Just as air is invisible to us, copper is so common that many forget its importance to the global economy. As the third-most-used metal, copper is vital in modern industry. Known as "Dr. Copper," it serves as an indicator of the global economy's health. Let's explore how copper prices change and what they tell us about economic trends. The Economic Impact of Copper Price Fluctuations

The Economic Impact of Copper Price Fluctuations

Copper, among the oldest known metals, boasts exceptional ductility, electrical conductivity, and resistance to corrosion. These attributes make it indispensable in the production of critical items such as electrical appliances, construction materials, and household goods. Its versatility extends across diverse sectors including electrical engineering, construction, transportation, telecommunications, energy, and healthcare.

In construction, copper is pivotal for wiring, piping, and heating systems. In manufacturing, it forms a crucial part of electric motors, transformers, and circuitry. The widespread use of copper underscores its integral role in modern society, contributing to its sustained price appreciation over time. The demand for copper continues to surge, driven by robust growth in industries like power generation, construction, and telecommunications, buoyed by global economic expansion. Additionally, the rise of renewable energy sources such as electric vehicles, solar panels, and wind turbines has further bolstered copper demand and prices.

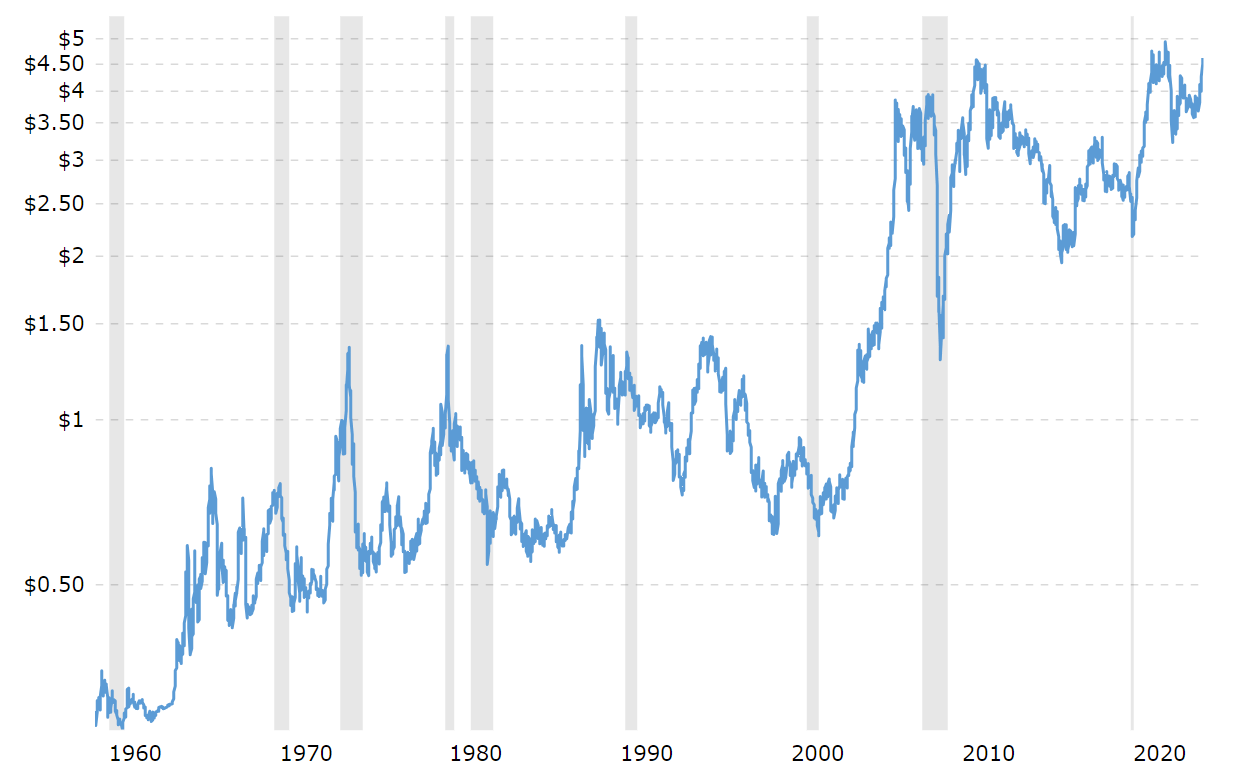

On the supply side, geopolitical tensions and environmental constraints limit accessible copper reserves, reinforcing its market value. Escalating production costs and its appeal as a commodity investment also contribute to upward price momentum. While copper prices generally trend upwards in the long term, short-term volatility persists due to fluctuations in supply, demand dynamics, and geopolitical events. Historically, copper prices correlate inversely with economic downturns, plummeting during recessions and peaking in economic booms.

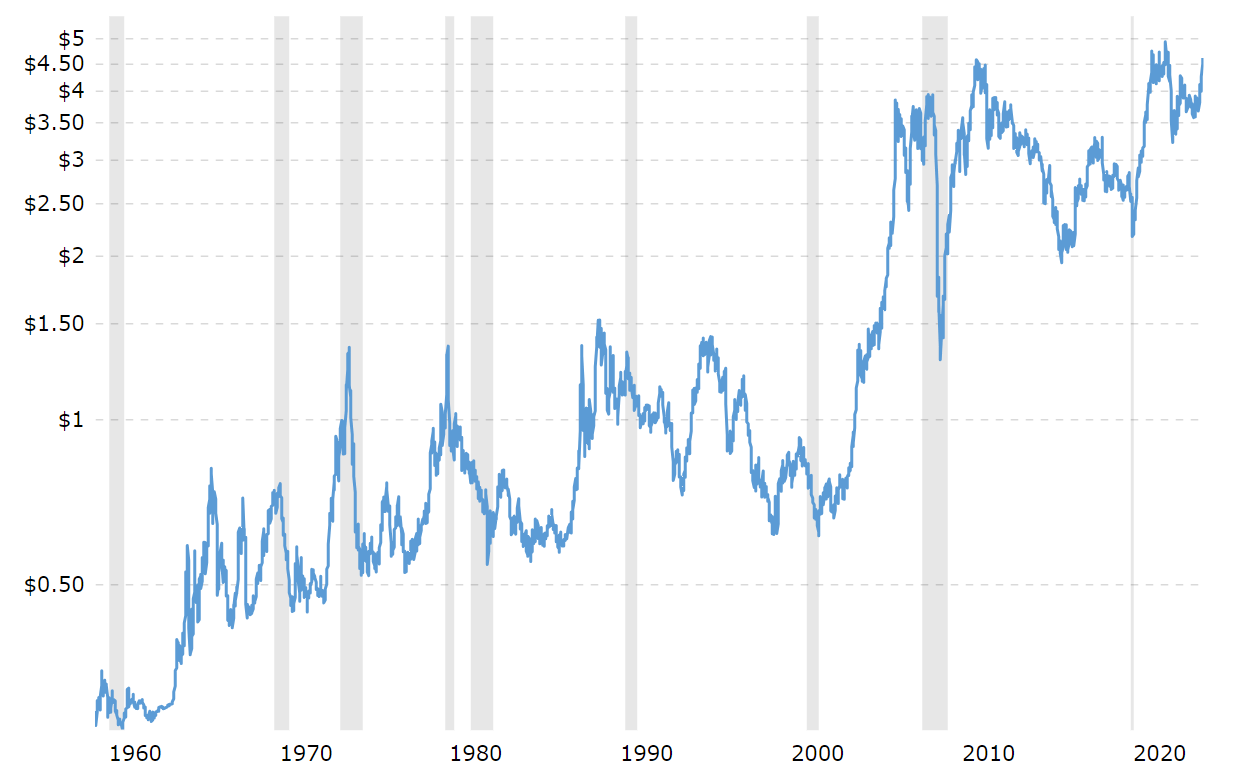

The chart below illustrates the significant volatility in copper prices during the 1970s and 1980s, driven largely by the global energy crisis. This period of economic instability saw drastic fluctuations in copper prices, influenced by high inflation and global economic uncertainty stemming from the energy crisis.

