The UK government said last week it has “no plans” to get back into Erasmus+

scheme. It came as a surprise when newly elected PM is bent on resetting

relationships with the EU.

Starmer was speaking at a joint news conference with German Chancellor Olaf

Scholz in Berlin on Thursday, after the pair began talks on a new co-operation

agreement between the two nations.

It remains unclear whether Brussels would entertain major changes to the

existing Brexit trade deal he seeks, which is due to be reviewed in 2026. And

youth mobility shows the UK still prioritised border control.

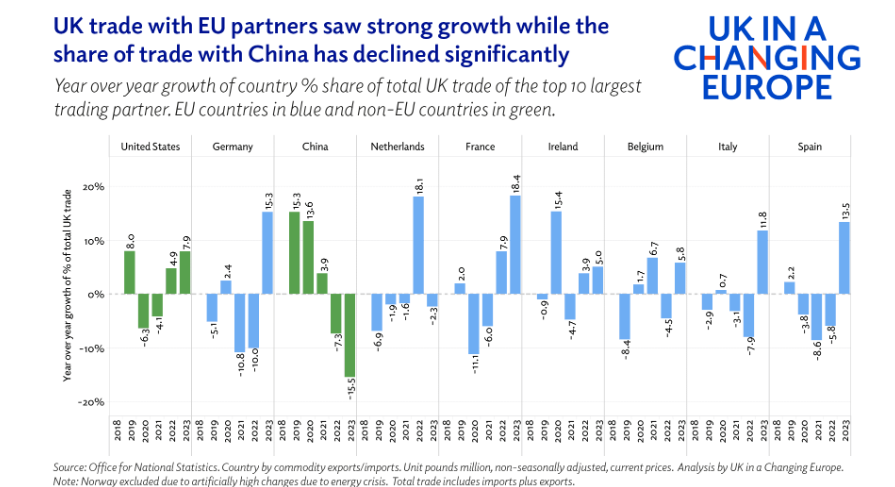

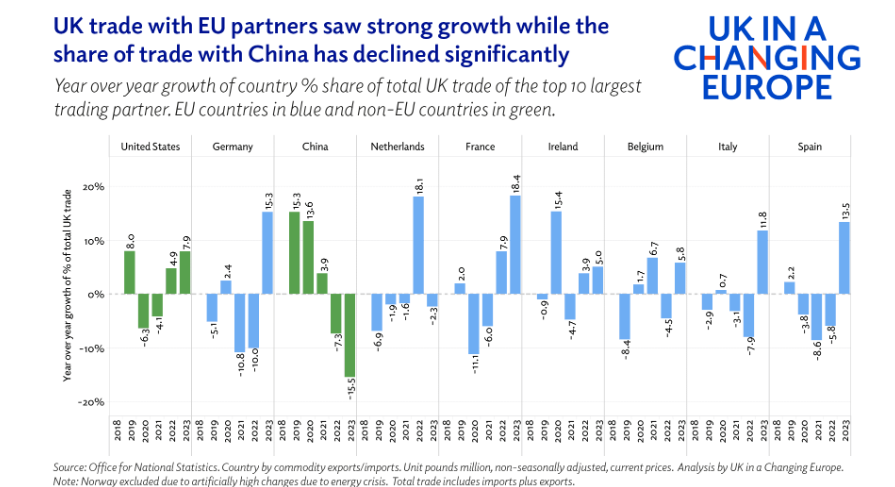

Breturn may not be needed indeed. A think tank’s study finds that the UK’s

trade ties with the EU looked surprisingly strong in 2023, the first post-Brexit

year not significantly impacted by Covid-19.

Data shows that trade flows between the UK and EU for goods grew in 2023 at a

healthy rate of 2.2% compared to 2022. EU countries all saw trade with the UK

jump in 2022 but then stabilise in 2023.

The study explains the TCA led to initial trepidation among EU trading

partners, but businesses quickly adapted and continued as usual.

While businesses have maintained trade between the UK and EU, there has been

no significant growth, businesses look focused on maintaining current trade

flows but are not looking to grow them.

Restrictive Conditions

Starmer warned earlier that his government's first budget in months will be

"painful," asking the country to "accept short-term pain for long-term

good."

Rachel Reeves is planning to raise taxes, cut spending and get tough on

benefits amid alarm that the pickup in the economy has failed to improve the

poor state of the public finances.

