In popular view, financial professionals are often seen as incredibly wealthy, especially those working in Wall Street's high-powered firms. Even a junior employee's salary can be several times higher than the average person's. This raises the common question: how do these finance professionals make so much money? The truth is, the high salaries in finance are largely driven by the use of complex financial tools and strategies that can greatly boost investment returns. One such tool is asset securitisation, which stands out as a prime example.

In this article, we'll take a closer look at what asset securitisation is, how it works, its benefits, and the risks involved, to understand its role in the financial markets.

Asset Securitisation's Definition

Asset Securitisation's Definition

Asset securitisation is a form of securitisation that aims to transform assets with low liquidity, such as loans, receivables, and real estate, into securities that can be traded in the financial markets.

Specifically, the securitisation process involves pooling these assets together, then reconfiguring the cash flows generated by the pool (such as principal and interest from loans, or payments from receivables) into a series of securities with varying risk and return profiles. These securities are then sold to investors, who, by holding them, share in the future cash flow returns from the asset pool.

At its core, asset securitisation converts the future cash flows of assets (such as loan repayments) into tradable securities, allowing companies or institutions to quickly raise funds. In this way, the future income rights of the assets are separated and sold to investors in the form of securities, blurring the line between direct and indirect financing, and making the financing process more flexible and efficient.

Moreover, this process enhances the liquidity of assets by trading securities on the market, thereby achieving the financing goal. It allows companies to access funds more swiftly, while offering investors solid investment opportunities, driving innovation and deeper development in the financial markets.

Additionally, asset securitisation discounts the rights to future cash flows to the present, thereby securing immediate funding. This method not only optimises the efficiency of capital usage but also diversifies risk, while offering investors new investment tools and channels, playing a crucial role in the financial markets.

In essence, asset securitisation is the transformation of future expected income or assets into tradable securities, which are then sold to investors. This process not only helps firms raise capital quickly, but it also improves the liquidity of the underlying assets.

For example, imagine taking out a loan of £200.000 from the bank to open a florist shop. The shop is performing well, generating a net profit of £10.000 a month. If the goal is to accelerate the cash flow, the expected profits for the next five years could be packaged into a security product. These securities would be sold by the bank to other investors, who would receive regular interest payments, with the principal being redeemed at maturity.

Asset securitisation allows businesses or financial institutions to turn their assets into more liquid securities, optimising capital turnover and enabling them to secure urgently needed funds for growth. Meanwhile, investors benefit from relatively stable returns. This dual advantage enhances financing capacity for businesses and provides investors with sound investment opportunities, fostering efficient capital movement and utilisation.

The core of asset securitisation lies in the predictability of the underlying asset's cash flows, which must be stable and foreseeable in the future. This predictability ensures that investors can have reasonable expectations about the future returns of the asset, making it more attractive. Common assets with predictable cash flows include loans, lease income, and receivables, as these often have a clear schedule and fixed amounts of cash flow.

During the securitisation process, assets are restructured through the capital markets, transforming future cash flows into tradable securities. This process enhances the liquidity of assets that would otherwise be illiquid, while also allowing investors to choose from securities with varying levels of risk based on their preferences. This enables more efficient allocation of capital and better risk management.

To sum up, asset securitisation helps businesses and financial institutions optimise capital efficiency by converting predictable future cash flows into tradable securities, improving liquidity. It not only meets financing needs but also provides investors with stable investment opportunities. Moreover, it drives innovation and deepens financial markets, facilitating more efficient capital allocation, diversifying financial instruments, and enhancing market flexibility.