In the early 1990s, copper prices stabilized after the tumultuous previous decades. However, the Asian financial crisis of 1997 triggered a brief downturn in copper prices, reflecting the interconnectedness of global markets and the impact of regional economic turmoil on commodity demand.

Entering the 21st century, copper prices embarked on a sustained upward trajectory. From 2003 to 2008, demand surged, particularly from China and other emerging markets amidst a global economic expansion. The subsequent global financial crisis in 2008 initially led to a sharp decline in copper prices, only to rebound swiftly alongside the broader economic recovery.

Peak prices in 2011 marked another turning point as China's economic growth slowed, global copper supplies increased, and geopolitical tensions strained international trade. This period underscored copper's susceptibility to multifaceted global factors, contributing to heightened price volatility.

The onset of the COVID-19 pandemic in 2020 precipitated a global economic downturn, prompting a temporary dip in copper prices. However, rapid rebounds ensued in late 2020 and early 2021 as global economic stimulus measures and supply chain disruptions tightened copper supplies, surpassing historical highs.

Copper's price dynamics continue to reflect its role as a global economic indicator, sensitive to shifts in global economic health, supply chain dynamics, and geopolitical developments.

Causes Behind Copper Price Fluctuations

Causes Behind Copper Price Fluctuations

Copper is cited by countries as one of the key metals in the short to medium term, mainly because of its importance in the modern economy and industry. Copper is usually one of the best-performing commodity assets during the global economic recovery and upward inflationary phase. In 2024. copper prices are likely to be influenced by supply uncertainty and environmental demand.

Its price, in general, is mainly affected by supply and demand. On the supply side, copper mine production and smelter processing fees will have a direct impact on its price, with higher processing fees usually implying an adequate supply of copper; supply disruptions, such as mine strikes, political unrest, or natural disasters, may also push up prices.

On the demand side, changes in global demand for copper in manufacturing, infrastructure construction, real estate, transportation, power, and new energy will have a direct impact on the price of copper. As the world's largest copper consumer, China's economic conditions and changes in demand have a significant impact on its prices. In addition, lower inventory levels also provide support for copper prices.

The global distribution of copper mines is unbalanced, with reserves and production unevenly distributed across regions, all of which affect changes in the global copper supply chain. According to the 2023 U.S. Geological Survey (USGS) data, global copper reserves are about 890 million tons, with the Central American region being the highest copper production region.

Chile, Australia, and Peru are the three countries with the highest global copper reserves, with total reserves accounting for about 41% of the world. Among them, Chile has rich copper resources and is one of the richest countries in the world, which plays an important role in the stability and supply of the global copper market.

Meanwhile, China's Zijin Mining announced that its copper production exceeded one million tons, ranking it among the world's fifth-largest copper companies. This shows that China, as one of the world's largest copper consumers, has had an important influence on the development of the copper mining industry. Due to China's high dependence on copper imports, which makes the global copper trade very active, global copper demand is mainly affected by China's economic development and policy changes.

