USD traded near 2-week low - EBC Daily Snapshot

2023-10-11

Summary:

Summary:

The US dollar traded sideway largely near its two-week low on Wednesday as investors await the FOMC meeting minutes for more clues on interest rate path.

EBC Forex Snapshot

11 Oct 2023

The US dollar traded sideway largely near its two-week low on Wednesday as

investors await the FOMC meeting minutes for more clues on interest rate

path.

Atlanta Fed Bank President Raphael Bostic said the central bank did not need

to raise borrowing costs any further. His view was then echoed by Minneapolis

Fed President Neel Kashkari.

China is preparing to bring a new round of stimulus to meet Beijing's annual

growth target, Bloomberg News reported on Tuesday. The two Antipodean currencies

were buoyed before paring their gains later.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 3 Oct) |

HSBC (as of 11 Oct) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0477 |

1.0834 |

1.0476 |

1.0700 |

| GBP/USD |

1.2011 |

1.2308 |

1.2112 |

1.2380 |

| USD/CHF |

0.8745 |

0.9338 |

0.8969 |

0.9181 |

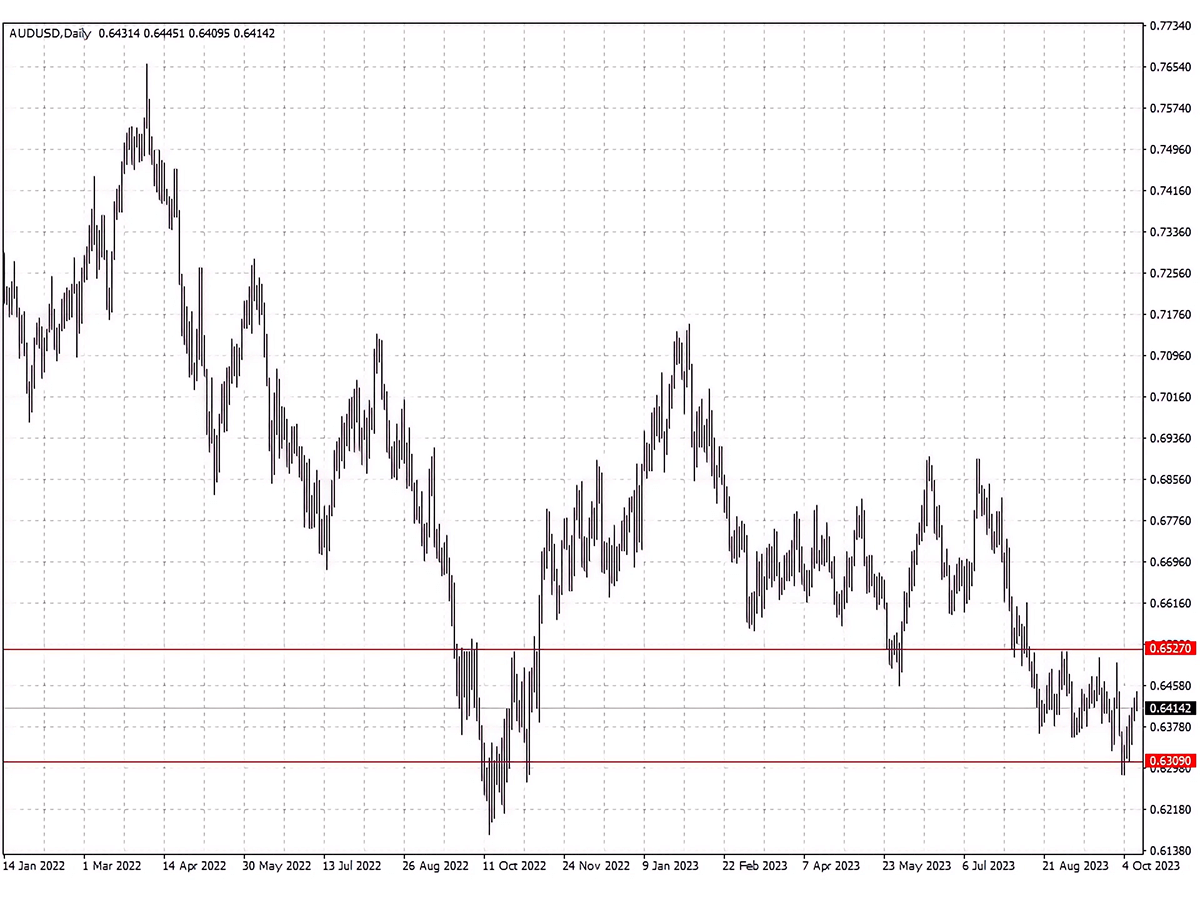

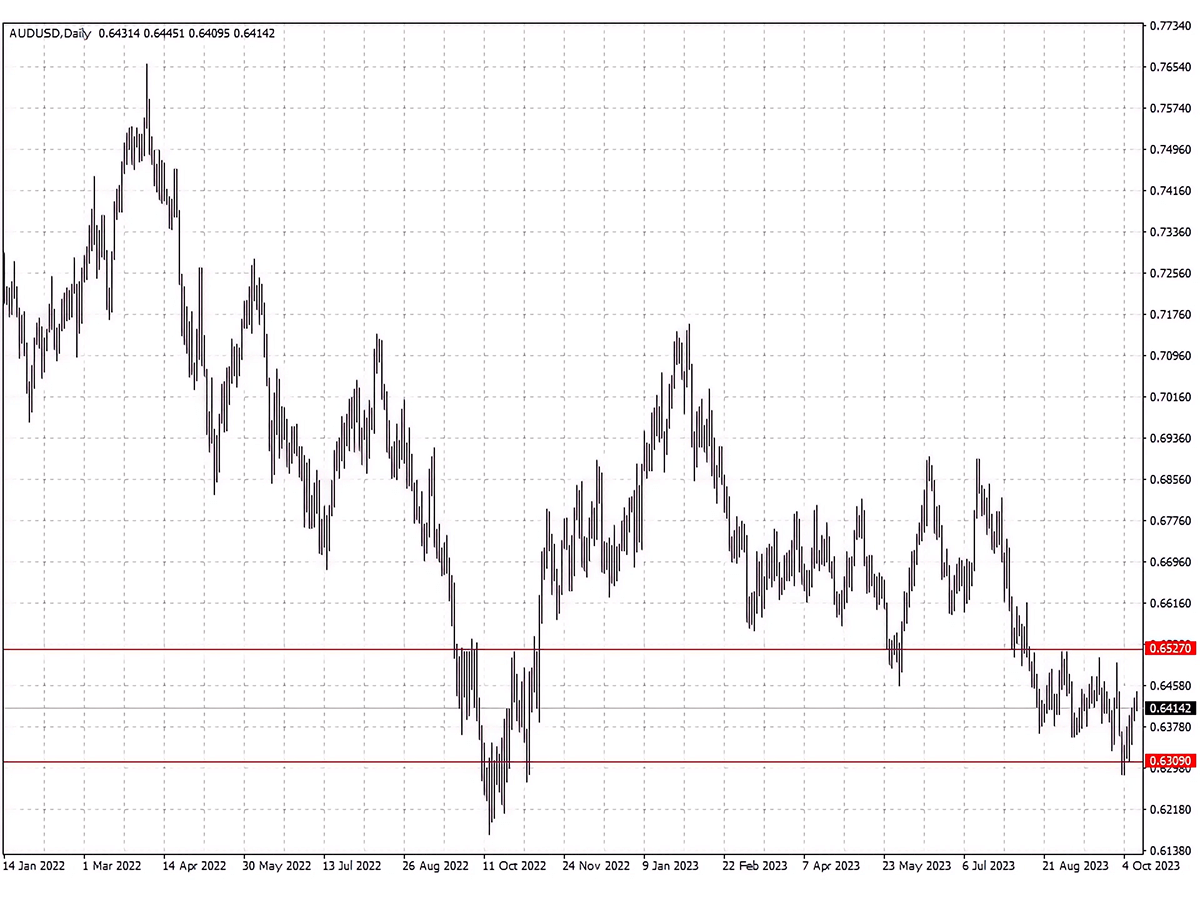

| AUD/USD |

0.6300 |

0.6522 |

0.6309 |

0.6527 |

| USD/CAD |

1.3302 |

1.3695 |

1.3404 |

1.3774 |

| USD/JPY |

144.54 |

150.15 |

147.33 |

150.12 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.