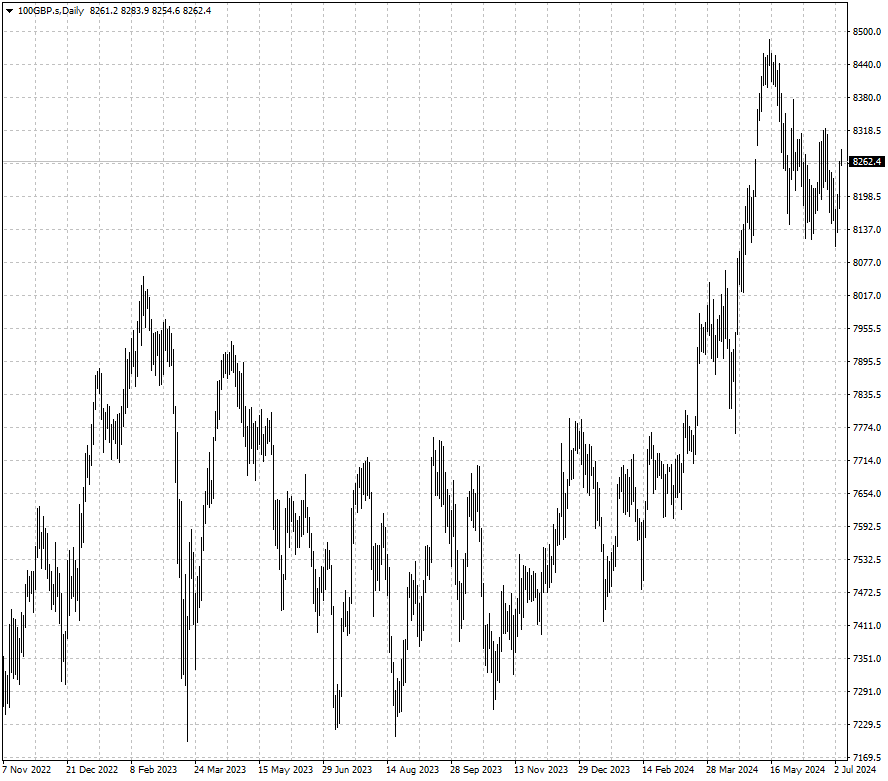

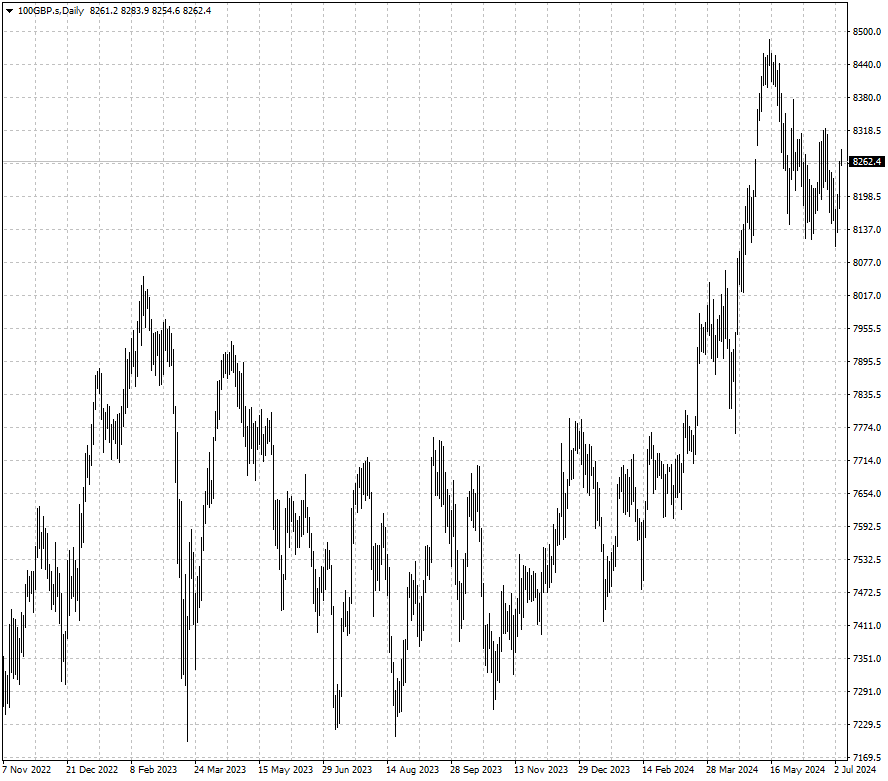

London's benchmark stock index closed at more than a two-month low on Tuesday

ahead of parliamentary elections. But now the market is set to advance for three

consecutive sessions.

The FTSE 100 rose 5.6% in the first half of 2024 while the CAC 40 was in the

red partly due to the rise of the far-right National Rally. They both

underperformed the DAX 40 that saw a gain of almost 9%.

