Have you ever wondered how the financial markets manage to stay fluid and efficient, even during times of high volatility? Or how you can always buy or sell a stock, currency, or asset, no matter how uncertain the market seems? The answer often lies with an invisible but crucial player in the market: the market maker.

But what exactly does this role entail, and how do they ensure that the market runs smoothly? How do they manage to earn a profit from what seems like an invisible function, and why does this matter to you as an investor?

In this article, we'll uncover the important role that market makers play in maintaining market liquidity, ensuring quick trades, and stabilising prices—making them an essential cog in the machinery of global markets. From their unique business model to their critical influence on market efficiency, understanding the mechanics of these liquidity providers will give you a deeper insight into the forces that shape your investments and trading strategies.

Market Maker's Definition

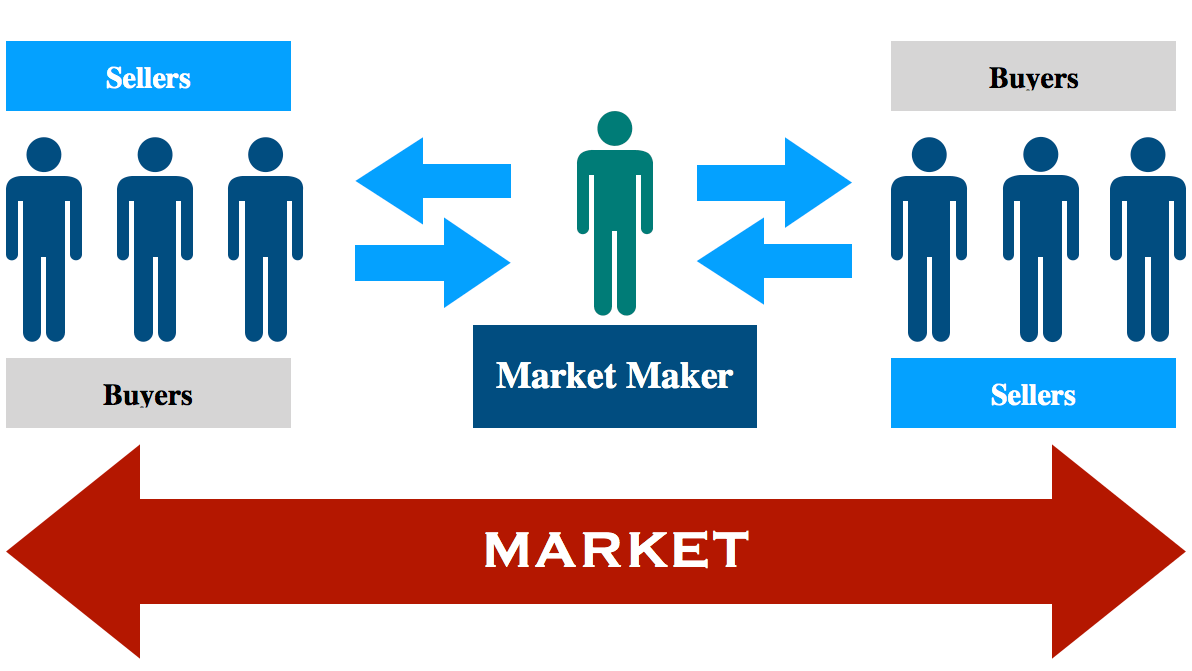

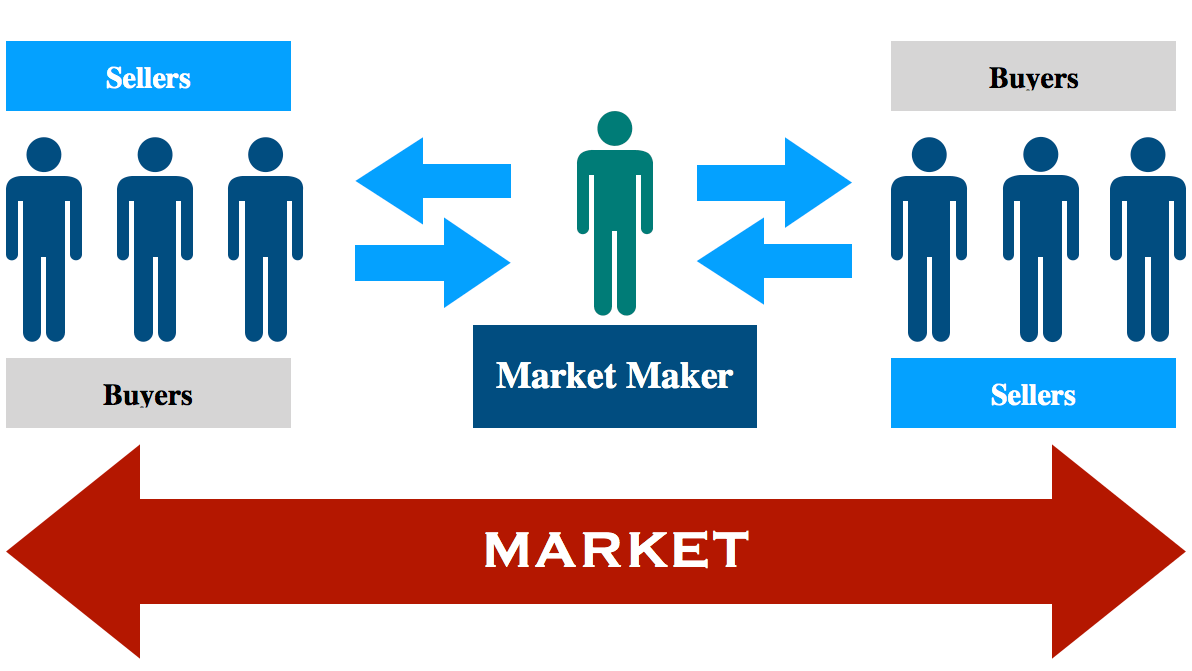

At its core, a market maker is a financial institution or individual that facilitates trading by providing liquidity in a specific asset or security. In simple terms, it's always willing to buy or sell a security, ensuring there is no gap in the market between buyers and sellers. This is essential for the functioning of any market, from stocks and bonds to foreign exchange (forex) and cryptocurrencies.

Unlike a traditional investor or trader who might only look to buy or sell a security based on personal interest or market analysis, a market maker is primarily focused on maintaining the continuous flow of transactions. Their role is to quote both a buying price (the bid) and a selling price (the ask), always ready to take