In US stock investing, investors are always on the lookout for standout stocks that can outperform the market. In the past, Apple, Microsoft, and Tesla were considered top picks by most investors. However, since the beginning of this year, the returns from these stocks have significantly lagged behind the S&P 500 and Nasdaq. In contrast, one stock in the biotech sector has managed to outperform the market — AbbVie. While it may not have the same level of recognition as those tech giants, it has proven to be a strong performer. Let's take a closer look at this biotech leader and its investment potential.

AbbVie Company Overview

AbbVie is a global leader in the biopharmaceutical industry, headquartered in North Chicago, Illinois. The company focuses on developing innovative drugs, primarily for the treatment of diseases in immunology, haematology-oncology, neuroscience, aesthetics, and ophthalmology. Its core strength lies in developing biopharmaceutical products for complex diseases, with notable achievements in immunology and oncology.

Founded in 2013. AbbVie was spun off from Abbott Laboratories, allowing it to concentrate on its core areas, particularly in the research and development of innovative medications. This strategic separation not only preserved its deep-rooted legacy from Abbott but also granted the company greater flexibility and room for innovation, enabling it to expand in the global biopharmaceutical market.

One of AbbVie's flagship products is Humira (adalimumab), a biologic drug primarily used to treat autoimmune diseases such as rheumatoid arthritis, Crohn's disease, and psoriasis. Since its launch, Humira quickly became one of the world's best-selling drugs, holding the top spot in global pharmaceutical sales for several years and playing a critical role in its business growth.

Another significant success for AbbVie is Imbruvica (ibrutinib), a targeted therapy used to treat certain types of blood cancers, including chronic lymphocytic leukaemia and mantle cell lymphoma. The launch of Imbruvica provided an important treatment option for patients with blood cancers and further solidified its leadership position in the global biopharmaceutical market.

However, with the expiration of Humira's patent in 2023. the company has focused on maintaining its market competitiveness through active investments in R&D and a diversified product portfolio. AbbVie is not only developing new drugs in immunology and oncology but is also increasing its R&D efforts in areas such as neuroscience, virology, and women's health to ensure continued growth in the future.

In immunology, AbbVie has launched next-generation immune therapies, such as Skyrizi and Rinvoq, which have shown strong market potential. Skyrizi is primarily used to treat moderate to severe plaque psoriasis, while Rinvoq is an oral drug for autoimmune diseases like rheumatoid arthritis.

These new drugs not only help the company reduce its reliance on Humira but also significantly enhance its competitive position in the immunotherapy market. As these innovative therapies gain traction, the firm's leadership in global immunology continues to strengthen, driving substantial revenue growth for the company.

Additionally, AbbVie's 2019 acquisition of Allergan brought new revenue streams, particularly in the fields of aesthetics and neuroscience, with products like the antipsychotic drug Vraylar and migraine treatment Ubrelvy. These drugs are expected to see significant growth in sales in the future.

AbbVie remains committed to advancing the forefront of biotechnology, investing substantial resources into the development of new drugs and clinical trials to address unmet global medical needs. The company accelerates drug development through its global R&D centres and manufacturing facilities, maintaining high standards of production quality. This global presence allows the firm to quickly respond to market demands and remain at the forefront of the biopharmaceutical industry.

Moreover, the company actively collaborates with academia, research institutions, and other biopharmaceutical companies to drive innovation. Through close partnerships with external collaborators, it enhances its R&D capabilities, ensuring long-term competitive advantages in biotechnology and drug development, while continuously providing new treatment options for patients.

In summary, AbbVie, with its exceptional R&D capabilities and broad product portfolio, is dedicated to improving the quality of life for patients around the world through innovative medications. Its continued breakthroughs in science and business have earned it a strong reputation in the industry, making it a key driver of progress in global healthcare.

