Rivian Automotive (NASDAQ: RIVN), once a promising entrant in the electric vehicle (EV) market, has experienced significant volatility since its ipo. As of April 2025, the stock has declined approximately 90% from its peak, with a 30% drop year-to-date.

This downturn prompts investors to question whether Rivian presents a buying opportunity or remains a high-risk investment. Thus, is Rivian a good stock to buy or too risky in 2025?

Current Financial Performance and Outlook

Rivian's financial trajectory reveals both challenges and potential. In 2024, the company reported revenues of $5.39 billion, marking an 8% year-over-year increase.

However, it also posted a net loss of $1.86 billion, an improvement from the previous year's $2.69 billion loss. The company's liquidity remains robust, with $9.06 billion in total liquidity, including $7.7 billion in cash and equivalents. Analysts project an EBITDA loss of $2.2 billion for 2025, 17% below previous estimates.

Looking forward, Rivian's 2025 guidance indicates anticipated vehicle deliveries between 46,000 and 51,000 units, slightly below the 52,000 vehicles delivered in 2024. This projection reflects tariff uncertainties and the potential elimination of EV tax credits, which could impact pricing and consumer demand.

Why Did Rivian Stock Drop?

1) Production Challenges and Strategic Initiatives

Rivian continues to face production and supply chain challenges. Despite efforts to ramp up its R1T pickup and R1S SUV, supply chain bottlenecks persist, affecting delivery timelines. The company's partnership with Amazon, involving the delivery of 100,000 electric vans, remains a significant revenue driver, though it has yet to alter Rivian's financial standing.

Moreover, the company aims to deliver between 46,000 and 51,000 vehicles in 2025, a decrease from the 51,579 units delivered in 2024.

In response to these challenges, Rivian is focusing on cost efficiency and software advancements and developing its new R2 model, slated for production in 2026. CEO RJ Scaringe emphasises the company's commitment to navigating external uncertainties by concentrating on controllable factors

2) Market Position and Competitive Landscape

Rivian operates in a highly competitive EV market, contending with established players like Tesla, Ford and emerging startups. Unlike Tesla's early years, Rivian faces a more crowded market, influencing its valuation and growth prospects.

Currently, Rivian's market capitalisation stands at approximately $15 billion, a fraction of Tesla's valuation, despite being considered the second-largest company in the EV space.

The company's valuation metrics reflect investor caution. Rivian trades at under three times sales, compared to Tesla's historical valuation of around ten times during its growth phase. This discrepancy underscores the market's tempered expectations for Rivian's future performance.

3) Regulatory and Policy Risks

Policy changes pose another layer of risk. Analysts warn of a "triple-whammy" of potential policy shifts, including revocating Rivian's $6.6 billion Department of Energy loan, eliminating the $7,500 EV tax credit, and changes to California's emissions regulations.

Such developments could adversely affect Rivian's financial stability and market competitiveness.

Analyst Perspectives and Stock Forecasts

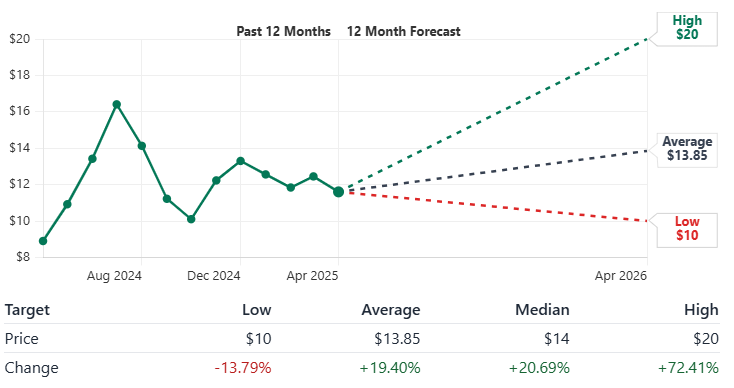

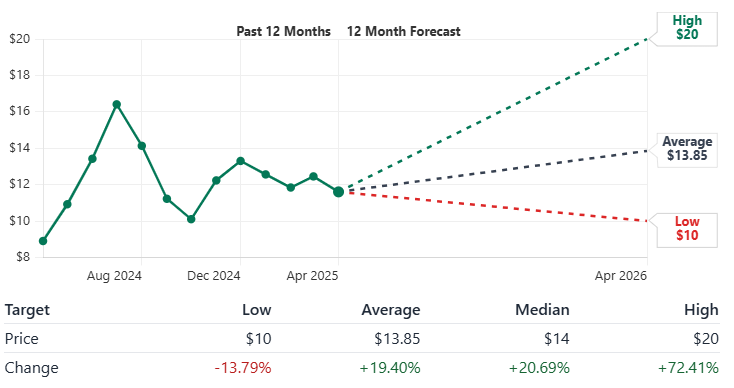

Analyst opinions on Rivian are mixed. The consensus rating is "Hold," with 13 out of 22 analysts on Wall Street maintaining this stance, six recommending a "Buy," and three advising a "Sell". Price targets for 2025 vary, with averages around $13.70 and projections ranging from $6.10 to $23.00.

Long-term forecasts present a spectrum of possibilities. Some analysts predict a potential rise to $140 per share by 2030, contingent on successful scaling and market penetration. Conversely, others anticipate a decline to approximately $3.41, citing ongoing challenges in profitability and market competition.

Is Rivian a Good Stock to Buy for Long-term Investors?

Rivian's story is still unfolding, and for long-term investors, the answer depends on risk tolerance, belief in the electric vehicle (EV) transition, and patience with short-term volatility. Rivian isn't profitable yet as it's burning through cash and faces competition from legacy automakers and well-capitalised rivals like Tesla. However, it has distinct advantages and ambitions that may appeal to investors willing to take a long view.

One of Rivian's most compelling long-term strengths is its clear brand identity and focus on adventure-oriented EVs. Its R1T pickup and R1S SUV have drawn praise for quality, innovation, and design. Unlike other EV startups, Rivian is not trying to be everything for everyone; it's targeting a specific lifestyle market, similar to how companies like Jeep or Subaru carved out loyal customer bases. If Rivian continues to build around that segment and scale efficiently, it could establish a defensible niche in a growing EV market.

Another long-term factor is its partnership potential and manufacturing roadmap. Rivian has a massive production facility in Illinois and plans a second plant in Georgia. These are big bets, but if demand justifies the scale, the company could eventually lower per-unit costs and improve margins. Its deal with Amazon — though now limited to commercial vans— also gives it experience in fleet manufacturing and logistics.

That said, the risks are real. Rivian's cash burn is significant, and without strong vehicle sales growth, future capital raises could dilute existing shareholders. It's also operating in a tough macro environment, with high interest rates affecting financing options for both consumers and businesses.

Nonetheless, it is not a traditional "safe" long-term buy and should be approached with a clear understanding of the risks involved.

Conclusion

In conclusion, Rivian's stock presents a complex investment scenario. While there is potential for growth, particularly with future product launches and strategic partnerships, the company currently grapples with financial losses, production challenges, and policy uncertainties.

Given the current landscape, Rivian represents a high-risk, high-reward investment. For long-term investors with high-risk tolerance and confidence in the EV sector's future, Rivian could be a high-upside opportunity. But it's not a buy-and-forget stock — it demands close attention to execution, quarterly delivery numbers, and the EV regulatory landscape. Patience and discipline will be key.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.