EBC Forex Snapshot

12 Oct 2023

The US dollar hovers near a two-week low on Thursday ahead of important

inflation data. The recent weakness has been largely driven by declining

Treasury yields.

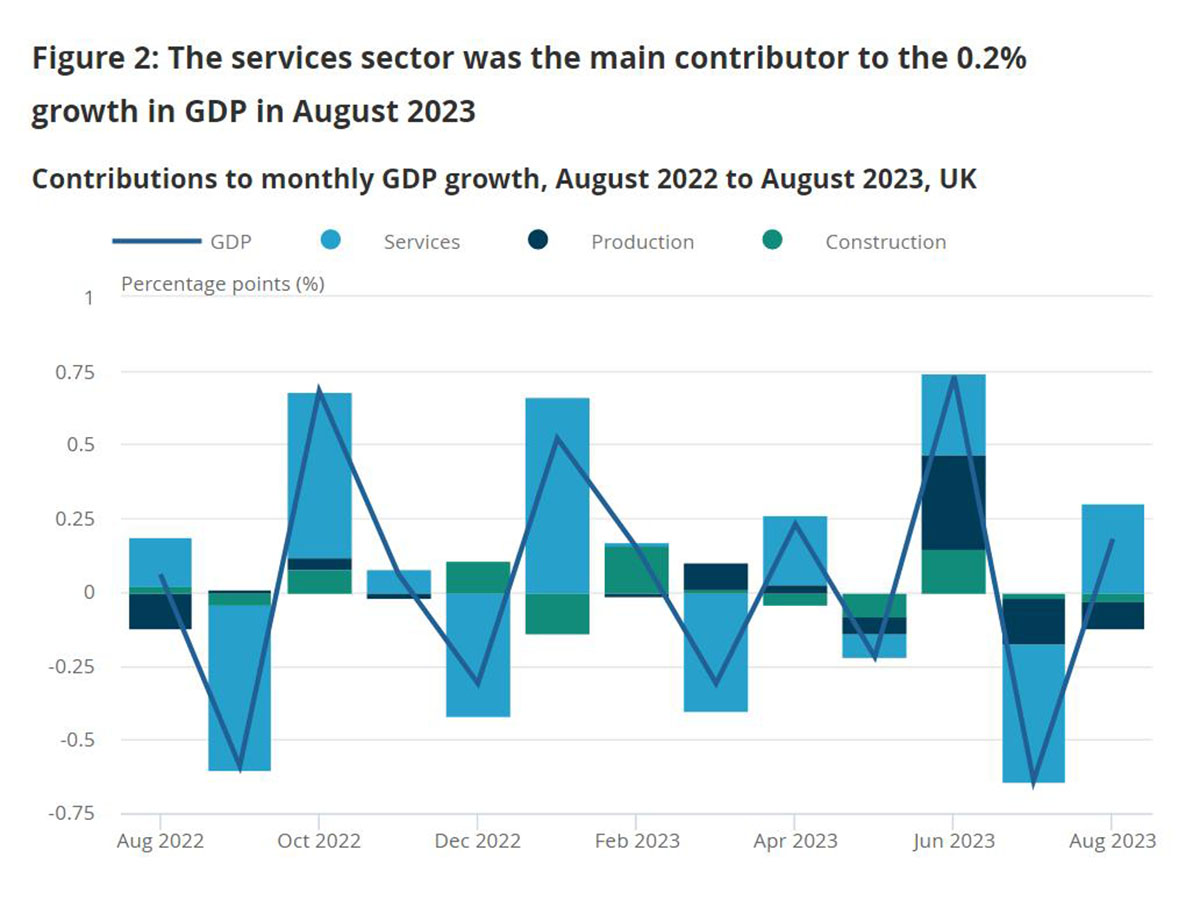

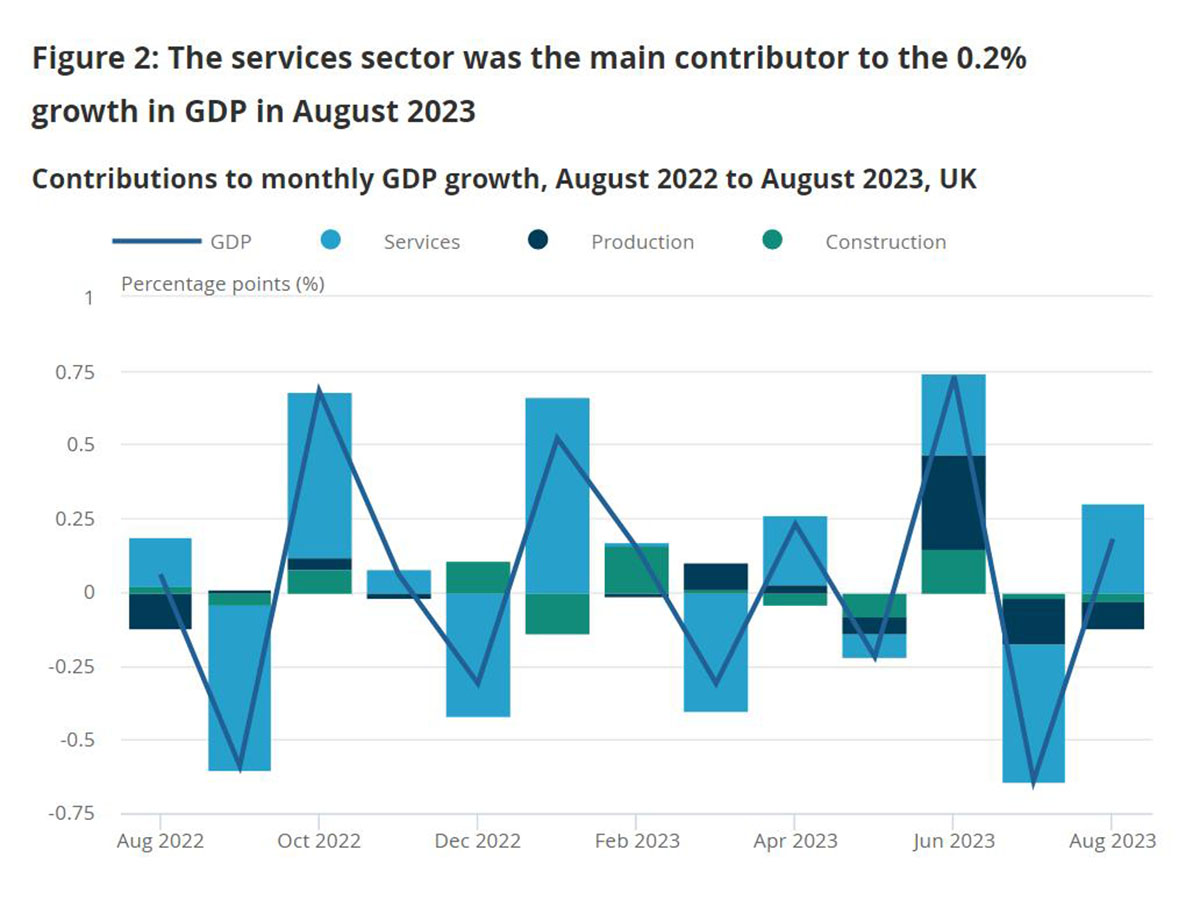

The UK economy returned to growth in August, as activity picked up but July’s

GDP report has been revised down to show a fall of 0.6% from 0.5%. The pound

barely reacted to the report.