AbbVie's Stock Price and Financial Performance

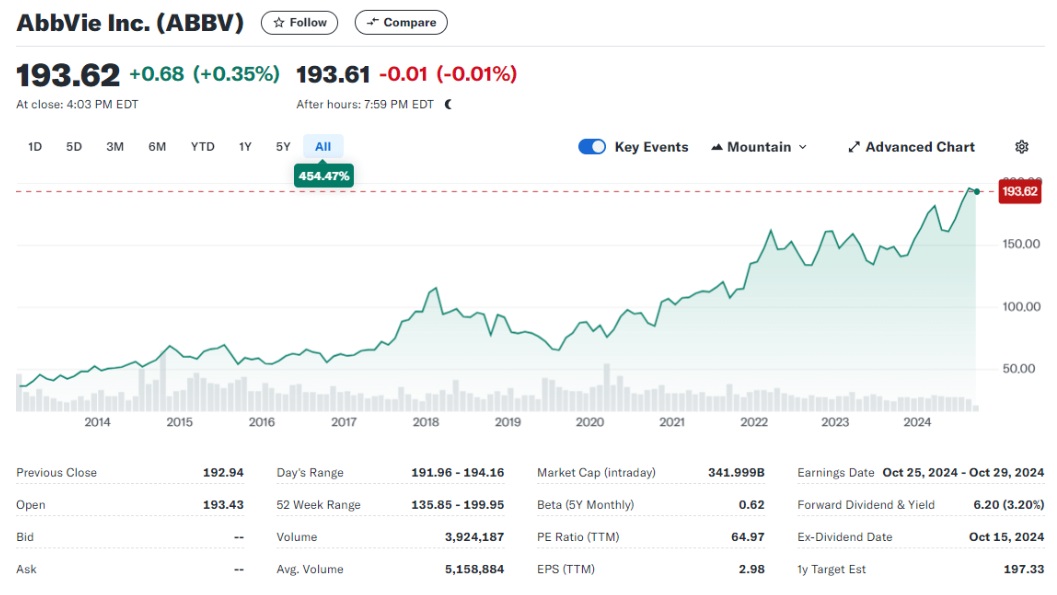

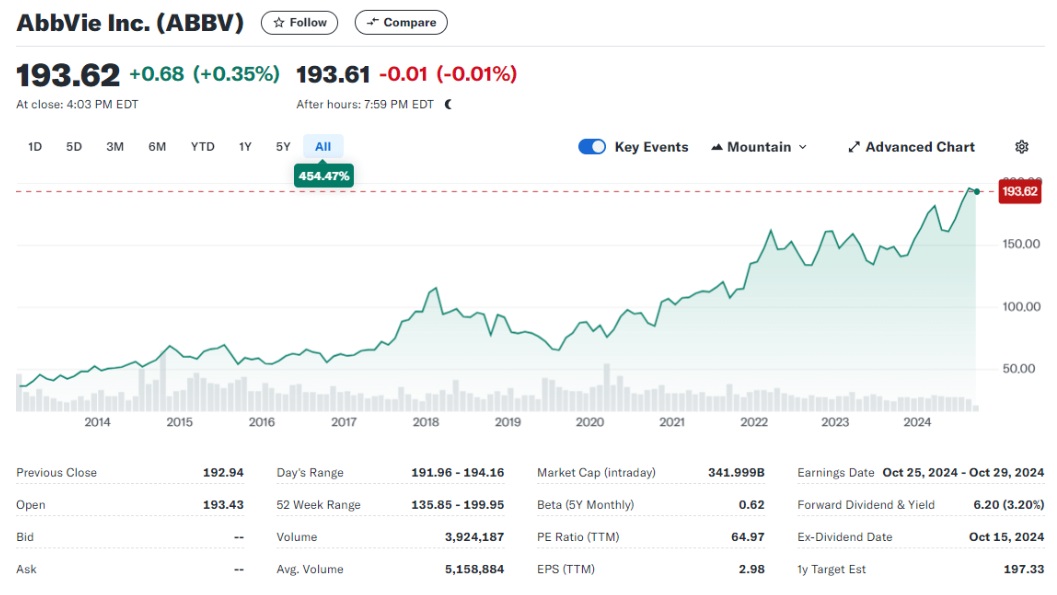

As a global leader in the biopharmaceutical industry, AbbVie has demonstrated exceptional stock performance in the market. According to the historical stock price chart, its overall trend has been consistently upward, reflecting investor confidence in its long-term growth potential.