the other side of a trade. This continuous quoting of prices ensures that other market participants—whether traders or investors—can enter and exit positions quickly and with minimal slippage. This system helps stabilise the market, allowing it to function smoothly even when there are periods of high volatility or uncertainty.

Market Maker's Revenue Streams

Now, you might be wondering, how do they make money from this seemingly one-sided arrangement? The answer lies in the bid-ask spread—the difference between the price at which they are willing to buy an asset and the price at which they are willing to sell it.

For example, if the price of a stock is quoted at £100 to buy and £101 to sell, the market maker stands to earn £1 on every trade, assuming they buy at £100 and sell at £101. This spread is their main source of revenue. While the individual spread may seem small, these traders engage in high volumes of transactions, so even a small difference can lead to substantial earnings over time.

Beyond the bid-ask spread, market makers may also generate income through various other streams. These include rebates or incentives for executing trades on certain exchanges, as well as fees earned through high-frequency trading (HFT), which involves using advanced algorithms to execute large numbers of orders at rapid speeds.

However, the business of market making is not without risk. Market makers must hold inventory in the assets they trade, which means they are exposed to market fluctuations. If they hold a significant amount of a particular asset and its price falls dramatically, they could face losses. Nevertheless, by providing liquidity in the market and accepting the risk of price fluctuations, these market facilitators earn the reward of the spread, and potentially, the efficiency of their trading strategies.

