The Rate of Change (ROC) is a fundamental concept in mathematics and finance that measures the speed at which one quantity changes relative to another.

In trading and investing, the ROC indicator is widely used to assess price momentum, helping traders determine trend strength and potential reversals.

For example, this indicator quantifies the percentage change in an asset’s price over a specific period, helping traders determine whether momentum is accelerating or slowing down. By analysing the ROC, traders can identify potential trend reversals, overbought or oversold conditions and confirm ongoing trends.

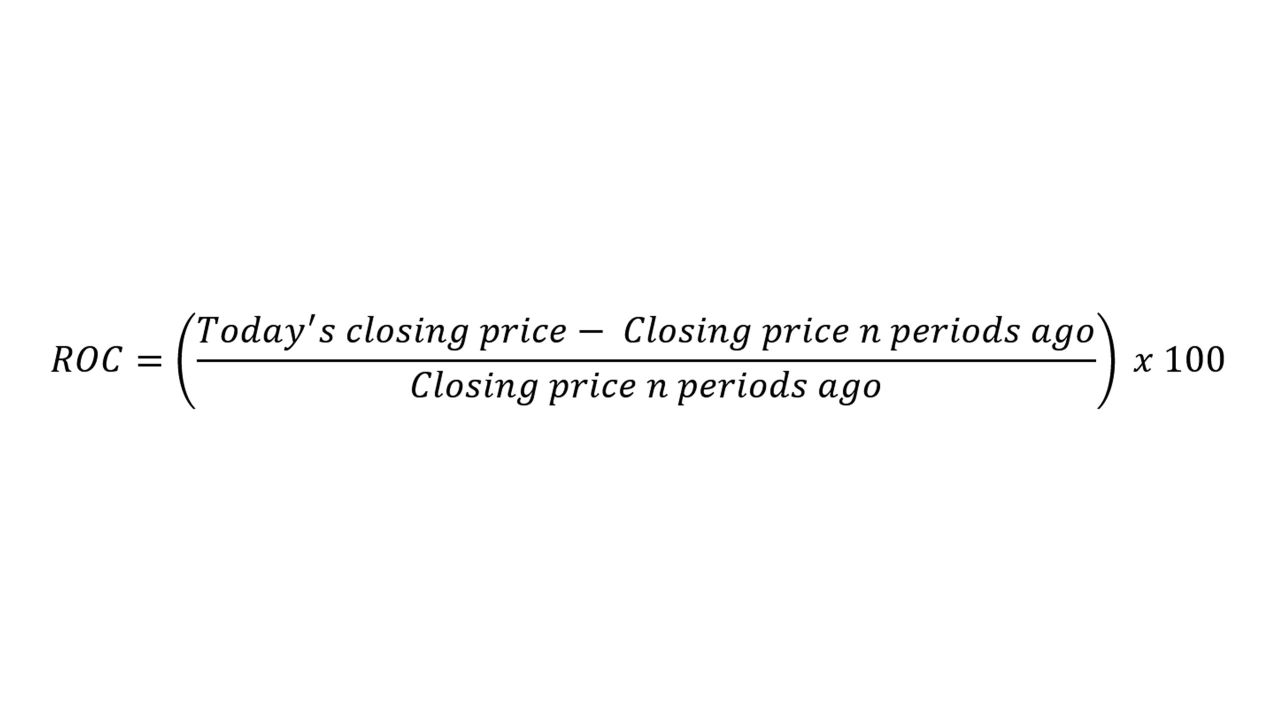

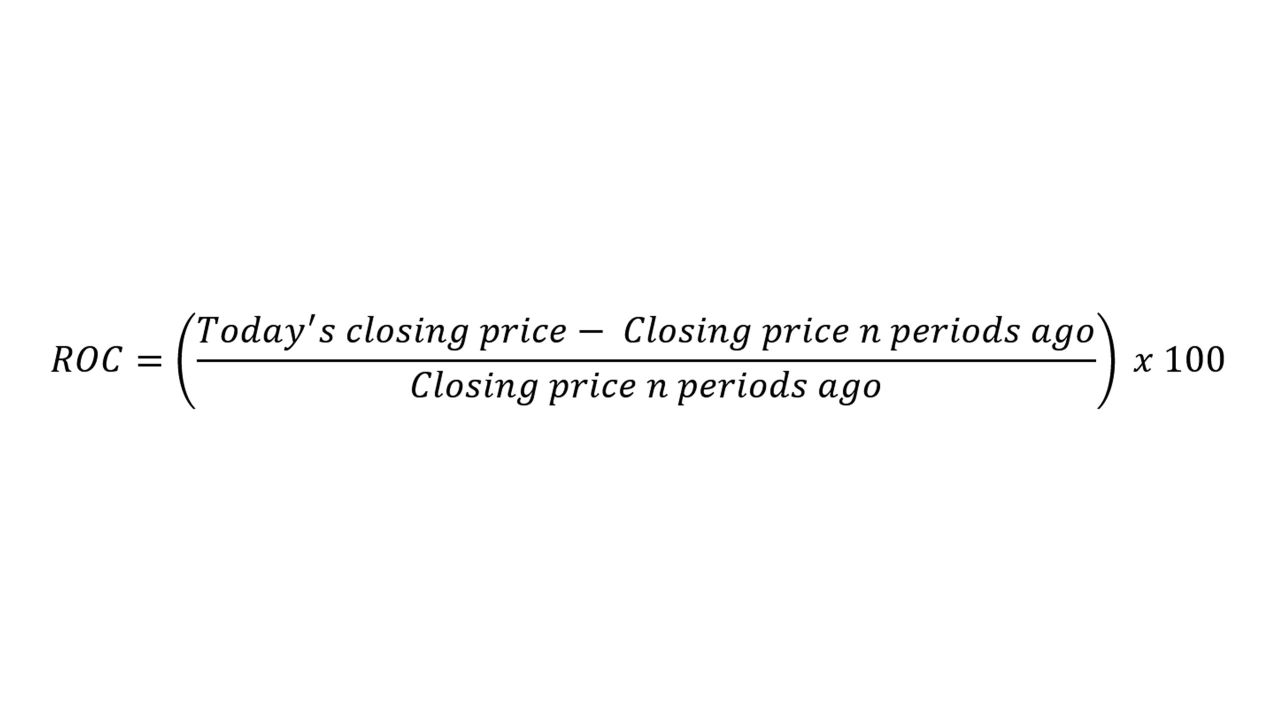

Understanding the Rate of Change Formula

The Rate of Change is a momentum-based oscillator that quantifies the percentage change in price over a specified period. The formula for ROC is relatively straightforward, as shown in the picture above.

This calculation provides a percentage-based view of how much the price has moved over a specified period. A positive ROC suggests that the price has risen over that period, while a negative ROC indicates a decline. By analysing these percentage changes, traders can determine whether an asset is gaining or losing momentum.

A rising ROC suggests that prices are accelerating, while a declining ROC indicates that momentum is slowing down. When the ROC approaches zero, it suggests that prices have stalled, and if the ROC continues declining after reaching an extreme, it could indicate that a reversal is imminent.

The key to identifying trend reversals lies in spotting when the ROC begins diverging from price action, signalling a weakening trend before the market reverses direction.

Calculating the Rate of Change Step by Step

To calculate the Rate of Change, follow these steps. First, determine the current value of the asset or data set you are analysing. Next, identify the previous value from a chosen period in the past.

Subtract the previous value from the current value to find the price change. Then, divide this difference by the previous value to normalise the change relative to the original data point. Finally, multiply the result by 100 to express it as a percentage.

For example, suppose a stock trade was at $50 ten days ago, and today it is trading at $55. Using the formula, the Rate of Change would be calculated as:

From this calculation, we can conclude the stock price has increased by 10%, indicating bullish momentum.

Conversely, if the stock had dropped from $50 to $45, the Rate of Change would be:

A negative ROC indicates the stock has lost value, signalling bearish momentum.