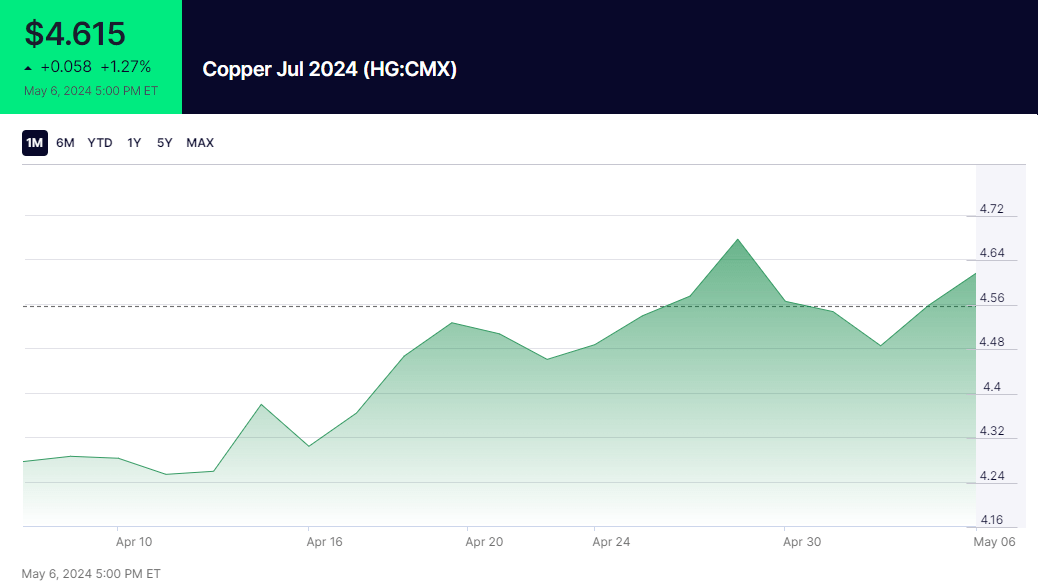

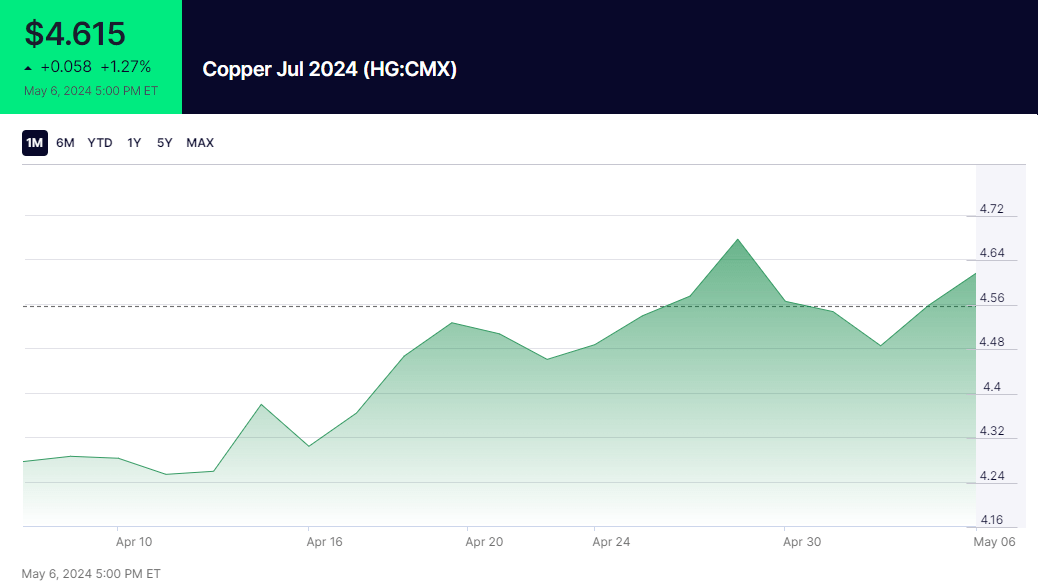

Through the price trend of copper in the past five years, it can be seen that the price of copper has experienced two substantial increases. The first time was in 2020. during the New Crown Epidemic, when its price began to climb due to heightened market concerns about copper supply coupled with a gradual turnaround in the Chinese economy.

This reflects the impact of supply chain issues and Chinese demand on copper prices. During this period, copper production around the world slowed down due to the impact of the epidemic, coupled with China's economic recovery as the world's largest consumer of copper, which led to a pick-up in copper demand, which in turn drove up prices.

At the same time, the macroeconomy also has a great impact on the price of copper, including domestic and foreign policy adjustments, economic data, and so on. And copper prices and the trend of the U.S. dollar are usually negatively correlated; when the dollar is weak, its price tends to rise. This is because the depreciation of the dollar makes non-dollar-denominated copper cheaper on the international market, thus stimulating demand.

