Options trading can be a rollercoaster. With market swings, traders often turn to stop loss options to protect their investments. But what are they? Simply put, a stop loss is an order to sell an option when it hits a set price.

This tool aims to limit losses. Yet, it's not foolproof. Volatility, premature triggers, and missed gains can complicate things. So, let's dive into stop loss options, exploring their benefits, drawbacks, and key pitfalls every trader should know.

What Are Stop Loss Options?

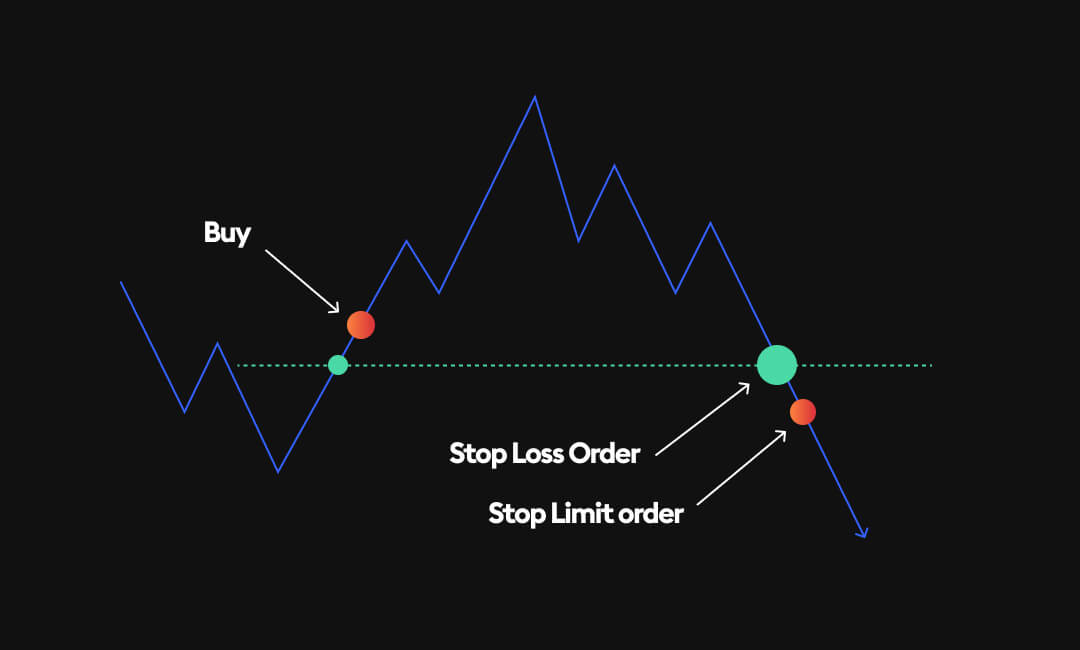

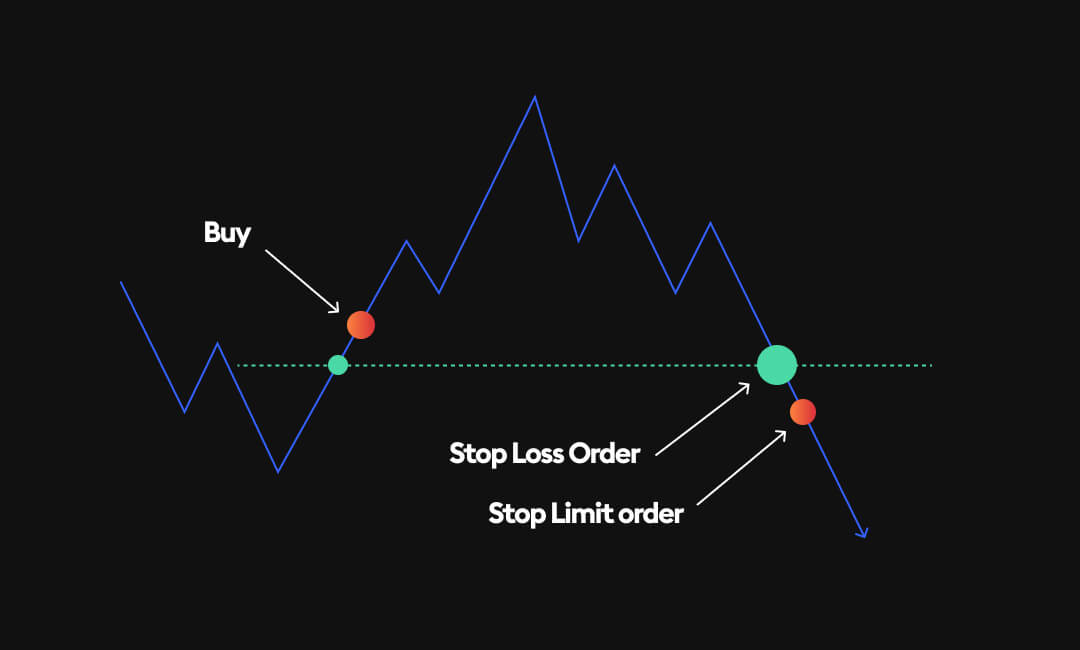

Stop loss options are automated orders in options trading. They kick in when the option's price drops to your chosen level. For example, if you buy a call option at $10, you might set a stop loss at $8. If the price falls, it sells automatically.

This helps cap losses. Around 60% of traders use stop losses, according to a 2023 survey by Options Insider. But using stop loss options isn't as simple as it sounds.