AbbVie was officially listed after spinning off from Abbott Laboratories in 2013. with an initial share price of around $45. As a biopharmaceutical company focused on the development of innovative drugs, the firm quickly attracted investors due to its leading-edge technologies in immunology, neuroscience, and oncology. With continuous investment in research and development and strategic acquisitions, the company's market performance steadily improved, and since its ipo, its stock price and market capitalisation have risen significantly, making it a key player in the global biopharmaceutical sector.

Between 2015 and 2020. AbbVie's stock price saw steady growth, primarily driven by the massive success of its flagship product, Humira, along with the launch of other new drugs. As Humira became widely used in the treatment of autoimmune diseases, the company expanded its market share, which in turn propelled its revenue and profit growth.

During this period, the company's stock price surpassed the $100 mark and reached a historic peak of $122 in February 2018. showcasing investors' confidence and expectations for the company's future development. Furthermore, the company's continued investment in R&D laid a solid foundation for the successful launch of subsequent drugs, further cementing its leading position in the biopharmaceutical industry.

Since 2020. the company's stock price has experienced some fluctuations, mainly due to increased market competition and the expiration of Humira's patent. With the introduction of generic drugs, Humira's sales faced a threat, putting pressure on the company's revenue. However, AbbVie did not stagnate; instead, it actively advanced the research and development of new drugs and expanded its market, launching a series of innovative products to fill the revenue gap.

By strengthening its investment in immunology and neuroscience, the company successfully attracted investor attention, and despite the volatility, its stock price remained relatively stable. In June 2022. it reached a new high of $164. highlighting its ability to adapt flexibly in challenging times and its potential for long-term growth.

Since 2024. AbbVie's stock price has typically fluctuated between $150 and $180. recently rising to the range of $190 to $199. reflecting investor confidence in its future growth potential. On September 11. 2024. its stock price touched a high of $199.47. further highlighting the company's continued competitiveness in the biopharmaceutical sector and strong recognition from investors.

From a financial perspective, the company has successfully navigated the impact of Humira's patent expiry. In Q2 2024. its total revenue reached $14.46 billion, a 17.48% increase from the previous quarter. This substantial growth reflects strong market demand and continued product sales, indicating that the company's competitive position in the biopharmaceutical industry remains robust.

However, despite the rise in total revenue, net income was only $1.36 billion, a 59.09% decline compared to 2023. This decline is largely due to increased expenditure, particularly in R&D and marketing. This situation signals to investors that the company faces challenges in cost control and efficiency improvements, while also reflecting the pressure of high R&D investments that are common in the biopharmaceutical industry.

In Q2 2024. AbbVie's earnings per share (EPS) reached $2.98. exceeding analysts' expectations of $2.95 and staying flat compared to the previous year. This result not only demonstrates the company's financial resilience in the face of market challenges but also reflects its effective strategy for maintaining profitability.

Notably, the company has surpassed market expectations in all of the past four quarters. This sustained performance is seen as a positive signal by the market, demonstrating its ability and determination to tackle market challenges and maintain profitability. Despite market volatility, the company has managed to stabilise its earnings, providing confidence to investors and further enhancing its competitiveness in the biopharmaceutical sector.

In conclusion, AbbVie's stock performance not only reflects the company's solid fundamentals but also showcases its success in innovation and product line expansion, reinforcing its leadership position in the industry. Moreover, the ongoing revenue growth and better-than-expected EPS have strengthened investor confidence, highlighting the company's profitability and sustainable growth potential.

