The "Magnificent 7" — Apple, Microsoft, Amazon, Alphabet, Meta Platforms, Nvidia, and Tesla — have dominated the U.S. equity market performance over the past few years.

Their dominance in technology and innovation propelled them to unprecedented valuations, with their combined market capitalisation reaching $17.5 trillion by late 2024, accounting for 35% of the S&P 500's market cap.

However, as we navigate through 2025, investors are reevaluating the prospects of these Magnificent 7 stocks amid shifting economic landscapes and geopolitical tensions.

Magnificent 7 Stocks Performance Overview in 2025

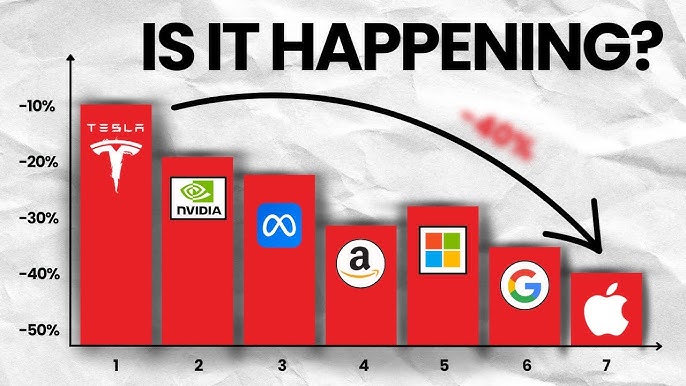

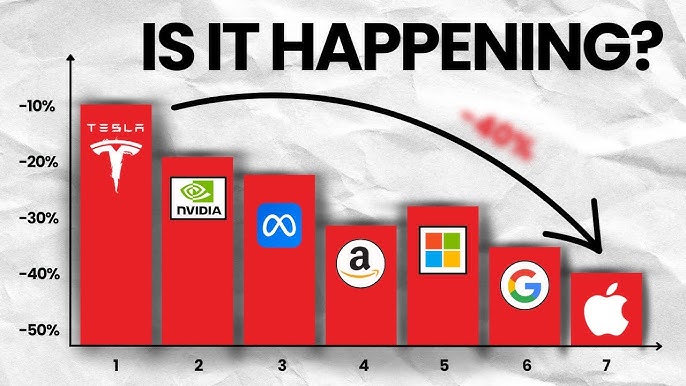

The year 2025 has introduced a series of challenges for the Magnificent Seven. The group experienced significant market volatility, with the Roundhill Magnificent Seven ETF (MAGS) declining over 15% since the start of the year.

By March, six of the seven stocks had declined between 7% and 15%, with Tesla experiencing a notable 38.1% drop due to slowing sales and concerns over CEO Elon Musk's political involvement.

Nvidia also faced a substantial setback, shedding a quarter of its value, primarily due to an anticipated $5.5 billion in export-related charges from new U.S. restrictions on AI chip exports to China.

Meta Platforms was the only stock in the group with a positive trajectory during this period.

Geopolitical and Economic Headwinds

As mentioned, the resurgence of trade tensions between the U.S. and China has cast concern in the tech sector. The Trump administration's imposition of new export restrictions, especially targeting AI chips, has directly impacted companies like Nvidia and Apple. Nvidia's market value alone declined by nearly $250 billion in response to these measures.

Additionally, Federal Reserve Chairman Jerome Powell's warnings about the potential inflationary effects of renewed tariffs have further unsettled markets, leading investors to seek refuge in traditional safe-haven assets like gold, which surged 23% in 2025, reaching record highs above $3,200 per ounce.

Earnings and Growth Prospects

Despite market volatility, the Magnificent 7 continues to showcase strong earnings. In 2024, the group achieved a 40.4% increase in earnings on a 13.9% rise in revenue. Projections for 2025 estimate a 12.6% earnings growth on a 9.5% revenue increase.

For the first quarter of 2025, the group's earnings are expected to increase by 13.1% on an 11.9% rise in revenues. For the full year, projections indicate a 12.6% earnings growth on a 9.5% revenue increase, translating to an aggregate earnings figure of $556.1 billion, up from $493.7 billion in 2024.

However, this marks a deceleration from the previous year's 40.4% earnings growth, suggesting that while growth persists, it is moderating. In addition, the median price-to-forward earnings ratio for these stocks stands at a 42% premium compared to the top eight S&P 500 stocks, marking a historical high.

Individual Company Outlooks

Each member of the Magnificent Seven faces unique challenges and opportunities:

Apple continues to innovate but faces headwinds from supply chain disruptions and regulatory scrutiny in key markets.

Microsoft maintains a strong position in cloud computing and enterprise solutions, though its growth is tempered by increased competition and market saturation.

Amazon is navigating a complex retail landscape, balancing its e-commerce dominance with challenges in its cloud services division.

Alphabet grapples with antitrust investigations and evolving digital advertising dynamics, impacting its revenue streams.

Meta Platforms continues investing heavily in the metaverse, a venture that holds promise but entails significant risk and uncertainty.

Nvidia confronts geopolitical challenges affecting its AI chip exports while striving to maintain its leadership in graphics processing technology.

Tesla faces intensified competition in the electric vehicle market and internal challenges in leadership and strategic direction.

Market Concentration and Diversification Concerns

Moreover, the Magnificent 7's dominance has led to concerns about market concentration. Their substantial weight in major indices means their performance heavily influences broader market movements.

In 2023 and 2024, these companies accounted for a significant portion of the S&P 500's returns. However, in 2025, their share of the index's earnings growth is expected to contract to 33%, indicating a potential shift towards more diversified market contributions.

This evolution underscores the importance of considering broader diversification strategies to mitigate risks associated with overexposure to a select group of stocks.

Investment Considerations

Investors contemplating positions in the Magnificent 7 stock should weigh several factors:

Valuation Metrics: Assessing current stock valuations in the context of projected earnings and growth trajectories is crucial.

Regulatory Environment: Understanding the implications of ongoing and potential regulatory actions can inform risk assessments.

Technological Innovation: Evaluating each company's commitment to and success in innovation can provide insights into long-term viability.

Market Dynamics: Monitoring shifts in consumer behaviour, competitive landscapes, and macroeconomic indicators can aid in forecasting performance.

Conclusion

In conclusion, the Magnificent 7 has undeniably shaped the technological and financial landscapes over the past decade. As of 2025, while they continue to exhibit strong fundamentals, the convergence of geopolitical tensions, regulatory challenges, and market saturation necessitates a more nuanced investment approach.

Investors should conduct thorough due diligence, considering the company's prospects and the broader economic context, to make informed decisions about including them in investment portfolios.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.