Pros and Cons

1) The Pros

Stop loss options offer clear advantages. First, they minimise big losses. In fast-moving markets, prices can plummet quickly. A stop loss acts as a safety net. Second, they automate decisions.

Emotions often cloud judgement, but stop loss options enforce discipline. Third, they free up time. You don't need to watch charts all day. Data shows traders using stop losses reduce losses by 25% on average, per a 2024 trading study.

2) The Cons of Stop Loss Options

However, stop loss options have downsides. Premature triggering is a big issue. Markets fluctuate, and a brief dip might sell your option too soon. This happened to 45% of traders in volatile conditions, a 2023 report found. Missed opportunities follow.

If the price rebounds after a dip, you're left out. Plus, costs add up. Frequent trades mean more fees, eating into profits.

Volatility and Stop Loss Options

Options markets are volatile. Prices swing wildly, especially near expiry. Stop loss options can backfire here. A sudden drop might trigger your order, even if the market recovers fast. For instance, during the 2022 FTSE 100 dip, 30% of stop loss orders executed unnecessarily.

Wider stop levels might help, but they reduce protection. Balancing this is tricky.

How to Set Stop Loss Options Effectively

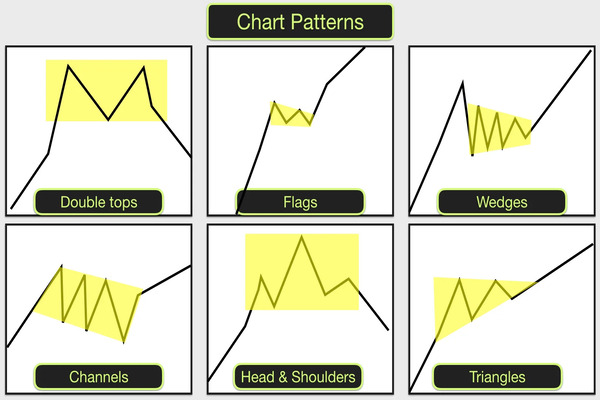

Setting stop loss options needs strategy. Start with your risk tolerance. Can you handle a 10% loss or just 5%? Next, study market trends. Historical volatility data, like the VIX index, guides price limits.

For example, if an option's average swing is $2, set your stop beyond that. Test with small trades first. Adjust as you learn what works.

Key Pitfalls to Avoid with Stop Loss Options

Pitfall

|

Impact |

Solution |

| Too tight-stops |

Sells too early |

Use wider price ranges |

| Ignoring Volatility |

Unnecessary Exits |

Check VIX or ATR indicators |

No Exit Plan

|

Missed recovery gains |

Pair with profit targets |

Alternatives to Stop Loss Options

Not sold on stop loss options? Try alternatives. Mental stops involve watching prices and selling manually. This avoids automation pitfalls but demands focus. Hedging is another. Buy a put option to offset a call's risk.

In 2023, hedging cut losses by 15% for UK traders, per TradingView stats. Exit plans, like selling at a set profit, also work without rigid orders.

Risk Management Beyond Stop Loss Options

Smart traders mix strategies. Diversify your portfolio to spread risk. Use position sizing—never risk more than 2% of your capital per trade. Combine stop loss options with hedging for flexibility.

For example, a trader with $10,000 might cap risk at $200 per option. This layered approach beats relying on one tool alone.

Real-World Example

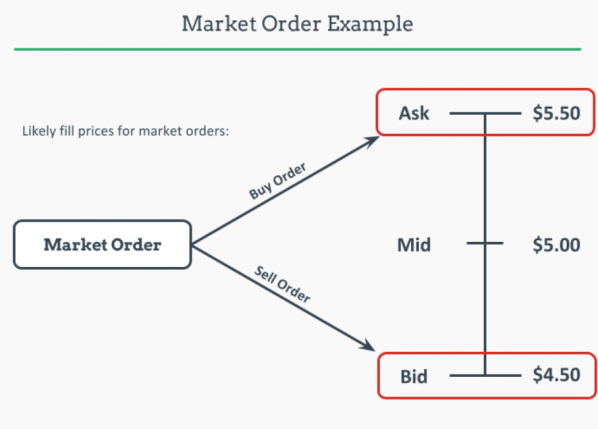

Imagine you buy a BP option at $5. You set a stop loss at $4.50. The market dips to $4.40, triggering a sale. You lose $0.50 per contract. But then, prices climb to $6. Without the stop, you'd have gained $1. This shows the double-edged nature of stop loss options. Timing and settings matter.

Actionable Tips for Using Stop Loss Options

Ready to use stop loss options? Here's how:

Set stops based on technical analysis, like support levels.

Avoid placing stops at round numbers—others do, causing pile-ups.

Review performance monthly. Did stops save or cost you?

Use trailing stops. They adjust as prices rise, locking in gains.

Start small. Test with $100 before scaling up.

Is It Worth It?

So, are stop loss options right for you? They shine in choppy markets, saving you from crashes. But in steady uptrends, they might eject you too soon. The key is balance.

Combine them with other tactics. A 2024 UK trading poll found 70% of pros use stop loss options selectively, not always. Tailor them to your goals.

Final Thoughts

Stop loss options are powerful yet flawed. They limit losses and automate trades, but volatility and mistiming can sting. Learn their quirks. Experiment with settings. Blend them into a broader risk plan.

Whether you're a newbie or seasoned trader, mastering stop loss options takes practice. Get it right, and they're a game-changer for your portfolio.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.