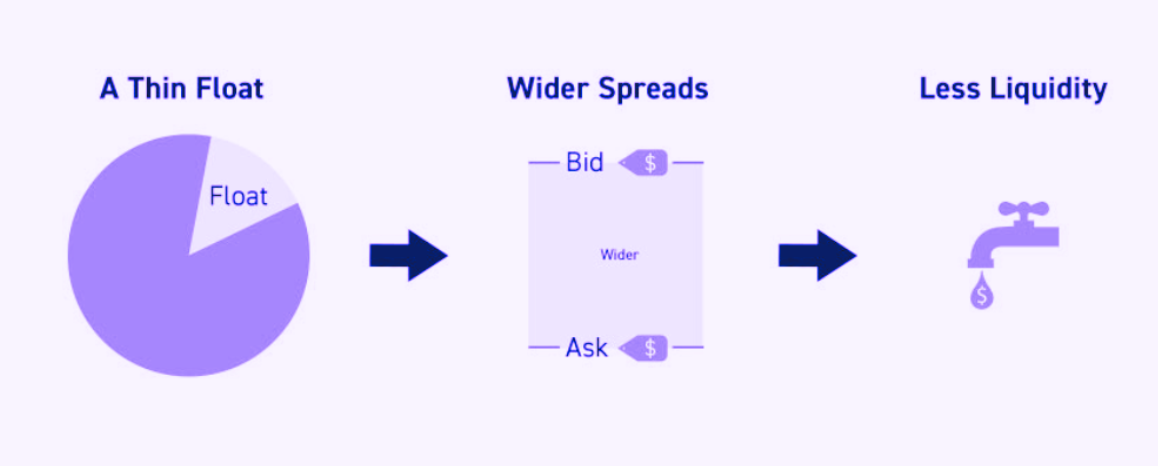

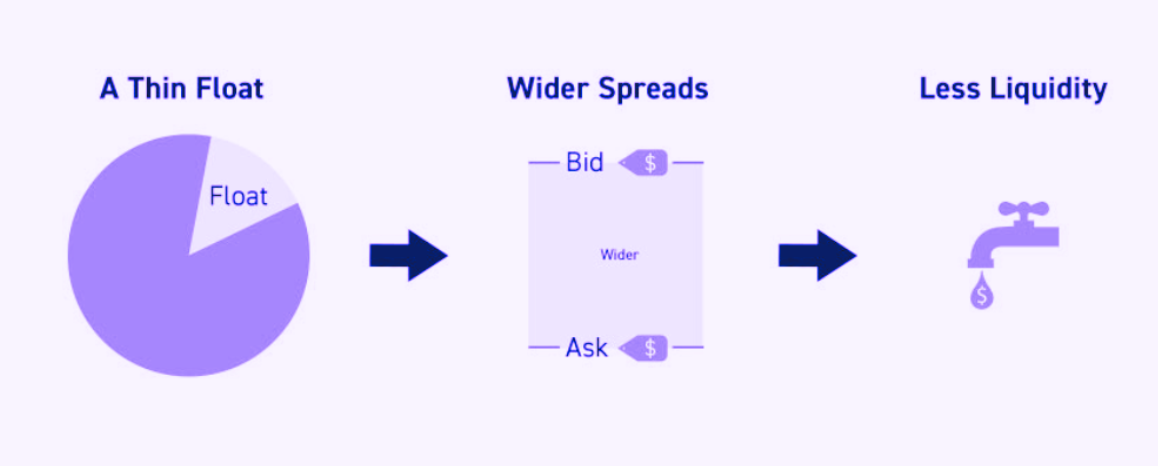

Low float stocks have recently caught the attention of investors and traders alike, but what exactly are they, and why are they generating so much interest? At their core, low float stocks refer to shares of a company that are not readily available for trading on the open market due to a smaller number of shares in circulation. A "float" refers to the number of shares that are freely traded, and when a company has a low float, it typically means that the stock is more sensitive to changes in supply and demand.

This limited availability of shares means that small changes in buying or selling activity can lead to significant price movements, making them incredibly volatile—and in some cases, highly profitable. The buzz around these stocks isn't just because they are prone to large price swings; it's also because their volatility can present unique opportunities for savvy traders who know how to handle the risk.

