectors connected by a theme.

The potential upside is significant if themes gain traction, but risks increase due to a limited focus and growth valuations.

Why traders use them: They enable trend-based strategies and speculative positions aligned with structural growth trends.

Examples: Global X Robotics & AI ETF (BOTZ), ARK Innovation ETF (ARKK), iShares Global Clean Energy ETF (ICLN).

7. Dividend and Income ETFs

Created for those seeking yield, these ETFs contain stocks or bonds that pay high dividends or generate income. Examples include high‑dividend equity ETFs, preferred stock ETFs, or MLP and REIT income funds.

They attract retirees or investors insistent on consistent cash flow, but carry sensitivity to interest rate shifts and sector concentration risk.

Why traders use them: They generate reliable cash flow while offering equity exposure.

Examples: Vanguard High Dividend ETF (VYM), SPDR S&P Dividend ETF (SDY), Vanguard Real Estate ETF (VNQ) for REIT exposure.

8. ESG and ESG-Focused ETFs (SRI / Thematic)

Environmental, social, and governance (ESG) ETFs screen companies based on sustainability factors. These investments attract investors who value ethical principles and financial returns.

While controversy exists over greenwashing and tracking consistency, ESG ETFs continue to attract inflows, particularly among younger and ESG-conscious portfolios.

Why traders use them: They appeal to ethical investors and can align performance with long-term sustainable metrics.

Examples: iShares MSCI KLD 400 Social ETF (DSI), SPDR S&P 500 ESG ETF (EFIV), Vanguard ESG U.S. Stock ETF (ESGV).

9. Leveraged and Inverse ETFs

Leveraged ETFs aim to amplify daily returns (such as 2× or 3×) by using derivatives. Inverse ETFs deliver the opposite performance of an index. These are designed for short-term use, typically as tactical or hedging tools, not for buy-and-hold investors.

They have significant expenses, experience cumulative deterioration over time, and require constant supervision, making them unfit for long-term investments.

Why traders use them: They aim to systematically outperform market-cap exposures by leveraging documented factors.

Examples: Invesco S&P 500® Low Volatility ETF (SPLV), iShares Edge MSCI USA Momentum Factor ETF (MTUM), Vanguard Value ETF (VTV).