Government spending in Q2 was £297.3 billion – £4.6 billion more than in the

same period a year earlier – partly as a result of the impact of inflation on

benefits and departmental spending.

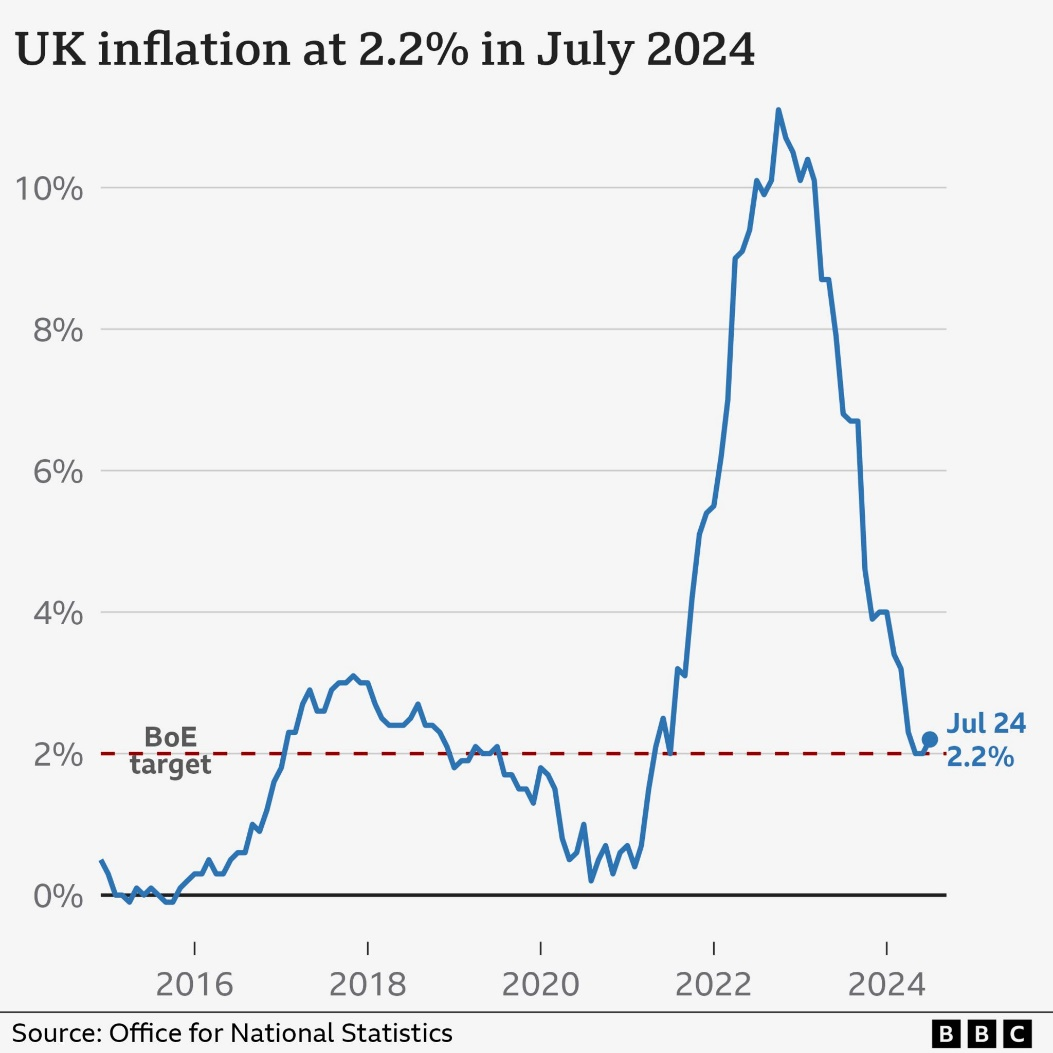

A restrictive fiscal policy will be introduced at a time when the BOE could

refrain from aggressive interest rate cuts. The economy expanded 0.6% in Q2 and

0.7% in Q1, the fastest pace in more than two years.

