In an era of rapid financial evolution, how can investors tap into one of the world's most dynamic markets? What opportunities lie at the crossroads of East and West, where global capital meets China's economic powerhouse? The answer may well lie in the Hong Kong Exchanges and Clearing Limited (HKEX), a pivotal institution that connects investors with a wealth of opportunities in Asia and beyond.

As a leading global exchange, it offers a gateway to the world's fastest-growing financial markets, combining cutting-edge technology, extensive product offerings, and strategic connectivity with China's vast economy. As an investor, you may be wondering: How can I access the diverse range of investment options available on HKEX? What are the key market opportunities I should focus on? And how are new technologies transforming the way we invest?

In this article, we'll explore the various ways you can engage with the Hong Kong Stock Exchange, the exciting investment opportunities available, and how international investors can seamlessly tap into the power of this dynamic financial platform. From traditional investments like stocks and ETFs to emerging technologies such as blockchain and AI, this marketplace provides a fertile ground for those looking to diversify and grow their wealth. Let's dive into what makes the exchange in Hong Kong a unique and attractive destination for savvy investors.

HKEX's Overview of Trading

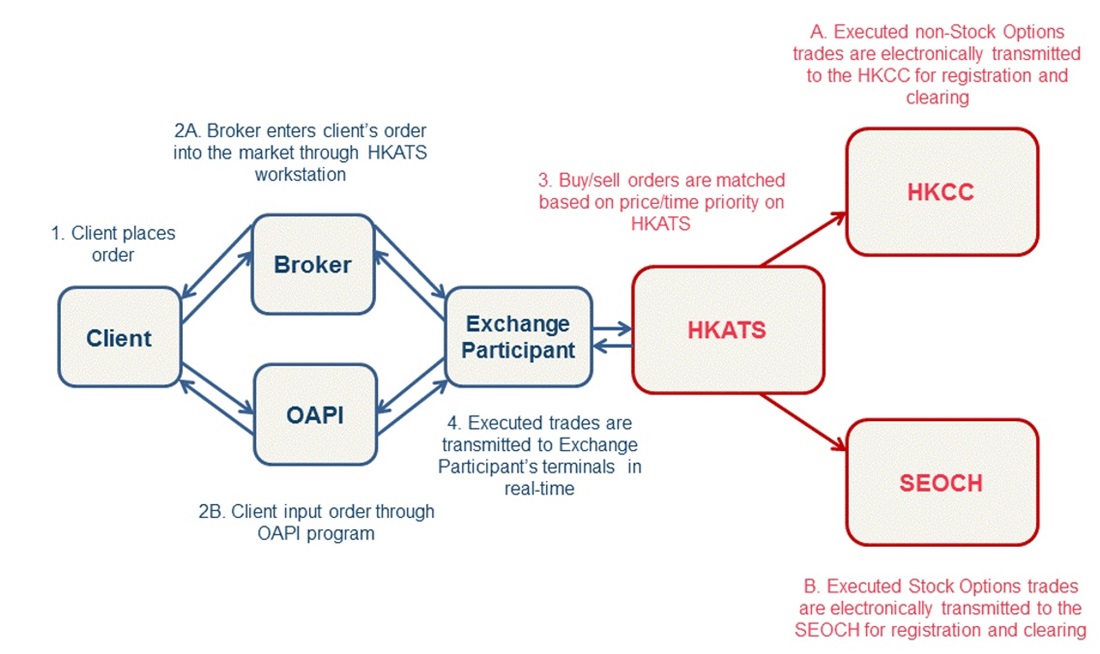

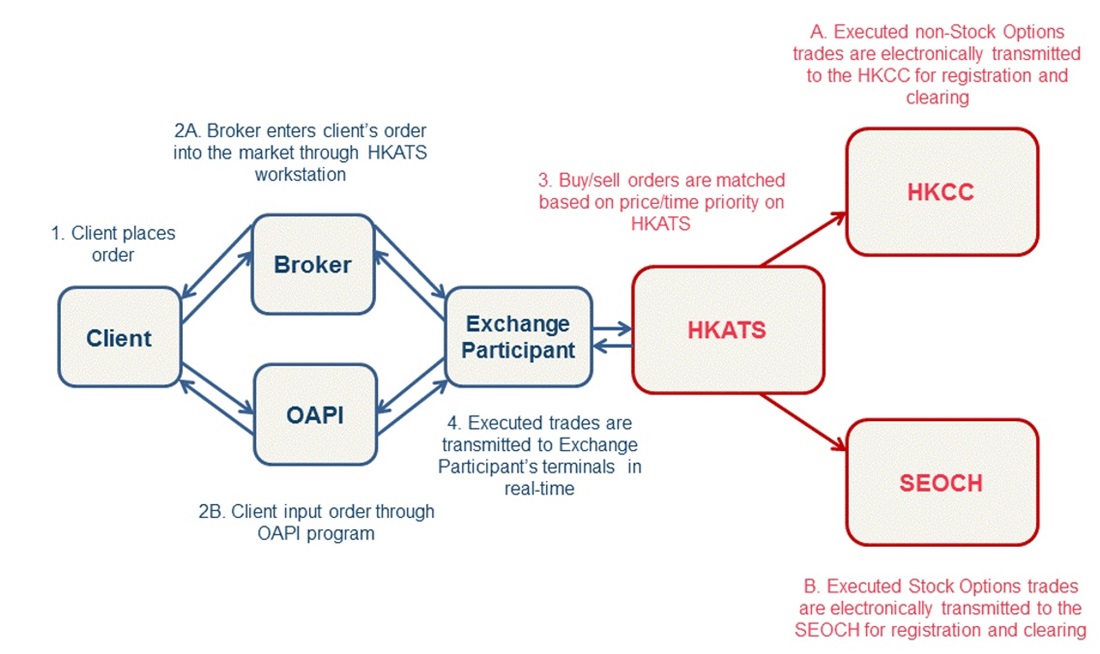

HKEX stands as one of the world's leading financial exchanges, facilitating the trading of a wide variety of securities. It serves as a critical gateway between international investors and the Chinese market, offering access to both local and global companies. Operating within a highly regulated and transparent environment, the exchange ensures fair and secure transactions for all market participants.

HKEX trades a diverse range of assets, including equities, derivatives, and exchange-traded funds (ETFs). The market is open from 9:30 AM to 4:00 PM Hong Kong Time, with a break between 12:00 PM and 1:00 PM. This provides a structured trading window where investors can engage in various activities, from buying and selling stocks to executing complex derivatives strategies.

The exchange attracts a wide array of market participants, including retail investors, institutional investors, brokers, and proprietary traders. This diversity creates a dynamic environment, with various trading strategies and approaches at play. Investors can leverage HKEX's extensive infrastructure and technology to execute trades efficiently, making it a prime venue for both local and international market activity.

HKEX's Investment Opportunities

HKEX offers a range of investment opportunities across different asset classes, making it an attractive choice for investors looking to diversify their portfolios. One of the key areas of focus is equities, with a large number of companies listed on the exchange. These include some of the most significant corporations from Hong Kong, mainland China, and other international markets. With an extensive selection of stocks spanning various sectors, this exchange offers investors opportunities to engage with both established industries and emerging growth sectors.

Another area of opportunity is derivatives, such as options, futures, and index-linked products. These financial instruments offer sophisticated ways for investors to hedge risk, speculate on market movements, or gain exposure to specific sectors. Derivatives can be particularly attractive for institutional investors and traders seeking to implement complex strategies.

