In technical analysis, the descending triangle pattern is one of the most well-known and widely used Chart Patterns. The bearish continuation pattern typically forms during a downtrend, indicating that sellers are in control and that the price is likely to break lower.

This pattern is most commonly found in downtrends, reinforcing the overall bearish sentiment in the market. Traders use it to anticipate potential price movements and position themselves accordingly.

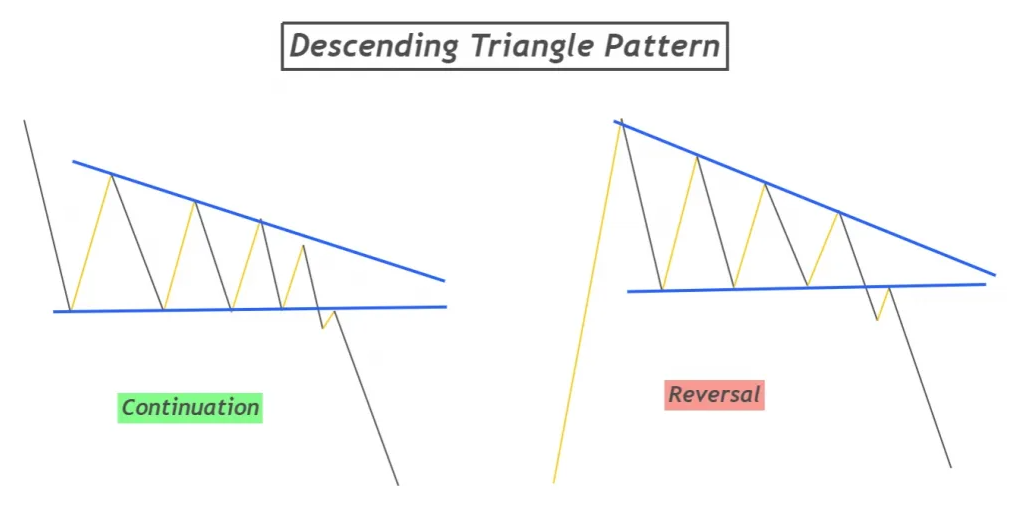

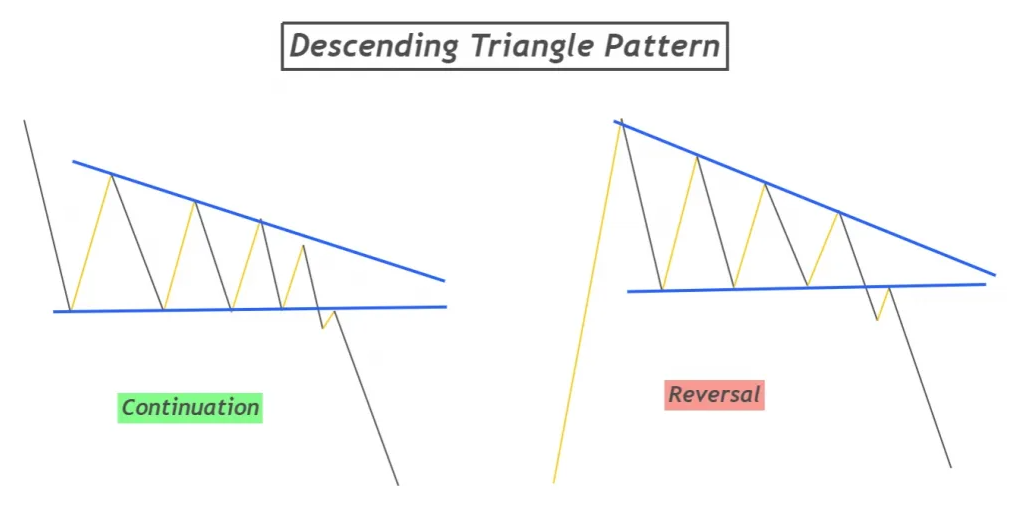

Although the descending triangle is predominantly a bearish pattern, there are instances where a bullish breakout occurs instead. It happens when buying pressure overcomes selling pressure, causing the price to break above the descending trendline.