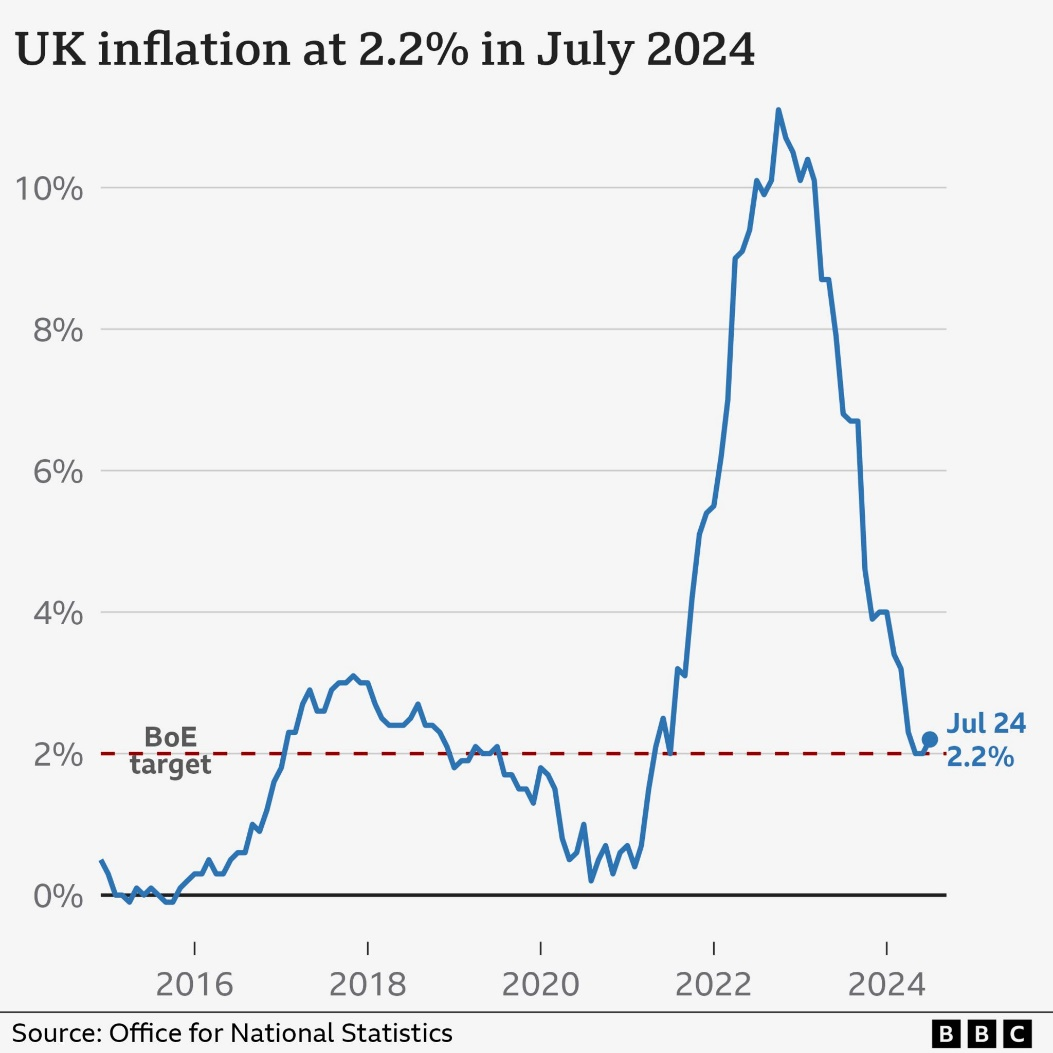

Inflation fell to the central bank's 2% target in May and June but rose to

2.2% in July. Wage inflation was still nearly double the rate the BoE sees as

consistent with CPI staying at its 2% target in Q2.

A majority of economists said in a Reuters poll said the central bank will

cut rates just once more in November. Apart from rate decisions, the next

monetary meeting could set for the path ahead for QT.

It has already reduced stock of money printed under the QE schemes that ran

from 2009 to 2021 and Governor Andrew Bailey wants to go further with QT, in

part to improve the government’s fiscal outlook.

Uphill Battle

The downturn in Germany's manufacturing sector, which accounts for about a

fifth of Europe's biggest economy, continued to gather pace in August, a survey

showed on Monday.

An accelerated drop in new orders in August was the main factor weighing on

the headline index. Inflows of new work posted the steepest decline since

November last year, the report showed.