Asset securitisation's development

| Stage |

Period |

Key Features |

| Initial |

1960s-1970s |

Start of mortgage-backed securities. |

| Growth |

1980s-early 1990s |

Securitisation of cards, loans. |

| Complexity |

Mid-1990s-2000s |

Rise of CDOs, product diversification. |

| Crisis |

2007-2009 |

Subprime crisis, market instability. |

| Recovery |

2010s |

Market recovery, tighter regulation. |

| Innovation |

2020s-present |

Tech innovation, green finance rise. |

Asset Securitisation Procedure Explained

The asset securitisation process involves converting a group of cash-generating assets into tradable securities, which are then used to raise funds from investors. The key stages of this process include asset pooling, securities issuance, and cash flow management.

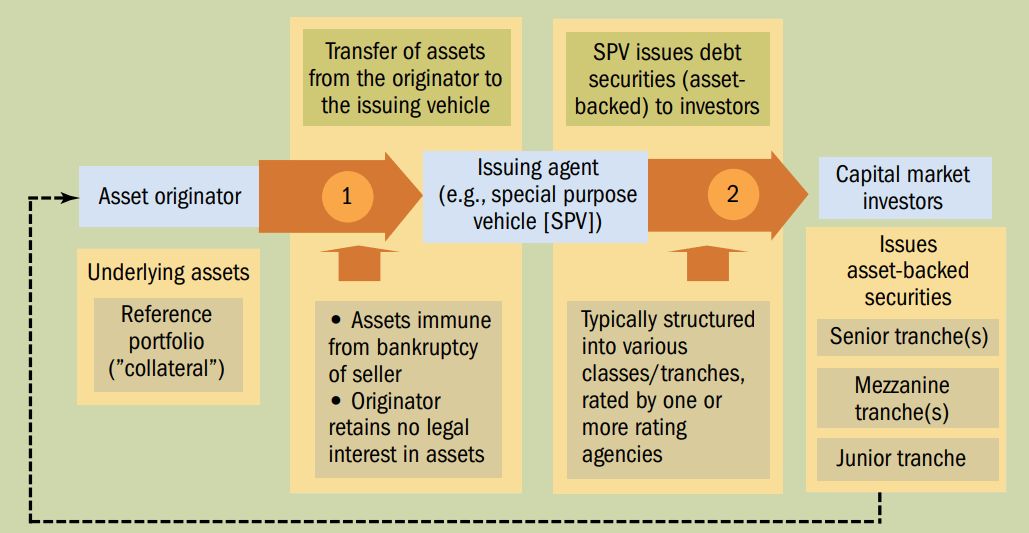

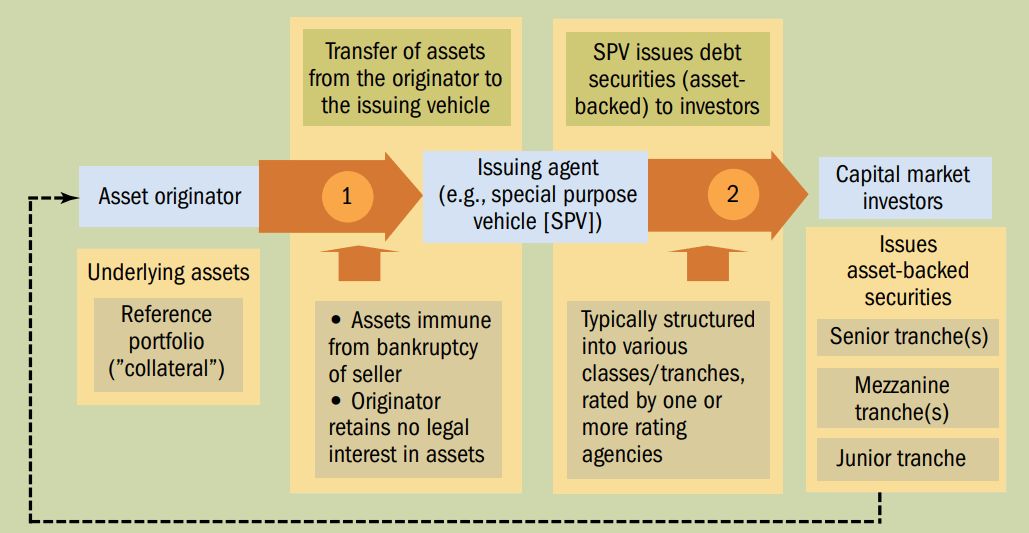

The securitisation process begins with the originating institution, such as a bank or lending firm, which sells its assets (e.g. loans or receivables) to a Special Purpose Vehicle (SPV) in exchange for funds. These funds can be reinvested or used for other business activities, thus enhancing financial flexibility and the efficient use of capital.

