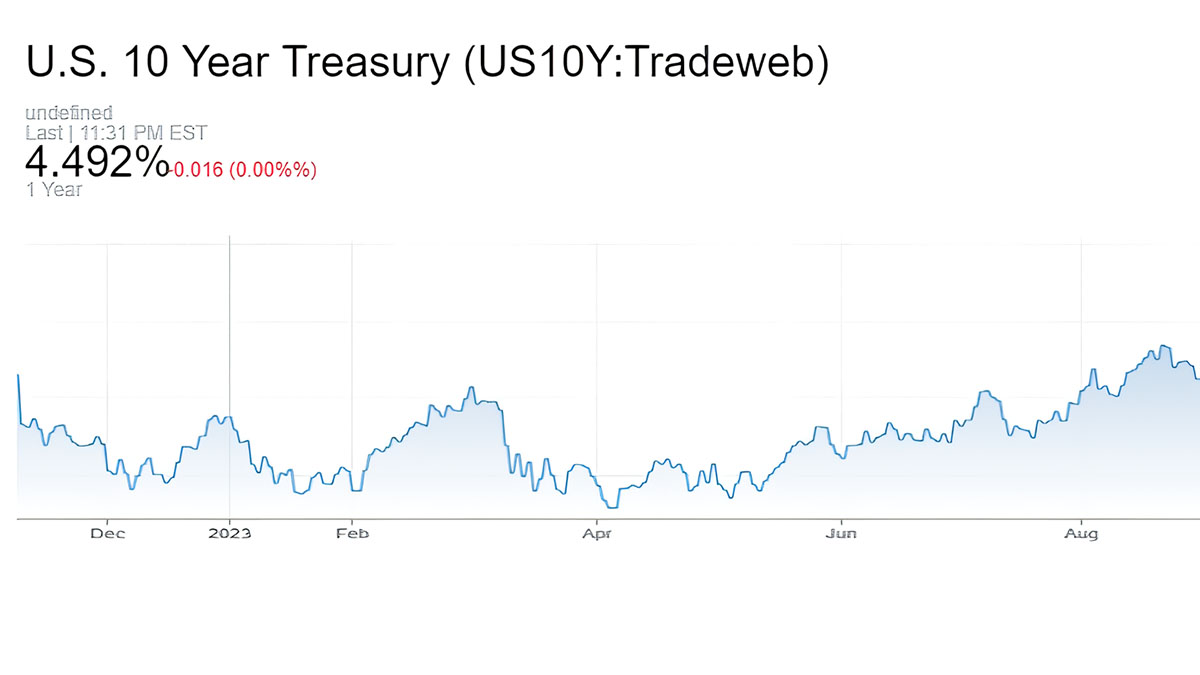

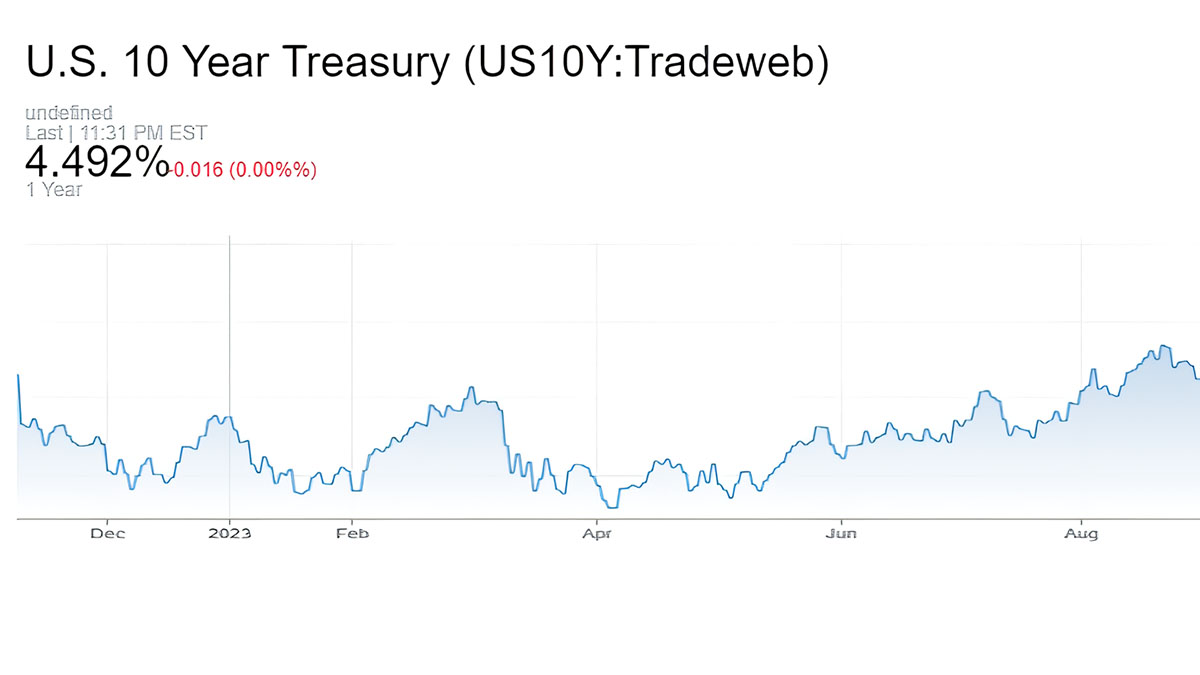

US stocks posted their best weekly gain in about a year last week after

rising Treasury yields spurred heavy sell-off in Oct. The resilient US economy

and debts oversupply both dampened the appeal of the safe-haven asset.

Monday marks the sixth straight advance for the Dow and S&P 500 and

seventh straight gain for the Nasdaq. The streak is the longest for the S&P

500 since early June, since July for the Dow and since January for the

Nasdaq.

According to a Bloomberg survey last month, 45% of respondents predicted the

Nasdaq 100 will decline by as much as 10% this quarter and 20% said it will drop

even more than that.

Still, analysts expect earnings growth of 5.7% for S&P 500 companies in

the third quarter, with over 80% of the companies in the benchmark index that

have reported profits so far having beaten estimates, per LSEG data.

Hedge funds last week "aggressively" bought US stocks at the fastest pace in

two years, said a Goldman Sachs note. Hedge fund long positions in information

technology stocks reached the largest in eight months.

Wrong Treasury bets

Hedge funds extended short positions on Treasuries to a record just before

smaller-than-expected US bond sales and weaker jobs data spurred a rally,

according to the CFTC as of 31 Oct.

Those funds may have taken as part of the basis trade where they can make

money from small pricing mismatch between futures and their underlying

bonds.

But a steep plunge in yields since then may bring about a substantial

reversal in the coming weeks. Citi's strategy team expects Treasuries to

continue rallying this week.

“Price action in Treasuries for the past few months was a classic case of a

persuasive story feeding the price action, until it went too far, leading to an

overshoot which is now correcting,” said Gareth Berry, strategist at Macquarie

at Singapore.

Meanwhile, asset managers extended their bullish positions in Treasury

futures. Traders have brought forward their predictions for the first cut by the

Fed to June from July.

"The stability in rates is helping other asset classes find a footing," said

Jason Draho, head of asset allocation Americas at UBS Global Wealth

Management.

"If equities move higher you may find investors starting to feel as if they

need to chase performance through the end of the year."

He expects the S&P 500 to trade between 4,200 and 4,600 until investors

determine whether the economy will be able to avoid a recession.