In addition, the direction of monetary policy in the U.S. and China also affects the price of copper. For example, monetary policy adjustments by the Federal Reserve or other major central banks may alter market liquidity, which can have an impact on copper prices. Increased liquidity also typically drives up the price of copper because of increased market demand for commodities such as copper.

In the second quarter of 2022. the intensification of the epidemic in China, along with the tightening of the Federal Reserve's monetary policy, increased the risk of a recession, which led to a significant decline in the price of copper. In the fourth quarter of the same year, China optimized its epidemic prevention and control policies, and the Fed began to slow the pace of interest rate hikes, which led to a second sharp upturn in copper prices.

These two copper price increases reflected uncertainty in the global supply chain, changes in Chinese demand, and the impact of global monetary policy on the copper market. With policy adjustments in China and changes in the Fed's monetary policy, copper price action is likely to continue to be influenced by these factors.

Uncertain events typically have a disruptive effect on market sentiment, which in turn affects the price of copper. Whenever uncertain events such as political, economic, geopolitical, or natural disasters occur, market participants may become concerned about future copper supply or demand. Such mood swings may lead to significant short-term fluctuations in its price. In particular, the impact on the market may be greater when uncertain events affect major copper-producing or consuming countries.

For example, at the end of November 2023. Canada's First Quantum Mining signed a contract with the Panamanian government to operate a giant copper mine. First Quantum owns Cobre Panamá, one of the world's largest open-pit copper mines, which produces 350.000 tons, or 1.5% of the global copper supply. First Quantum's share price has continued to fall as the Cobre Panamá mine shut down due to protests initiated by the Panamanian population, causing copper prices to rise to a two-month high.

This shutdown reflects the impact of geopolitics and popular activity on the copper supply chain. Barrick Gold has shown interest in acquiring First Quantum, which would become one of the world's largest copper producers if the deal goes through. Similar events include Anglo American's plan to reduce its copper production target for 2024. adjusting it from 1 million tons to 730–790.000 tons. This move to reduce production will further impact the global copper supply chain.

Overall, copper prices are likely to continue to be affected by a combination of these factors in 2024. showing volatile movements. Therefore, investors need to pay close attention to global economic conditions, supply chain issues, and policy changes to better anticipate and respond to changes in copper prices.

Copper Market Price Analysis

From the perspective of the historical trend of copper's price and the reasons for the price impact, by the joint influence of the fundamentals and macro, in the short term, its price may be fluctuating within a relatively narrow range. Upside and downside space is usually limited due to copper's supply-demand balance and relatively stable market expectations.

On the upside, copper supply chain issues, production cuts by producers, and increased demand may drive copper prices up, while on the downside, a global economic slowdown, increased supply, or reduced demand may lead to a fall in copper prices. Overall, however, copper prices are likely to fluctuate within a relatively stable range.

Copper supply and demand, to a certain extent, determine the price volatility of copper. The supply side includes factors such as copper mine production, smelter processing fees, and inventory levels. These factors influence the available supply and cost of copper, which in turn have an impact on the price of copper. On the demand side, global demand for copper from manufacturing and infrastructure development is a key factor, particularly from China and other emerging markets, where economic conditions and development goals directly affect the amount of copper demanded.

Macroeconomic policies, international trade policies, changes in interest rates, global economic growth expectations, and other macro-factors can have a large impact on the price of copper. The trend of the U.S. dollar and monetary policy adjustments in major economies around the world can also cause large fluctuations in the price of copper. The U.S. dollar and copper prices usually show a negative correlation; that is, the depreciation of the U.S. dollar may push its price up, while the appreciation of the dollar may form downward pressure on its price.

Therefore, under the combined effect of fundamentals and macros, copper prices are likely to fluctuate within a range. The upward space is limited by factors such as sufficient supply, high processing fees, and low demand; the downward space is supported by factors such as tight supply, low inventory, and strong demand. Therefore, in the short term, its price may appear to have an obvious unilateral trend, but it is more of a shock trend. This oscillating trend reflects the market's search for a balance between fundamentals and macro aspects, which affects the upward or downward trend of prices.