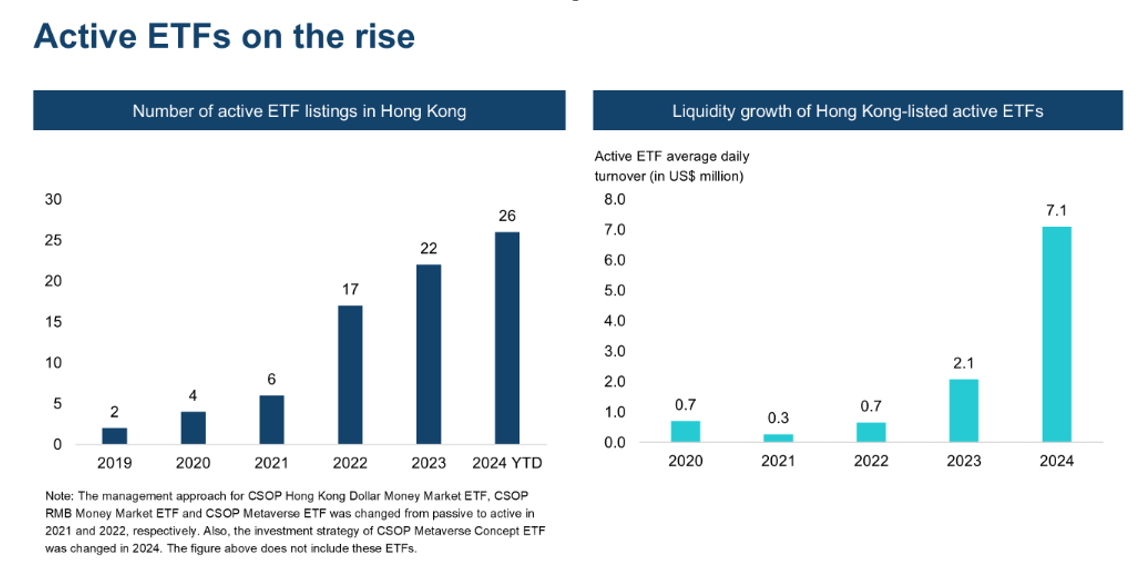

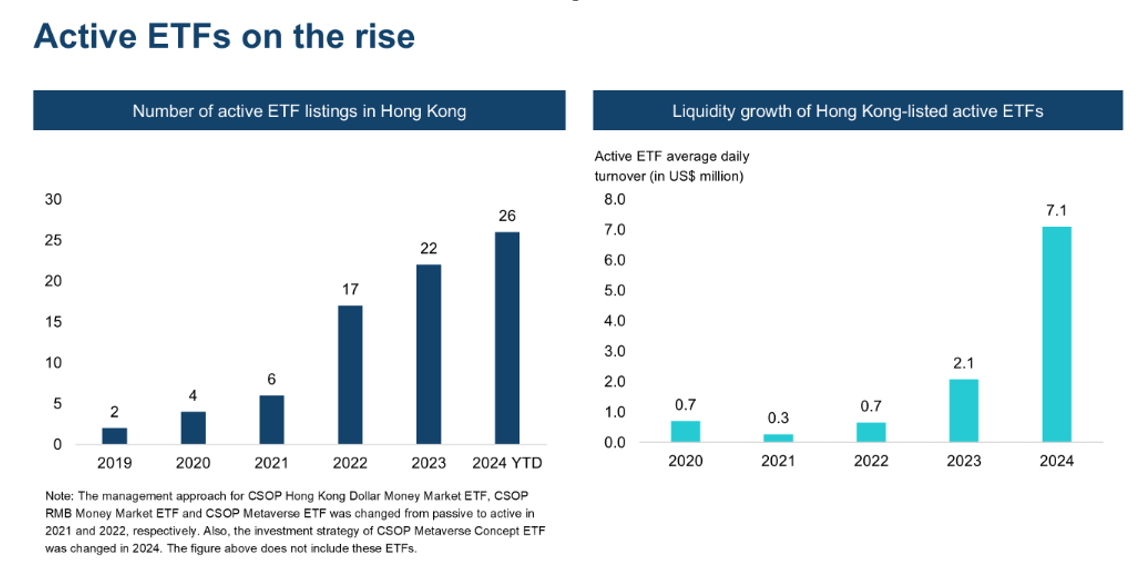

For those looking for diversified exposure, ETFs provide a cost-effective way to invest in a basket of assets. These funds are traded like stocks and provide exposure to various asset classes, including equities, bonds, and commodities. ETFs on HKEX cover numerous sectors and regions, allowing investors to align their portfolios with their investment goals.

Additionally, HKEX's ipo market is one of the largest globally, with a significant number of companies going public each year. This provides investors with the chance to participate in early-stage growth opportunities by investing in companies before they become widely available to the public. The IPO process on the exchange is known for its transparency and strict regulation, ensuring investor protection while providing the potential for significant returns.

HKEX's Access for International Investors

International investors have multiple ways to access HKEX and participate in its diverse market opportunities. One of the most common methods is through brokers who offer trading services for Hong Kong-listed securities. These brokers are familiar with the local market structure and regulations and can guide investors through the trading process. By using a broker, international investors can buy and sell stocks, ETFs, and derivatives listed on the exchange.

Another important access point is the Stock Connect programme, a collaboration between HKEX and mainland China's stock exchanges in Shanghai and Shenzhen. Stock Connect allows international investors to trade Chinese stocks listed on the mainland exchanges through the Hong Kong market. This programme offers a seamless pathway for global investors to tap into China's vast and rapidly expanding economy, positioning the exchange as a vital link in connecting international capital to mainland China.

In addition, various investment platforms and digital brokers have begun offering online access to HKEX, making it easier for investors around the world to trade directly on the exchange. These platforms often provide user-friendly interfaces, access to real-time market data, and a range of tools to support investors in executing their trades.

HKEX's Emerging Trends and Technologies