This section of process is referred to as asset pooling. Typically, a financial institution will gather and package similar types of loans (e.g. mortgages or car loans) into a pool before transferring them to an SPV. The SPV holds these assets and manages their cash flows, isolating the risk of the assets from the rest of the institution's business. This allows the assets' cash flows to be traded in the securitisation market.

Then, the SPV will structure the securities into different layers according to their varying levels of risk and return. These layers typically include senior securities, mezzanine securities, and subordinate securities, with each layer bearing a distinct level of risk.

To enhance the appeal of these securities in the market, credit rating agencies are typically employed to assess their ratings. A high rating indicates greater security, making investors more inclined to purchase them. Additionally, to further reduce investor risk, various credit enhancement measures may be implemented. These measures include excess collateral, reserve funds, and third-party guarantees.

Excess collateral refers to the total value of the underlying assets being higher than the amount of securities issued, thus providing an additional margin of safety. Reserve funds are established through the creation of a reserve fund to address potential default risks within the asset pool, while third-party guarantees involve external institutions providing extra security to further enhance the safety of the securities. These enhancement measures effectively boost investor confidence and reduce investment risks.

Subsequently, the SPV issues these layered securities in the form of bonds and sells them to investors in the market. The senior securities offer more stable returns, albeit at lower yields, while the subordinated securities provide higher returns but come with greater risk. This layered structure and bond issuance method enable investors to participate in investments with varying risk-return profiles, according to their individual needs.

Cash flow management is a crucial element in the implementation of asset securitisation. Borrowers (such as homebuyers) make repayments according to the terms of the contract, which are first collected by the Special Purpose Vehicle (SPV). The SPV then allocates these cash flows according to the priority and risk levels of the securities, converting the cash flows from the asset pool into interest and principal payments to the securities holders. Investors receive regular interest payments and have their principal redeemed when the securities mature.

This process ensures the fair distribution of returns. The SPV is responsible for allocating the cash flows generated by the asset pool (such as repayments) according to the priority of the bonds. Depending on the risk level of the securities, holders of higher-risk bonds may receive higher returns, while those holding lower-risk bonds will earn relatively lower returns. In this way, investors can align their returns with their individual risk tolerance and return expectations, helping them achieve their investment objectives.

Throughout the lifecycle of the asset securitisation, the SPV is responsible for managing and overseeing the underlying asset pool, ensuring that cash flows are properly received. Additionally, the SPV must regularly report on the performance of the asset pool to investors and relevant parties, ensuring transparency and compliance.

Asset Securitisation's Benefits and Risks

Asset securitisation offers several significant benefits. These advantages not only benefit asset holders but also have a positive impact on investors, financial markets, and the broader economy. However, while it provides financial institutions with tools for funding and risk diversification, it also introduces various risks.

One of the main benefits of asset securitisation is its ability to reduce issuance costs. By converting assets into securities, companies can raise funds at lower interest rates. This method is typically more cost-effective than traditional lending, thereby reducing the expenses associated with direct financing and providing businesses with a more efficient and affordable financing channel.

Moreover, by distributing credit assets across a range of investors, asset securitisation effectively reduces the concentration of credit risk. This diversification mechanism ensures that the risk is not concentrated in a single lender or financial institution, enhancing the overall stability of the financial system.

The packaging of dispersed assets into securities also enables economies of scale. Not only does this centralise asset management, but it also optimises resource use, reducing operational costs while increasing asset utilisation.