In the medium term, to determine whether the price of copper will be reversed, the key is to observe whether domestic demand is picking up and when the Federal Reserve's monetary policy will enter the interest rate reduction cycle. The direction of these two will have a significant impact on the future trend of copper prices. If domestic demand continues to improve and the Fed's monetary policy enters a rate-cutting cycle, this could drive a reversal in copper prices out of the uptrend.

It is important to realize that copper has important uses in many industries, including construction, infrastructure, power, and manufacturing. Therefore, domestic economic growth and demand recovery, especially in real estate and manufacturing, will directly drive the demand for copper, which in turn will drive prices up. If domestic demand continues to grow, especially in China, as the world's largest consumer demand for copper continues to rise, the price of copper may move higher.

And the Fed's monetary policy, especially its interest rate decisions, has a direct impact on copper prices. If the Fed begins to slow down its rate hikes or enters a cycle of rate cuts, the U.S. dollar could weaken and global liquidity increase, which would be a positive factor for copper prices. If the Fed's monetary policy enters an easing cycle, this could provide further support for its price.

In the long term, copper prices are definitely in a bullish trend. One reason for this is that capital expenditure by copper mining companies has fallen significantly in recent years, which could lead to a lack of copper supply in the future. Since it takes a long time (usually 5-7 years) for a copper mine to go from input to output, copper supply shortfalls may become apparent in the next few years. This will put upward pressure on its price.

The second reason is that, with the global focus and development of new energy, the new energy industry's demand for copper has increased significantly. For example, the amount of copper used in new energy vehicles is several times that of traditional cars, and new energy facilities such as charging piles, photovoltaic, and wind power also require large amounts of copper. With the further development of the new energy industry, the demand for copper will continue to grow, which will drive the overall price of copper upward.

Both of these logics suggest that copper prices are expected to continue to rise in the long term. Whether it is the decline in capital expenditure by copper miners or as the global focus on sustainability and energy transition continues to grow, demand for copper as one of the key metals will continue to rise, which in turn will support its long-term bullish outlook.

Therefore, copper prices are likely to remain on an upward trend in the long term. However, it is still likely to face uncertainties in the short and medium term, including fluctuations in the global economy, geopolitical risks, and market sentiment. Investors should therefore exercise caution when investing in commodities such as copper, pay close attention to market changes, and consider risk management strategies.

Copper price trends and global economic analysis

| Time period |

Copper Price Trend |

Relevant economic factors |

| 1970s to 1980s |

Large fluctuations |

Energy crisis, high inflation, and global economic instability |

| Early 1990s |

Relatively stable |

A more stable global economy |

| 1997 |

Short decline |

Asian financial crisis |

| 2003 to 2008 |

Continuously rising |

China and emerging markets drive global growth. |

| 2008 |

Sharp decline |

Global financial crisis |

| 2009 to 2011 |

Rebound, peak |

Increased demand as the global economy recovers |

| 2011 to 2019 |

Down, fluctuating |

Slower growth in China, stronger dollar, global trade frictions |

| 2020 |

Sharp decline |

Global economic weakness due to the new crown epidemic |

| Late 2020 to early 2021 |

Sharp rebound |

Copper supply shifts with uncertainty and rising demand. |

| Second quarter of 2022 |

Sharp decline |

China outbreak intensifies, Fed tightens monetary policy |

| Fourth quarter of 2022 |

Sharply up |

China optimizes epidemic policy, Fed slows rate hikes |

| 2024 |

Fluctuating trend |

Copper supply changes with uncertainty and higher demand. |

| Long-term outlook |

Continuing to rise |

New energy industry development, copper demand growth |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

The Economic Impact of Copper Price Fluctuations

The Economic Impact of Copper Price Fluctuations Causes Behind Copper Price Fluctuations

Causes Behind Copper Price Fluctuations