Understanding the Descending Triangle Pattern

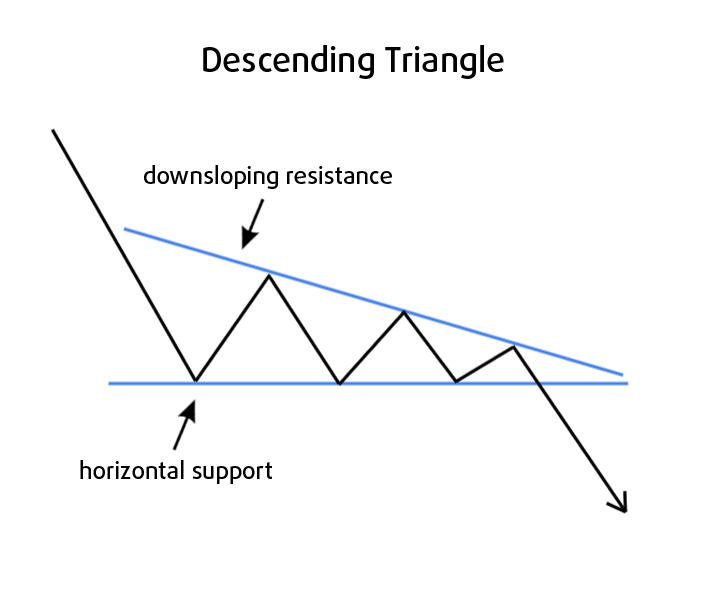

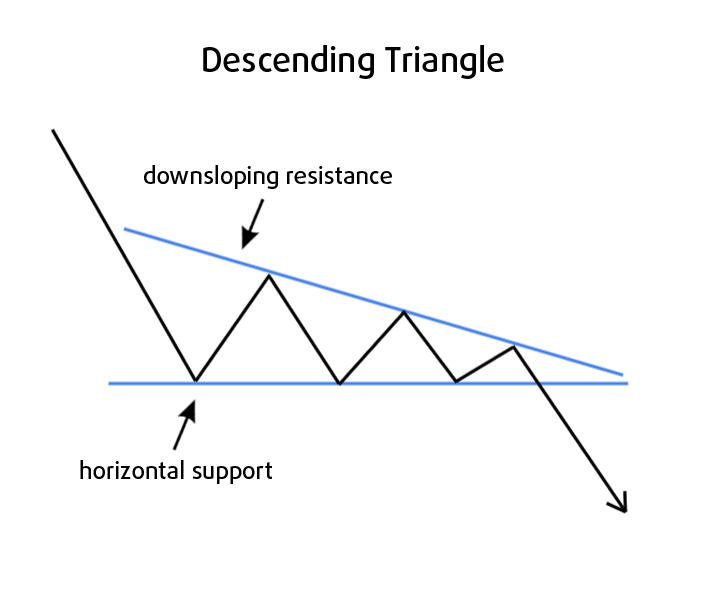

A descending triangle pattern has two key components: a horizontal support level and a descending resistance line. The support level represents a price point where buyers step in to prevent further decline. The descending resistance line forms through a series of lower highs, showing that selling pressure is increasing.

The price continues oscillating between these two lines, forming a triangular shape. As the pattern develops, the range of price movement becomes narrower, and tension builds until the price eventually breaks out, typically to the downside.

However, as mentioned, in some cases, the pattern can signal a bullish reversal if a breakout occurs in the opposite direction. Therefore, we recommend waiting for a valid breakout before taking a position.

Identifying the Descending Triangle Pattern On a Chart

To successfully recognise and trade this pattern, one must first look for a series of lower lows and lower highs before the pattern forms, as a descending triangle is most effective when it forms within a downtrend.

After finding a preceding downtrend, try locating slopes downward on the upper trendline of the triangle slopes downward, as it indicates that buyers are losing strength. Note that each new high should be lower than the previous one, as lower highs signal buyers are losing control and sellers are becoming stronger.

Then, locate the flat support level, as the horizontal support line is a crucial part of the descending triangle. For context, the price should bounce off a consistent support level multiple times, as a flat support level shows that buyers are defending a price level, but selling pressure is increasing.

Lastly, volume often decreases as the triangle forms and increases on the breakout. Thus, pay attention to volume decline during the formation as volume should gradually decrease, and a spike in volume during the breakdown confirms the bearish move. Remember, a valid descending triangle pattern only completes when the price breaks below the support. Thus, stay patient and wait for confirmation to avoid false breakouts.

Why the Descending Triangle is Ideal for Short-Selling

Provide a Clear Breakdown Level: The horizontal support level serves as a well-defined breakdown point, making it easy to identify when to enter a short trade.

Indicates a Clear Stop-Loss Placement: Traders can place stop-loss orders above the most recent lower high, ensuring controlled risk.

Highlights High Probability of Downward Continuation: Since it's a continuation pattern, it often appears in strong downtrends, reinforcing the likelihood of further declines.

Display Reliable Price Targets: The projected price movement after a breakdown can be estimated using the triangle's height, providing traders with realistic profit expectations.

Short-Selling Trading Strategies for Descending Triangle Patterns

The most common and effective way to trade a descending triangle pattern is to short-sell the asset once the price breaks below the established support level. For starters, traders should identify a well-formed descending triangle pattern on the chart and monitor trading volume, as a breakout with increased volume adds credibility to the move.

Once the price approaches the support level, traders have two options for entry. The first approach is to enter a short position before the breakdown through anticipation that selling pressure will eventually overwhelm buyers. However, this method carries a higher level of risk, as the price may temporarily bounce from support instead of breaking down. To mitigate this risk, traders can place a stop-loss above the most recent lower high, ensuring they exit the trade if the pattern fails.

The second and more conservative approach we recommend is to wait for breakdown confirmation. Traders can then enter a short position on the first retest of the broken support, which now acts as resistance. This strategy reduces the risk of false breakouts and provides a more reliable entry point.

In addition, we recommend using momentum indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) to confirm the strength of the breakdown. An RSI reading below 40, with a bearish MACD crossover, adds further confidence that the trend will continue downward.

Real-World Example of Short-Selling Using the Descending Triangle

One of the most famous examples occurred in Tesla's (TSLA) stock during its 2022 downtrend. As the stock began forming a descending triangle pattern with support at $700, traders anticipated a potential breakdown.

When the price finally broke below this level, it led to a rapid sell-off, pushing TSLA down to $600 within days. Traders who entered short positions on the confirmation of the breakdown were able to generate significant profits.

Conclusion

In conclusion, the descending triangle pattern is one of the most effective tools for profitable short-selling. By providing direct breakdown levels, well-defined stop-loss points, and reliable profit targets, this pattern helps traders execute high-probability trades with minimal risk.

While short-selling descending triangles can be highly profitable in down-trending markets, traders should remain cautious of sudden shifts in momentum, economic news, and broader market trends that may influence price action.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.