HKEX is continuously evolving, and emerging trends and technologies are playing a significant role in shaping the future of the exchange. One of the most significant developments is the growing use of blockchain technology. Blockchain has the potential to enhance market efficiency, security, and transparency, particularly in areas such as securities trading, settlement, and post-trade processes. The exchange has been exploring blockchain-based solutions to streamline operations and improve the overall trading experience.

The rise of artificial intelligence (AI) is another trend that is beginning to have a major impact on trading strategies and market analysis. AI-driven tools are helping investors make more informed decisions by analysing vast amounts of data and identifying trends that may not be immediately apparent. Machine learning algorithms are also being used for market surveillance and risk management, enhancing the overall stability and integrity of the exchange.

Sustainable investing is also becoming an increasingly important focus at HKEX, with growing demand for investments that consider Environmental, Social, and Governance (ESG) factors. The exchange has introduced initiatives to encourage companies to disclose their ESG practices, and many investors are now incorporating these criteria into their decision-making processes. This trend reflects a broader global movement towards responsible investing, which prioritises sustainability and ethical practices.

In conclusion, the Hong Kong Stock Exchange, a leading global financial hub, offers a wide array of investment opportunities across equities, derivatives, ETFs, and IPOs. Investors can access both local and international markets, gaining exposure to some of China's most rapidly growing companies. International participants can easily engage with the exchange through brokers or the Stock Connect programme, which enables trading of Chinese stocks listed on mainland exchanges.

As the exchange continues to innovate, emerging trends such as blockchain technology, artificial intelligence, and sustainable investing are transforming the market landscape. These developments enhance market efficiency, provide advanced tools for investors, and reflect the growing global emphasis on responsible investing. For both experienced and new investors, the Hong Kong Stock Exchange represents a unique opportunity to diversify portfolios and tap into one of the world's most dynamic financial markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.