In the search for profitable investment opportunities, growth stocks stand out as one of the most attractive options for long-term investors. These stocks, typically associated with companies that are expanding at an above-average rate, offer the potential for substantial capital gains. But what exactly makes a stock a high-growth equity? And how can investors identify which ones are poised for success?

In this article, we'll explore its definition, key indicators to look for, and the core advantages of growth stocks compared to value stocks to consider for your investment portfolio.

Growth Stocks's Definition

Growth stocks refer to shares in companies that are expected to grow at an above-average rate compared to other companies within the market. These companies typically reinvest their earnings into expanding operations, new products, or markets, rather than paying out dividends. As a result, these stocks often offer investors the potential for substantial capital appreciation. This potential for future growth tends to attract investors who are willing to take on more risk in exchange for the possibility of high returns.

The companies behind such stocks are often in emerging industries, such as technology, healthcare, or renewable energy, and are known for their ability to innovate and disrupt established markets. Examples of such stocks include companies like Tesla, Amazon, and Nvidia, which have demonstrated rapid growth over the years, driven by strong demand for their products and services. These stocks tend to be more volatile due to the reliance on future growth expectations, but they can also provide significant rewards for long-term investors.

Growth Stocks VS Value Stocks

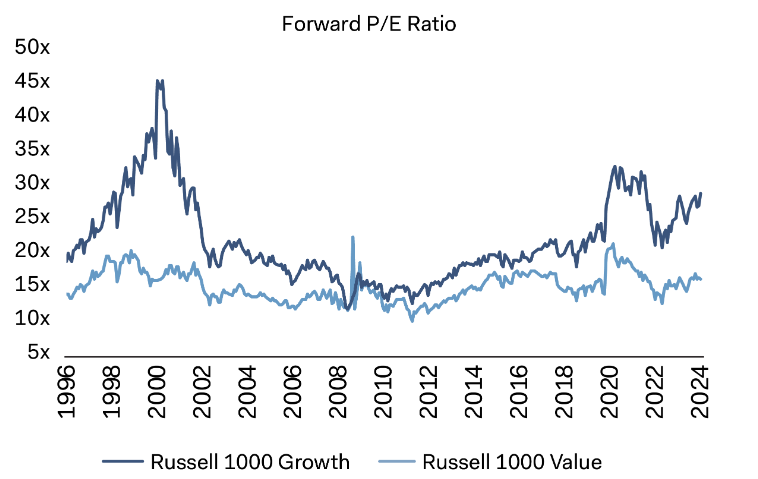

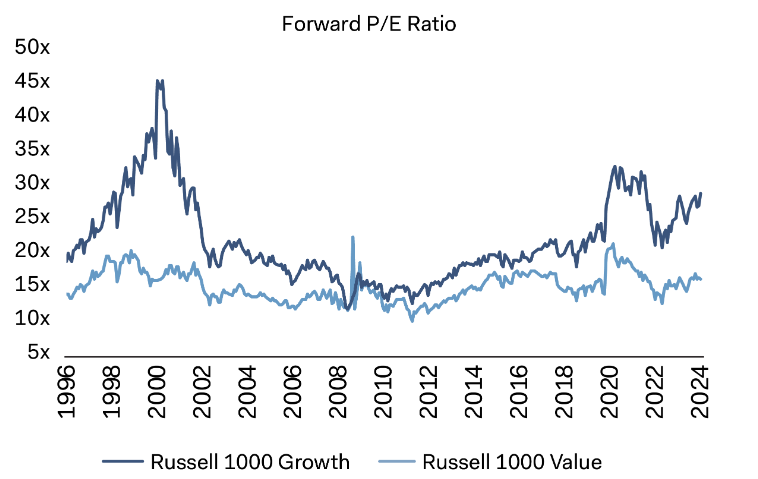

In the world of investing, growth stocks and value stocks represent two distinct strategies that cater to different investor goals. Such stocks are typically favoured by those looking for high potential returns driven by future growth, while value stocks appeal to investors seeking stability and opportunities to buy undervalued companies with strong fundamentals.

In this section, we will delve into the primary advantages of growth stocks compared to value stocks, examining key factors such as volatility and investment horizons to help investors make more informed decisions.

Growth stocks offer a unique investment opportunity that distinguishes them from value stocks. While both types of stocks can lead to profitable returns, the growth ones have particular characteristics that attract investors seeking higher potential gains, particularly over the long term.

One of the primary advantages of high-growth equities is their ability to generate substantial capital appreciation, driven by their rapid growth potential. These stocks belong to companies that are in the early stages of development or are part of emerging industries. They typically reinvest their profits into expanding their operations, developing new products, or entering new markets, rather than paying dividends.

This reinvestment strategy allows these companies to compound their growth and attract investors who are seeking long-term capital gains rather than immediate income.