Market Maker's Role in Financial Markets

The importance of market makers cannot be overstated. By offering liquidity, they ensure that financial markets remain efficient and stable, even in times of uncertainty or heightened volatility. The ability of such participants to provide continuous buy and sell orders means that there is always a mechanism for price discovery. They act as a buffer to prevent large price gaps, which can be especially important in markets that operate with limited trading hours or in times of market stress.

Take the stock market, for instance. Without these players, if you wanted to buy or sell shares of a company, there might not always be an immediate buyer or seller available. This could result in significant delays or worse—price discrepancies. Market makers step in to prevent this from happening by keeping a constant supply of buy and sell orders at different price levels. As a result, they enable smoother and quicker transactions for all market participants, from institutional investors to individual traders.

In more complex markets, like foreign exchange or cryptocurrency, market makers take on a particularly pivotal role. These markets often see fluctuating demand from a wide array of global participants, each with different trading objectives. In such an environment, these intermediaries provide an essential service, helping to reduce volatility by ensuring there are always quotes available for traders to act upon. Their participation helps to ensure that the prices of currencies or assets remain relatively stable, despite the high volume and diversity of market actors.

Market Maker vs. Broker

As we've seen, market makers are vital for ensuring liquidity, efficiency, and price stability in the financial markets. However, while these participants are integral to market functioning, they are not the only key players involved in facilitating trades. Another crucial participant is the broker, who also plays a role in ensuring that buyers and sellers connect. But unlike these facilitators, brokers don't directly provide liquidity or hold inventory. Instead, they act as intermediaries, matching buyers with sellers.

So, what sets them apart from brokers? How do their roles and functions differ in a way that impacts your trades? Let's explore the distinction between the two, so you can better understand the different ways these players contribute to the market ecosystem.

Market makers are the backbone of liquidity in the market. Their role is to provide constant buy and sell prices, allowing trades to be carried out seamlessly, even when there is a lack of immediate buyers or sellers. By continuously offering to buy or sell assets, they ensure that there is always someone on the other side of a trade, facilitating smoother transactions.

In contrast, brokers act as intermediaries who help clients execute trades, but they do not take on the same risks. A broker's job is to connect buyers and sellers, facilitating the trade but not participating directly in the market by holding inventory.

They don't assume the risks associated with price changes. Instead, brokers earn their revenue by charging a commission or a fee for executing a trade. When you place an order to buy or sell, the broker will either match your order with another trader or route it to a market maker or an exchange. While brokers don't hold assets, they play a crucial role in ensuring that the orders placed by their clients are fulfilled.

The relationship between market makers and brokers is inherently intertwined. When you, as an investor, place an order through a broker, it is often the liquidity provider who steps in to take the other side of the transaction. The broker doesn't provide liquidity directly; instead, they rely on these participants to fill the order. In this way, brokers act as the facilitators, while the liquidity providers provide the liquidity necessary to execute trades. While these participants are exposed to market risks by holding assets, brokers are risk-averse and focus primarily on connecting buyers and sellers.

This partnership ensures that, regardless of market conditions, investors can execute trades with minimal delay. Without these liquidity providers offering liquidity, the broker would have no one to fulfil the order. Similarly, without brokers bringing orders to the market, market makers would have no counterparties to trade with. Thus, both play essential but different roles in the financial system, working together to ensure the market runs efficiently and that trades can be completed quickly and reliably.

In summary, while market makers and brokers both help investors complete trades, they operate in fundamentally different ways. They provide liquidity and take on the risk of holding assets, profiting from the bid-ask spread. Brokers, on the other hand, facilitate the transaction, ensuring that buyers and sellers meet, without taking on the same risks. Understanding how these two players interact is key to understanding how markets function and how your trades are executed.

Market Maker vs Broker

| Aspect |

Market Maker |

Broker |

| Role |

Provides liquidity by quoting prices. |

Connects buyers and sellers. |

| Profit Source |

From the bid-ask spread and inventory. |

Through commissions or fees. |

| Risk |

Takes on market risk with securities. |

No risk, only transaction fees. |

| Example |

Banks offering buy/sell prices. |

Online platforms or brokers. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.