The Supertrend indicator is one of the most effective tools for traders in both forex and stock markets. It is a trend-following indicator that helps traders identify the market's direction and provides clear buy and sell signals.

Due to its simplicity and reliability, the Supertrend indicator has gained popularity among traders who seek an easy yet powerful strategy to navigate the markets.

For example, the accuracy of the Supertrend indicator makes it an essential part of any trader's strategy, whether for intraday trading, swing trading, or long-term investing.

What is the Supertrend Indicator?

The Supertrend indicator is a trend-following indicator that overlays price action to provide clear buy and sell signals. It derives from the Average True Range (ATR), which measures market volatility.

The indicator consists of a single dynamic line following price movements and changes colour based on the trend direction. For example, when the price is above the Supertrend line, the indicator turns green, signalling an uptrend. When the price is below the Supertrend line, the indicator turns red, indicating a downtrend.

The Supertrend formula is calculated as follows:

High: The highest price of the current period.

Low: The lowest price of the current period.

Multiplier: A pre-set factor (usually 2 or 3).

ATR: The Average True Range (14-period ATR is commonly used).

Let's assume we are calculating the Supertrend indicator for EUR/USD on a 1-hour chart, and we have the following data:

High Price: 1.1050

Low Price: 1.1000

14-period ATR: 0.0025

Multiplier: 2

The calculation amount will be as follows:

Let's assume the closing price is 1.1080. Since the price is above the Upper Band, the Supertrend turns bullish, and traders can look for buy opportunities.

Alternatively, if the closing price is 1.0960, the price would be below the Lower Band, signalling a downtrend, and traders would consider short positions.

How to Use the Supertrend Indicator in Forex and Stock Trading

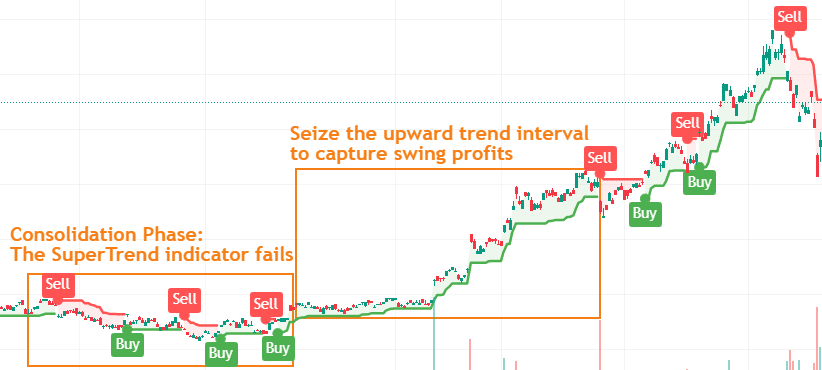

As mentioned, the Supertrend indicator is used in multiple ways to identify market trends, generate trading signals, and manage risk. The basic concept behind the Supertrend indicator is that when the price moves above the Supertrend line, it signals a buying opportunity. When it moves below the Supertrend line, it signals a selling opportunity.

For forex trading, the Supertrend indicator is used to identify strong trends in major currency pairs like EUR/USD, GBP/USD, and USD/JPY. A trader using the Supertrend in forex might enter a long position when the Supertrend turns green and place a stop-loss below the indicator line to protect against sudden reversals. Similarly, traders may enter short positions when the indicator turns red in a downtrend, setting a stop-loss above the indicator line.

As for stock trading, traders used the Supertrend indicator to spot trend reversals and manage trade entries and exits in blue-chip stocks, mid-cap stocks, and penny stocks. A stock trader looking to buy shares might wait for the Supertrend to turn green before entering a long position, ensuring the stock is in a confirmed uptrend. On the other hand, if the Supertrend turns red, it signals a bearish phase, indicating a potential short-selling opportunity.