This limited availability of shares means that small changes in buying or selling activity can lead to significant price movements, making them incredibly volatile—and in some cases, highly profitable. The buzz around these stocks isn't just because they are prone to large price swings; it's also because their volatility can present unique opportunities for savvy traders who know how to handle the risk.

What Makes Low Float Stocks So Attractive (and Risky)?

The main allure of low float stocks is their potential for large price movements in a short amount of time. If there's a limited number of shares available, and if a big investor or group of traders starts buying, the stock can surge quickly because there aren't many shares to go around. This creates an environment where small changes in demand can cause significant price jumps, offering traders the opportunity to make fast profits.

However, this high volatility also means that limited float stocks can be a double-edged sword. While they offer great potential for gains, they also carry high risks. A single news event, earnings report, or external market force can drive prices down just as quickly as they go up. This is why trading such stocks requires a particular mindset and risk management strategy. Traders who are drawn to these stocks are typically more experienced and prepared to handle the market's rapid movements.

How to Spot Potential Low Float Stocks

So, how do you go about identifying promising low float stocks? There are several key factors to consider when scanning the market for these opportunities. Here's what to look out for:

Low Float and High Short Interest: Stocks that are both low in float and have a high short interest tend to be very volatile. Short interest refers to the number of shares that traders have borrowed in order to sell them, hoping to buy them back at a lower price. When a lot of people are betting against the stock, it can lead to a "short squeeze," where the price surges as short sellers rush to cover their positions.