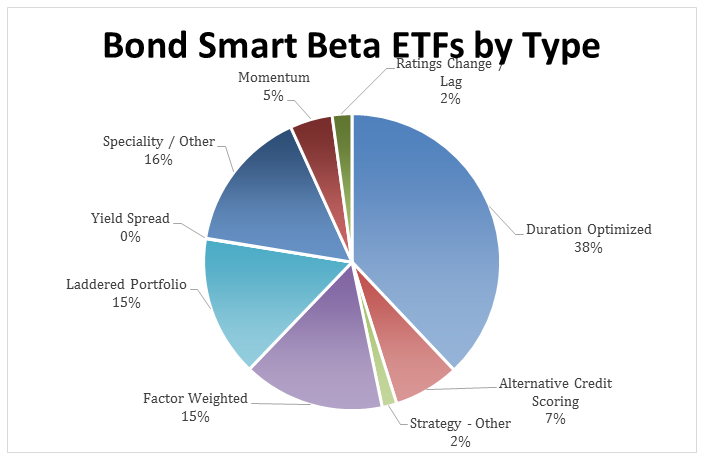

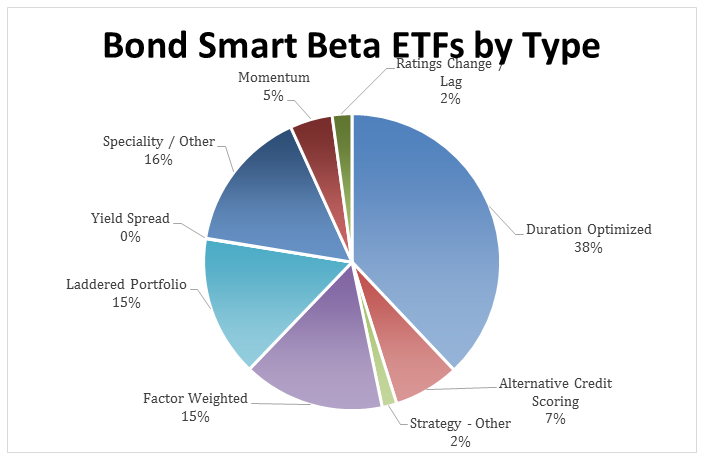

10. Smart Beta or Factor-Based ETFs

Smart Beta ETFs weight holdings based on factors like value, momentum, dividend growth, low volatility, or quality instead of traditional market-cap. These hybrid funds attempt to beat market returns systematically by tilting toward persistent drivers of performance.

They offer nuanced exposure, but performance varies by cycle. For example, some factors thrive during strong bull runs, others during defensive periods. Smart Beta adds complexity, but may enhance returns for long-term investors.

Why traders use them: For short-term tactical plays, hedges, or opportunistic trades aligned with daily moves.

Examples: ProShares UltraPro QQQ (TQQQ), Direxion Daily S&P 500 Bull 2X ETF (SPUU), ProShares UltraShort S&P 500 (SDS).

Factors to Weigh and How to Choose the Right ETF for Your Goals

Match Your Investment Objective

If you want broad exposure and low fees, stick with core market index ETFs. For income generation, consider dividend or bond ETFs. For targeting particular trends, thematic or sector ETFs are more effective. For inflation protection, commodity ETFs are more useful.

Review Expense Ratios and Holdings

Lower expense ratios improve compound returns over time, especially with broad index ETFs (often under 0.10%). Verify the clarity of investments, trading volume, and replication strategy before purchase.

Understand Liquidity and Bid-Ask Spread

Large, popular ETFs offer tighter bid-ask spreads and easier execution. Less liquid ETFs may carry higher transaction costs. Verify average daily volume and bid-ask spread, especially for niche or thematic funds.

Blend Core and Satellite Allocation

A strong portfolio typically employs a core-satellite strategy with a 60–80% allocation to broad index ETFs. Additionally, boost performance or yield with smaller satellite investments in sectors, themes, or income funds.

Understand Risk Factors

Factor-based and thematic ETFs often fluctuate more than core holdings. Bond ETFs have interest rate risk. Commodity ETFs may contain roll or contango costs. Know the inherent risks and align position sizing accordingly.

Example of Building a Balanced ETF Portfolio

A potential investor using a core-satellite approach could use:

60% in the broad market index ETF (SPY, IWDA)

15% in dividend/income or bond ETF (AGG, VYM)

10% in thematic opportunity (ICLN, ARKK)

5% in commodity hedge (GLD, DBC)

10% in factor-based exposure (SPLV, MTUM)

Adjust according to risk tolerance and horizon. Rebalance annually or semi-annually to maintain target allocation.

Frequently Asked Questions

1. What Are the Main Types of ETFs Beginners Should Know?

Beginners should start with broad market ETFs, sector ETFs, bond ETFs, and dividend ETFs. These types offer diversified exposure, are easy to understand, and come with relatively low risk, making them ideal for new investors.

2. Are Thematic ETFs a Good Investment Now?

Thematic ETFs can be good if you're targeting long-term trends in AI, clean energy, or robotics. However, they may be more volatile than traditional ETFs, so they're best suited as part of a diversified strategy.

3. Can I Build a Full Portfolio Using Only ETFs?

Yes, you can build a complete, diversified portfolio using ETFs. By combining broad market ETFs, bond ETFs, sector/thematic ETFs, and dividend ETFs, you can create a balanced strategy tailored to your risk and return preferences.

Conclusion

In conclusion, ETFs simplify investing by providing core index funds that deliver inexpensive, diversified access, while specialised thematic, bond, commodity, and factor funds enable personalisation.

If you're establishing a portfolio now, start with a broad index ETF and progressively add satellite investments such as income, thematic, or commodity ETFs as your strategy develops and your confidence increases.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.