How the Rate of Change Helps Identify Trend Reversals

One of the most important ways the Rate of Change helps identify trend reversals is through divergence. Divergence occurs when the price of an asset moves in one direction, but the ROC indicator moves in the opposite direction. There are two main types of divergence: A bearish divergence and a bullish divergence.

A bearish divergence happens when the price of an asset makes a higher high, but the ROC fails to make a corresponding high. It indicates that while prices may increase, the momentum behind the move is weakening. A weakening ROC suggests buyers are losing strength, and a reversal to the downside could soon follow.

On the flip side, a bullish divergence occurs when the price of an asset makes a lower low, but the ROC does not confirm the new low and instead begins to trend higher. It suggests that while prices are falling, the downward momentum is lowering, and a reversal to the upside could be near.

Divergence is a critical early warning signal for traders because it allows them to see trend weakness before it becomes evident in the actual price action. It enables traders to exit trades before a reversal occurs or prepare for a new entry before the trend changes direction.

Applying the Rate of Change in Trading Strategies

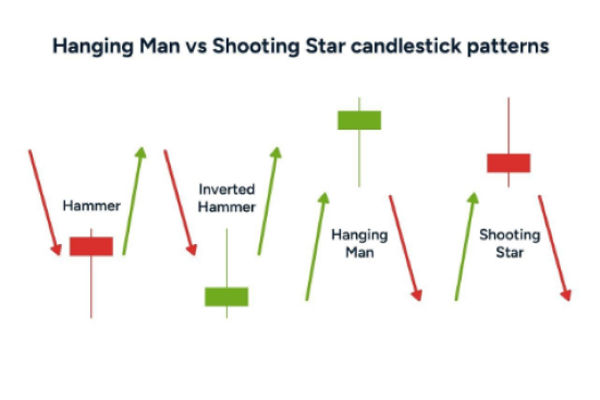

The Rate of Change is most effective when combined with other technical indicators to confirm trend reversals. Traders often pair ROC with moving averages, support and resistance levels, and candlestick patterns to strengthen their trading signals.

For instance, one common approach is to use the ROC with moving averages. If the ROC signals a potential reversal but the price is still above a 50-day or 200-day moving average, traders might wait for additional confirmation before entering a trade. However, if the ROC shows bearish divergence and the price breaks below a key moving average, this provides strong confirmation of a trend reversal.

Another effective method is using ROC with support and resistance levels. If the price is approaching a major resistance level and the ROC is declining, it suggests that momentum is weakening, increasing the likelihood of a reversal to the downside. Likewise, if the price is near a support level and the ROC rises, it signals bullish strength and the potential for an upward reversal.

Lastly, ROC can also be used in breakout trading strategies. If an asset has been trading within a range and the ROC suddenly spikes, it signals a momentum breakout. Traders who recognise this early can enter trades before the broader market reacts. However, if the ROC spikes but quickly starts declining, it suggests that the breakout lacks sustainability and may result in a false move.

Risks to Consider When Using the Rate of Change

Despite its benefits, the Rate of Change indicator has some limitations that traders should understand. One major drawback is that it does not provide direction alone, requiring confirmation from other indicators. It is also susceptible to price fluctuations, which could generate false signals in choppy or sideways markets.

Another limitation is that the ROC lags behind real-time price action during strong trends. While it helps measure momentum, it does not predict exact turning points, so traders should avoid relying solely on it for trade entries or exits.

Additionally, setting the wrong ROC period length can lead to misleading signals. A shorter period (e.g., 5 days) makes the ROC highly sensitive to price changes, increasing noise and false signals. A longer period (e.g., 50 days) smooths out fluctuations but may result in delayed signals.

Conclusion

Regardless, the Rate of Change formula is essential in momentum analysis to help traders assess the speed and strength of price movements over a given period. When interpreted correctly, it can be a powerful leading indicator that enables traders to stay ahead of market movements.

Ultimately, mastering the Rate of Change indicator requires practice and experience. Traders should backtest different ROC settings, observe how they interact with price action in various market conditions, and refine their strategies accordingly.

By combining ROC with other technical tools, adjusting timeframes based on trading style, and incorporating risk management techniques, traders can enhance their ability to make informed, profitable trading decisions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.