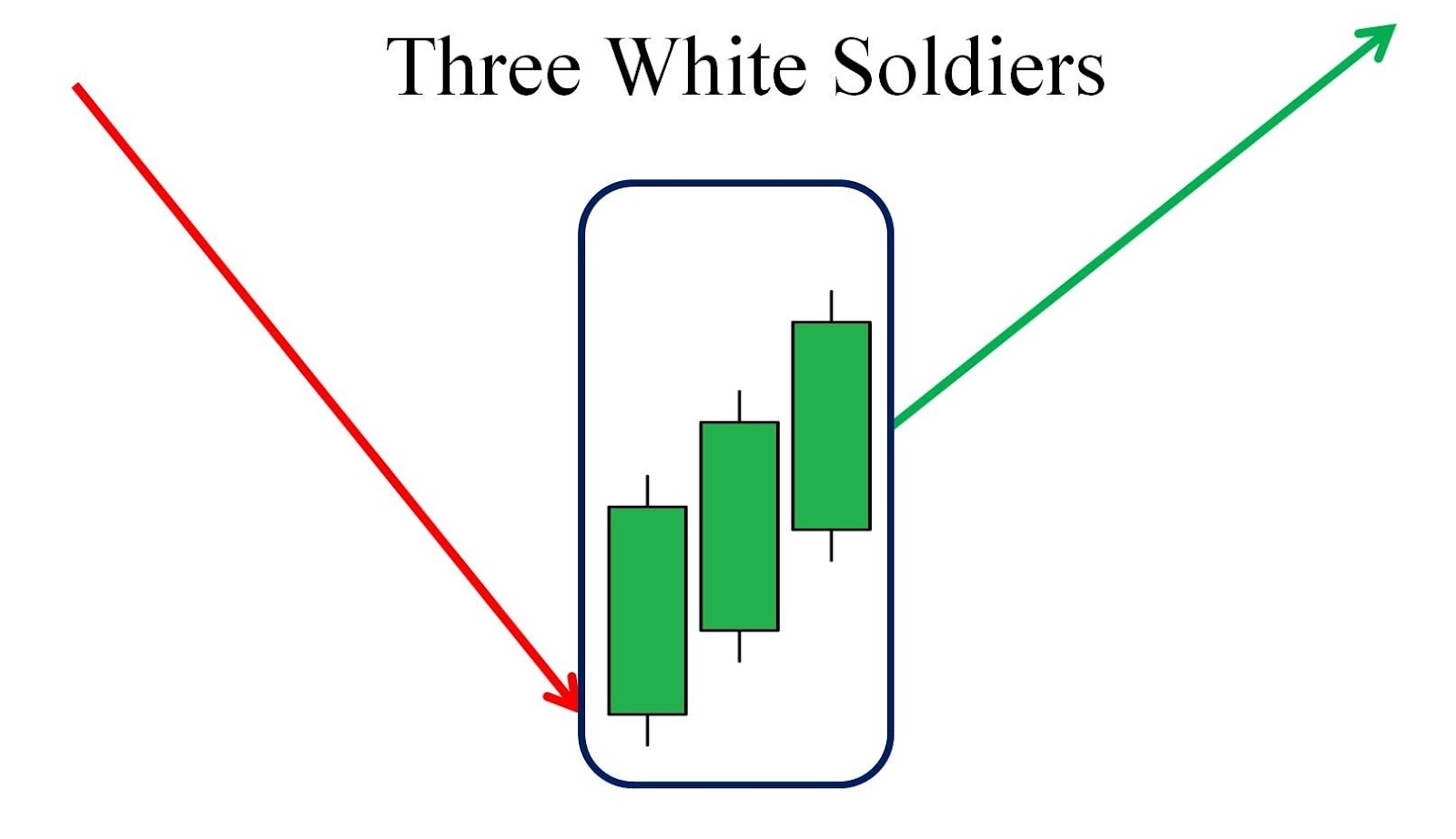

Price Action and Volume: One of the most significant signals that a low float stock is poised for movement is its price action and trading volume. When you see a significant increase in both, it may indicate that the stock is gaining attention and could experience a price spike. Pay attention to patterns of upward momentum and whether the stock is being mentioned in news or on social media platforms.

News and Catalysts: Low float stocks can be highly sensitive to news and announcements. Positive news — such as an earnings surprise, a new product launch, or a major partnership — can drive the price up quickly. Similarly, negative news can cause a sharp decline. Monitoring news sources and understanding a company's fundamentals will give you a clearer picture of how the stock might behave.

Market Sentiment: Low float stocks are often heavily influenced by sentiment. A positive sentiment can spark a rally, while negative sentiment can trigger a sell-off. Sentiment analysis, particularly on social media platforms like Twitter and Reddit, can provide insight into where the collective market mood is heading.

Day Trading Low Float Stocks: The Art of Timing

Day trading low float stocks is a strategy that many traders use to capitalise on short-term price movements. But as with any kind of day trading, timing is everything. Because of their volatility, such stocks can make significant moves in a very short amount of time. For those who are adept at reading charts and monitoring market trends, day trading these stocks can be a lucrative endeavour. But for those who aren't prepared, it can also lead to steep losses.

What makes stocks with low float so interesting for day traders is their potential to explode in price within hours, or even minutes. This is particularly true if there's a catalyst behind the movement, like an earnings report or a major announcement. The idea behind day trading is to enter and exit a stock position within the same day to capture profits from these sharp price fluctuations. Here are a few tips for day trading such stocks:

Timing Your Entry and Exit: Day trading low float stocks requires impeccable timing. You need to be able to identify the right entry points — often when the stock starts to gain momentum and is heading upwards. Timing your exit is equally important; you'll need to know when to take profits before the price starts to dip again. Many day traders use technical analysis and chart patterns to guide their decisions.

Monitor Pre-market and After-market Trading: The price of low float stocks can be influenced by activity before the market officially opens or after it closes. By keeping an eye on pre-market and after-market trading volumes, you can often get a good indication of whether the stock will make a significant move during the regular market hours.

Use Stop-Loss Orders: Because of the volatility of low float stocks, it's essential to have risk management strategies in place. A stop-loss order can automatically sell your shares if the price drops below a certain threshold, helping to limit potential losses.

Focus on Momentum: One of the most important strategies in day trading low float stocks is to focus on momentum. If a stock is trending upwards, it's crucial to be able to identify the signs early and jump in on that momentum. The same goes for downward momentum — if the stock starts to show signs of weakness, exiting the position quickly is key.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

This limited availability of shares means that small changes in buying or selling activity can lead to significant price movements, making them incredibly volatile—and in some cases, highly profitable. The buzz around these stocks isn't just because they are prone to large price swings; it's also because their volatility can present unique opportunities for savvy traders who know how to handle the risk.

This limited availability of shares means that small changes in buying or selling activity can lead to significant price movements, making them incredibly volatile—and in some cases, highly profitable. The buzz around these stocks isn't just because they are prone to large price swings; it's also because their volatility can present unique opportunities for savvy traders who know how to handle the risk.