The volatility of rapid-growth companies is often seen as an advantage for investors with a higher risk tolerance, as price fluctuations can result in significant returns when the company achieves its growth targets. This contrasts with value stocks, which are generally perceived as stable and less volatile. Value stocks tend to be underpriced relative to their intrinsic value, with stable earnings and established market positions, making them more attractive to conservative investors.

While value stocks offer steady returns and lower risk, they typically do not provide the explosive growth potential that growth stocks can offer. Growth companies, on the other hand, can experience higher highs and deeper lows, but their upside potential is considerably greater, making them ideal for investors willing to ride out the volatility.

Growth Stocks's Key Indicators to Look For

Growth stocks offer substantial potential for long-term capital appreciation, making them attractive to investors seeking high returns. But how can investors identify these promising stocks? Identifying such stocks isn't a simple task, but certain characteristics can help investors spot companies with strong growth potential. So, what are the signs that a stock is truly a growth stock? Let's dive into the key factors that can guide your investment decisions.

One of the key indicators of growth stocks is consistent revenue growth. This is a crucial sign that a company is expanding its market share and that its products or services are in demand. Companies like Tesla, Amazon, and Nvidia have demonstrated impressive revenue growth year after year, positioning them as prime examples of high-growth equities.

The ability to maintain steady and robust revenue growth signals that the company is on track to achieve its ambitious growth goals, which, in turn, increases the potential for capital appreciation. Furthermore, companies that consistently expand their revenue are more likely to reinvest profits into the business, fuelling even further growth, creating a positive feedback loop for investors.

Another key indicator is profitability or progress towards profitability. While many growth companies may not be immediately profitable, they should demonstrate a clear path towards profitability. For example, companies such as Spotify have made strides in improving their margins and reducing losses, positioning themselves well for long-term success.

Investors look for signs that a company is on the right track, such as rising operating income, improving profit margins, or a decrease in losses. Even if a company is not yet profitable, improving financial metrics signal that the company is likely to become profitable in the future, making it an attractive investment opportunity.

Innovation is also a crucial factor when identifying such stocks. Companies that lead in innovation, particularly in technology or other high-growth sectors, tend to disrupt existing industries or create entirely new markets. Apple's constant stream of innovative products, like the iPhone, Apple Watch, and AirPods, is a prime example of how innovation drives growth. Other companies, such as Zoom Video Communications, saw explosive growth as they capitalised on the demand for remote communication during the pandemic.

Innovation doesn't have to be limited to consumer products—companies leading in areas like artificial intelligence, renewable energy, or biotechnology can also experience rapid growth by introducing cutting-edge technologies or solutions.

Finally, market conditions and industry trends play a pivotal role in identifying growth stocks. These stocks typically emerge from sectors undergoing rapid expansion, such as the electric vehicle market, cloud computing, or renewable energy. Companies like NIO and NextEra Energy have benefited from the growing demand for electric vehicles and clean energy, respectively. Identifying and investing in companies that are positioned to take advantage of these expanding sectors can offer significant rewards, particularly as market trends evolve and new industries emerge.

To assist investors in identifying high-growth equities, here are some recommended equities that have demonstrated exceptional performance in their respective industries and possess strong growth potential:

Growth Stocks' Recommendations

| Company Name |

Industry |

Key Indicators |

| Tesla |

Electric Vehicles & Renewable Energy |

High market share, innovative products, global expansion |

| Amazon |

E-commerce & Cloud Computing |

Strong revenue growth, global market expansion |

| Nvidia |

Semiconductors & Artificial Intelligence |

High market demand, technological leadership |

| Netflix |

Streaming & Entertainment |

User growth, original content, global expansion |

| Zoom |

Video Conferencing & Remote Work |

User growth, global business expansion |

| Adobe |

Software & Creative Tools |

Subscription user growth, innovative creative products |

| Microsoft |

Software & Cloud Computing |

High revenue growth, cloud computing market share |

| Square (Block) |

Digital Payments & Fintech |

User growth, expanding transaction volume |

| Salesforce |

Enterprise Software & Cloud Computing |

Strong revenue growth, customer expansion |

| Shopify |

E-commerce Platforms & Software |

User growth, e-commerce platform expansion |

In conclusion, growth stocks represent a compelling investment opportunity for those seeking high potential returns driven by companies with strong growth prospects. Key indicators such as consistent revenue growth, profitability or progress towards profitability, innovation, and leadership are essential when evaluating these stocks. While such investments tend to be riskier and more volatile due to their reliance on future earnings, they offer the possibility of significant capital appreciation, especially in emerging industries or companies at the forefront of innovation.

However, it's important to remember that growth investing requires patience and a long-term perspective, as the rewards often take time to materialise. Investors in such stocks should be prepared for market fluctuations and willing to embrace the uncertainty that comes with high-growth sectors. Ultimately, for those with the right risk tolerance and investment horizon, these stocks can be a powerful tool for building wealth and capturing opportunities in rapidly expanding markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.