Using the Supertrend Indicator in Intraday Trading

In addition, the Supertrend indicator is ideal for intraday trading because it adapts to volatility and provides direct entry and exit points. When applied to shorter timeframes such as 1-minute, 5-minute, or 15-minute charts, the Supertrend helps traders make informed decisions in fast-moving markets.

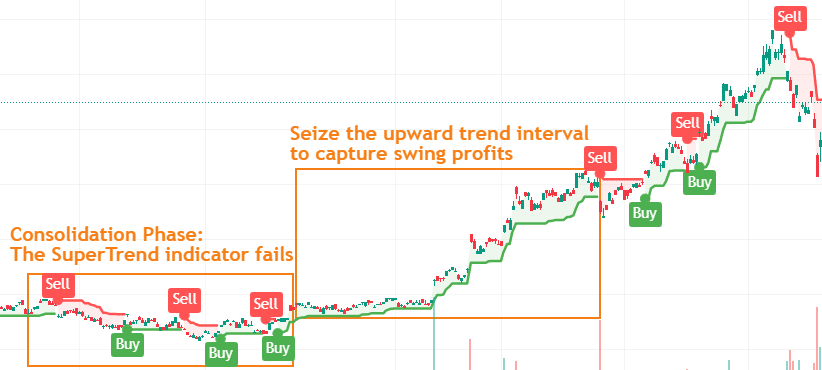

The basic Supertrend day trading strategy involves looking for buy signals when the price moves above the Supertrend line and for sell signals when the price moves below it. The ideal Supertrend settings are ATR 10 with a multiplier of 2. This setting ensures it reacts swiftly to price movements while filtering out minor fluctuations. However, relying solely on the Supertrend indicator may result in false signals, especially in choppy or sideways markets.

Thus, the best way to use the Supertrend indicator in day trading is by combining it with moving averages, volume analysis, or momentum indicators like the Relative Strength Index (RSI) or MACD. It helps confirm trend direction and reduces the chances of false breakouts.

A day trader typically enters a long position when the Supertrend turns green and places a stop-loss just below the Supertrend line. Similarly, enter a short position when the Supertrend turns red, with a stop-loss above the indicator line.

