In technical analysis, the Morning Star pattern is one of the most powerful and reliable bullish Reversal Candlestick Patterns.

Candlestick patterns play a crucial role in Price Action Trading, and the Morning Star is particularly valuable because it provides an early indication of changing market sentiment.

For example, it signals a potential shift from a downtrend to an uptrend, and traders widely use it to identify profitable entry points.

Understanding the Morning Star Pattern

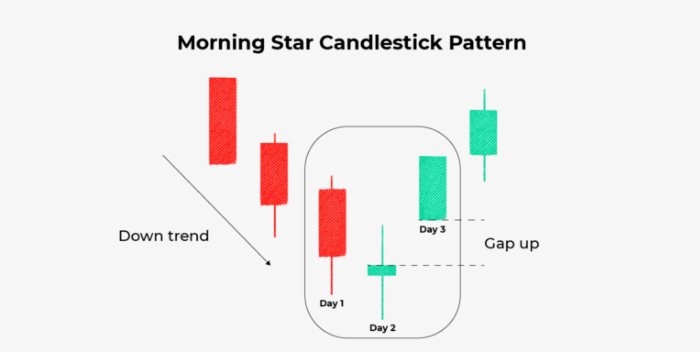

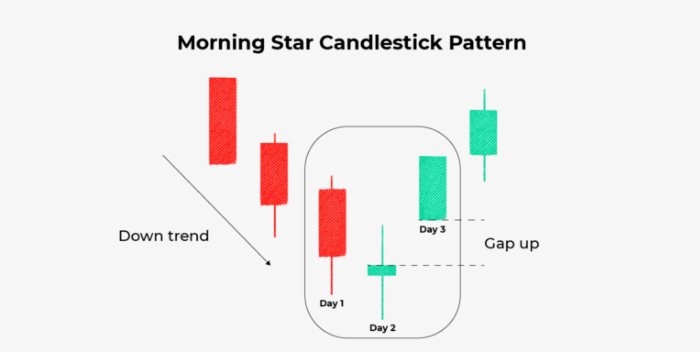

Before utilising the Morning Star pattern effectively for entry and exit strategies, it is crucial to understand how it forms and what it represents. For starters, the Morning Star is a three-candlestick formation which appears at the bottom of a downtrend. The pattern consists of a large bearish candle, followed by a small-bodied candle, and finally, a strong bullish candle that signals the reversal.

However, for the Morning Star pattern to be considered valid, it must meet certain conditions. Firstly, the first candle in the pattern should be a large bearish candle, indicating that the prevailing downtrend is still in force and sellers are in control.

The second candle should have a small body, which is often referred to as a Doji or spinning top, indicating hesitation among traders. It is a crucial part of the pattern because it signals that the previous selling pressure is weakening.

Lastly, the final candle in the formation should be a strong bullish candle, closing at least halfway into the first candle’s body, confirming that buyers have taken control and that a reversal is likely underway.

As a further note, the strength of the Morning Star pattern depends on several factors. The larger the bullish candle, the stronger the confirmation of the reversal. If this candle closes above a significant resistance level, it further validates the bullish momentum. Additionally, higher trading volume on the third candle increases the reliability of the pattern, as it suggests that institutional buyers are stepping in to drive the price higher.

How the Morning Star Pattern Helps in Entry Strategies

The Morning Star pattern provides a clear signal to enter long positions when a downtrend loses momentum as a bullish reversal is imminent. By recognising this pattern at the right time, traders can position themselves ahead of the crowd and capture early gains in the new uptrend.

One of the most effective ways to enter a trade using the Morning Star pattern is to wait for confirmation on the third candle. The ideal entry point is typically at the opening of the next candle after the pattern completes, as long as the price remains above the closing level of the third candle.

Another strategy for optimising entry points is to use other technical indicators with the Morning Star pattern. For instance, many traders combine it with the Relative Strength Index (RSI) to confirm whether the asset is in oversold territory. If the RSI is below 30 when the pattern forms and starts to rise, it strengthens the bullish signal. Similarly, we recommend using the Moving Average Convergence Divergence (MACD) to confirm the reversal when the MACD line crosses above the signal line after the Morning Star pattern appears.

Like other trading strategies, risk management is crucial when entering trades based on the Morning Star pattern. A well-placed stop-loss order helps minimise potential losses in case the reversal fails. The ideal stop-loss placement is just below the low of the second candle in the pattern. It ensures that if the price breaks below the Morning Star formation, the bearish trend is likely still intact, and the trader can exit with minimal loss.

How the Morning Star Pattern Helps in Exit Strategies

In addition to helping traders enter trades at the right time, the Morning Star pattern also provides key insights for exiting positions and securing profits. Since it signals the beginning of a bullish trend, traders can use it as an early indication to exit short positions or manage their existing long positions effectively.

For traders holding short positions, the appearance of a Morning Star pattern is a strong signal to close the trade and take profits. Since the pattern indicates a shift in momentum from bearish to bullish, staying in a short trade after this signal can lead to significant losses as the market moves against the position. Many professional traders use the formation of the Morning Star as a reason to exit short positions immediately or at least tighten their stop-loss levels to reduce risk.

For traders already in a long position, the Morning Star pattern confirms that the uptrend is gaining strength. However, knowing when to exit a long trade requires careful analysis of price movements and additional technical indicators. One of the most effective ways to determine an exit point is by using resistance levels.

For example, if the price approaches a well-established resistance zone after forming the Morning Star pattern, it may be a good opportunity to take profit and exit.

Another method for exiting long trades is to use trailing stop-loss orders. A trailing stop allows traders to stay in the trade while securing profits as the price rises. Setting a stop-loss just below each new higher low ensures that traders capture gains while allowing room for the trend to continue.

Understanding the Psychological Aspect of the Morning Star Pattern

Technical analysis is more than just recognising Chart Patterns; it is deeply intertwined with market psychology. Despite the straightforward structure of the Morning Star Pattern, the underlying psychology behind its formation is complex and involves an interplay of fear, uncertainty, and optimism.

For example, the first candle represents maximum pessimism in the market as it is the last phase of a prevailing downtrend, meaning the market sentiment is overwhelmingly bearish, and selling pressure overtakes. Traders who were previously hopeful for a reversal may begin to lose confidence, and those holding long positions may start liquidating out of fear of further losses.

The second candle in the Morning Star pattern is perhaps the most crucial psychological perspective because it reflects a transition between fear and optimism. This stage is exhausting to traders because it introduces uncertainty. For example, novice traders may still fear that the downtrend will resume, as experienced traders recognise this pause in momentum as a potential buying opportunity, which creates a neutral or slightly bullish candle.

The third and final candle in the Morning Star pattern is where market sentiment shifts decisively from uncertainty to optimism. This strong bullish candle confirms that buyers have regained control and that a reversal is underway. Psychologically, traders who were previously fearful now experience relief and renewed optimism. They shift from a defensive mindset to an opportunistic one, focusing on profit potential rather than downside risk. This emotional shift creates a feedback loop where buying pressure increases, leading to further price appreciation.

Conclusion

In conclusion, the Morning Star pattern is a highly effective candlestick formation that helps traders identify entry and exit opportunities with a high degree of accuracy.

Moreover, the Morning Star pattern is more than just a technical formation; it is a psychological roadmap of market sentiment. Thus, by using the Morning Star pattern as part of a broader trading strategy, traders can overcome psychological biases and develop a structured, disciplined approach to navigating the markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.