AbbVie Share Investment Analysis

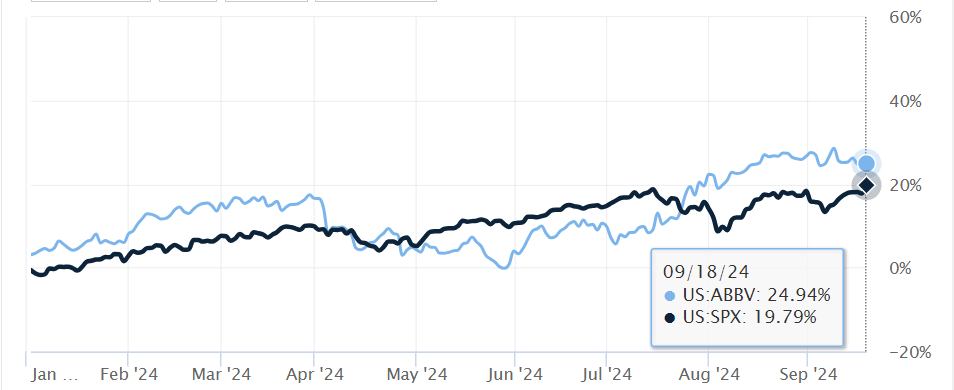

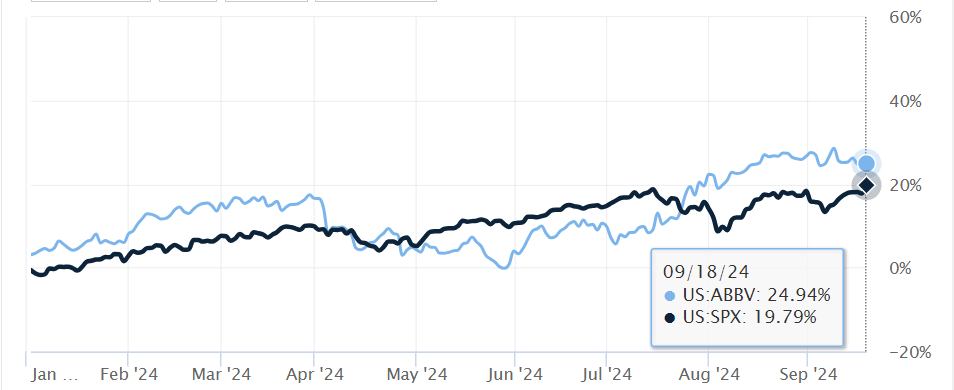

In addition to its financial performance, AbbVie's exceptionally high return also highlights its strong long-term investment potential. As shown in the chart above, over the past year, its return reached 24.94%, significantly outperforming well-known tech giants like Apple and Microsoft, as well as the S&P 500 and Nasdaq indices, making its performance particularly outstanding. This impressive result not only reflects the company’s business growth and market recognition but also signals investor confidence in its future development.