Sterling was the best performing G10 currency in the first half of this year

before losing fizz due to softening inflation and weakening growth. Investors

are putting a chance of less than 25% on the BoE resuming its rate hikes in

November.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 3 Oct) |

HSBC (as of 12 Oct) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0477 |

1.0834 |

1.0491 |

1.0699 |

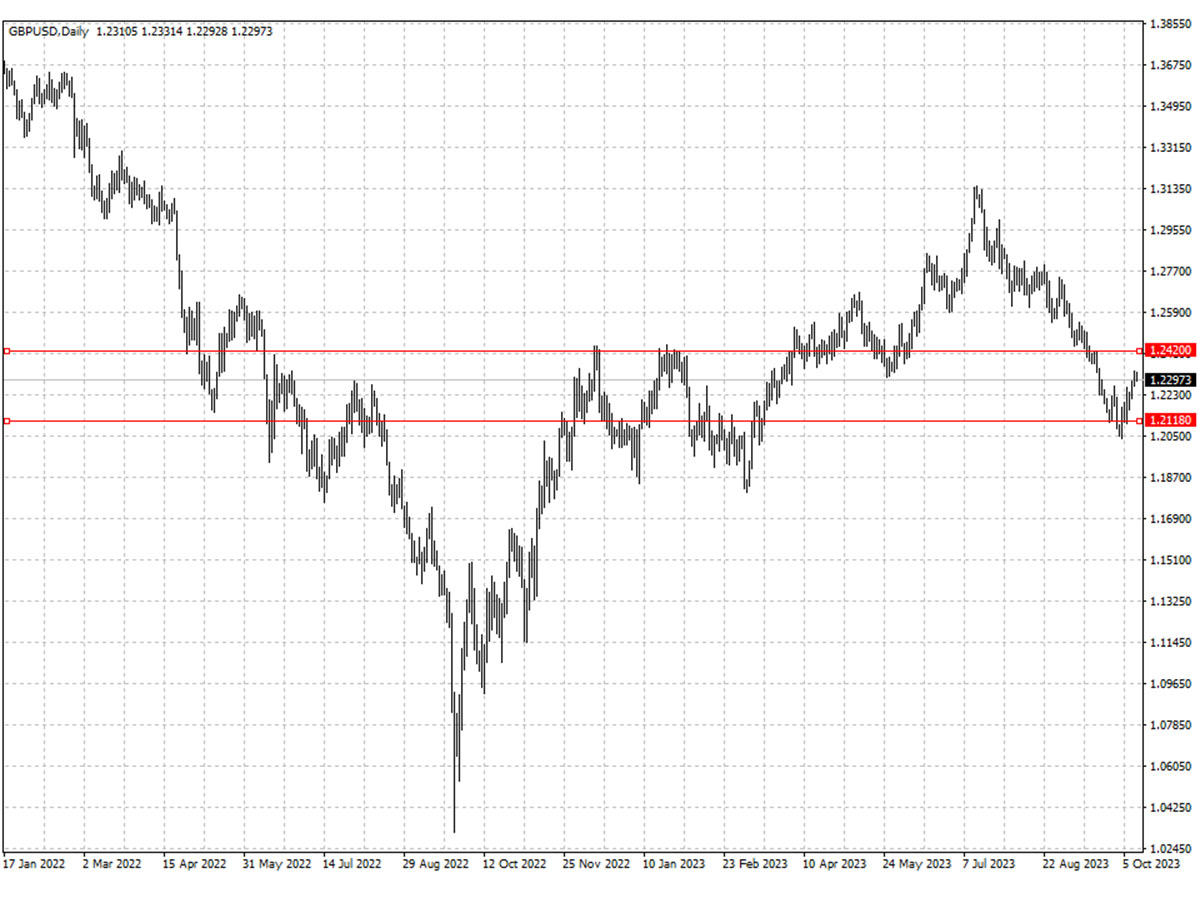

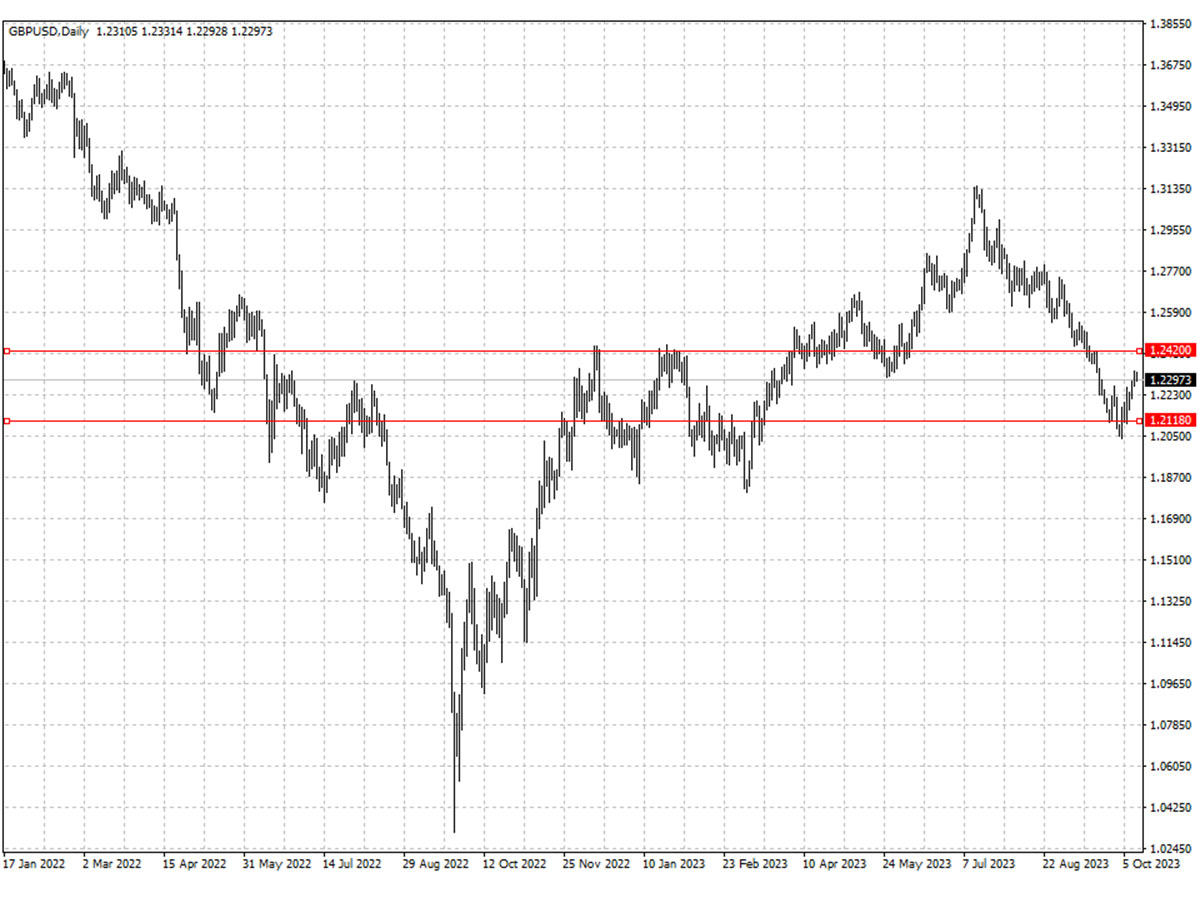

| GBP/USD |

1.2011 |

1.2308 |

1.2118 |

1.2420 |

| USD/CHF |

0.8745 |

0.9338 |

0.8931 |

0.9175 |

| AUD/USD |

0.6300 |

0.6522 |

0.6297 |

0.6515 |

| USD/CAD |

1.3302 |

1.3695 |

1.3410 |

1.3780 |

| USD/JPY |

144.54 |

150.15 |

147.63 |

150.42 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.