Moreover, converting future cash flows into securities can significantly enhance the liquidity of assets. This transformation makes assets that would otherwise be difficult to quickly liquidate become tradable, allowing them to be more swiftly converted into cash in the market. Not only does this optimise the efficiency of capital use, but it also increases the flexibility of asset management, enabling businesses and financial institutions to deploy and allocate funds more effectively.

This approach also enables financial institutions to release capital tied up in loans, thereby improving their capital ratios. This release strengthens the institution's capital base and enhances its capacity to manage risk, allowing it to better withstand market volatility and economic uncertainty while supporting business expansion and risk management.

Credit risk is one of the primary risks in asset securitisation, referring to the possibility that defaults on the underlying assets could prevent investors from receiving their expected returns on time. This risk manifests in two main ways. First, default on the underlying assets is a key risk. If the underlying assets, such as loans or receivables, default (for example, if a borrower fails to repay on time), it will directly impact the returns from the securitised products, preventing investors from receiving their expected returns as scheduled.

Secondly, changes in credit ratings represent a critical risk. The credit rating of a security may be downgraded due to a deterioration in the quality of the underlying assets, which in turn can affect the market value of the security and, consequently, the returns for investors. The presence of these credit risks means that, while they provide financing benefits, they also require careful management and assessment.

Structural risk is another key risk factor, primarily encompassing the complexity of the product structure and the risks associated with hierarchical structures. Securitised products often have intricate structures, and when multiple layers of debt are involved (such as in CDOs), this complexity can make it difficult for investors to fully understand and assess the actual risks of the product.

At the same time, although hierarchical structures (such as senior and subordinated securities) can help diversify risk, investors in subordinated securities may face significant losses if the underlying assets experience widespread defaults. The complexity of these structures and the differentiation between levels make risk management more challenging, thereby increasing the uncertainty associated with the investment.

Finally, asset securitisation also carries significant leverage risks, particularly when the frequency and scale of securitisation increase dramatically. For example, small loan companies may expand their securitisation efforts rapidly, magnifying the leverage effect. This can lead to systemic risks if even a low default rate accumulates rapidly and triggers broader financial instability.

Assuming these companies typically have a bad debt rate of under 2%, the interest income generated is usually enough to cover these losses. However, when the scale of asset securitisation expands rapidly, even a low bad debt rate can quickly accumulate, leading to significant systemic risks and increasing the vulnerability of the entire financial system.

While asset securitisation has the potential to enhance financial market liquidity and efficiency, it can also introduce risks to the financial system. This was evident during the 2008 financial crisis, where excessive use of CDOs and Credit Default Swaps (CDS) led to market instability, ultimately triggering a severe economic downturn.

In conclusion, asset securitisation can significantly improve financing efficiency and lower loan interest rates, making it easier for individuals and businesses to access the funds they need, thereby driving economic growth. However, this process can also introduce more complex financial products, which may expose ordinary investors to higher financial risks. At the same time, these intricate securitised products can increase uncertainty in the financial markets, meaning investors must carefully assess the associated risks to ensure they make informed investment decisions.

Asset securitisation's Benefits and Risks

| Benefits |

Risks |

| Improved Liquidity |

Credit Risk |

| Converts illiquid assets into tradable securities. |

Assets may fail to generate expected cash flows. |

| Cost Reduction |

Complex Structure |

| Funds often cheaper than traditional loans. |

Hard to understand and assess risk. |

| Risk Diversification |

High Leverage |

| Spreads risk across investors. |

Can amplify losses. |

| Optimised Capital Use |

Market Volatility |

| Unlocks asset value, improving efficiency. |

Market changes can affect performance. |

| Wider Funding Sources |

Liquidity Issues |

| Attracts diverse investor capital. |

Limited secondary market liquidity. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Asset Securitisation's Definition

Asset Securitisation's Definition