Have you ever wondered how institutional investors, like pension funds and hedge funds, execute massive trades without sending shockwaves through the market? How do they manage to buy or sell millions of dollars' worth of securities without causing a frenzy of price fluctuations? The answer lies in block trades—large, private transactions that are crucial to the functioning of today's financial markets.

While most trades happen in plain sight on public exchanges, block trades are typically kept out of the limelight, allowing investors to move vast amounts of securities with discretion. Whether you're an investor looking to understand the mechanics behind these trades or simply curious about how the financial giants operate, this article will walk you through the ins and outs of block trading. From how they work to why they matter, let's explore what makes these trades both fascinating and essential to the smooth running of the global markets.

Block Trade's Definition

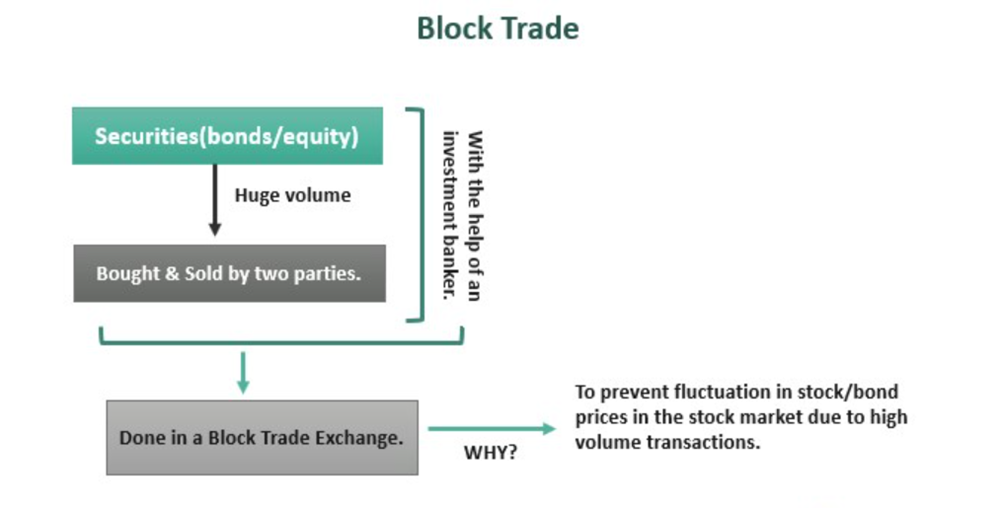

At its core, a block trade is a large transaction that takes place outside of the regular public market. It involves a substantial quantity of securities, typically stocks, bonds, or other financial instruments, which are traded privately rather than through standard market orders. Typically, such transactions involves at least 10.000 shares or a transaction worth around $200.000 or more. These large trades are typically negotiated between institutional investors, such as pension funds, mutual funds, hedge funds, and insurance companies.

Block trades are executed privately to prevent the large size of the transaction from impacting the market price. If such a trade were to be placed directly on the public exchange, the sheer volume of shares or securities being traded could drive the price of the asset up or down, causing significant market disruption. Therefore, executing a trade off-exchange helps minimise the market impact, allowing for a smoother execution of large trades.

This private negotiation process is essential because it shields both parties from the risks of market volatility while also offering them an opportunity to secure better pricing. But how exactly are these trades executed? The next section will delve into the mechanics of block trade execution.

Block Trade's Function in the Market

The execution of a block trade is a more complex process compared to a regular market order. Unlike smaller trades, which are simply matched on public exchanges, these large private transactions are typically negotiated privately between buyers and sellers. The process often begins when an institutional investor, such as a pension fund or hedge fund, expresses interest in buying or selling a large quantity of securities.

Once the investor has decided on the size and type of asset to trade, they usually approach a broker or market maker. Brokers act as intermediaries, identifying counterparties willing to take on such a large position. Market makers, on the other hand, help ensure liquidity by providing the ability to absorb large amounts of securities when there is no immediate counterparty available. They are instrumental in facilitating block trades when matching buyers and sellers directly is not feasible.

The price of the block trade is determined through private negotiation. The buyer and seller agree on a price that is typically based on current market conditions, but without the transparency of an open exchange. This is crucial because large trades executed on an exchange could cause volatility, pushing prices up or down in response to market sentiment. Once a price is agreed upon, the trade is completed privately, often using private or over-the-counter (OTC) networks, keeping the details of the transaction away from the public eye.

While the process allows large trades to be executed efficiently, it's important to remember that block trades are not without their risks. What advantages and disadvantages does this method hold for institutional investors? Let's explore the key benefits and challenges in the next section.