According to the FT, some rich individuals in the UK were selling assets in

preparation for a Labour victory on concerns that the new government would

increase capital gains tax.

Shadow chancellor Rachel Reeves has said her party has no plans to raise CGT,

but she has refused to rule out increasing the levy in the next four years.

Nick Ritchie, a senior director at RBC Wealth Management, warned "you could

see a brain drain of people who are building businesses, creating jobs and have

already paid significant amounts of tax in the UK."

But data showed the opposite. The proportion of global fund managers who are

net-underweight on UK equities has fallen to the lowest in a year at 12%,

according to a survey from BofA.

That which helped spur the stock rally has signalled a significant turnaround

in sentiment after London's equities were mostly shunned by global investors

since the Brexit vote in 2016.

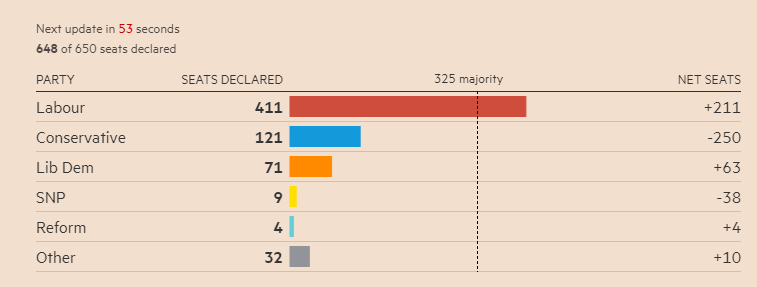

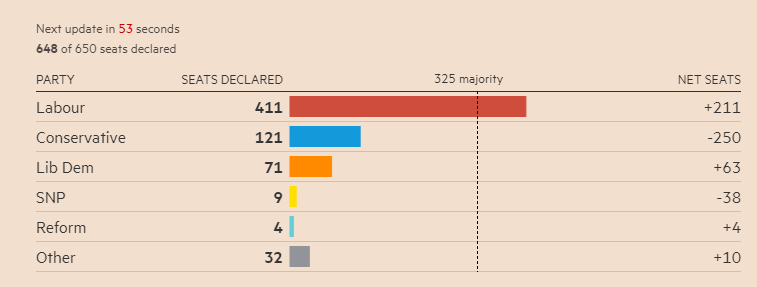

Labour Landslide

Labour has won a historic landslide victory in the UK general election,

returning to government after 14 years in opposition. The result was basically

predicted by exist polls.

The party was on course to secure a House of Commons majority of at least

168, despite gaining only 34% of the national vote, the lowest-ever winning

share.

That is similar in scale to the 179-seat majority won by Tony Blair in the

1997 election. About 60% of eligible UK voters cast a ballot this time – a

near-record low, according to the PA news agency.

It has been eight years since just under 52% of the British electorate voted

to leave the EU. Some Brexiters begin to doubt whether life outside the economic

and political union is really better.

Some analysts believe a thawing of icy relations between the EU and UK and,

perhaps, even a rapprochement with Keir Starmer at the helm. His party has been

broadly pro-EU.

"I think it would be the heartbeat of Keir Starmer and his close team to get

Britain back into Europe, and to ride roughshod over the democratic will of the

British people," said Matt Beech at the University of Hull.

The cannot be taken for granted. The EU has so far always stuck to its

position that Britain would not be able to "Cherry-Pick" the advantageous bits

of its former EU membership that it would like to keep.

Positive Reaction

UK domestic-focused stocks surged on Friday with the FTSE 250 hitting its

highest level since April 2022. Goldman Sachs raised its UK GDP growth forecast

and said the index is for investors to watch later on.

"Any changes in the UK's economic activity will impact the FTSE 250 more than

the FTSE 100. Investors feel that a labour government is going to be a positive

catalyst for the UK economy," said Michael Field, European market strategist at

Morningstar.

"A landslide victory provides the sort of clarity and stability that equity

markets need in an increasingly volatile world," said Ben Ritchie, head of

developed market equities at abrdn, who also favours the FTSE 250.

Allianze wrote in a note that the UK equity market will likely benefit from

the status as a political oasis of calm compared to other markets before the

second stage of voting in the French election.

According to OECD data, GDP per hour worked in the UK grew roughly 6% from

2007 to 2022, compared with 17% in the US, 12% in Japan and 11% in Germany.

"The new government faces enormous financial and fiscal challenges. Elevated

gilt yields reflect the fact that public debt is within spitting distance of

100%, and the deficit is at 4.4%" said ING Group.

Attentions in the market could turn to the State Opening of Parliament and

the King's Speech on 17 July and the policies that may usher in, as well as the

prospect of a possible interest rate cut in August.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.