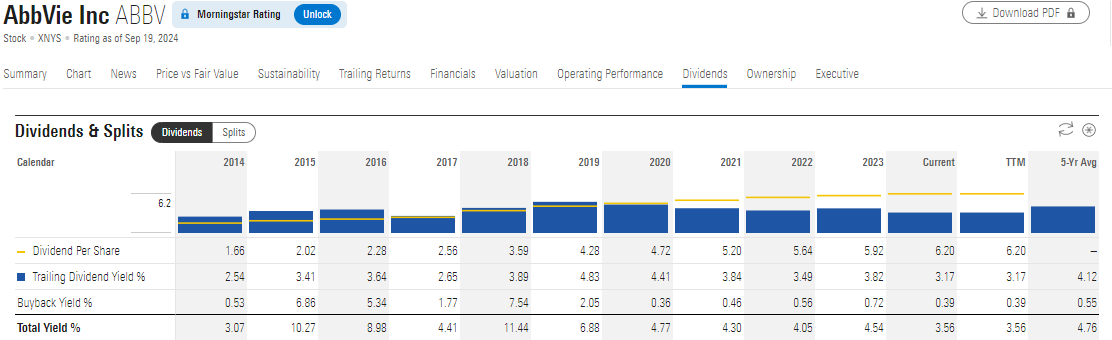

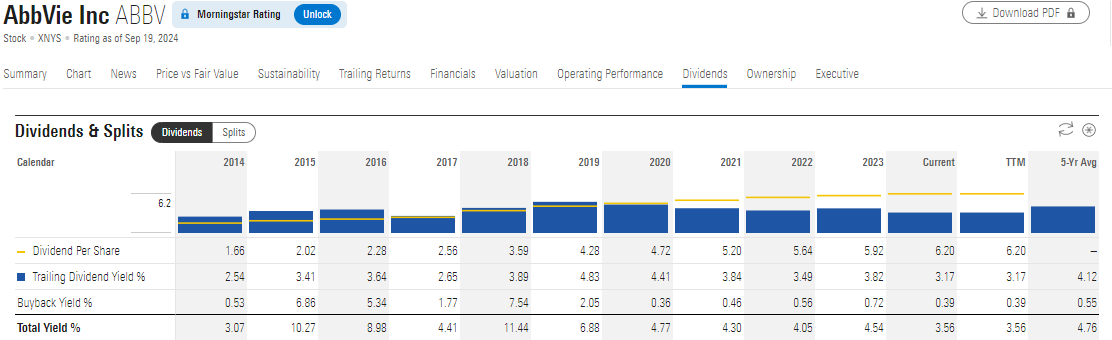

Moreover, when it comes to dividends, AbbVie has been consistently increasing its payout since becoming an independent company in 2013. with the current dividend standing at $6.20. This ongoing dividend growth demonstrates the company's confidence in its future profitability and provides investors with a stable source of income, making its stock more attractive. Especially in a low-interest-rate environment, the fixed dividend yield is even more appealing.

Currently, the firm's dividend yield stands at 3.17%, and it has raised dividends for 11 consecutive years, which makes the company highly appealing to investors seeking cash flow returns. The stable and growing dividend policy not only reflects the company's robust profitability but also offers investors a reliable income stream, enhancing its investment attractiveness. In uncertain market conditions, this dividend strategy is especially important, helping investors mitigate risks from market fluctuations.

Compared to its peers, such as Johnson & Johnson, AbbVie’s dividend performance is relatively better, further highlighting its competitive advantage in attracting shareholders. This not only reflects the management's focus on shareholder returns but could also attract more long-term investors seeking stable cash flow, which may drive further growth in its stock price.

However, it is worth noting that, despite the company's strong performance over the past year, its high debt-to-equity ratio of 90% has placed some pressure on the company's financial position. This level of debt could impact AbbVie's financial flexibility and long-term growth potential, meaning investors should closely monitor whether the company can effectively reduce its debt ratio.

Maintaining stable revenue growth is also crucial, as it directly affects the company's ability to service its debt and overall financial health. Therefore, a careful evaluation of its financial management strategies and its ability to navigate market challenges will be key factors for investors to make informed decisions.

Moreover, AbbVie's global blockbuster, Humira, lost its US patent protection in 2023. creating a sales gap of over $20 billion. While the company has already managed to replace some of Humira's revenue with new drugs, it remains to be seen whether this will fully make up for the shortfall, and ongoing observation is necessary.

Of course, the growth in the company's stock price also reflects the positive market conditions. The company's fair value is estimated at $197. with the current stock price at $193. indicating that the two are closely aligned. It’s important to note that AbbVie's price-to-earnings ratio stands at 64.97. suggesting high market expectations for future profits. This also implies that there is still potential for the stock price to rise, making it worthy of investor attention.

Thus, while AbbVie faces some financial risks, such as debt pressures, its long-term growth potential and strong dividend performance still make it a company with considerable investment appeal. Investors should conduct their own research before making any investment decisions, ensuring that their choices align with their personal financial goals.

AbbVie Company and Investment Potential Analysis

| Aspect |

Details |

Notes |

| Overview |

Leading biopharma company, focused on innovation |

Spun off from Abbott in 2013 |

| Key Products |

Humira, Imbruvica |

Humira is a top-selling drug |

| Financials |

Q2 2024 revenue: $14.46bn (+17.48%) |

Net income: $1.36bn (-59.09%) |

| Stock Price |

$190–199 range |

peaked at $199.47 (11th Sept 2024) |

| Investment Potential |

3.17% dividend yield, ongoing drug launches |

High debt, patent expiry risks |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.