How the Supertrend Indicator Works in Swing Trading

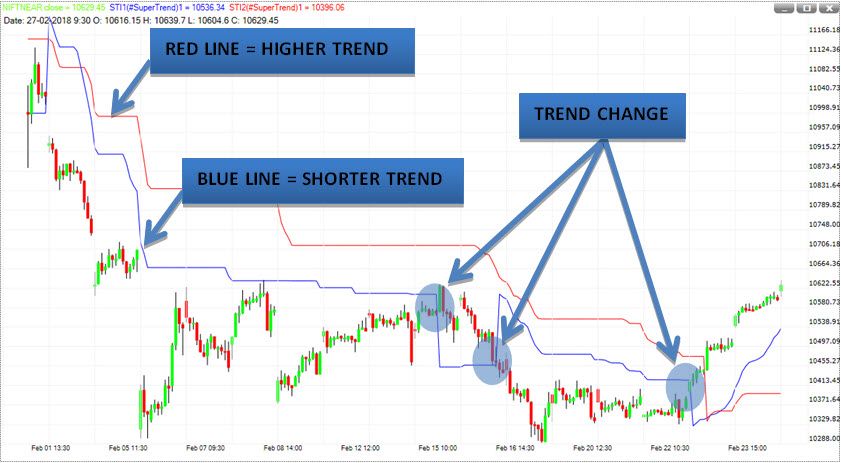

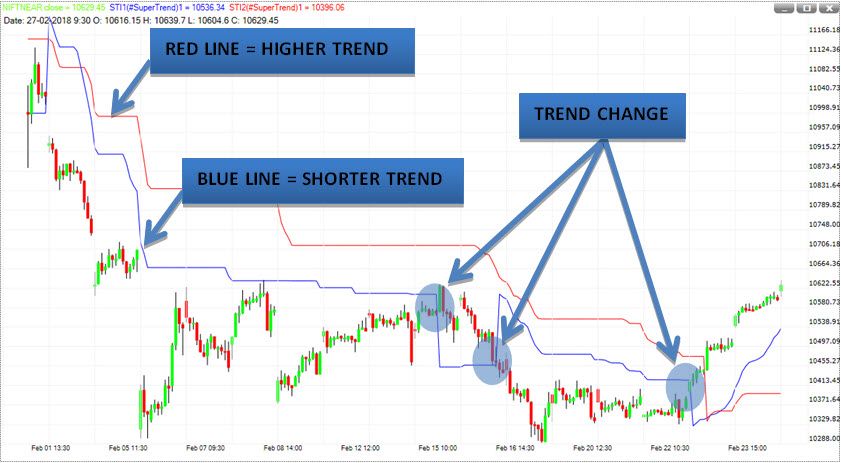

On the other hand, Swing trading focuses on capturing medium-term price movements, typically lasting from a few days to several weeks. The Supertrend indicator is highly effective for swing traders because it helps identify dominant trends and filter out short-term fluctuations. Unlike day traders focusing on short timeframes, swing traders apply the Supertrend indicator to daily or 4-hour charts to spot longer-term trends.

The recommended Supertrend settings for swing trading are ATR 14 with a multiplier of 3. These settings help smooth out price action and provide fewer but more reliable signals.

For example, a typical swing trading strategy using the Supertrend indicator involves entering a long trade when the indicator turns green and staying in the trade until it turns red. Since swing trading involves holding trades longer, it is crucial to place a wider stop-loss to allow for normal market fluctuations.

One of the most effective swing trading strategies involves the Fibonacci retracement levels. If the price retraces to a key Fibonacci support level while the Supertrend indicator remains bullish, it provides an excellent opportunity to enter a long trade. Similarly, if the price retraces to a Fibonacci resistance level while the Supertrend indicator remains bearish, it signals a potential short trade.

Best Supertrend Indicator Strategies for Forex and Stock Trading

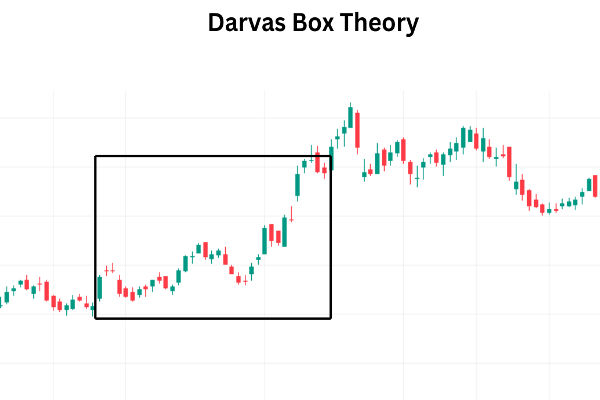

One of the most effective Supertrend indicator strategies involves using the indicator as a standalone trend filter. Traders look for Supertrend crossovers, where the price shifts from below the indicator to above it (bullish signal) or from above the indicator to below it (bearish signal). This provides clear entry points in trending markets.

Another effective strategy is the Supertrend Breakout Strategy for forex trading. Traders look for instances where the price breaks above or below a key resistance or support level while the Supertrend indicator aligns with the breakout direction. A Supertrend-supported breakout usually indicates strong momentum continuation, offering an excellent opportunity for traders to enter a position early in the trend.

Conclusion

In conclusion, the Supertrend indicator is a valuable tool for traders looking to capitalise on market trends in forex and stock trading. By identifying clear buy and sell signals, filtering out market noise, and providing dynamic support and resistance levels, the Supertrend enhances trading accuracy and efficiency.

Mastering the Supertrend indicator strategy requires practice, and traders should adjust the ATR multiplier based on market conditions to optimise performance and avoid false signals. However, once traders understand how to interpret its signals, it becomes an invaluable tool for making profitable trading decisions in forex, stocks, and other financial markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.