Block Trade's Benefits and Risks

Block trades offer several advantages to institutional investors, primarily in terms of market impact and transaction costs. One of the biggest benefits is the ability to reduce market impact. When a large trade is executed on a public exchange, the sheer volume of shares or securities can drive the price up or down, depending on whether the trade is a buy or a sell. By conducting the trade off-market, the investor can avoid this price disruption.

Additionally, block trades can offer more favourable pricing. In some cases, the buyer and seller agree on a price that may be better than what is currently available in the open market. This is especially true when there is a long-standing relationship between the buyer and the broker or market maker, which can lead to negotiated discounts or more favourable terms for both parties involved.

However, such trades also come with certain risks. The primary risk is related to liquidity. Finding a counterparty who is willing to buy or sell a large number of securities can be challenging, particularly in less liquid markets. In some cases, the trade may not be executed as quickly as desired, or the investor may have to accept a less-than-ideal price due to liquidity constraints.

Another risk of block trading is price uncertainty. While the agreed-upon price is negotiated privately, there is no immediate price discovery mechanism, as there would be on a public exchange. As a result, the price of the trade may not always reflect the true market value of the security, especially during periods of high volatility or market instability.

Block Trade vs. Regular Trade

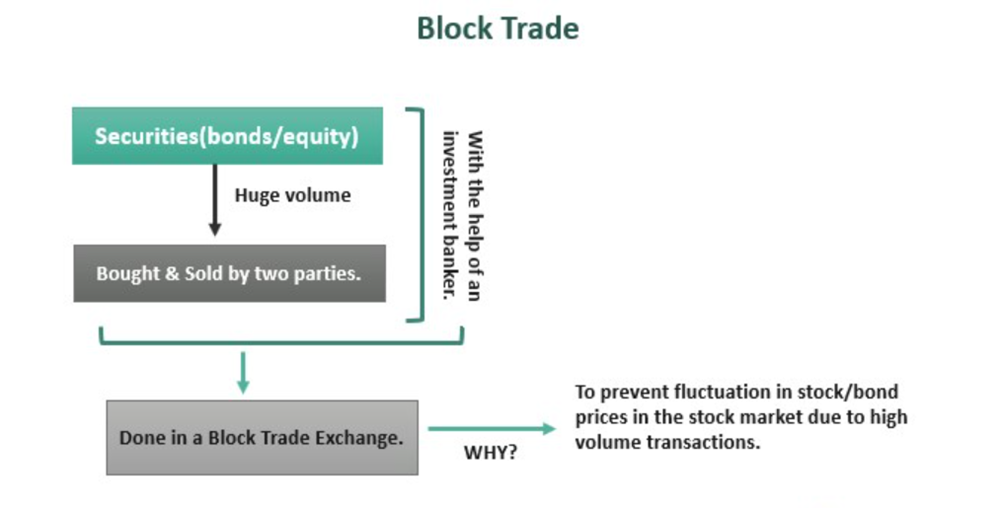

When comparing block trades to regular market trades, the differences become apparent in several key areas, including size, execution method, and market impact.

Regular market trades are generally much smaller in size compared to block trades and are executed on the public exchanges where prices are determined by the broader market. These trades are visible to all market participants, contributing to the price discovery process. As such, regular market trades can have a direct impact on the price of an asset. A large sell order, for example, may cause the price of a stock to fall, whereas a large buy order can drive the price up.

In contrast, block trades are negotiated privately and are executed away from the public exchanges. While regular trades contribute directly to the price discovery process, large private transactions are designed to be discreet, preventing the market from reacting to large orders. This means that these transactions don't immediately influence the price of an asset in the same way regular trades do.

Furthermore, such trades often offer more favourable pricing and lower transaction costs than regular market trades, which can be particularly advantageous for institutional investors. However, they also carry liquidity risks and potential price uncertainty, which are generally less of a concern for smaller, retail trades.

Block Trade vs. Regular Trade

| Aspect |

Block Trade |

Regular Trade |

| Size |

Large, institutional. |

Smaller, retail. |

| Execution Method |

Private, off-market. |

Public exchange. |

| Market Impact |

Minimal impact on price. |

Direct impact on price. |

| Pricing |

Negotiated, often better terms. |

Market-driven, no negotiation. |

| Liquidity |

Liquidity risks, harder to execute. |

More liquid, easier to execute. |

| Price Discovery |

No immediate discovery, private deal. |

Directly contributes to price discovery. |

| Risk |

Liquidity and price uncertainty. |

Lower risk, more predictable. |

In conclusion, Block trades play a crucial role in modern financial markets, providing institutional investors with a mechanism to execute large transactions efficiently and discreetly. While they offer substantial advantages, including reduced market impact, better pricing, and confidentiality, they are not without risks. Liquidity constraints and price uncertainty can pose challenges, but by understanding how these trades work, investors can better navigate their investment strategies and ensure they make the most of this valuable tool in their portfolios.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.