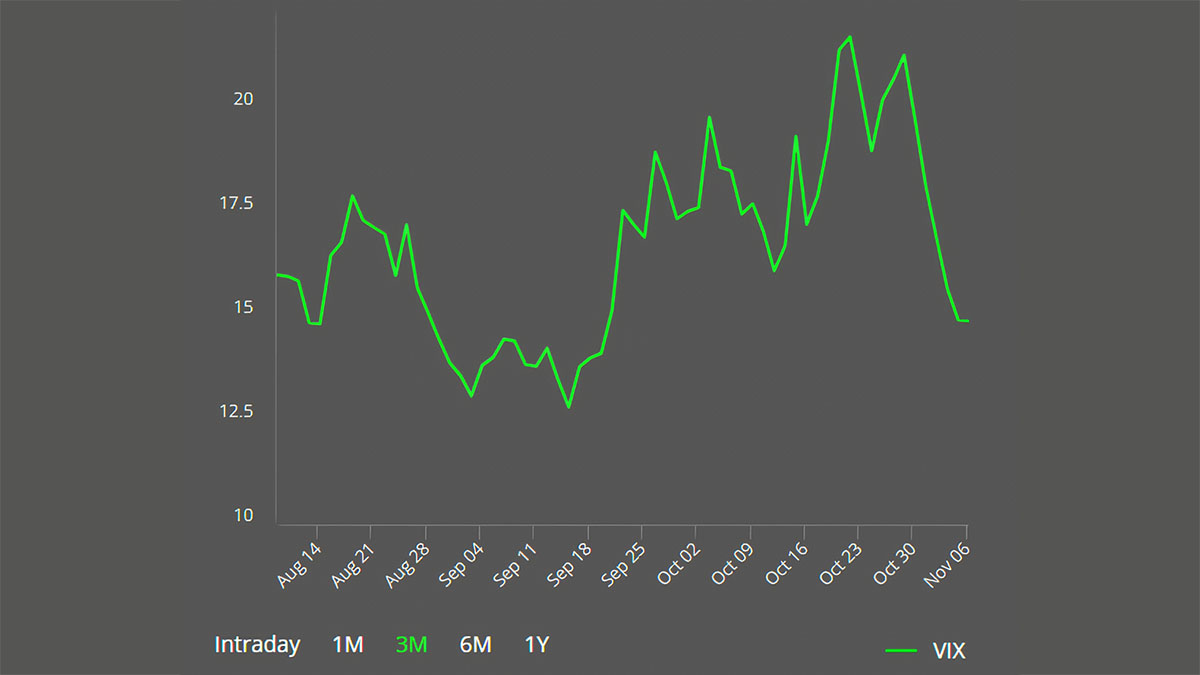

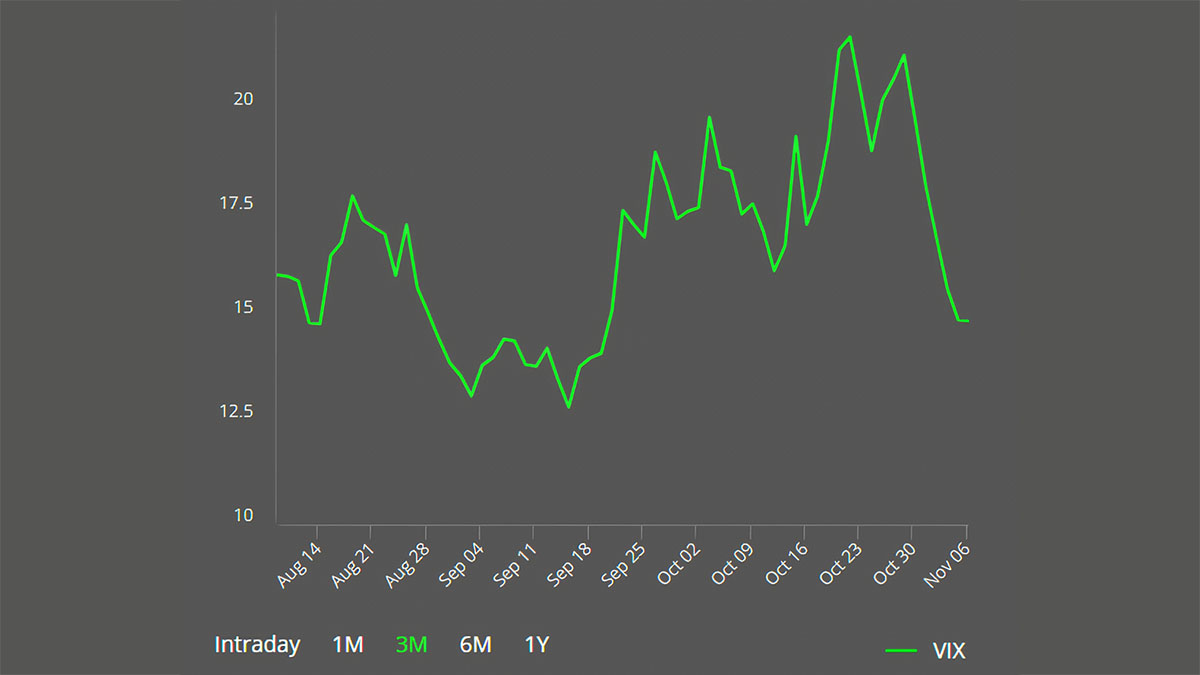

Contrarian stock signals

The CBOE Volatility Index has tumbled to its lowest level in seven weeks. The

cost of hedging against a drop in stocks has also fallen in part due to

underexposure to stocks.

Exposure to equities among active money managers stands near its lowest level

since October 2022, according to an index compiled by the Naaim.

A report from hedge fund research firm PivotalPath showed US equity

long/short hedge funds had cut their risk exposures to the S&P 500 to

six-year lows at the end of Oct.

Investors' equity positioning fell to a five-month low before last week's

rally, Deutsche Bank data showed. And there are more reasons for risk-taking

though some caution against the tech fever.

The last two months of the year have tended to be a strong stretch for

stocks, with the S&P 500 rising an average of 3%, according to data from

CFRA Research.

The average valuation premium of the Nasdaq 100 Index verses the S&P 500

comes out to around 30% over the past 10 years. All else equal, restoring that

equilibrium requires a fall to 12,500, according to Sameer Samana at Wells Fargo

Investment Institute.

Kevin Gordon, senior investment strategist at Charles Schwab also sees

further losses for big tech while the rest of the market catches up given the

valuations gap between the biggest seven tech companies and the average stock in

the S&P 500.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.