Elsewhere France is still struggling to put together a new government. In

2017-18 it took Germany nearly six months to stitch together painstaking

coalition deals between rival political parties.

A hung parliament could jeopardise the country's ability to reduce its debt

burden, warns the ratings agency Moody. In 2023, the public sector budget

widened to 5.5% of GDP, well above official target of 5%.

Both the right-wing National Rally and the let-wing coalition proposed fiscal

plans which would boost spending, so Macron will likely face mounting pressures

to realise debt sustainability.

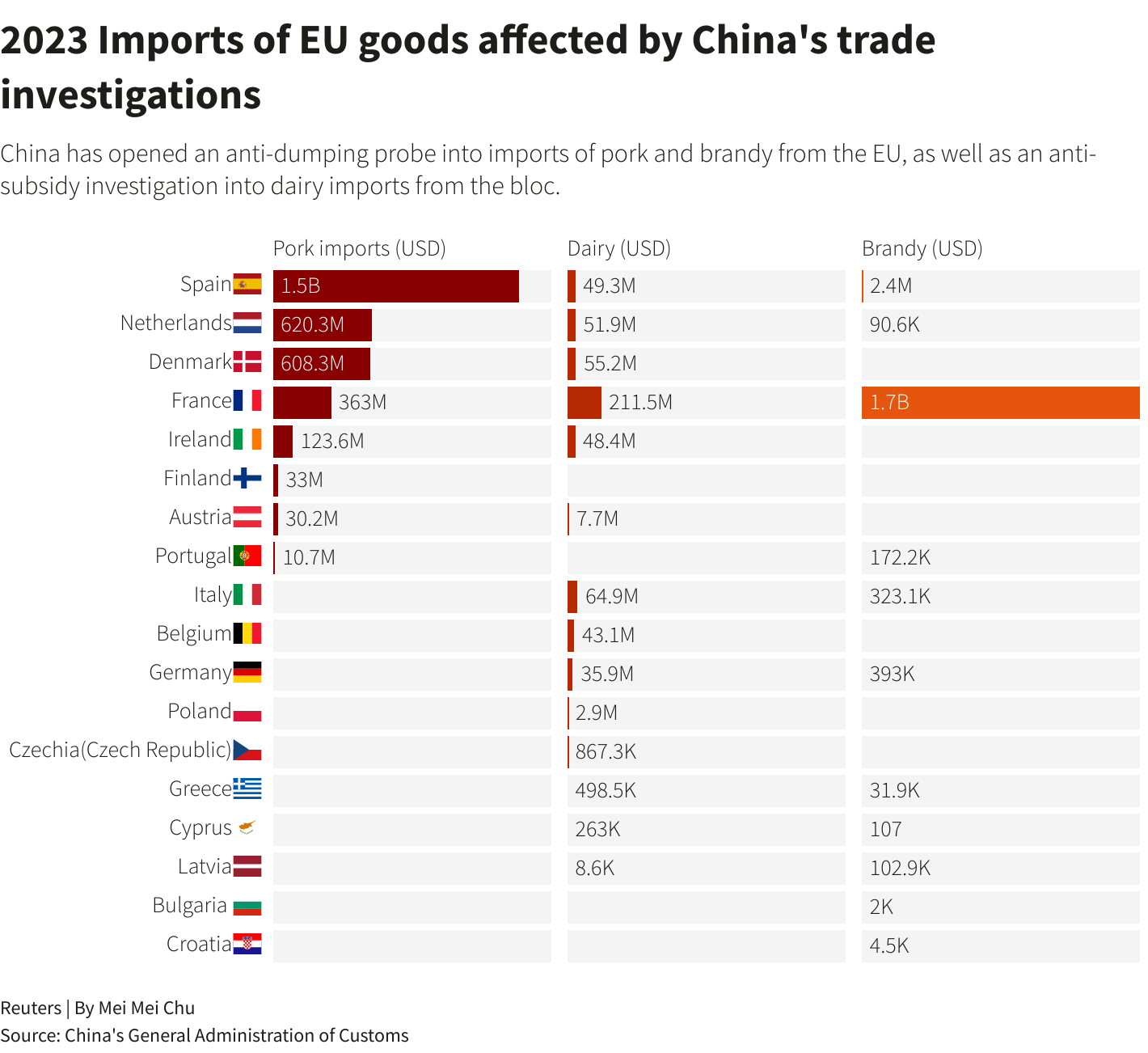

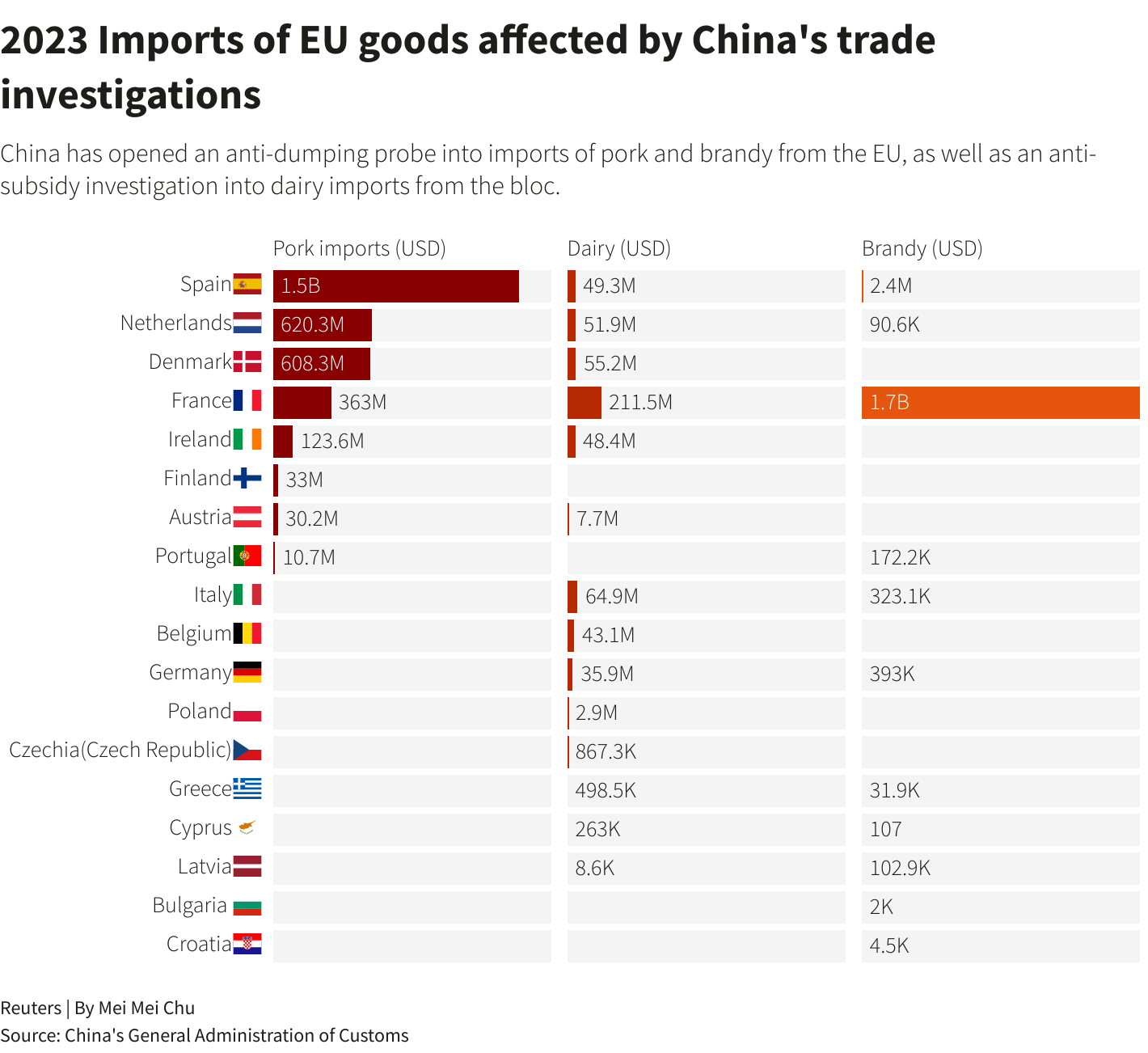

Moreover, France was also seen as the target of Beijing's brandy probe due to

its support of tariffs on China-made EVs. The trade dispute could hinder the

bloc’s already anaemic recovery.

The single currency has fallen around 2.9% against sterling, and the

downtrend may continue more likely than not given contrasting political scenes

across the Channel.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.